Enlarge image

WEST VIRGINIA STATE TAX DEPARTMENT

2022

Substitute Tax Form

Requirements

Rev. 10/06/2022

Enlarge image |

WEST VIRGINIA STATE TAX DEPARTMENT

2022

Substitute Tax Form

Requirements

Rev. 10/06/2022

|

Enlarge image | Introduction This publication provides information necessary for the development of substitute forms. Software developers must comply with the requirements in this publication to gain approval by the Department. Periodically this publication may be updated detailing changes to published tax forms, stating requirements for forms not included in this version of the document, or outlining additional processing requirements and informing developers of new requirements imposed by the West Virginia Legislature. It is the responsibility of the software developer to submit tax forms for approval based on the latest version of this publication. Updates to forms will be sent via the NACTP listserv and can be found in the substitute forms folder of the FTA State Exchange System (SES). When reviewing forms for approval, the Department is verifying that the form can be processed through the system. The Department will neither review nor approve the logic of specific software programs, nor confirm calculations entered on the forms. The accuracy of the program remains the responsibility of the software developer. Contact Information Questions or comments may be addressed to: TaxWVForms@wv.gov When sending email, please begin subject lines with Tax type, test ETIN, and product name, followed by description of the email. Examples: PIT 12345 Tax Fox - questions about Schedule M CIT 98765 Tax Ninja - Forms submission West Virginia MeF Calendar for Tax Year 2022 Initial review begins. November 1, 2022 Final testing begins (tentatively) December 1, 2022 Last date to send an initial forms submission for approval January 31, 2023 While submissions may pass initial testing as early as November, final testing cannot begin until the scanner system is updated. This usually does not occur until December. Please do not ask the status of any submission until December 7, allowing for time to be sent through final testing. If errors are determined, corrections must be resubmitted within 30 days Substitute Tax Forms Requirements 2 of 8 |

Enlarge image |

Publications

West Virginia State Tax Department

• 2022 West Virginia Business and Individual E-File (MeF) Handbook

• 2022 Forms Requirements

Internal Revenue Service

• Publication 1436, Test Package for Electronic Filers of Individual Tax Returns

• Publication 3112, IRS e-file Application and Participation

• Publication 4162, Modernized e-file Handbook for Authorized e-file Providers for Form 1120, 1120S,

and 1065.

• Publication 4164, Modernized e-file Guide for Software Developers and Transmitters

• Publication 4505, Modernized e-file Test Package for Forms 1065/1065-B

Related Internet Links

• Credit Card Payments

( http://tax.wv.gov/Individuals/ElectronicFiling/PaymentOptions/Pages/

IndividualsCreditCardPayments.aspx )

• MyTaxes ( https://mytaxes.wvtax.gov )

• West Virginia State Tax Department ( www.tax.wv.gov )

• Information for Software Vendors

( http://tax.wv.gov/TaxProfessionals/SoftwareDevelopers/Pages/

SoftwareDevelopers.aspx )

• Electronic Filing and Services

( http://tax.wv.gov/TaxProfessionals/ElectronicFiling/Pages/

TaxProfessionalsElectronicFiling.aspx )

Substitute Tax Forms Requirements 3 of 8

|

Enlarge image |

New for 2022

NEW High Wage Growth Tax Credit added to Credit Schedules

Film Tax Credit returned to all Credit recaps and summaries

The grey color of labels may be omitted.

Important Information

Where can we find forms? Forms are posted on the FTA State Exchange System (SES).

● Substitute forms must be visually built on the version posted in the Substitute Forms folder of the FTA SES

● Forms are designed using a 6x10 character grid for fields that will be captured by the scanners. If forms are

not set to the grid as specified, data may not be properly collected and the form will not be accepted.

Please note that we will usually only post the grid version of barcoded forms.

● Targets are now required on forms. They should follow the PDF version posted in the substitute forms

folder of the FTA SES. Please note that the targets in the corners occupy the entire space and may not

have any other marks or data in their area. Details on page 6.

