Enlarge image

Supplemental Instructions for Form DR 0100

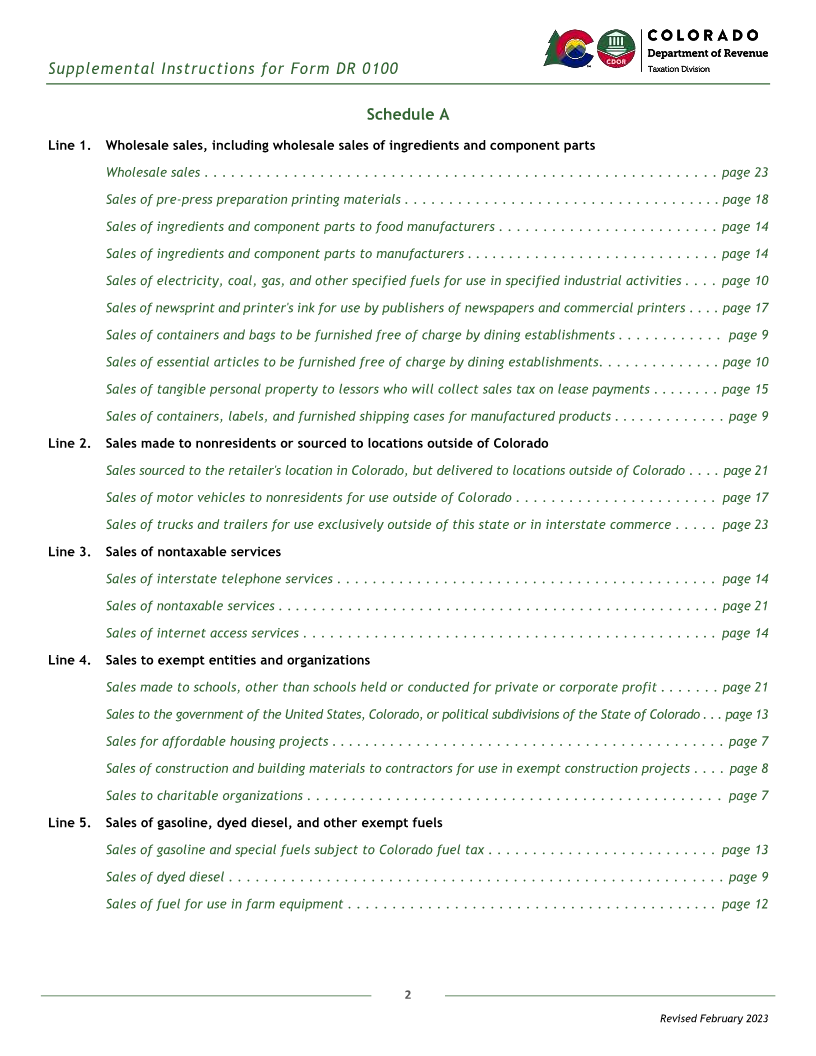

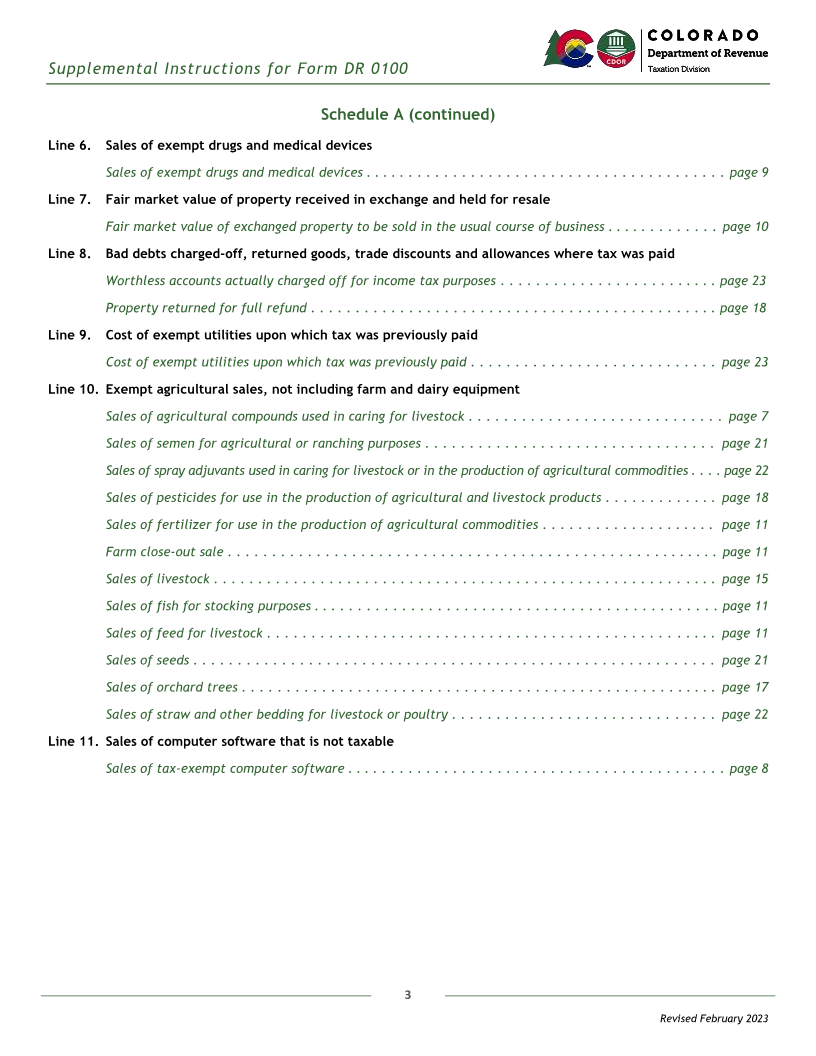

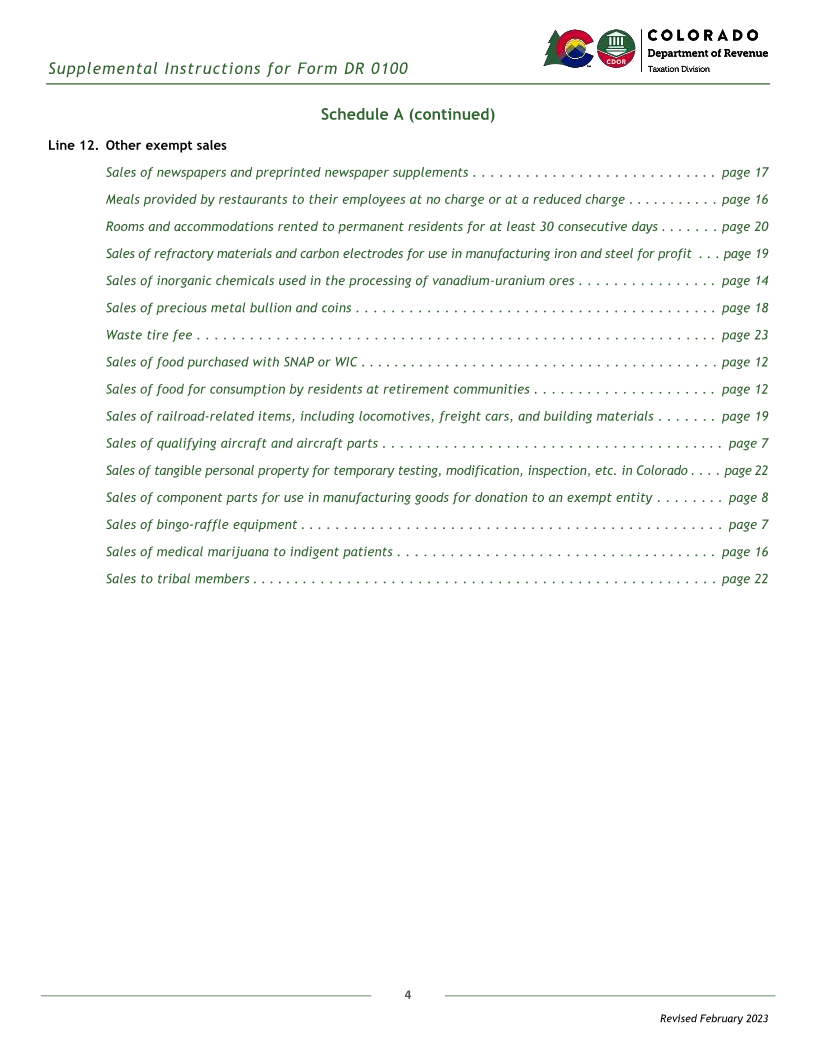

These supplemental instructions are intended to assist Pages 2 through 6 of this publication list various

retailers in the preparation of their Colorado Retail exemptions and deductions reported on each line of

Sales Tax Returns (DR 0100) and the supporting Schedules A and B of the DR 0100. Pages 7 through 23

