Enlarge image

DR 0103 (11/22/22)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0013

*DO=NOT=SEND* Tax.Colorado.gov

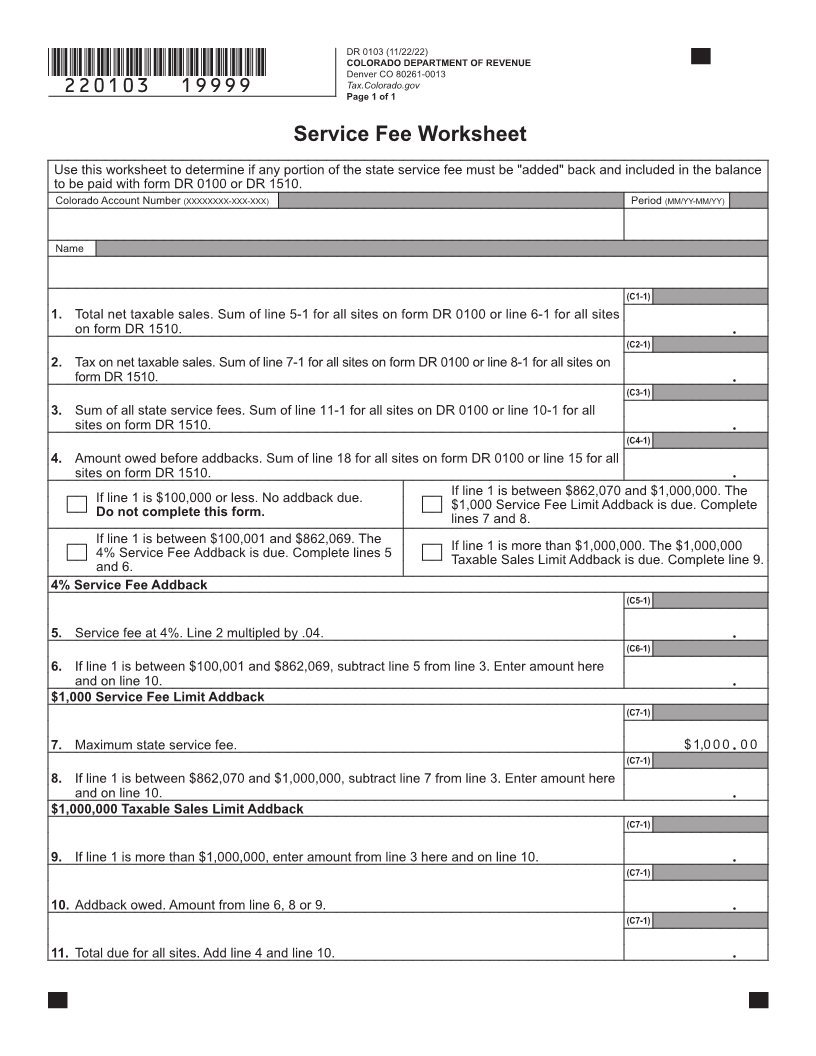

Service Fee Worksheet

General Information Line 4.

Enter the sum of the balance due/amount owed on all sites/

If you are filing the Sales Tax Return (DR 0100) or the

returns for this period. The balance due appears on line 18

Aviation Fuel Sales Tax Return (DR 1510) after the due

of form DR 0100 and line 15 of form DR 1510.

date of the return, do not complete this form. Returns filed

and paid late are not eligible to retain the state service fee. Checkboxes:

Check the applicable box and complete the applicable lines

Electronic Filing as instructed.

Retailer's can avoid completing the paper DR 0103 by filing Line 5.

electronically through Revenue Online. Revenue Online Multiply line 2 by .04. Enter result.

can be accessed at Colorado.gov/RevenueOnline.

Line 6.

Form Instructions If line 1 is between $100,001 and 862,069. Subtract line 5

from line 3. Enter result on line 6 and on line 10.

Retailer's must enter their eight digit Colorado account

number, their name, and their filing period. Line 7.

This is the maximum state service fee allowed, $1,000.

Line 1.

Enter the sum of all net taxable sales for all sites/returns Line 8.

for this period. The net taxable sales appears in the state If line 1 is between $862,070 and $1,000,000. Subtract

column on line 5 on form DR 0100 and on line 6 on form line 7 from line 3. Enter result on line 8 and on line 10.

DR 1510. Line 9.

Line 2. If line 1 is more than $1,000,000. Enter amount from line 3

Enter the sum of the tax on net taxable sales for all sites/ on line 9 and on line 10.

returns for this period. The tax appears in the state column Line 10.

on line 7 of form DR 0100 and on line 8 of form DR 1510. Amount from line 6, 8 or 9.

Line 3. Line 11.

Enter the sum of all state service fees calculated on all Add line 4 and line 10.

sites/returns filed for this period. The state service fee

appears in the state column on line 11 of form DR 0100

and on line 10 of form DR 1510. Do not include any service

fees calculated and claimed for any state-administered

local jurisdictions.