Enlarge image

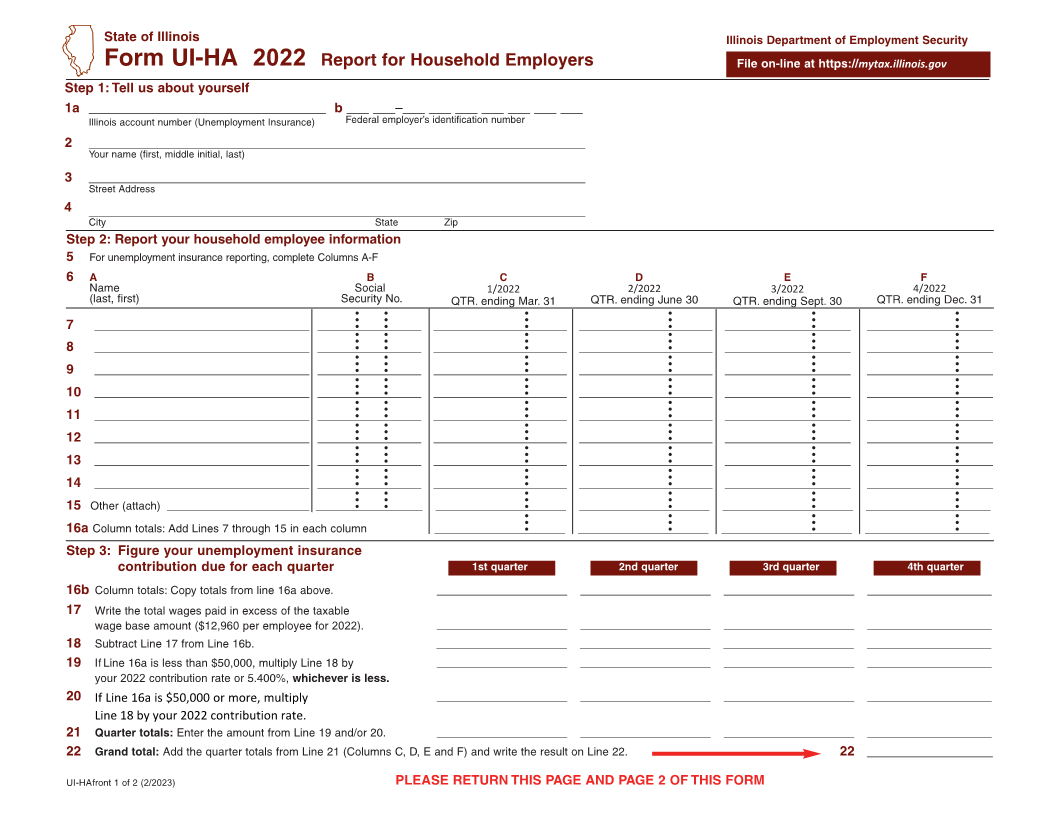

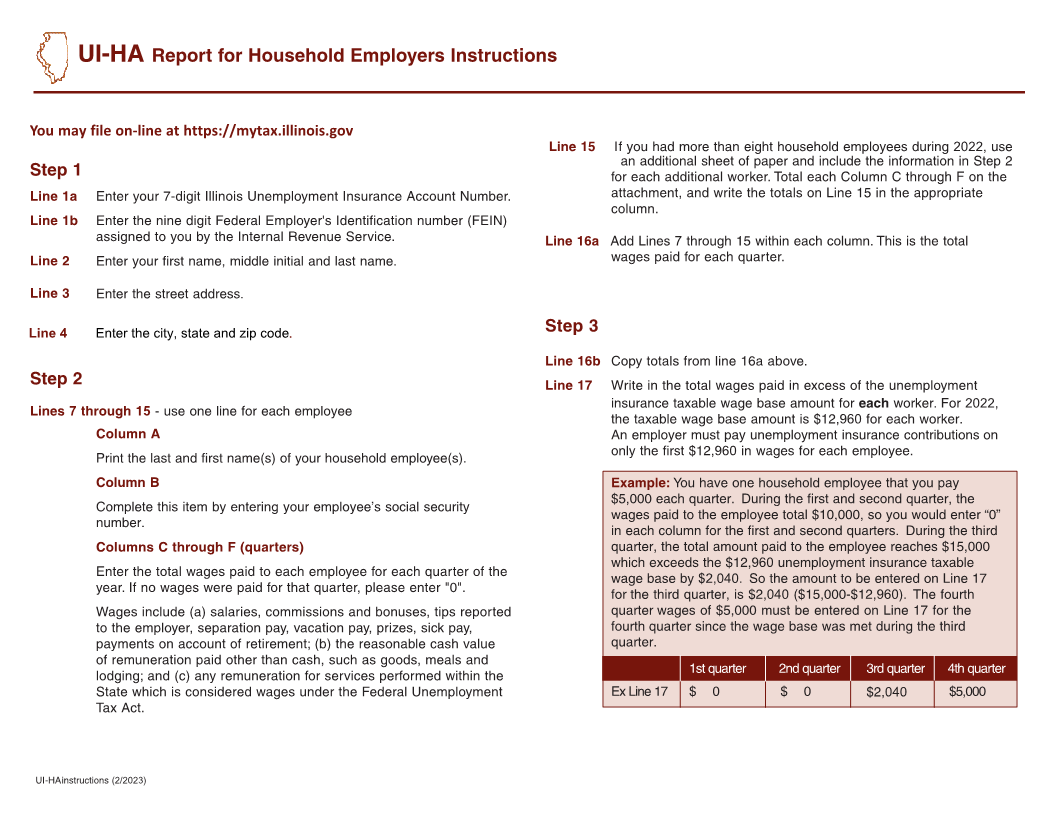

UI-HA Report for Household Employers Instructions

You may file on-line at https://mytax.illinois.gov

Line 15 If you had more than eight household employees during 2022, use

an additional sheet of paper and include the information in Step 2

Step 1 for each additional worker. Total each Column C through F on the

Line 1a Enter your 7-digit Illinois Unemployment Insurance Account Number. attachment, and write the totals on Line 15 in the appropriate

column.

Line 1b Enter the nine digit Federal Employer's Identification number (FEIN)

assigned to you by the Internal Revenue Service. Line 16a Add Lines 7 through 15 within each column. This is the total

Line 2 Enter your first name, middle initial and last name. wages paid for each quarter.

Line 3 Enter the street address .