Schedules A and B, upon which exemptions and provide references to additional information about

deductions are reported. Retailers have the burden of each of these exemptions, including the statutory

proof to demonstrate the proper exemption of any sale authority for the exemption or deduction, any

upon which the retailer did not collect sales tax and applicable Department regulation, and any guidance

must report exempt sales on the correct line(s) of published by the Department. For exemptions that are

Schedules A and B. See section 39-26-105(3)(a), C.R.S., not mandatory for cities and counties, the statutory

and 1 CCR 201-4, Rule 39-26-105-3 for additional authority for the option and the letter used to

information regarding the documentation of exempt represent the exemption in Department publication

sales. Colorado Sales/Use Tax Rates (DR 1002) are also listed.

Department publications can be found online at

This publication lists various exemptions and

Tax.Colorado.gov.

deductions reported on each line of Schedules A and B

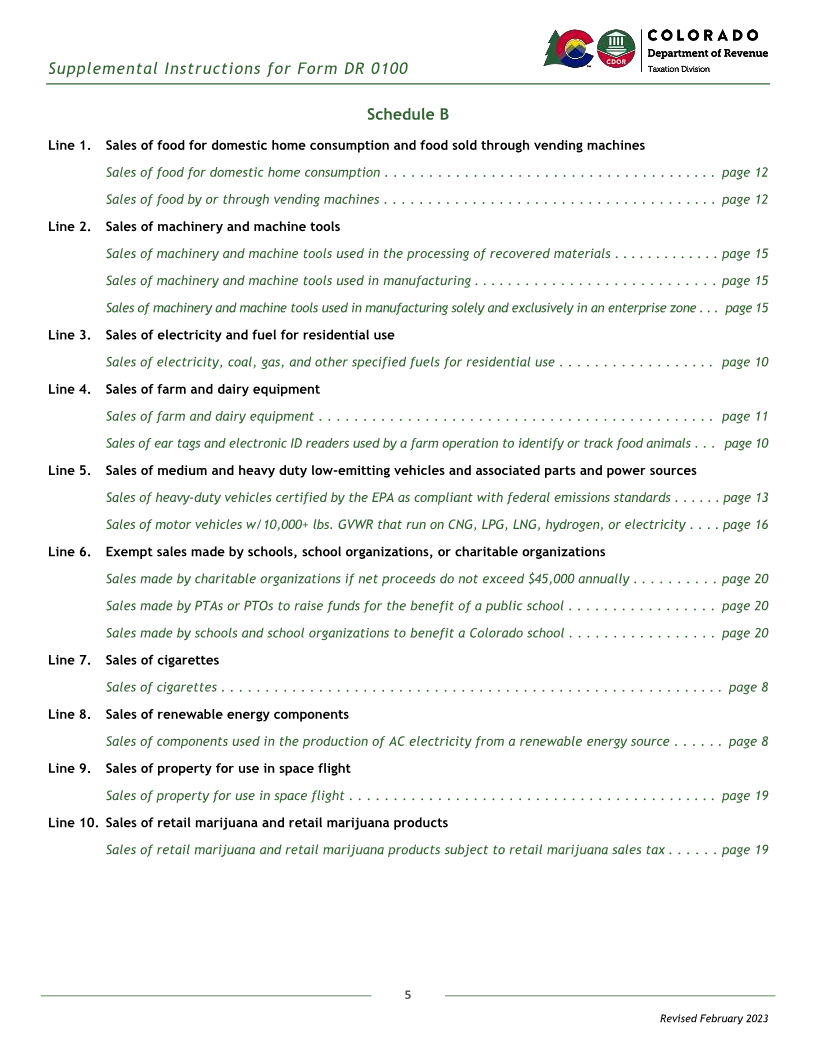

of the DR 0100. In general, Schedule A includes The information in this publication pertains only to

exemptions and deductions that apply to all state- state and local sales taxes administered by the

administered local sales taxes and Schedule B includes Colorado Department of Revenue and does not apply to

exemptions that cities and counties may opt into for any local sales tax imposed and administered by any

their state-administered sales taxes. All Colorado sales home-rule city in Colorado.

tax exemptions also apply to all special districts

reported in either the RTD/CD or Special District

columns of the DR 0100.

Exemptions and deductions are often subject to specific requirements not described

in this publication. Nothing in this publication modifies or is intended to modify the

requirements of Colorado’s statutes and regulations. Taxpayers are encouraged to

consult their tax advisors for guidance regarding specific situations.

1

Revised February 2023