Enlarge image

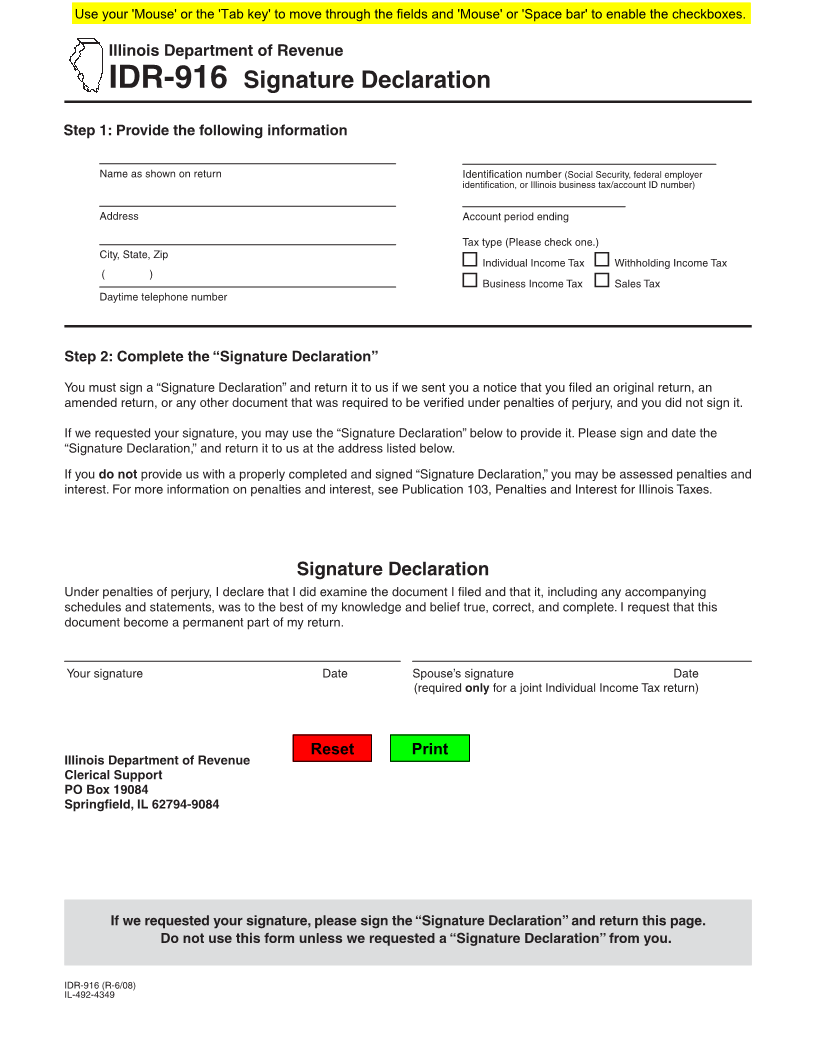

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

IDR-916 Signature Declaration

Step 1: Provide the following information

Name as shown on return Identifi cation number (Social Security, federal employer

identifi cation, or Illinois business tax/account ID number)

Address Account period ending

Tax type (Please check one.)

City, State, Zip

Individual Income Tax Withholding Income Tax

( )

Business Income Tax Sales Tax

Daytime telephone number

Step 2: Complete the “Signature Declaration”

You must sign a “Signature Declaration” and return it to us if we sent you a notice that you fi led an original return, an

amended return, or any other document that was required to be verifi ed under penalties of perjury, and you did not sign it.

If we requested your signature, you may use the “Signature Declaration” below to provide it. Please sign and date the

“Signature Declaration,” and return it to us at the address listed below.

If you do not provide us with a properly completed and signed “Signature Declaration,” you may be assessed penalties and

interest. For more information on penalties and interest, see Publication 103, Penalties and Interest for Illinois Taxes.

Signature Declaration

Under penalties of perjury, I declare that I did examine the document I fi led and that it, including any accompanying

schedules and statements, was to the best of my knowledge and belief true, correct, and complete. I request that this

document become a permanent part of my return.

Your signature Date Spouse’s signature Date

(required only for a joint Individual Income Tax return)

Reset Print

Illinois Department of Revenue

Clerical Support

PO Box 19084

Springfi eld, IL 62794-9084

If we requested your signature, please sign the “Signature Declaration” and return this page.

Do not use this form unless we requested a “Signature Declaration” from you.

IDR-916 (R-6/08)

IL-492-4349