Enlarge image

DR 1366 (10/12/22)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*DO=NOT=SEND*

2022 Enterprise Zone Credit and Carryforward Schedule

(See form which starts on the next page)

General Instructions be used to populate column A of the DR 0106CR form (Credit

Use this form to calculate enterprise zone credits earned Available for Colorado pass-through entities). The amount of the

in the current tax year and to report any carryforward pass-through credit that is passed through to resident members

amounts from previous years. Total non-refundable credit who will file a Colorado return should be entered in column B of

claimed cannot exceed the statutory limit or current year the DR 0106CR (Credit allocated to partners or shareholders not

tax liability. Any taxpayer who claims an enterprise included in this composite) and the amount of the pass-through

zone credit is statutorily required to file their returns credit that is passed through to non-resident members filing as

electronically (§39-30-111, C.R.S.) and most software a composite should be entered in column C of the DR 0106CR

products and tax preparers have the ability to meet this (Credit allocated to partners or shareholders included in this

requirement. Revenue Online can also be used to file your composite). Use form DR 0078A to report the detailed distribution

return and attachments electronically. If you are unable to of enterprise zone credits that are being distributed to investors/

file electronically, include this DR 1366 schedule and any owners by a pass-through entity. Furthermore, each recipient of

supporting documentation with your paper return. HOWEVER, pass-through credits shall complete form DR 1366 to claim their

the Department strongly recommends electronic filing portion of the credit that is identified in form DR 0078A. If you are

for taxpayers with enterprise zone credits. Failure to file using a credit received from a pass-through entity, complete row

electronically may result in delays processing your return. b.) in the carryforward table and list the FEIN or account number

of the pass-through entity for each credit you are claiming.

You must submit copies of certification forms or emails

generated from the EZ Tax Credit online system with your Composite filings: Complete form DR 1366 to reflect the

tax return. Refer to the Enterprise Zone Tax Guide and or aggregate credits for the composite members. Complete

the Income Tax Topics: Enterprise Zone Contribution Credit row b.) in the carryforward table and list the FEIN or account

guidance publication available at Tax.Colorado.gov for more number of the pass-through entity for each credit that is being

information regarding enterprise zone income tax credits. used to offset tax for members of the composite filing.

Additional information about the Enterprise Zone Program is Important information regarding the refundable

available at OEDIT.Colorado.gov/enterprise-zone-program investment tax credit for renewable energy

Follow the instructions and the example below to report investments: The $750,000 cap is applicable at the

unused enterprise zone credit(s) from a previous year. List partnership or pass-through entity level. The combination

only the carryforward not the full credit amount generated of credits claimed and used by investors/owners and any

for that year. If more than 5 years of carryforward credits members cannot exceed $750,000 for a tax year.

are being reported include a supplemental spreadsheet.

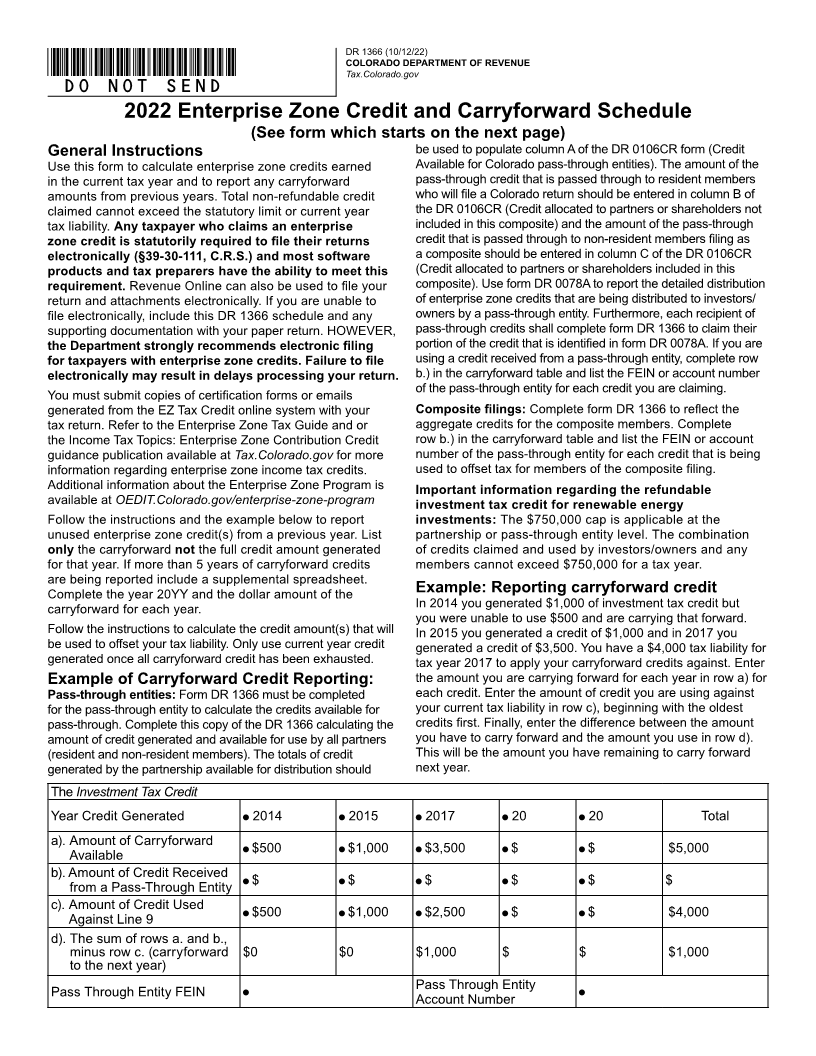

Complete the year 20YY and the dollar amount of the Example: Reporting carryforward credit

carryforward for each year. In 2014 you generated $1,000 of investment tax credit but

you were unable to use $500 and are carrying that forward.

Follow the instructions to calculate the credit amount(s) that will In 2015 you generated a credit of $1,000 and in 2017 you

be used to offset your tax liability. Only use current year credit generated a credit of $3,500. You have a $4,000 tax liability for

generated once all carryforward credit has been exhausted. tax year 2017 to apply your carryforward credits against. Enter

Example of Carryforward Credit Reporting: the amount you are carrying forward for each year in row a) for

Pass-through entities: Form DR 1366 must be completed each credit. Enter the amount of credit you are using against

for the pass-through entity to calculate the credits available for your current tax liability in row c), beginning with the oldest

pass-through. Complete this copy of the DR 1366 calculating the credits first. Finally, enter the difference between the amount

amount of credit generated and available for use by all partners you have to carry forward and the amount you use in row d).

(resident and non-resident members). The totals of credit This will be the amount you have remaining to carry forward

generated by the partnership available for distribution should next year.

The Investment Tax Credit

Year Credit Generated 2014 2015 2017 20 20 Total

a). Amount of Carryforward $500 $1,000 $3,500 $ $ $5,000

Available

b). Amount of Credit Received $ $ $ $ $ $

from a Pass-Through Entity

c). Amount of Credit Used $500 $1,000 $2,500 $ $ $4,000

Against Line 9

d). The sum of rows a. and b.,

minus row c. (carryforward $0 $0 $1,000 $ $ $1,000

to the next year)

Pass Through Entity FEIN Pass Through Entity

Account Number