● DO NOT place anything next to the form number in the header. This is for State Forms to indicate Form

Source. Leave this area BLANK. Do not enter “B”, “W”, your vendor code, or anything else there.

● The Department will only approve substitute tax forms developed to produce computer generated data.

Substitute forms completed by manual processing (handwritten or typewritten) will not be accepted.

● Forms without barcodes are not to be submitted for substitute forms testing and are therefore not placed on

the SES as separate files.

● This substitute forms testing is meant for West Virginia income taxes, supporting schedules, and related

withholding and payments forms. Substitute forms for other taxes are outside the scope of this testing.

● When in doubt about margins, follow the PDF version posted in the substitute forms folder of the FTA SES.

● Each form must include the 4 digit NACTP vendor code. While there is no specific location for this on the

form, this code must be printed away from the barcode, targets, and any variable data fields.

How do we make a substitute form test submission? All test submissions must be submitted as .pdf’s via

email to TaxWVForms@wv.gov.

● Use this convention for email subject lines: Tax Type - Test ETIN - Product Name - additional information

If you do not have MEF products, use your 2 character form ID and 4 digit NACTP number instead of ETIN.

EXAMPLE: PIT 12345 Awesome Tax Prep - IT-140 forms test

CIT 67890 Best Tax Filing - CNF-120 forms test

PTE ZT 1234 Zebra Tax Forms Solutions - PTE-V test

● Each submission must include:

■ NACTP standardized approval checklist, found on the NACTP website at www.nactp.org.

■ one (1) blank copy of packet which includes all the supported forms for a given tax type

■ five (5) data copies - The data copies should be grouped by test, not by form. For example, the

attachments on an personal income submission would be Checklist.pdf, IT140blank.pdf,

IT140test1.pdf, IT140test2.pdf, IT140test3.pdf, IT140test4.pdf, and IT140test5.pdf

● Photocopies will not be accepted.

● Please send forms from different sets separately. DO NOT SEND ALL TAX TYPES ON ONE EMAIL.

If you are supporting all substitute forms, you would have a separate email for PIT, FDY, CIT, PTE, and

each of the WHT forms.

● Only forms with a barcode should be submitted for approval.

● If the space of a single line in the field is insufficient for data such as names, addresses, or emails, you may

use both rows within the field, so long as the data does not touch the field outline.

● Name control field on the IT-140V must be limited to the first 4 characters of the taxpayer’s last name.

Substitute Tax Forms Requirements 4 of 8

|

Enlarge image | General Information All software developers must receive approval by the Department to develop substitute tax forms. The 2021 Letter of Intent must be submitted by every software developer, for every year, that it intends to reproduce West Virginia Tax Forms. This form is available on the FTA State Exchange System (SES). The developer must email TaxLOI@wv.gov in order to request access to the Letter of Intent. There is one Letter of Intent for both MeF and substitute forms. If your company will only be supporting substitute forms then please disregard all MeF information. Barcode Requirements The Department uses an alphanumeric Code 39e (3 of 9) barcode configuration. The barcode must be centered in the barcode location on each page of the published tax form. The barcode must be positioned so it reads from left to right when printed horizontally, top to bottom when printed vertically on the left edge, and bottom to top when printed vertically on the right edge of the form. The human readable value of the barcode must be printed near the barcode even if the human readable value is not printed on the tax form published by the Department. On coupon size forms, the barcode may be placed vertically on the left or right side. If the back of the coupon has a barcode, they must be on opposite ends. Substitute tax forms’ barcodes must contain a vendor’s two letter ID. This ID is placed in the barcode by removing the first and last letters in the barcode of the published form and placing the two-letter unique ID at the beginning of the barcode. For example, the barcode for page one of the 2021 CNF-120 is B30202101W. A software vendor reproducing this form would use the barcode ID30202201 where “ID” is the unique two-letter vendor ID. A company reproducing West Virginia Tax Forms for the first time must contact TaxWVForms@wv.gov to have a two-letter vendor ID assigned. Each vendor must produce a barcode to fit the following specifications: ● Barcode must be surrounded by a minimum of 0.2 inch of white space. ● Barcode must be start and end with an asterisk (*) non-readable. ● Barcode must start with an assigned 2 alpha character ID. ● Barcode must measure close to 2.5” width and 0.5” in height (not including clearance space). ● The minimum wide-to-narrow ratio is 3:1. Margins and Form Size All forms must measure 8½”x 11”. Generally the printable area of a form on the grid is from Row 4 to Row 63 and Column 6 to Column 80. Margins on substitute forms must be equal to the margins on the published form. Coupon forms may be no taller than 3½”. Paper Specifications Paper must be white, 20lb. unlined bond – portrait orientation, unless otherwise specified. Legibility & Ink The West Virginia State Tax Department reserves the right to reject any substitute form because of poor legibility. The ink and printing method used must ensure no part of the form develops smears or other printing defects that reduce print quality. Black non-magnetic and non-reflective ink/toner must be used on all substitute forms. Substitute Tax Forms Requirements 5 of 8 |

