Enlarge image

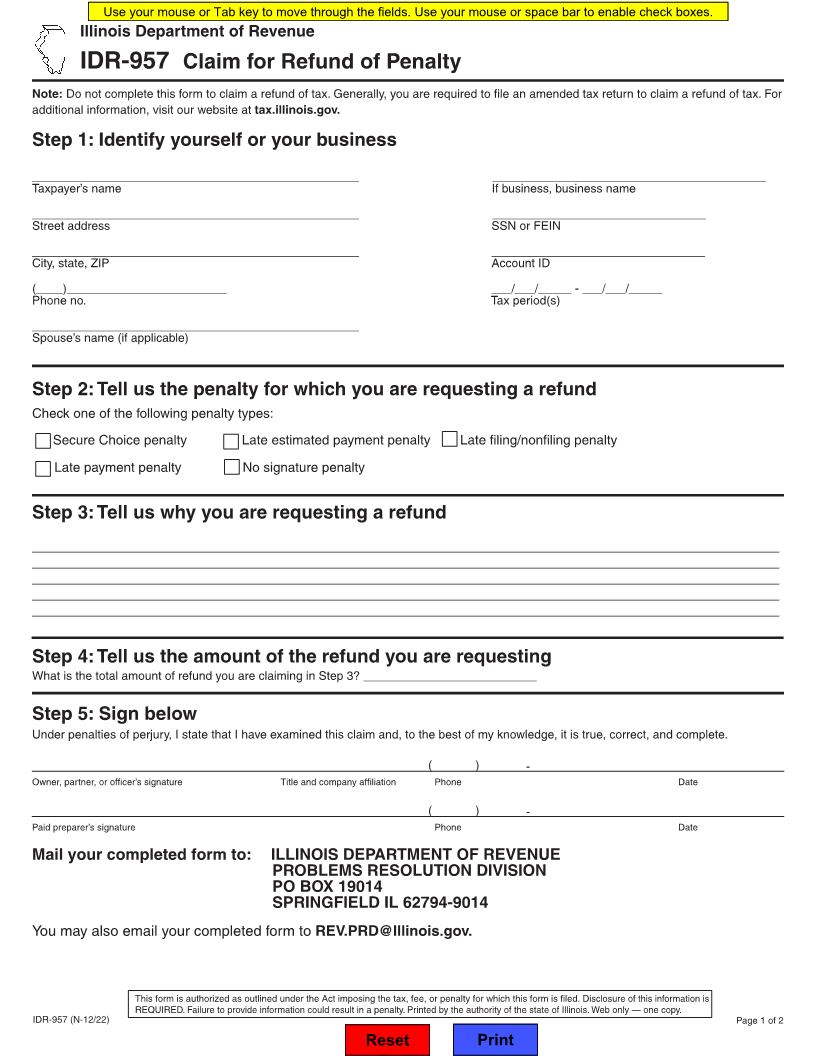

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

IDR-957 Claim for Refund of Penalty

Note: Do not complete this form to claim a refund of tax. Generally, you are required to file an amended tax return to claim a refund of tax. For

additional information, visit our website at tax.illinois.gov.

Step 1: Identify yourself or your business

_________________________________________________ _________________________________________

Taxpayer’s name If business, business name

_____________________________________ ____________ ________________________________

Street address SSN or FEIN

_________________________________________________ ________________________________

City, state, ZIP Account ID

(____)________________________ ___/___/_____ - ___/___/_____

Phone no. Tax period(s)

_________________________________________________

Spouse’s name (if applicable)

Step 2: Tell us the penalty for which you are requesting a refund

Check one of the following penalty types:

Secure Choice penalty Late estimated payment penalty Late filing/nonfiling penalty

Late payment penalty No signature penalty

Step 3: Tell us why you are requesting a refund

____________________________________________________________________________________

____________________________________________________________________________________

____________________________________________________________________________________

____________________________________________________________________________________

____________________________________________________________________________________

Step 4: Tell us the amount of the refund you are requesting

What is the total amount of refund you are claiming in Step 3? __________________________

Step 5: Sign below

Under penalties of perjury, I state that I have examined this claim and, to the best of my knowledge, it is true, correct, and complete.

( ) -

Owner, partner, or officer’s signature Title and company affiliation Phone Date

( ) -

Paid preparer’s signature Phone Date

Mail your completed form to: ILLINOIS DEPARTMENT OF REVENUE

PROBLEMS RESOLUTION DIVISION

PO BOX 19014

SPRINGFIELD IL 62794-9014

You may also email your completed form to REV.PRD@Illinois.gov.

This form is authorized as outlined under the Act imposing the tax, fee, or penalty for which this form is filed. Disclosure of this information is

REQUIRED. Failure to provide information could result in a penalty. Printed by the authority of the state of Illinois. Web only — one copy.

IDR-957 (N-12/22) Page 1 of 2

Reset Print