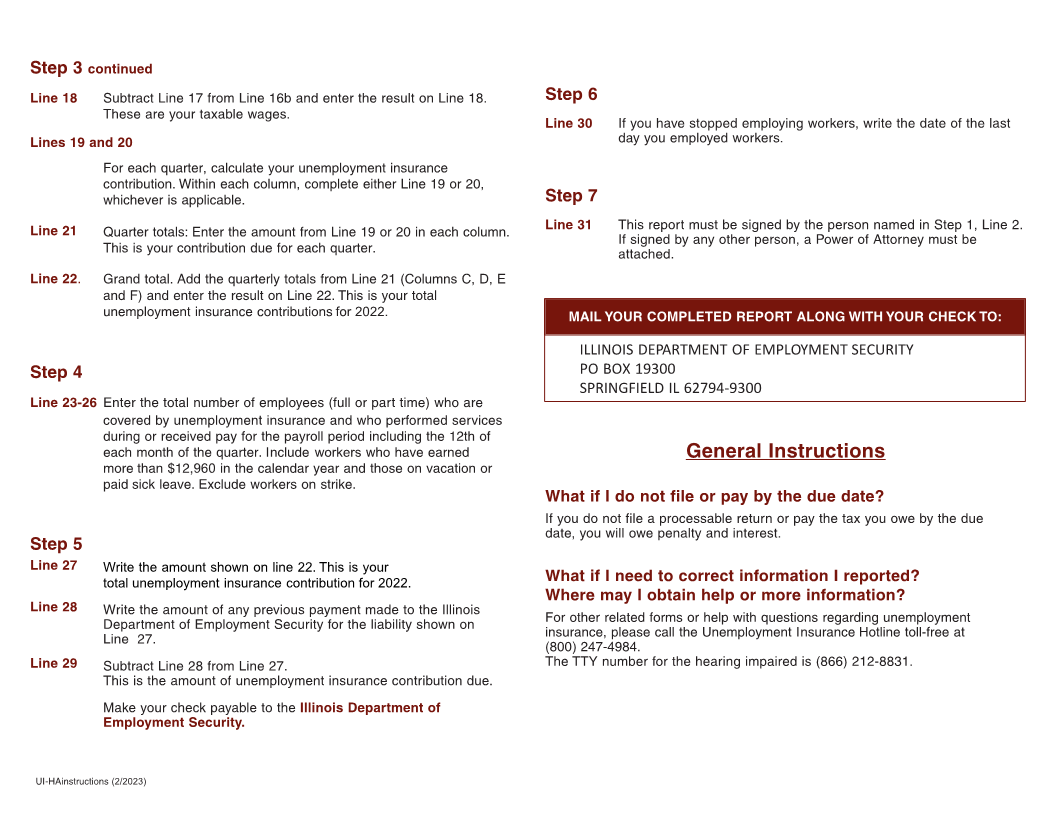

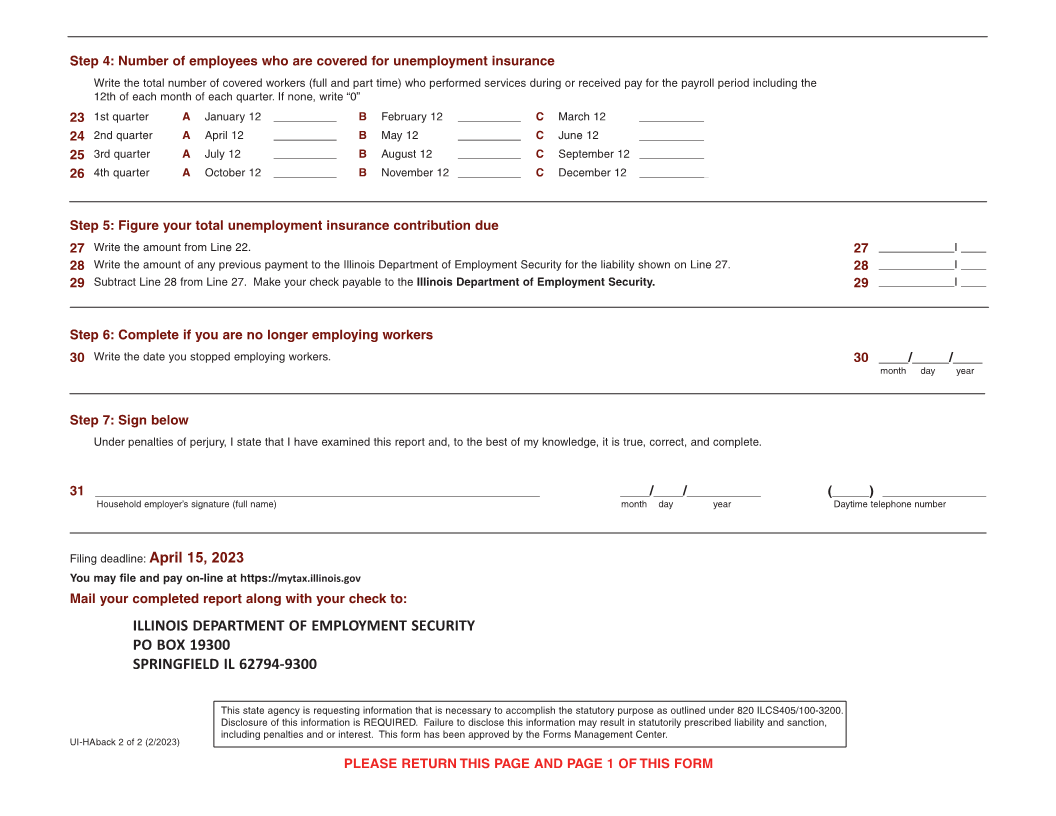

. Step 3

Line 4 Enter the city, state and zip code

Line 16b Copy totals from line 16a above.

Step 2 Line 17 Write in the total wages paid in excess of the unemployment

insurance taxable wage base amount for each worker. For 2022,

Lines 7 through 1 5 - use one line for each employee the taxable wage base amount is $12, 960 for each worker.

Column A An employer must pay unemployment insurance contributions on

only the first $12, 960 in wages for each employee.

Print the last and first name(s) of your household employee(s).

Column B Example: You have one household employee that you pay

$5,000 each quarter. During the first and second quarter, the

Complete this item by entering your employee’s social security wages paid to the employee total $10,000, so you would enter “0”

number.

in each column for the first and second quarters. During the third

Columns C through F (quarters) quarter, the total amount paid to the employee reaches $15,000

which exceeds the $12, 960 unemployment insurance taxable

Enter the total wages paid to each employee for each quarter of the wage base by $2,040. So the amount to be entered on Line 17

year. If no wages were paid for that quarter, please enter "0". for the third quarter, is $2, 040 ($15,000-$12,960 ). The fourth

Wages include (a) salaries, commissions and bonuses, tips reported quarter wages of $5,000 must be entered on Line 17 for the

to the employer, separation pay, vacation pay, prizes, sick pay, fourth quarter since the wage base was met during the third

payments on account of retirement; (b) the reasonable cash value quarter.

of remuneration paid other than cash, such as goods, meals and

1st quarter 2nd quarter 3rd quarter 4th quarter

lodging; and (c) any remuneration for services performed within the

State which is considered wages under the Federal Unemployment Ex Line 17 $ 0 $ 0 $2,040 $5,000

Tax Act.

UI-HAinstructions (2/2023)