Enlarge image

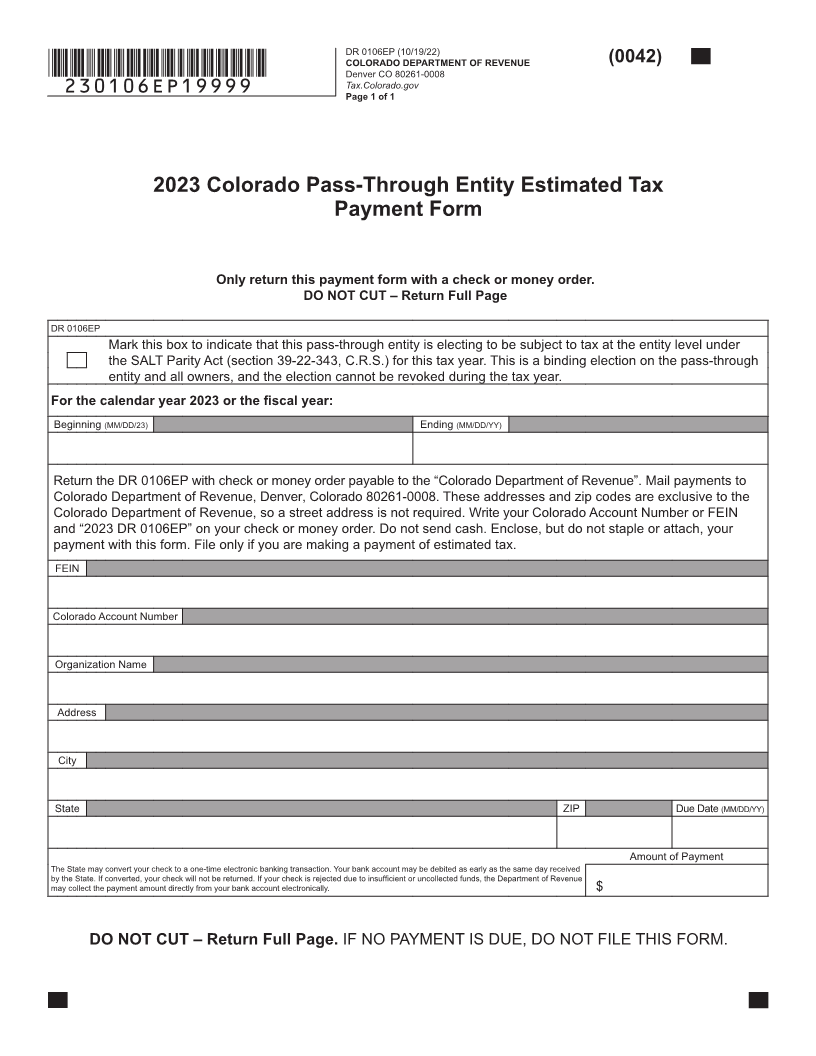

DR 0106EP (10/19/22)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0008

=DO=NOT=SEND= Tax.Colorado.gov

Colorado Pass-Through Entity Estimated Income Tax

Instructions

Taxpayers are required to make estimated payments being billed, see form DR 0204, Underpayment of

during the tax year if their Colorado income tax due will Individual Estimated Tax (composite filers) or form DR

exceed certain thresholds. This form is used for 0205, Underpayment of Corporate Estimated Tax (entities

partnerships and S corporations to make estimated making an election under the SALT Parity Act).

payments. Refunds

General Rule Estimated tax payments can only be claimed as

In most cases, a partnership or S corporation must pay prepayment credit on the 2023 Colorado income tax return.

estimated tax if it will file a composite return on behalf Therefore, estimated payments cannot be refunded until

of nonresident partners, and the Colorado income tax the 2023 Colorado income tax return is filed.

liability for any individual partner or shareholder per the

composite return will be more than $1,000 for 2023 SALT Parity Act Election

A partnership or S corporation may, on an annual basis,

A partnership or S corporation that elects to be subject elect to be subject to tax at the entity level under the SALT

to tax at the entity level under section 39-22-343, Parity Act (section 39-22-343, C.R.S.). This is a binding

C.R.S. is subject to the same requirement to remit election on the pass-through entity and all owners, and

quarterly estimated tax payments as C corporations. the election is irrevocable for the tax year. The election

In general, an electing entity will pay estimated tax if can be made during the tax year on this form DR 0106EP,

its Colorado income tax liability will exceed $5,000 for or on the Colorado income tax return (DR 0106) when it

2023. is filed after the close of the tax year. Mark this box only

Required Payments if the partnership or S corporation is making the election

In general, payments are required quarterly, and the under the SALT Parity Act for this tax year. This election

amount due is 25% of the required annual payment. The cannot be revoked for this tax year once it is made. A

required annual payment is generally 70% of the actual partnership or S corporation may make required estimated

net Colorado tax liability for the current year, or 100% of payments before making an election under the SALT

the actual net Colorado tax liability for the preceding year Parity Act.

(whichever is less). For more information on calculating

estimated payment for nonresident partners and Go Green with Revenue Online

shareholders included in a composite return, please see Colorado.gov/RevenueOnline allows taxpayers to file

the Individual Income Tax Guide. taxes, remit payments and monitor their tax accounts.

Please see the Corporate Income Tax guide if the DR 0106EP is not required to be sent if electronic

payment is remitted through this site. Please be advised

partnership or S corporation intends to make an

that a nominal processing fee may apply to electronic

election under the SALT Parity Act. payments.

Calculating the Payment

Pay by Electronic Funds Transfer (EFT)

Estimated tax payments must be made on a quarterly

EFT payments can be made safely, for free, and can be

basis. scheduled up to 12 months ahead of time to avoid

Payments and forms should be submitted using the same forgetting to make a quarterly payment. This requires

account number as will be used on the Colorado pre-registration before payments can be made.

Partnership and S Corporation and Composite Nonresident Visit Tax.Colorado.gov/electronic-funds-transfer for

Income Tax Return (DR 0106). If, for any reason, the registration information.

account numbers are inconsistent, the Department must be

notified in writing prior to filing the DR 0106. Mail this

notification to: Additional information, guidance publications and forms are

available at Tax.Colorado.gov, or you can call

Colorado Department of Revenue

303-238-SERV (7378) for assistance.

Denver, CO 80261-0008

Penalties

Failure to timely remit estimated tax will result in an

estimated tax penalty. An estimated tax penalty will also be

calculated for each missed or underpaid payment.

For calculation specifics, or to remit this penalty before