Enlarge image

Colorado Consumer Use Tax Guide

Enlarge image | Colorado Consumer Use Tax Guide |

Enlarge image |

Colorado Consumer Use Tax

Colorado use tax is a complement to Colorado sales tax This publication is designed to provide general

and is imposed for the privilege of storing, using, or guidance regarding Colorado use tax requirements

consuming tangible personal property in Colorado. prescribed by law. Nothing in this publication modifies

Taxable uses of tangible personal property include, but or is intended to modify the requirements of Colorado’s

are not limited to, the keeping or retention of it, any statutes and regulations. Taxpayers are encouraged to

exercise of dominion or control over it, and the waste consult their tax advisors for guidance regarding

or destruction of it. specific situations.

In general, whenever a purchaser acquires tangible

personal property without paying sales tax at the time Table of Contents

of the sale, they must pay consumer use tax directly to

the Department. If an item is exempt from sales tax, it Part 1: Liability for Consumer Use Tax . . . . . . . . . 2

is generally exempt from use tax as well.

Part 2: Taxable Property . . . . . . . . . . . . . . . . . 4

The Colorado use tax rate is 2.9%, the same as the sales

Part 3: Calculating Consumer Use Tax . . . . . . . . . 7

tax rate in Colorado, and use tax is calculated in the

same manner as sales tax. A taxpayer may claim a Part 4: Filing, Remittance & Recordkeeping . . . . . 9

credit against the Colorado use tax due for any legally

Part 5: Refunds and Assessments . . . . . . . . . . . . 12

imposed sales or use tax they previously paid to

another state with respect to the same tangible

personal property.

The filing and remittance requirements for Colorado use

tax depend on multiple factors. Individuals may generally

remit use tax annually with their Colorado income tax

return, but businesses generally must remit use tax as it is

accrued, with the Consumer Use Tax Return. Any

Colorado use tax due for a motor vehicle must be

remitted to the county clerk at the time of registration.

The Colorado Department of Revenue administers use

taxes for both the State of Colorado and certain special

districts within the state, including the Regional

Transportation District (RTD), the Scientific and Cultural

Facilities District (CD), and certain Regional

Transportation Authorities (RTA). However, the

Department does not administer any city or county use

taxes. The information in this publication applies to

state and state-administered special district use taxes,

but generally does not apply to city and county use

taxes, including any use taxes imposed and collected by

any home-rule cities. Please see the information about

motor vehicles and construction and building materials

in Part 4 of this publication and contact the city or

county directly for information about their use tax.

1

Revised March 2023

|

Enlarge image |

Part 1: Liability for Consumer Use Tax

In general, anyone who stores, uses, or consumes Certain governmental entities

tangible personal property in Colorado is subject to

consumer use tax, although Colorado law authorizes A use tax exemption is allowed for the storage, use, or

certain exemptions from the tax. Furthermore, direct consumption of tangible personal property by certain

pay permit holders are generally required to remit governmental entities, in their governmental capacities

sales tax, rather than use tax, to the Department for only. The exemption is allowed to:

all of their purchases. This Part 1 discusses individuals,

➢ the United States government;

entities, and organizations that are subject to or

exempt from consumer use tax. ➢ the Colorado government and its institutions; and

➢ any city, county, and other local government in

Taxpayers who owe consumer use tax Colorado.

In general, every individual, corporation, limited The exemption also applies to any property loaned to

liability company, partnership, firm, joint venture, any of the governmental entities listed above. For

association, estate, trust, and receiver in Colorado is additional information, please see Sales & Use Tax

subject to consumer use tax, regardless of whether Topics: Governmental Entities, available online at

they conduct any business in the state. Tax.Colorado.gov/sales-use-tax-guidance-publications.

Charitable organizations

Exempt entities and organizations

A use tax exemption is allowed for the storage, use, or

Certain entities and organizations are exempt from consumption of tangible personal property by certain

both sales and use taxes. Exempt organizations and charitable organizations, in the conduct of their regular

entities include: charitable functions and activities. In general, the

exemption is allowed to any organization meeting the

➢ certain governmental entities; requirement of section 501(c)(3) of the Internal Revenue

Code. For additional information, please see Sales & Use

➢ charitable organizations; and Tax Topics: Charitable Organizations, available online at

Tax.Colorado.gov/sales-use-tax-guidance-publications.

