Enlarge image

AB AP-114

CD (Rev.4-21/19) PRINT FORM CLEAR FIELDS

b

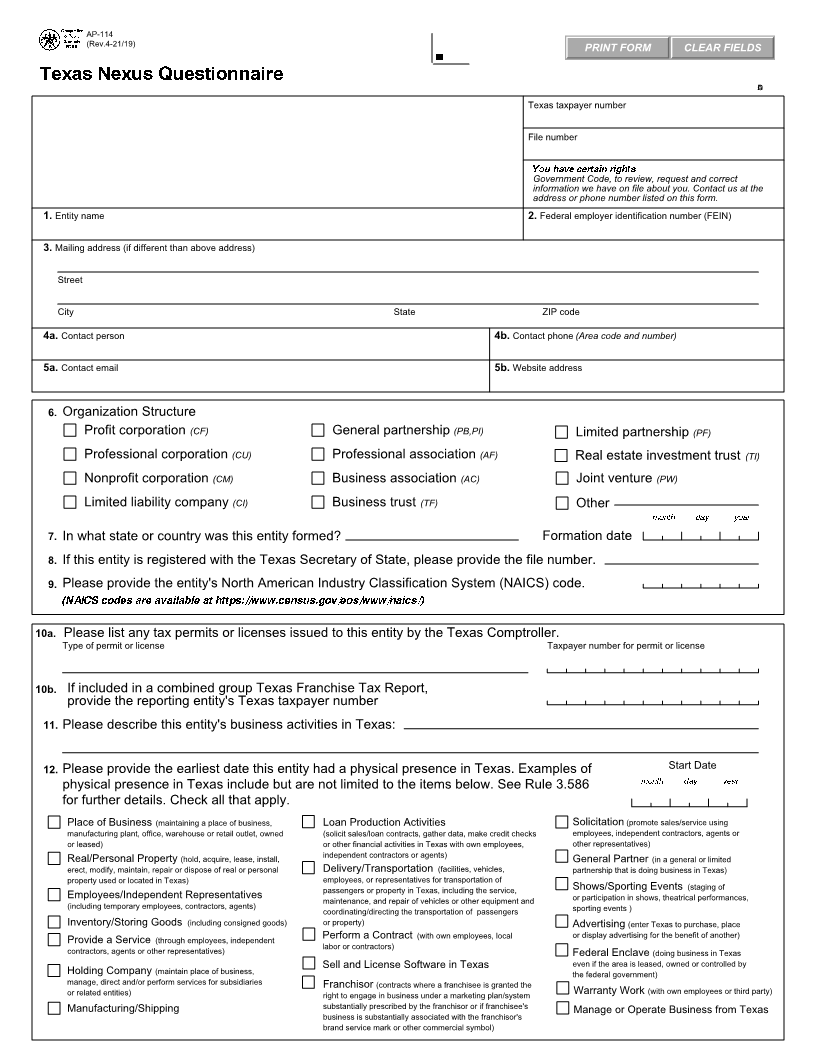

Texas Nexus Questionnaire

ACID

Texas taxpayer number

File number

You have certain rights under Chapters 552 and 559,

Government Code, to review, request and correct

information we have on file about you. Contact us at the

address or phone number listed on this form.

1. Entity name 2. Federal employer identification number (FEIN)

3. Mailing address (if different than above address)

Street

City State ZIP code

4a. Contact person 4b. Contact phone (Area code and number)

5a. Contact email 5b. Website address

6. Organization Structure

Profit corporation (CF) General partnership (PB,PI) Limited partnership (PF)

Professional corporation (CU) Professional association (AF) Real estate investment trust (TI)

Nonprofit corporation (CM) Business association (AC) Joint venture (PW)

Limited liability company (CI) Business trust (TF) Other

month day year

7. In what state or country was this entity formed? Formation date

8. If this entity is registered with the Texas Secretary of State, please provide the file number.

9. Please provide the entity's North American Industry Classification System (NAICS) code.

(NAICS codes are available at https://www.census.gov/eos/www/naics/)

10a. Please list any tax permits or licenses issued to this entity by the Texas Comptroller.

Type of permit or license Taxpayer number for permit or license

10b. If included in a combined group Texas Franchise Tax Report,

provide the reporting entity's Texas taxpayer number

11. Please describe this entity's business activities in Texas:

12. Please provide the earliest date this entity had a physical presence in Texas. Examples of Start Date

month day year

physical presence in Texas include but are not limited to the items below. See Rule 3.586

for further details. Check all that apply.

Place of Business (maintaining a place of business, Loan Production Activities Solicitation (promote sales/service using

manufacturing plant, office, warehouse or retail outlet, owned (solicit sales/loan contracts, gather data, make credit checks employees, independent contractors, agents or

or leased) or other financial activities in Texas with own employees, other representatives)

Real/Personal Property (hold, acquire, lease, install, independent contractors or agents) General Partner (in a general or limited

erect, modify, maintain, repair or dispose of real or personal Delivery/Transportation (facilities, vehicles, partnership that is doing business in Texas)

property used or located in Texas) employees, or representatives for transportation of

passengers or property in Texas, including the service, Shows/Sporting Events (staging of

Employees/Independent Representatives maintenance, and repair of vehicles or other equipment and or participation in shows, theatrical performances,

(including temporary employees, contractors, agents) coordinating/directing the transportation of passengers sporting events )

Inventory/Storing Goods (including consigned goods) or property) Advertising (enter Texas to purchase, place

Provide a Service (through employees, independent Perform a Contract (with own employees, local or display advertising for the benefit of another)

contractors, agents or other representatives) labor or contractors)

Federal Enclave (doing business in Texas

even if the area is leased, owned or controlled by

Holding Company (maintain place of business, Sell and License Software in Texas the federal government)

manage, direct and/or perform services for subsidiaries Franchisor (contracts where a franchisee is granted the

or related entities) right to engage in business under a marketing plan/system Warranty Work (with own employees or third party)

Manufacturing/Shipping substantially prescribed by the franchisor or if franchisee's Manage or Operate Business from Texas

business is substantially associated with the franchisor's

brand service mark or other commercial symbol)