Enlarge image |

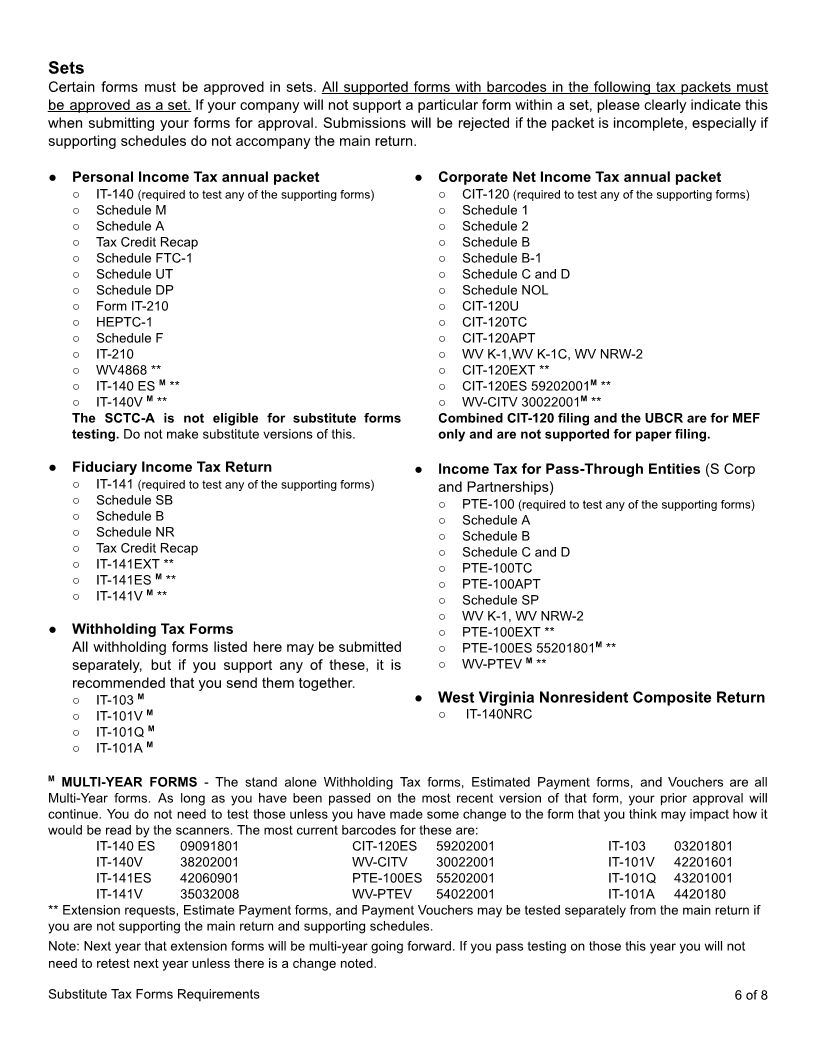

Sets

Certain forms must be approved in sets. All supported forms with barcodes in the following tax packets must

be approved as a set. If your company will not support a particular form within a set, please clearly indicate this

when submitting your forms for approval. Submissions will be rejected if the packet is incomplete, especially if

supporting schedules do not accompany the main return.

