Enlarge image

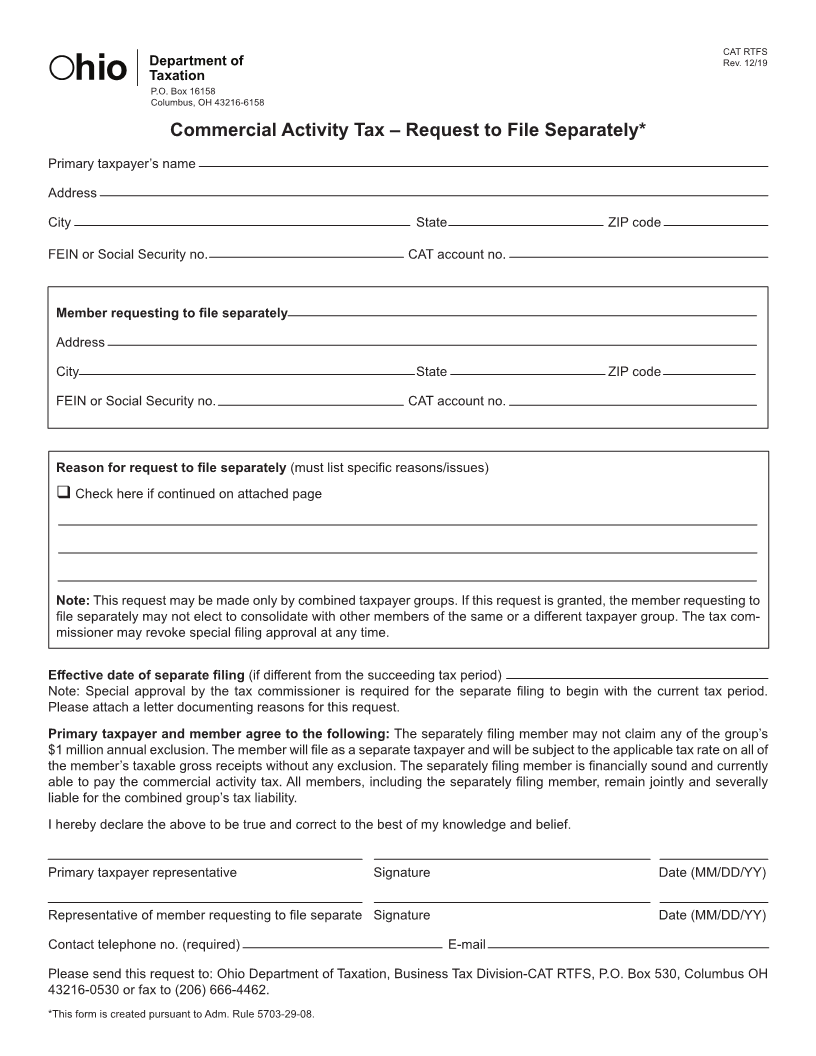

CAT RTFS

Department of Rev. 12/19

Taxation

hio P.O. Box 16158

Columbus, OH 43216-6158

Commercial Activity Tax – Request to File Separately*

Primary taxpayer’s name

Address

City State ZIP code

FEIN or Social Security no. CAT account no.

Member requesting to file separately

Address

City State ZIP code

FEIN or Social Security no. CAT account no.

Reason for request to file separately (must list specific reasons/issues)

q Check here if continued on attached page

Note: This request may be made only by combined taxpayer groups. If this request is granted, the member requesting to

file separately may not elect to consolidate with other members of the same or a different taxpayer group. The tax com-

missioner may revoke special filing approval at any time.

Effective date of separate filing (if different from the succeeding tax period)

Note: Special approval by the tax commissioner is required for the separate filing to begin with the current tax period.

Please attach a letter documenting reasons for this request.

Primary taxpayer and member agree to the following: The separately filing member may not claim any of the group’s

$1 million annual exclusion. The member will file as a separate taxpayer and will be subject to the applicable tax rate on all of

the member’s taxable gross receipts without any exclusion. The separately filing member is financially sound and currently

able to pay the commercial activity tax. All members, including the separately filing member, remain jointly and severally

liable for the combined group’s tax liability.

I hereby declare the above to be true and correct to the best of my knowledge and belief.

Primary taxpayer representative Signature Date (MM/DD/YY)

Representative of member requesting to file separate Signature Date (MM/DD/YY)

Contact telephone no. (required) E-mail

Please send this request to: Ohio Department of Taxation, Business Tax Division-CAT RTFS, P.O. Box 530, Columbus OH

43216-0530 or fax to (206) 666-4462.

*This form is created pursuant to Adm. Rule 5703-29-08.