Enlarge image

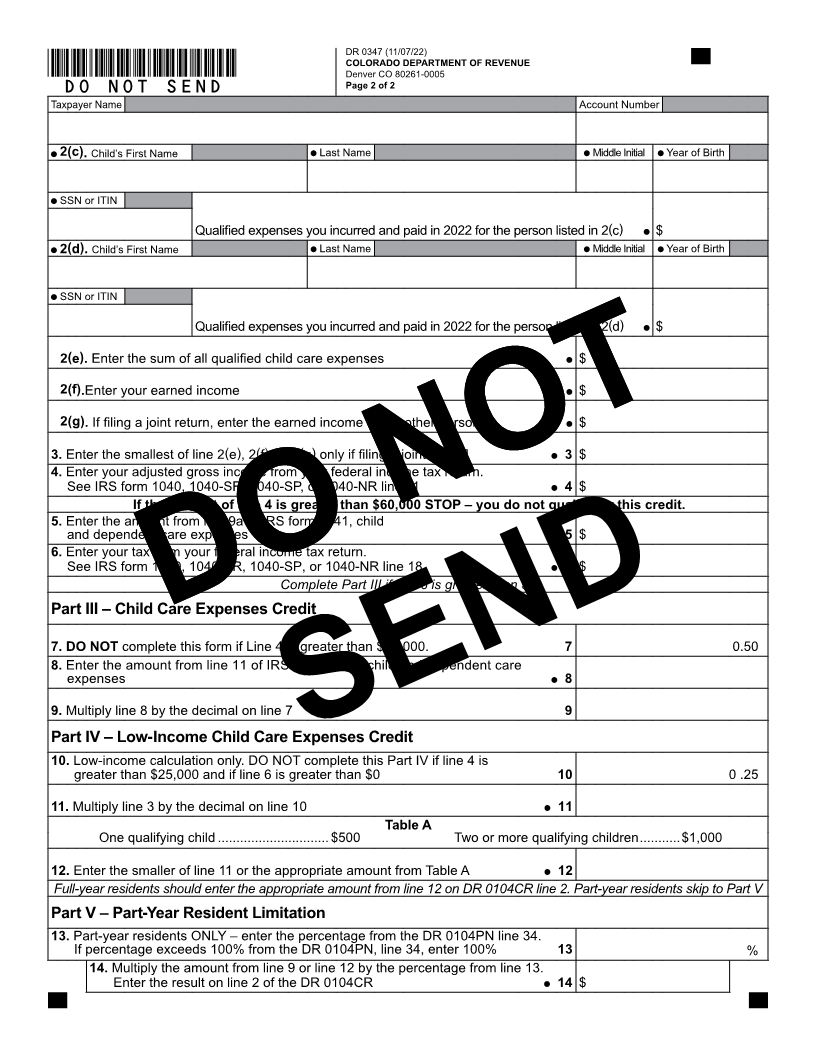

DR 0347 (11/07/22)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0005

*DO=NOT=SEND* Tax.Colorado.gov

Child Care Expenses Tax Credit

Instructions

Use this form to determine if you can claim the Colorado Part II – Qualifying Child Information

Child Care Expenses tax credit. You may be able to claim For lines 2a – 2d, list each qualifying child, their year of

the credit if you pay someone to care for your dependent birth and their Social Security number. You must also list

who is under age 13. For information about any federal the amount of child care expenses for each specific child.

form or publication listed below, please visit IRS.gov Complete lines 2e through 4 as instructed on the form.

If the amount on line 4 is greater than $60,000 do not

Eligibility

To be able to claim the Colorado credit for child care continue because you do not qualify for this credit.

expenses, you must file federal form 1040, 1040SR, If line 4 is $60,000 or less, enter the amount from line

1040SP, or 1040NR and you (and/or your spouse) must 9a of the IRS form 2441, Child and Dependent Care

have been a part or full-year resident of Colorado. Colorado Expenses, on line 5 of this form DR 0347.

non-resident filers may not claim this credit. If you did not For line 6 enter your tax from your federal income tax

file a federal income tax return, you may still be eligible for return. See IRS form 1040, 1040SR, 1040SP, or 1040NR

the Low Income Child Care Expenses credit. To claim the line 18. If you claimed a Federal Child Care Tax Credit,

low income credit, you must complete and submit with your continue to Part III. Otherwise, if you could not not claim

Colorado return a copy of your federal return and federal a Federal Child Care Tax Credit and your adjusted gross

form 2441. You must also meet all of the following tests: income is $25,000 or less, skip to Part IV.

1. The care must be for one or more qualifying If you have more than four qualifying children, we strongly

persons who are identified on federal form 2441. suggest you file your return electronically.

2. You (and your spouse if filing jointly) must have

earned income during the year. Part III – Child Care Expenses Credit

3. You must pay child care expenses so you (and For line 8 enter the amount from line 11 of IRS form 2441.

your spouse if filing jointly) can work or look for For line 9 multiply line 8 by the decimal on line 7.

work. Qualifying expenses are defined under

Section 21 of the Internal Revenue Code. Full–year residents should enter amount from this form on

line 9 to form DR 0104CR line 2. If you completed Part III

4. You must make payments for child care expenses

and you were a part-year resident, continue to Part V.

to someone you (and your spouse) cannot claim

as a dependent. If you make payments to your Part IV – Low-Income Child Care Expenses

child, he or she cannot be your dependent and If you were unable to claim the Federal Child Care Tax

must be age 19 or older by the end of the year. Credit and the amount of line 4 is $25,000 or less, use

You cannot make payments to: Table A to calculate the credit. Otherwise, go back to Part

a. Your spouse, or III to calculate your credit.

b. The parent of your qualifying person if your For line 11 multiply line 3 by the decimal on line 10.

qualifying person is your child and under the For line 12 enter the smaller amount of line 11 or the

age of 13. appropriate amount from Table A.

5. You cannot claim this credit if your federal filing

status is Married Filing Separate. Full–year residents should enter amount from this form on

6. You must identify the care provider on this form. line 12 to form DR 0104CR line 2. If you completed Part III

and you were a part-year resident, continue to Part V.

It is recommended that you fully review IRS Publication 503

for eligibility tests and the definition of qualifying income Part V – Part Year Resident Limitation

and children. All of the information in this form is required Complete this part only if you were a part-year resident

and your credit may be denied if it is incomplete. of Colorado in 2022. Enter the percentage from the

DR 0104PN line 34 on line 13 of this DR 0347.

Part I – Person or Organization Who Provided the Care

Use this section to list the name, address and Social For line 14 multiple the amount from line 9 or line 12 by

Security or Federal Employer ID number of the child care the percentage from line 13. Enter this amount on line 2 of

provider(s) you used. If you are unable to provide the Social the DR 0104CR.

Security or Federal Employer ID number of the child care

provider, you must show that you attempted to obtain the

required information by including such proof with this form.

List the total amount paid for the full year of child care, paid

to each provider. If you have more than two care providers

or if the provider is non-profit, we strongly suggest you file

your return electronically.