● Personal Income Tax annual packet ● Corporate Net Income Tax annual packet

○ IT-140 (required to test any of the supporting forms) ○ CIT-120 (required to test any of the supporting forms)

○ Schedule M ○ Schedule 1

○ Schedule A ○ Schedule 2

○ Tax Credit Recap ○ Schedule B

○ Schedule FTC-1 ○ Schedule B-1

○ Schedule UT ○ Schedule C and D

○ Schedule DP ○ Schedule NOL

○ Form IT-210 ○ CIT-120U

○ HEPTC-1 ○ CIT-120TC

○ Schedule F ○ CIT-120APT

○ IT-210 ○ WV K-1,WV K-1C, WV NRW-2

○ WV4868 ** ○ CIT-120EXT **

○ IT-140 ES M ** ○ CIT-120ES 59202001 M **

○ IT-140V M ** ○ WV-CITV 30022001 M **

The SCTC-A is not eligible for substitute forms Combined CIT-120 filing and the UBCR are for MEF

testing. Do not make substitute versions of this. only and are not supported for paper filing.

● Fiduciary Income Tax Return ● Income Tax for Pass-Through Entities (S Corp

○ IT-141 (required to test any of the supporting forms) and Partnerships)

○ Schedule SB ○ PTE-100 (required to test any of the supporting forms)

○ Schedule B ○ Schedule A

○ Schedule NR ○ Schedule B

○ Tax Credit Recap ○ Schedule C and D

○ IT-141EXT ** ○ PTE-100TC

○ IT-141ES M **

○ PTE-100APT

○ IT-141V M **

○ Schedule SP

○ WV K-1, WV NRW-2

● Withholding Tax Forms ○ PTE-100EXT **

All withholding forms listed here may be submitted ○ PTE-100ES 55201801 M **

separately, but if you support any of these, it is○ WV-PTEV M **

recommended that you send them together.

○ IT-103 M ● West Virginia Nonresident Composite Return

○ IT-101V M ○ IT-140NRC

○ IT-101Q M

○ IT-101A M

M MULTI-YEAR FORMS - The stand alone Withholding Tax forms, Estimated Payment forms, and Vouchers are all

Multi-Year forms. As long as you have been passed on the most recent version of that form, your prior approval will

continue. You do not need to test those unless you have made some change to the form that you think may impact how it

would be read by the scanners. The most current barcodes for these are:

IT-140 ES 09091801 CIT-120ES 59202001 IT-103 03201801

IT-140V 38202001 WV-CITV 30022001 IT-101V 42201601

IT-141ES 42060901 PTE-100ES 55202001 IT-101Q 43201001

IT-141V 35032008 WV-PTEV 54022001 IT-101A 4420180

** Extension requests, Estimate Payment forms, and Payment Vouchers may be tested separately from the main return if

you are not supporting the main return and supporting schedules.

Note: Next year that extension forms will be multi-year going forward. If you pass testing on those this year you will not

need to retest next year unless there is a change noted.

