Enlarge image

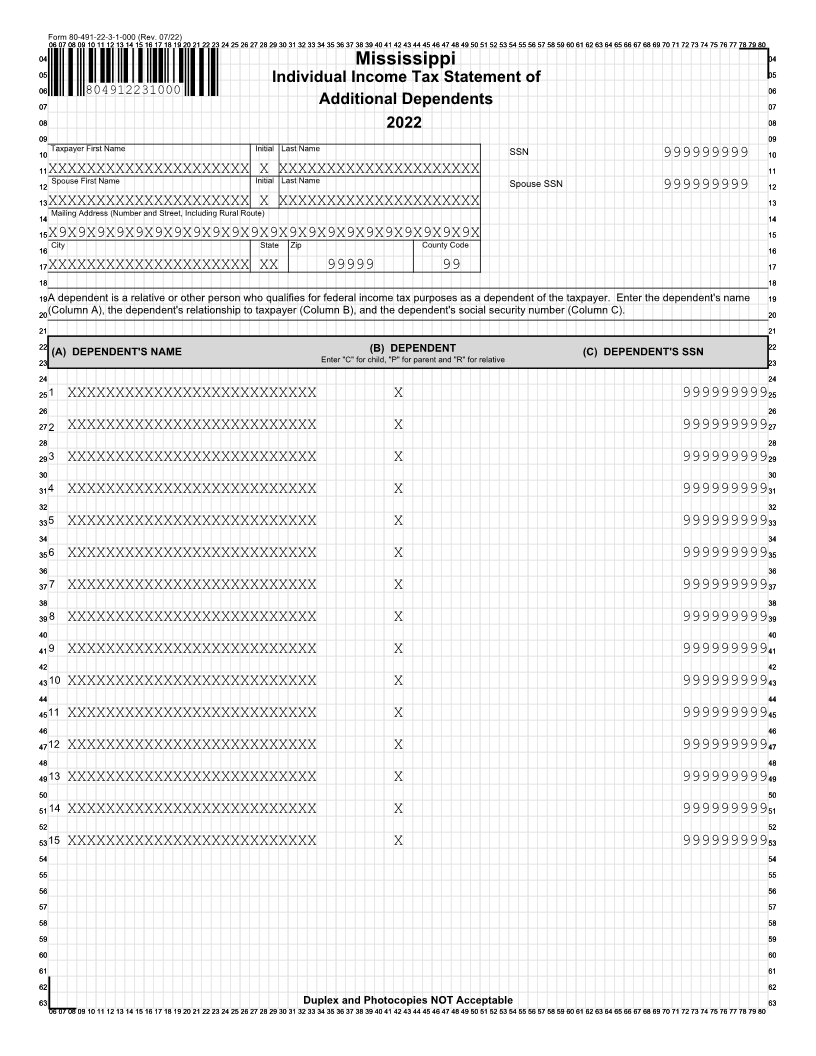

Form 80-491-22-3-1-000 (Rev. 07/22)

0606 0707 08009 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

0404 Mississippi 0404

0505 Individual Income Tax Statement of 0505

0606 804912231000 0606

0707 Additional Dependents 0707

0808 2022 0808

0909 0909

1010 Taxpayer First Name Initial Last Name SSN 1010

999999999

1111XXXXXXXXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXX 1111

1212 Spouse First Name Initial Last Name Spouse SSN 1212

999999999

1313XXXXXXXXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXX 1313

1414 Mailing Address (Number and Street, Including Rural Route) 1414

1515X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X 1515

1616 City State Zip County Code 1616

1717XXXXXXXXXXXXXXXXXXXXX XX 99999 99 1717

1818 1818

1919A dependent is a relative or other person who qualifies for federal income tax purposes as a dependent of the taxpayer. Enter the dependent's name 1919

2020(Column A), the dependent's relationship to taxpayer (Column B), and the dependent's social security number (Column C). 2020

2121 2121

2222 (A) DEPENDENT'S NAME (B) DEPENDENT (C) DEPENDENT'S SSN 2222

2323 Enter "C" for child, "P" for parent and "R" for relative 2323

2424 2424

25251 XXXXXXXXXXXXXXXXXXXXXXXXXX X 999999999 2525

2626 2626

27272 XXXXXXXXXXXXXXXXXXXXXXXXXX X 999999999 2727

2828 2828

29293 XXXXXXXXXXXXXXXXXXXXXXXXXX X 999999999 2929

3030 3030

31314 XXXXXXXXXXXXXXXXXXXXXXXXXX X 999999999 3131

3232 3232

33335 XXXXXXXXXXXXXXXXXXXXXXXXXX X 999999999 3333

3434 3434

35356 XXXXXXXXXXXXXXXXXXXXXXXXXX X 999999999 3535

3636 3636

3737 7 XXXXXXXXXXXXXXXXXXXXXXXXXX X 999999999 3737

3838 3838

3939 8 XXXXXXXXXXXXXXXXXXXXXXXXXX X 999999999 3939

4040 4040

41419 XXXXXXXXXXXXXXXXXXXXXXXXXX X 999999999 4141

4242 4242

4343 10 XXXXXXXXXXXXXXXXXXXXXXXXXX X 999999999 4343

4444 4444

454511 XXXXXXXXXXXXXXXXXXXXXXXXXX X 999999999 4545

4646 4646

474712 XXXXXXXXXXXXXXXXXXXXXXXXXX X 999999999 4747

4848 4848

494913 XXXXXXXXXXXXXXXXXXXXXXXXXX X 999999999 4949

5050 5050

5151 14 XXXXXXXXXXXXXXXXXXXXXXXXXX X 999999999 5151

5252 5252

535315 XXXXXXXXXXXXXXXXXXXXXXXXXX X 999999999 5353

5454 5454

5555 5555

5656 5656

5757 5757

5858 5858

5959 5959

6060 6060

6161 6161

6262 6262

6363 Duplex and Photocopies NOT Acceptable 6363

0606 0707 08009 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80