➢ affordable housing projects.

The exemption also applies to any property loaned to

Additionally, construction and building materials used any qualifying charitable organization.

in building, erection, alteration, or repair of structures,

highways, roads, streets, and other public works owned

Affordable housing projects

and used by governmental entities or charitable

organizations may qualify for exemption. For additional In general, a use tax exemption applies to tangible

information, please see Department publication FYI personal property purchased for the construction of any

Sales 6: Contractors and Retailer-Contractors, affordable housing projects directly or indirectly owned

available online at Tax.Colorado.gov/sales-use-tax- by, leased to, or under construction by a housing

guidance-publications. authority created pursuant to section 29-4-201, et seq.,

C.R.S. For additional information, please see Department

publication FYI Sales 95: Sales/Use Tax Exemption for

Affordable Housing Projects, available online at

Tax.Colorado.gov/sales-use-tax-guidance-publications.

2

Revised March 2023

|

Enlarge image |

Part 1: Liability for Consumer Use Tax

Direct pay permit holders Statutes and regulations

➢

In general, direct pay permit holders must remit sales § 39-26-103.5, C.R.S. Qualified purchaser –direct

pay permit number –qualifications.

tax to the Department, rather than consumer use tax,

for all taxable purchases they make in Colorado. ➢ § 39-26-201, C.R.S. Definitions.

However, a direct pay permit holder is required to

remit consumer use tax to the Department in the ➢ § 39-26-202, C.R.S. Authorization of tax.

following situations:

➢ § 39-26-204, C.R.S. Periodic return.

1) The direct pay permit holder purchased and took

possession of taxable property outside of Colorado ➢ § 39-26-704, C.R.S. Miscellaneous sales tax

before bringing the property into Colorado. exemptions –governmental entities.

2) The direct pay permit holder made a tax-exempt ➢ § 39-26-713, C.R.S. Tangible personal property.

wholesale purchase of an item, ingredient, or

➢

component part for resale, but later removed such Rule 39-26-202. Imposition of use tax.

item, ingredient, or component part from ➢ Rule 39-26-704-2. Sales Tax Exemption for Housing

inventory for their own use.

Authorities.

For additional information about direct pay permit

holders, please see Department publication FYI Sales Forms and guidance

78: Direct Pay Permit for Colorado Sales Tax, available

online at Tax.Colorado.gov/sales-use-tax-guidance- ➢ Tax.Colorado.gov

publications.

➢ Tax.Colorado.gov/consumer-use-tax

➢ Tax.Colorado.gov/sales-use-tax-guidance-publications

Additional resources

➢ FYI Sales 6: Contractors and Retailer-Contractors

The following is a list of statutes, regulations, forms,

and guidance pertaining to Colorado use tax and ➢ FYI Sales 78: Direct Pay Permit for Colorado Sales Tax

exemptions. This list is not, and is not intended to be,

an exhaustive list of authorities that govern the tax ➢ FYI Sales 95: Sales/Use Tax Exemption for

treatment of every situation. Individuals and businesses Affordable Housing Projects

with specific questions should consult their tax advisors.

➢ Sales & Use Tax Topics: Charitable Organizations

➢ Sales & Use Tax Topics: Governmental Entities

3

Revised March 2023

|

Enlarge image |

Part 2: Taxable Property

Property subject to use tax generally includes all Non-taxable property

tangible personal property, except if a specific

exemption is authorized by law. Consumer use tax is Use tax does not apply to either real property or

due if any taxpayer stores, uses, or consumes in intangible personal property. However, prior to their

Colorado any taxable property without having paid all incorporation into real property, construction and

applicable sales and/or use taxes at the time of building materials are tangible personal property that

acquisition. This occurs most commonly when a are subject to sales and use taxes.

purchase is from an out-of-state seller who does not

collect Colorado sales tax.

