Enlarge image

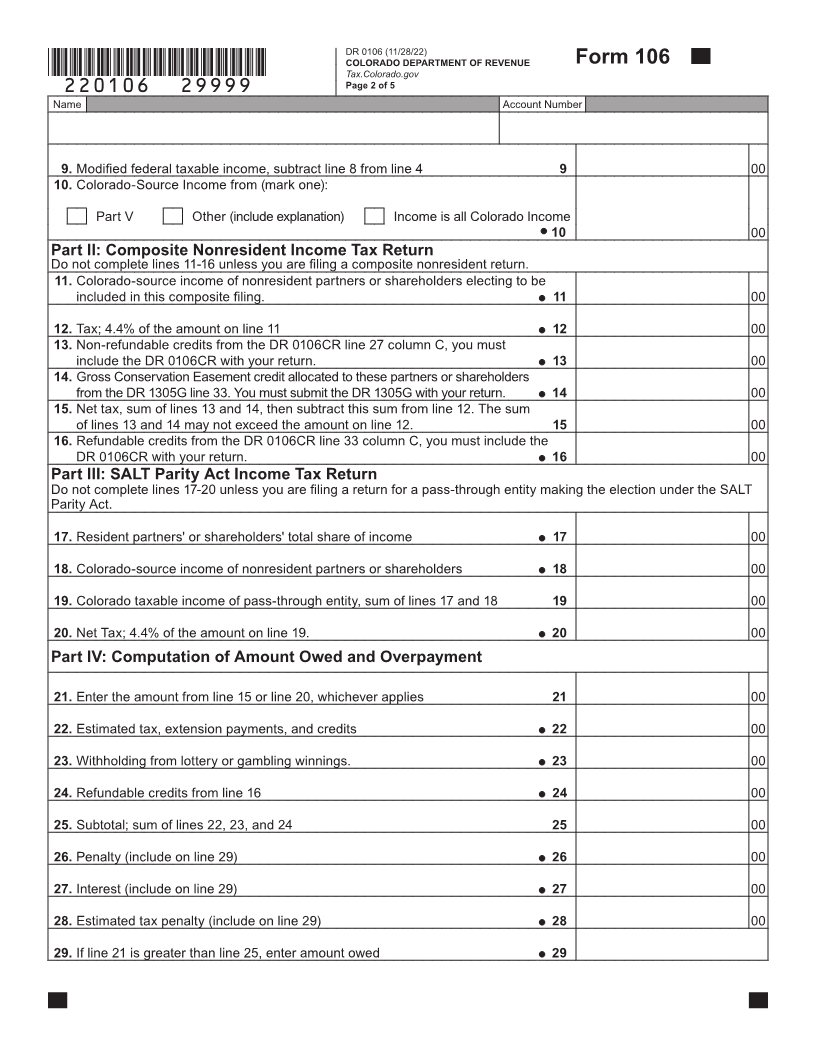

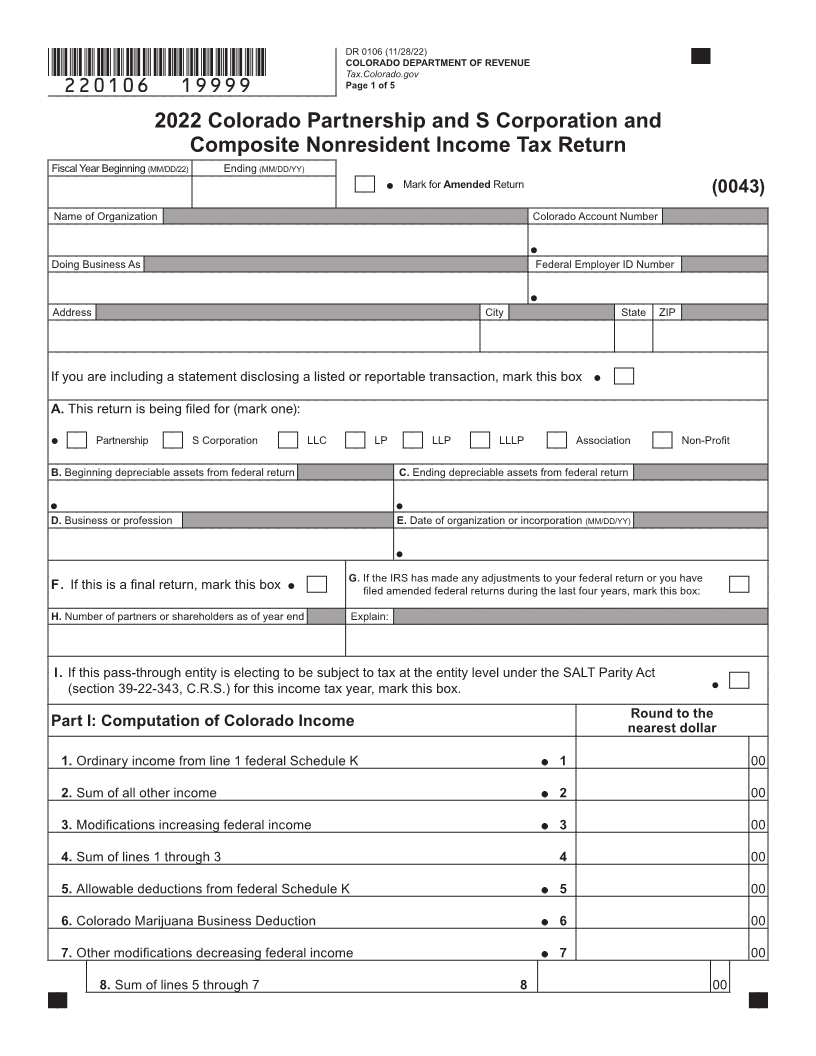

DR 0106 (11/28/22)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*220106==19999* Page 1 of 5

2022 Colorado Partnership and S Corporation and

Composite Nonresident Income Tax Return

Fiscal Year Beginning (MM/DD/22) Ending (MM/DD/YY)

Mark for Amended Return

(0043)

Name of Organization Colorado Account Number

Doing Business As Federal Employer ID Number

Address City State ZIP

If you are including a statement disclosing a listed or reportable transaction, mark this box

A. This return is being filed for (mark one):

Partnership S Corporation LLC LP LLP LLLP Association Non-Profit

B. Beginning depreciable assets from federal return C. Ending depreciable assets from federal return

D. Business or profession E. Date of organization or incorporation (MM/DD/YY)

G. If the IRS has made any adjustments to your federal return or you have

F. If this is a final return, mark this box filed amended federal returns during the last four years, mark this box:

H. Number of partners or shareholders as of year end Explain:

I. If this pass-through entity is electing to be subject to tax at the entity level under the SALT Parity Act

(section 39-22-343, C.R.S.) for this income tax year, mark this box.

Round to the

Part I: Computation of Colorado Income nearest dollar

1. Ordinary income from line 1 federal Schedule K 1 00

2. Sum of all other income 2 00

3. Modifications increasing federal income 3 00

4. Sum of lines 1 through 3 4 00

5. Allowable deductions from federal Schedule K 5 00

6. Colorado Marijuana Business Deduction 6 00

7. Other modifications decreasing federal income 7 00

8. Sum of lines 5 through 7 8 00