Substitute Tax Forms Requirements 6 of 8

|

Enlarge image | Coupons Coupon size forms must be printed on the bottom of the page to ensure that three sides of the paper have straight edges. Only one coupon form may be printed per page. Developers must include instructions for the user to cut the top of the tax form properly. Targets The Targets sit on the corners of the printable area and are formed by lines positioned at 90° angles. The lines should be black and 2pt thickness. Each Target is two tenths (0.2) inches wide and one third (0.3333) inches tall. There should be at least a 0.05 inch clearance around the target. The example below is a top left target. The horizontal line sits between rows 3 and 4 in columns 6 and 7. The vertical line sits between columns 5 and 6 in rows 4 and 5. The teal lines show the 6x10 grid. The space clearance around the target is notated by yellow. Font & Variable Printed Data Variable taxpayer data must be printed in the same location as the published form in capital letters using a 10 to 12 point Courier font (10cpi). No other fonts will be approved. Variable taxpayer data includes, but is not limited to, Taxpayer Name and Address, Filing Period, Due Date, Amount Paid, Account ID, SSN, FEIN, and all dollar fields. ● Data must be printed on a solid line or within a data box. ● Do not print dashes or slashes (a running line of numbers is preferred). ● Correct date format is MMDDYYYY with no spaces unless otherwise denoted. ● Italics and underlining is not accepted. ● Curved lines used in geometry are not accepted – use block lines where applicable. ● Do NOT print commas to separate numbers within amount fields. ● Do NOT print dollar signs unless they have been hard coded on the published form. ● Monetary fields with .00 reflected must be hard coded. If a monetary field does not have hard-coded zeros (.00) then dollars and cents must be reported in this field. If the software is unable to report cents, then it must be programmed to print the zeros. ● Monetary fields containing no data are to remain blank (except for hard coded decimal fields separating dollars and cents). ● Monetary amounts must be right justified. ● Indicate negative amounts by printing a negative sign (-) directly to the left of the amount. ● Taxpayer data must be printed in 6 lines per inch. Abbreviations In Names and Addresses Common abbreviations, listing the taxpayer address, may be used to generate taxpayer information. Refer to the NACTP Tax Form Design Guideline as a resource to identify acceptable abbreviations commonly used. Use of the correct two letter state abbreviation is mandatory. Do not include apostrophes, spaces, or hyphens. Print the name and address information in all caps. Example: O’Toole — OTOOLE Smith-Jones — SMITHJONES Mac Donald — MACDONALD Substitute Tax Forms Requirements 7 of 8 |

Enlarge image | Instructional Text and Signatures Instructional text must be included on all substitute forms and must be printed exactly as written by the Department. Do not use abbreviations unless the abbreviation appears on the published form. Taxpayer signatures must be originals and affixed after the form is printed on all published tax forms that include signature lines. The statement above the signature line must read “Under penalty of perjury, I declare that I have examined this return, accompanying schedules, and statements, and to the best of my knowledge and belief, it is true, correct and complete.” Software Developers Responsibility The West Virginia State Tax Department reserves the right to issue revisions to published tax forms at any time and as frequently as it finds necessary. It is the sole responsibility of the software developer to keep apprised of new editions to tax forms published by the Department. New editions will be noted through use of the NACTP listserv and posted in the substitute tax forms folder of the FTA State Exchange System (SES). If a published form is revised, software developers must request approval of the revised substitute form. It is the responsibility of the software developer to submit substitute forms for approval based upon the requirements in the latest edition of this publication. The Department does not authorize or encourage software developers to place unapproved forms in software packages. The Department requires developers to place a draft banner on the signature line of all forms reading “DRAFT FORM, DO NOT FILE”. This banner must be printed in bold capital letters in a 14 pt. font. If a form does not contain a signature line, this banner must be printed at the top of the form. If the form without a signature line is coupon size, the banner must be printed directly below the cut line at the top of the form. Software developers should advise their customers of the published tax form’s edition date. The developer must inform the customer of the Department requirements as listed in this publication. It is the developer’s responsibility to instruct customers to use the correct printer, paper weight, size, font and ink required by the Department. Customers must also be instructed to not SCALE the page or “shrink to fit” before printing. Substitute Tax Forms Requirements 8 of 8 |