Real property

This Part 2 provides information about tangible

personal property that is subject to use tax and Real property, such as land and buildings, is not subject

discusses the kind of transactions in which a seller may to use tax. Real property includes any tangible personal

not have collected sales tax. property that lost its identity as tangible personal

property when it was installed and became an integral

and inseparable part of real property and that is

Tangible personal property removable only with substantial damage to the real

property. If some part of real property is severed and

Tangible personal property that is subject to use tax removed, it once again becomes tangible personal

includes all goods, wares, merchandise, products, and property that is subject to sales and use taxes.

commodities, and all tangible or corporeal things and

substances that are dealt in and capable of being Intangible personal property

possessed and exchanged. However, Colorado law

exempts several types of tangible personal property Intangible personal property, which constitutes mere

from use tax. Additional information regarding rights of action with no intrinsic value, is not subject to

exemptions can be found at the end of this Part 2. use tax. Examples of intangible personal property

include the following:

Tangible personal property includes digital goods that

are delivered or stored by digital means, including, but ➢ contracts,

not limited to, video, music, or electronic books. The

➢

method of delivery does not impact the taxability of a deeds,

sale of tangible personal property.

➢ mortgages,

Colorado has specific rules regarding the taxability of

➢

computer software. If a particular purchase of stocks,

computer software is exempt from sales tax, that ➢ bonds, or

computer software will generally be exempt from use

tax as well. For additional information, please see ➢ certificates of deposit.

Department publication Sales & Use Tax Topics:

Computer Software, available online at

Tax.Colorado.gov/sales-use-tax-guidance-publications.

4

Revised March 2023

|

Enlarge image |

Part 2: Taxable Property

Sales made without tax collection Purchases made outside of Colorado

In general, any retailer who sells tangible personal If a person, business, or other legal entity purchases

property in Colorado is required to collect the taxable property outside of Colorado and brings that

applicable state and state-administered local sales property into Colorado for use in this state, the

taxes at the time of the sale. However, the consumer property will be subject to consumer use tax. However,

must pay use tax directly to the Department if the if the purchaser paid sales tax to the other state at the

seller did not collect the applicable tax for any reason. time of purchase, the purchaser will be allowed a

Some of the more common reasons that a seller might credit toward the use tax due in the amount of the

not have collected the applicable sales tax are sales tax paid. Please see Part 3 of this publication for

discussed in the following sections. additional information about the credit allowed for

sales taxes paid to another state.

Purchases made over the internet

Sales between private parties

Tangible personal property purchased over the internet

and delivered into Colorado is not exempt from taxation If tangible personal property is purchased from a

simply because it was purchased online. However, if the private party who does not have a sales tax license and

seller does not have a store, warehouse, or other therefore does not collect sales tax, the purchaser

physical location in Colorado and makes only minimal must pay the applicable consumer use tax directly to

sales into Colorado, the seller might not be required to the Department.

collect the applicable sales tax at the time of the

purchase. If a person, business, or other legal entity

Items removed from inventory

purchases tangible personal property online for use in

Colorado, and pays no sales or use tax to the seller at A wholesaler or retailer may purchase tangible personal

the time of purchase, that purchaser will owe use tax on property, including ingredients and component parts,

the purchased property. for resale without paying sales tax at the time of

purchase. However, if the wholesaler or retailer

An out-of-state retailer who sells taxable property into

withdraws an item purchased tax-free from inventory

Colorado, but does not collect Colorado tax, must:

for the retailer’s own use, the retailer will owe use tax

➢ present the purchaser with a notice at the time of on that item. Use tax applies regardless of whether the

the sale advising them of their obligation to pay wholesaler or retailer uses the withdrawn item for its

consumer use tax directly to the Department; customary purpose, for testing, for quality control, for

research and development purposes, or for any other

➢ send the purchaser an annual summary in January purpose.

listing the purchases they made during the prior

year; and

➢ report to the Department the total dollar amount of

the purchases each purchaser in Colorado made.

The annual summary will assist purchasers in reporting

and paying consumer use tax. Please see Part 4 of this

publication for information about reporting and paying

consumer use tax.

5

Revised March 2023

|

Enlarge image |

Part 2: Taxable Property

Use tax exemptions Additional resources

Colorado law exempts several types of property from The following is a list of statutes, regulations, forms,

use tax. Some of the more common types of exempt and guidance pertaining to Colorado use tax and

property are: exemptions. This list is not, and is not intended to be,

an exhaustive list of authorities that govern the tax

➢ property for which the purchaser paid the applicable treatment of every situation. Individuals and businesses

Colorado sales tax at the time of purchase; with specific questions should consult their tax advisors.

