Enlarge image

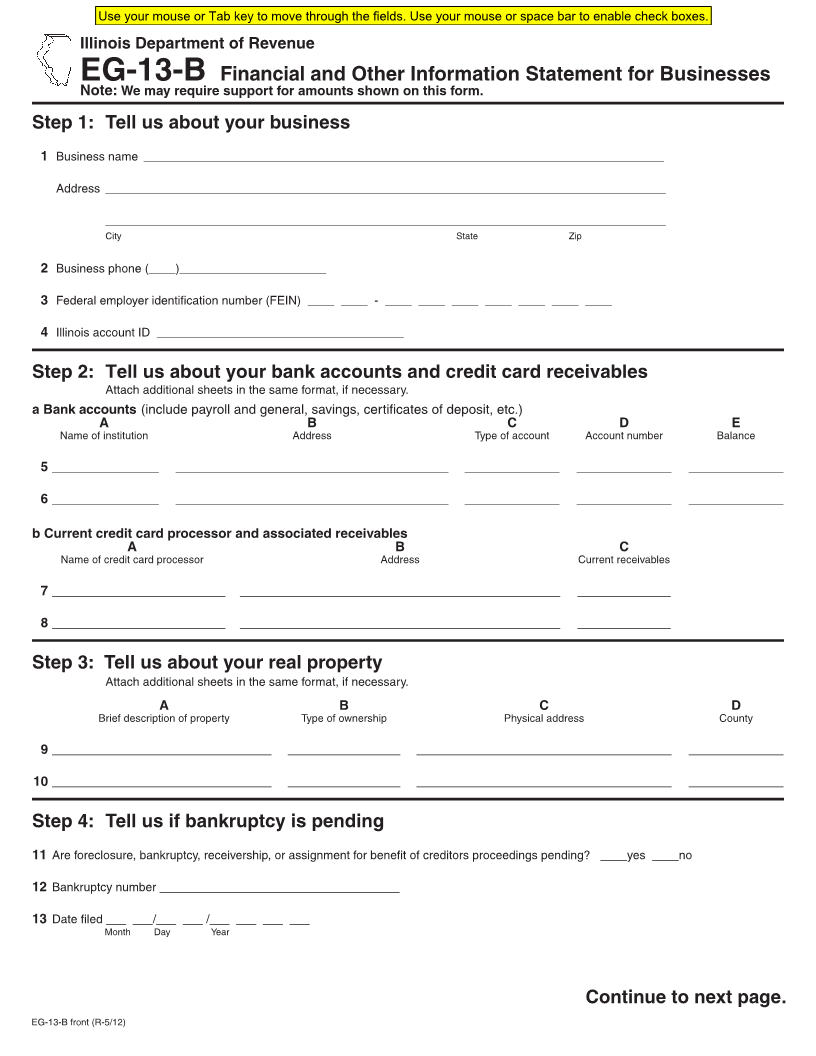

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

EG-13-B Financial and Other Information Statement for Businesses

Note: We may require support for amounts shown on this form.

Step 1: Tell us about your business

1 Business name ______________________________________________________________________________

Address ____________________________________________________________________________________

____________________________________________________________________________________

City State Zip

2 Business phone (____)______________________

3 Federal employer identification number (FEIN) ____ ____ - ____ ____ ____ ____ ____ ____ ____

4 Illinois account ID _____________________________________

Step 2: Tell us about your bank accounts and credit card receivables

Attach additional sheets in the same format, if necessary.

a Bank accounts (include payroll and general, savings, certificates of deposit, etc.)

A B C D E

Name of institution Address Type of account Account number Balance

5 __________________ ______________________________________________ ________________ ________________ ________________

6 __________________ ______________________________________________ ________________ ________________ ________________

b Current credit card processor and associated receivables

A B C

Name of credit card processor Address Current receivables

7 __________________________ ________________________________________________ ______________

8 __________________________ ________________________________________________ ______________

Step 3: Tell us about your real property

Attach additional sheets in the same format, if necessary.

A B C D

Brief description of property Type of ownership Physical address County

9 _ ____________________________________ ___________________ ___________________________________________ ________________

10 _ ____________________________________ ___________________ ___________________________________________ ________________

Step 4: Tell us if bankruptcy is pending

11 Are foreclosure, bankruptcy, receivership, or assignment for benefit of creditors proceedings pending? ____yes ____no

12 Bankruptcy number ____________________________________

13 Date filed ___ ___/___ ___ /___ ___ ___ ___

Month Day Year

Continue to next page....

EG-13-B front (R-5/12)