Enlarge image

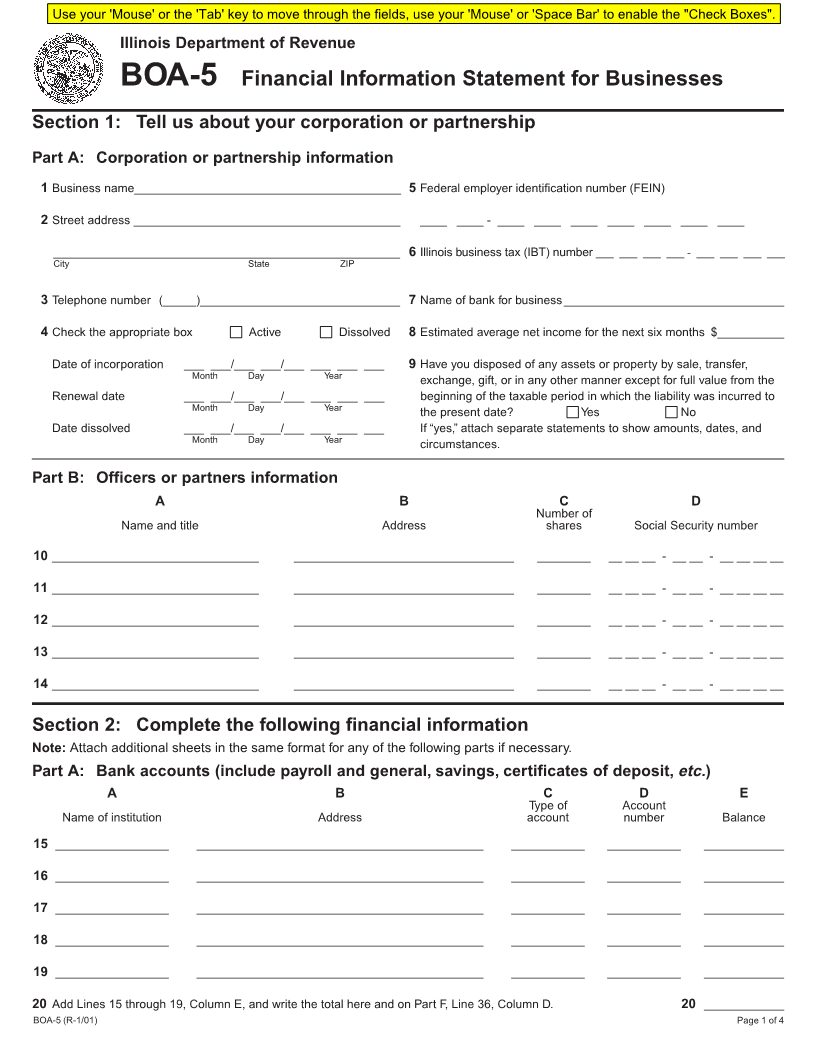

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

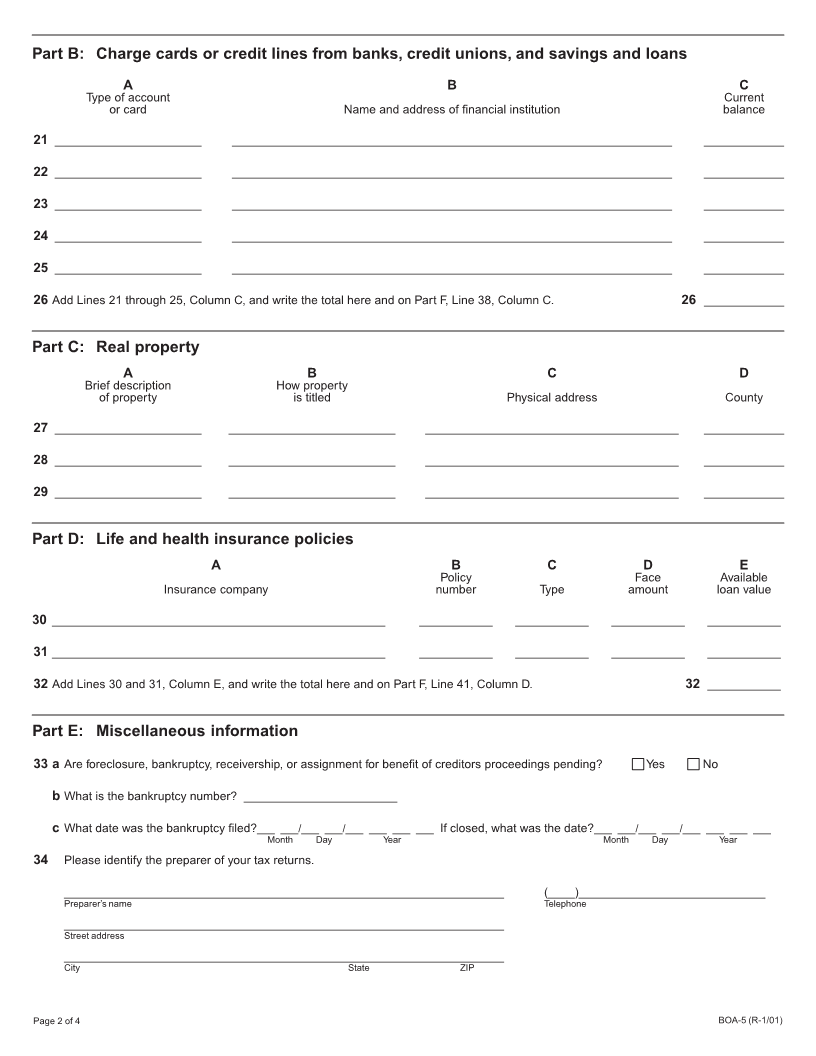

Illinois Department of Revenue

BOA-5 Financial Information Statement for Businesses

Section 1: Tell us about your corporation or partnership

Part A: Corporation or partnership information

1 Business name________________________________________ 5 Federal employer identification number (FEIN)

2 Street address ________________________________________ ____ ____ - ____ ____ ____ ____ ____ ____ ____

____________________________________________________ 6 Illinois business tax (IBT) number ___ ___ ___ ___ - ___ ___ ___ ___

City State ZIP

3 Telephone number (_____)______________________________ 7 Name of bank for business_________________________________

4 Check the appropriate box Active Dissolved 8 Estimated average net income for the next six months $__________

Date of incorporation ___ ___/___ ___/___ ___ ___ ___ 9 Have you disposed of any assets or property by sale, transfer,

Month Day Year exchange, gift, or in any other manner except for full value from the

Renewal date ___ ___/___ ___/___ ___ ___ ___ beginning of the taxable period in which the liability was incurred to

Month Day Year the present date? Yes No

Date dissolved ___ ___/___ ___/___ ___ ___ ___ If “yes,” attach separate statements to show amounts, dates, and

Month Day Year circumstances.

Part B: Officers or partners information

ABCD

Number of

Name and title Address shares Social Security number

10 _______________________________ _________________________________ ________ __ __ __ - __ __ - __ __ __ __

11 _______________________________ _________________________________ ________ __ __ __ - __ __ - __ __ __ __

12 _______________________________ _________________________________ ________ __ __ __ - __ __ - __ __ __ __

13 _______________________________ _________________________________ ________ __ __ __ - __ __ - __ __ __ __

14 _______________________________ _________________________________ ________ __ __ __ - __ __ - __ __ __ __

Section 2: Complete the following financial information

Note: Attach additional sheets in the same format for any of the following parts if necessary.

Part A: Bank accounts (include payroll and general, savings, certificates of deposit, etc. )

ABCDE

Type of Account

Name of institution Address account number Balance

15 _________________ ___________________________________________ ___________ ___________ ____________

16 _________________ ___________________________________________ ___________ ___________ ____________

17 _________________ ___________________________________________ ___________ ___________ ____________

18 _________________ ___________________________________________ ___________ ___________ ____________

19 _________________ ___________________________________________ ___________ ___________ ____________

20 Add Lines 15 through 19, Column E, and write the total here and on Part F, Line 36, Column D. 20 ____________

BOA-5 (R-1/01) Page 1 of 4