➢ property for which the purchaser paid, at the time

Statutes and regulations

of purchase, sales tax to another state in an

amount equal to or greater than the use tax due; ➢ § 39-21-112, C.R.S. Duties and powers of executive

director.

➢ food for domestic home consumption (please see

Department publication FYI Sales 4: Taxable and ➢ § 39-26-102, C.R.S. Definitions.

Tax-Exempt Sales of Food and Related Items);

➢ § 39-26-201, C.R.S. Definitions.

➢ certain machinery and machine tools used in

➢

manufacturing (please see Department publication § 39-26-202, C.R.S. Authorization of tax.

Sales & Use Tax Topics: Manufacturing); ➢ § 39-26-204, C.R.S. Periodic return.

➢ property purchased and held for resale in the ➢ § 39-26-707, C.R.S. Food, meals, beverages, and

regular course of business, either in its original packaging.

form or as an ingredient or a constituent part of a

manufactured product; ➢ § 39-26-709, C.R.S. Machinery and machine tools.

➢ property held by a nonresident and brought into ➢ § 39-26-713, C.R.S. Tangible personal property.

Colorado either temporarily or when the

➢

nonresident acquires residency in Colorado; Rule 39-21-112(3.5). Notice of reporting

requirements for non-collecting retailers.

➢ property purchased for $100 or less by Colorado ➢ Rule 39-26-102(15). Tangible personal property.

residents while outside of Colorado.

➢ Rule 39-26-713-3.

Please see Part 7 of Article 26 of Title 39 of the

Colorado Revised Statutes for information about other

types of property that are exempt from use tax. Forms and guidance

➢ Tax.Colorado.gov

➢ Tax.Colorado.gov/consumer-use-tax

➢ FYI Sales 4: Taxable and Tax-Exempt Sales of Food

and Related Items

➢ Sales & Use Tax Topics: Computer Software

➢ Sales & Use Tax Topics: Manufacturing

6

Revised March 2023

|

Enlarge image |

Part 3: Calculating Consumer Use Tax

Colorado use tax is calculated at the same 2.9% rate as Exchanged property

the state sales tax. This Part 3 provides information

about the calculation of Colorado use tax. Some cities, Under certain conditions, the fair market value of

counties, and special districts in Colorado also impose a tangible personal property exchanged by the purchaser

use tax. For information about local use tax rates and as part of a sale is excluded from the taxable purchase

applicability in Colorado, please see Department price. The fair market value of the tangible personal

publication Colorado Sales/Use Tax Rates (DR 1002), property exchanged by the purchaser is excluded from

available online at Tax.Colorado.gov/sales-use-tax- the taxable purchase price, if either:

forms. Additional information about the remittance of

local use taxes can be found in Part 4 of this ➢ such exchanged property is to be sold thereafter in

publication. the usual course of the retailer's business; or

➢ such exchanged property is a vehicle and is

Purchase price exchanged for another vehicle and both vehicles

are subject to licensing, registration, or

In general, Colorado use tax is calculated on the full certification in Colorado, including, but not

purchase price of the taxable item. The taxable limited to, vehicles operated upon public

purchase price includes the full amount paid, or highways, off-highway recreation vehicles,

promised to be paid, by the buyer at the time of watercraft, and aircraft.

purchase of the property, excluding only any direct

federal tax, any state and local sales tax imposed on If the purchaser transfers intangible property or performs

the sale, and any retail delivery fees imposed pursuant services in exchange for tangible personal property, the

to section 43-4-218, C.R.S. The taxable purchase price fair market value of the intangible property or service is

includes the gross value of all material, labor, and included in the taxable purchase price.

service, and the profit thereon included in the price

charged to the user or consumer.

Gifted property

Coupons In the case of a bona fide gift of tangible personal

property, the recipient of the gift owes no use tax on the

Whether a coupon reduces the taxable purchase price

items since they did not purchase the item at retail.

for use tax purposes depends on whether the coupon is

Instead, the giver must pay sales tax when purchasing the

a manufacturer's coupon or a store coupon.

item or, if no sales tax was collected by the seller at the

In the case of a manufacturer's coupon, the time of the sale, the giver must pay use tax based on the

manufacturer compensates the retailer for reducing purchase price of the item.

the price the purchaser pays. Because the retailer is

reimbursed by the manufacturer for the amount of the

reduction, use tax applies to the full selling price

before the deduction for the manufacturer's coupon.

A store coupon is issued by the retailer for a reduction

in the sales price when the coupon is presented to the

retailer by the customer. Because there is no

reimbursement to the retailer for such reduction, the

taxable purchase price is the reduced price that the

purchaser pays.

7

Revised March 2023

|

Enlarge image |

Part 3: Calculating Consumer Use Tax

Associated service charges Additional resources

With certain exceptions discussed below, the taxable The following is a list of statutes, regulations, forms,

purchase price includes any service charges associated and guidance pertaining to the calculation of Colorado

with the sale of tangible personal property, such as use tax. This list is not, and is not intended to be, an

charges for installation or delivery. Associated service exhaustive list of authorities that govern the tax

charges are included in the taxable purchase price unless treatment of every situation. Individuals and businesses

both the service is separable from the sale of the property with specific questions should consult their tax advisors.

and the service charge is separately stated from the price

of the property sold on the invoice or receipt.

Statutes and regulations

An associated service is separable from the sale of the ➢ § 24-60-1301, C.R.S. Execution of compact.

property if the service is performed after the taxable

property is offered for sale and the purchaser has the ➢ § 39-26-102, C.R.S. Definitions.

option not to purchase the associated service. For

example, if delivery is optional and the purchaser may ➢ § 39-26-201, C.R.S. Definitions.

elect to pick up the property at the seller’s store,

without paying the delivery charge, the delivery charge ➢ § 39-26-202, C.R.S. Authorization of tax.

is separable.

➢ § 39-26-713, C.R.S. Tangible personal property.

An associated service charge is separately stated if it

appears as a distinct line item on a written sales ➢ Rule 39-26-102(7)(a).

contract, retailer’s invoice, or other written document

➢

issued in connection with the sale, apart from the price Rule 39-26-102(10).

of the property sold. However, the statement of a

➢

charge as a separate line item does not necessarily Rule 39-26-102(12).

indicate that the charge is also separable. ➢ Rule 39-26-104-3. Exchanged tangible personal

A service charge that is overstated or intended to shift property.

cost and avoid the proper taxation of the property sold

➢

is not excluded from the purchase price, even if the Rule 39-26-713-4.

service charge is both separable and separately stated. ➢ Special Rule 11. Coupons.

➢ Special Rule 18. Transportation charges.

Credit for tax paid to another state

➢ Special Rule 21. Gifts, premiums, and prizes.

A purchaser liable for a use tax on tangible personal

property is allowed a credit for any legally imposed sales or

Forms and guidance

use taxes the purchaser paid in another state for the same

property. Credit is not allowed if the tax paid to the other ➢ Tax.Colorado.gov

state was not legally due under the laws of that state.

➢ Tax.Colorado.gov/consumer-use-tax

Credit may be claimed on the Consumer Use Tax Return

(DR 0252). The credit must be first applied against any ➢ Colorado Sales/Use Tax Rates (DR 1002)

Colorado use tax due, and any unused portion of the

credit is then applied against any local use taxes due. ➢ Consumer Use Tax Return (DR 0252)

8

Revised March 2023

|

Enlarge image |

Part 4: Filing, Remittance & Recordkeeping

While a purchaser typically will pay sales tax to the Businesses and other legal entities

seller at the time of the sale, if the seller does not

collect sales tax, the purchaser generally must remit Business and other legal entities that owe use tax must

the applicable use tax directly to the Department. The report and pay the applicable tax with a Consumer Use

time and manner for filing and remitting Colorado use Tax Return (DR 0252) and, if applicable, the RTA

tax differ for individuals and businesses. Additionally, Consumer Use Tax Return (DR 0251), both of which can

special rules apply to the imposition of local use taxes be filed electronically at Colorado.Gov/RevenueOnline.

on motor vehicles and construction and building

materials. This Part 4 provides information regarding The due date for businesses and other legal entities that

filing and payment requirements for Colorado use tax. owe consumer use tax depends upon the amount of use

tax owed. If the business or other legal entity accrues

less than $300 of total consumer use tax over the course

Individuals of the year, the business or other legal entity must file

an annual use tax return by January 20 thof the following

Individuals can report and pay consumer use tax in one year, to report and pay the tax due. If the cumulative

of two ways, both of which can be filed electronically use tax due at the end of any month is in excess of $300,

at Colorado.Gov/RevenueOnline: the business or legal entity must file a return by the 20 th

day of the following month.

➢ with the Consumer Use Tax Reporting Schedule

(DR 104US) as an attachment to their Colorado

Individual Income Tax Return (DR 104); or Construction and building materials

➢ with the Consumer Use Tax Return (DR 0252) and, Construction and building materials are exempt from sales

if applicable, the RTA Consumer Use Tax Return taxes imposed by any county, statutory city, or home-rule

(DR 0251). city if the purchaser of such materials presents to the

seller a building permit or similar documentation showing

The schedule or return must include use tax for any that local use tax has been paid or is required to be paid.

tangible personal property the individual stored, used, The exemption from city and county sales tax applies

or consumed during the preceding taxable year and for even if the materials are purchased outside of the city or

which sales or use tax was not previously paid. county in which the materials will be used. The applicable

Consumer use tax for individuals is due April 15th. If the local use taxes must be paid to the appropriate local

15 thfalls on a Saturday, Sunday, or legal holiday, the governmental agency.

return and tax remittance is due the next business day. Building permits do not affect the collection and

payment of state and state-administered special

district sales taxes on construction and building

materials. In general, the seller must collect the

applicable state and state-administered special district

sales taxes on any sale of construction and building

materials in Colorado. If, for any reason, the applicable

state and state-administered special district sales taxes

were not collected at the time of the sale, the

purchaser must remit the applicable state and special

district use taxes to the Department with a Consumer

Use Tax Return (DR 0252).

9

Revised March 2023

|

Enlarge image |

Part 4: Filing, Remittance & Recordkeeping

Motor vehicles Penalties and interest

In most cases, a motor vehicle dealer will collect all If anyone who owes consumer use tax does not file and

applicable state and state-administered local sales taxes pay the tax by the applicable due date, penalty and

at the time of the sale. At the time of titling and interest will be due. Penalty is imposed at a rate of 10%

registration, the county clerk must verify that all of the unpaid tax, plus an additional 0.5% for each

applicable state and local sales and use taxes have been month the tax remains unpaid, not to exceed a total of

paid. The county clerk must collect any remaining taxes 18%. Any underpayment of consumer use tax is also

due prior to titling and registering the vehicle. subject to the assessment of penalty interest in an

amount equal to the interest due, as described below.

In general, state and state-administered sales taxes Additional penalties may be imposed for negligence or

apply whenever the purchaser takes possession of the fraud.

vehicle in the same taxing jurisdiction as the vehicle

will be registered. If the applicable sales taxes are not Interest accrues on any late payment of tax from the

collected at the time of the sale because, for example, original due date of the tax to the date the tax is paid.

the vehicle is purchased from a private party who does The rate of interest accrual depends on the calendar

not have a sales tax license, the county clerk must year(s) over which the deficiency continues.

collect the applicable sales taxes. Additionally, a discounted rate is allowed if:

If the purchaser takes possession of the vehicle outside ➢ the taxpayer pays the tax in full prior to the

of the taxing jurisdiction in which it will be registered, issuance of a notice of deficiency;

the purchaser may owe use tax, rather than sales tax,

➢

for that jurisdiction. In order to facilitate titling and the taxpayer pays the tax in full within 30 days of

registration, motor vehicle dealers may collect the issuance of a notice of deficiency; or

applicable local use taxes and remit them to the county

➢

clerk with Department form DR 0024, Standard Sales within 30 days of the issuance of a notice of

deficiency, the taxpayer enters into an agreement

Tax Receipt for Vehicle Sales. If the seller has not

to pay the tax in monthly installments.

collected and remitted to the county clerk all

applicable use taxes, the county clerk must collect any

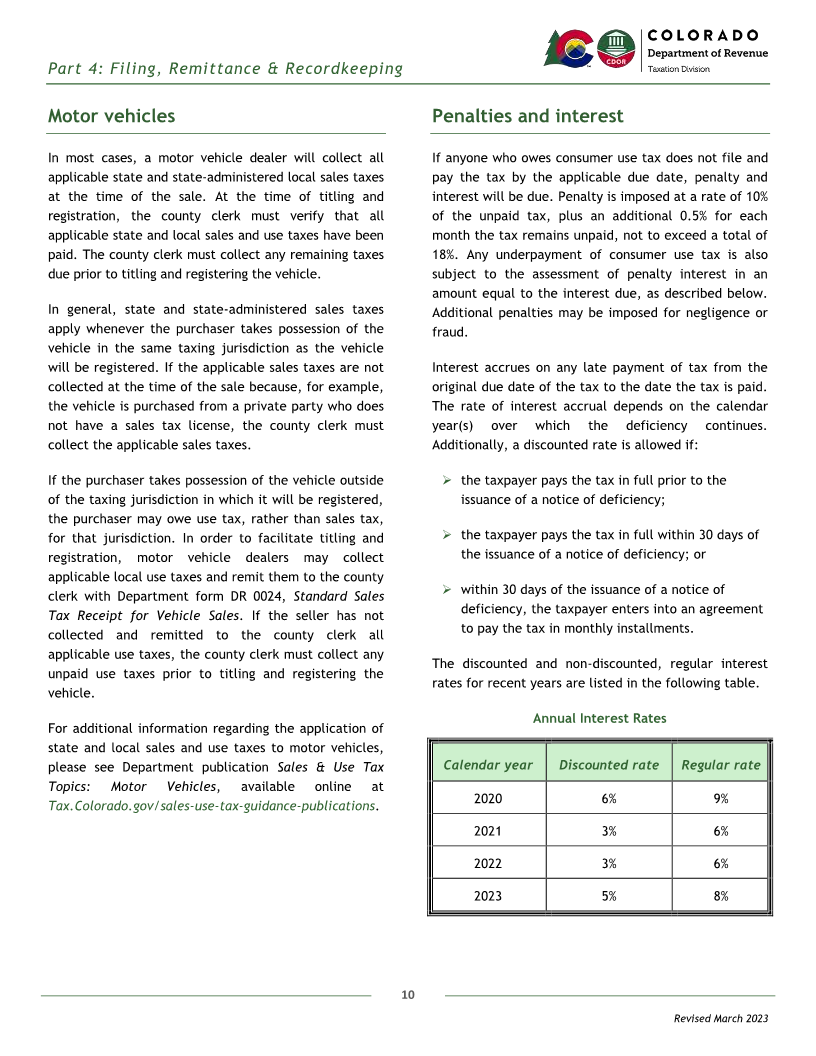

The discounted and non-discounted, regular interest

unpaid use taxes prior to titling and registering the

rates for recent years are listed in the following table.

vehicle.

Annual Interest Rates

For additional information regarding the application of

state and local sales and use taxes to motor vehicles,

please see Department publication Sales & Use Tax Calendar year Discounted rate Regular rate

Topics: Motor Vehicles, available online at

2020 6% 9%

Tax.Colorado.gov/sales-use-tax-guidance-publications.

2021 3% 6%

2022 3% 6%

2023 5% 8%

10

Revised March 2023

|

Enlarge image |

Part 4: Filing, Remittance & Recordkeeping

Failure to file Additional resources

If anyone neglects or refuses to file any required return The following is a list of statutes, regulations, forms,

or to remit any tax due, the Department will estimate and guidance pertaining to filing, remittance, and

the tax due based upon the best available information recordkeeping requirements for Colorado’s consumer use

and issue a notice of deficiency based upon this tax. This list is not, and is not intended to be, an

estimate. When such estimate and notice of deficiency exhaustive list of authorities that govern the tax

have been made, the taxpayer may prepare and file a treatment of every situation. Individuals and businesses

return for the tax period in question or otherwise with specific questions should consult their tax advisors.

protest the notice of deficiency as provided by law.

Statutes and regulations

Recordkeeping requirements ➢ § 29-2-105, C.R.S. Contents of sales tax ordinances.

Every taxpayer that is subject to Colorado consumer ➢ § 29-2-109, C.R.S. Contents of use tax ordinances.

use tax must keep and preserve such books, accounts,

➢

and records as may be necessary to determine the § 39-21-109, C.R.S. Interest on underpayment.

correct amount of tax. Such books, accounts, and

➢

records must be kept and preserved for a period of § 39-21-119, C.R.S. Filing with executive director.

three years following the due date of the return, the ➢ § 39-26-104, C.R.S. Property and services taxed.

filing of the return, or the payment of the tax,

whichever occurs later. All such books, accounts, and ➢ § 39-26-113, C.R.S. Collection of sales tax –motor

records shall be open for examination by the

vehicles.

Department at any time.

➢ § 39-26-115, C.R.S. Deficiency due to negligence.

➢ § 39-26-204, C.R.S. Periodic return.

➢ § 39-26-208, C.R.S. Collection of use tax –motor

vehicles.

Forms and guidance

➢ Tax.Colorado.gov

➢ Tax.Colorado.gov/consumer-use-tax

➢ Colorado.Gov/RevenueOnline

➢ Tax.Colorado.gov/sales-use-tax-forms

➢ Consumer Use Tax Reporting Schedule (DR 104US)

➢ Consumer Use Tax Return (DR 0252)

11

Revised March 2023

|

Enlarge image |

Part 5: Refunds and Assessments

Refunds and assessments may be made to correct Assessments

errors in the prior determination and reporting of tax.

Taxpayers may claim a refund for any overpayment of If, upon examination of a filed return, the Department

tax made with a previously filed return. Conversely, determines the correct amount of tax has not been paid,

the Department may issue an assessment for any the Department will issue a notice of deficiency to the

additional tax due that was not previously reported and taxpayer. In general, the Department may issue such

paid. The period of time allowed for making refunds notice no later than three years after the return was filed

and assessments is prescribed by law, but can be or three years after the return was due, whichever is

extended by agreement between the Department and later. In the case of a false or fraudulent return with

the taxpayer. intent to evade tax, there is no limit on the time for the

Department to issue a notice of deficiency.

This Part 5 provides information regarding refund

claims, assessments, and the period of time allowed by If anyone neglects or refuses to file any required return

law for both. or to remit any tax due, the Department will estimate

the tax due based upon the best available information

and issue a notice of deficiency based upon this

Refund claims

estimate. If anyone has not filed a required return,

there is no limit on the time for the Department to

If a taxpayer overpays any use tax due, the taxpayer

estimate the tax due and issue a notice for the

may request a refund by filing form DR 0137, Claim for

estimated tax due.

Refund. Please see the instructions for form DR 0137

for information about documentation that must be Please see Part 4 of this publication information about

submitted with refund claims. The taxpayer must also penalties and interest.

complete and file an amended Consumer Use Tax

Return (DR 0252) and, if applicable, RTA Consumer Use

Tax Return (DR 0251), to correct any errors in the Protests and appeals

originally filed return. Any claim for refund of consumer

use tax remitted to the Department must be made Anyone who receives a notice of deficiency or notice of

within three years and 20 days after the end of the refund rejection may submit a written protest and

month in which the taxable storage, use, or request a hearing to dispute the notice. Any protest or

consumption first occurred. request for hearing must be submitted within 30 days

of the date of the notice. The protest or request for

hearing must be signed by the taxpayer and contain at

least the following information:

➢ the taxpayer’s name, address, and account number;

➢ the tax period(s) involved;

➢ the type and amount of tax in dispute;

➢ a summary statement of the findings with which

the taxpayer does not agree and the grounds upon

which the taxpayer relies for the purpose of

showing the tax is not due.

12

Revised March 2023

|

Enlarge image |

Part 5: Refunds and Assessments

Additional resources

The following is a list of statutes, regulations, forms,

and guidance pertaining to refund claims and

assessments. This list is not, and is not intended to be,

an exhaustive list of authorities that govern the tax

treatment of every situation. Individuals and businesses

with specific questions should consult their tax

advisors.

Statutes and regulations

➢ § 39-21-103, C.R.S. Hearings.

➢ § 39-21-104, C.R.S. Rejection of claims.

➢ § 39-21-107, C.R.S. Limitations.

➢ § 39-26-204, C.R.S. Periodic return.

➢ § 39-26-210, C.R.S. Limitations.

➢ § 39-26-703, C.R.S. Disputes and refunds.

➢ Rule 39-21-103-1. Request for hearing.

Forms and guidance

➢ Tax.Colorado.gov

➢ Tax.Colorado.gov/consumer-use-tax

➢ Tax.Colorado.gov/sales-use-tax-forms

➢ Claim for Refund (DR 0137)

13

Revised March 2023

|