Enlarge image

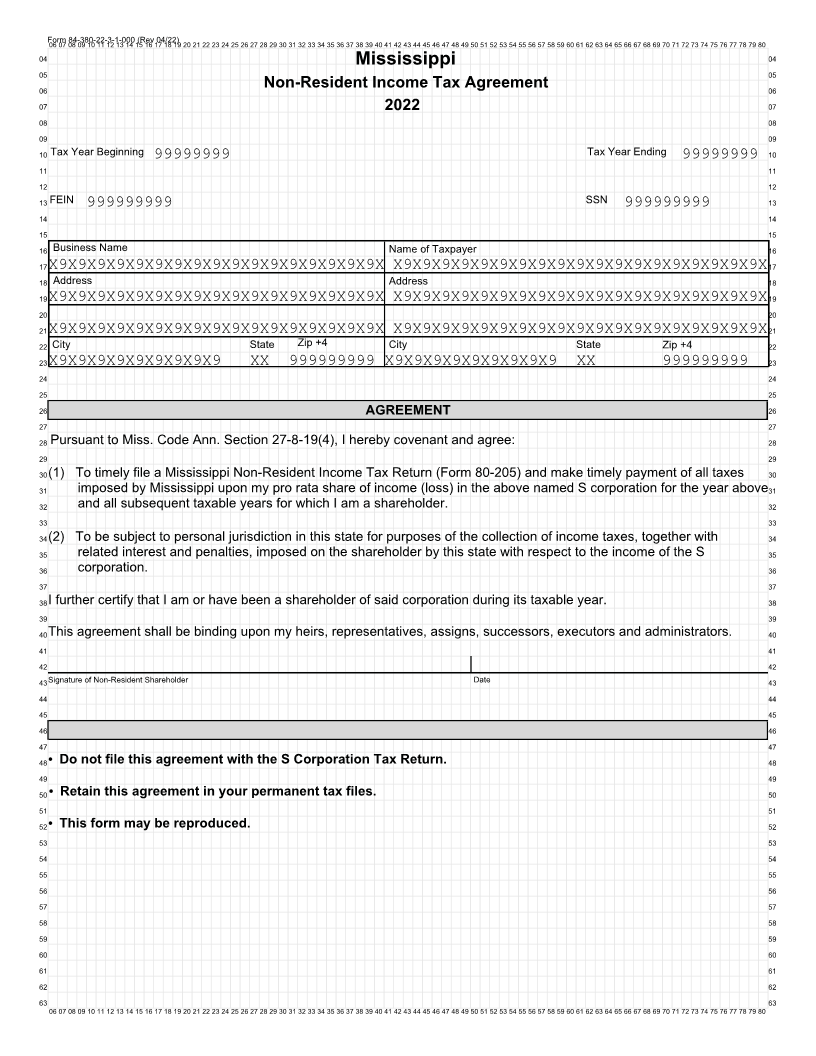

Form 84-380-22-3-1-000 (Rev 04/22)06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 04 Mississippi 04 05 05 06 Non-Resident Income Tax Agreement 06 07 2022 07 08 08 09 09 10 Tax Year Beginning 99999999 Tax Year Ending 99999999 10 11 11 12 12 13 FEIN 999999999 SSN 999999999 13 14 14 15 15 16 Business Name Name of Taxpayer 16 17X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X 17 18 Address Address 18 19X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X 19 20 20 21X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X 21 22 City State Zip +4 City State Zip +4 22 23X9X9X9X9X9X9X9X9X9 XX 999999999 X9X9X9X9X9X9X9X9X9 XX 999999999 23 24 24 25 25 26 AGREEMENT 26 27 27 28 Pursuant to Miss. Code Ann. Section 27-8-19(4), I hereby covenant and agree: 28 29 29 30(1) To timely file a Mississippi Non-Resident Income Tax Return (Form 80-205) and make timely payment of all taxes 30 31 imposed by Mississippi upon my pro rata share of income (loss) in the above named S corporation for the year above31 32 and all subsequent taxable years for which I am a shareholder. 32 33 33 34(2) To be subject to personal jurisdiction in this state for purposes of the collection of income taxes, together with 34 35 related interest and penalties, imposed on the shareholder by this state with respect to the income of the S 35 36 corporation. 36 37 37 38I further certify that I am or have been a shareholder of said corporation during its taxable year. 38 39 39 40This agreement shall be binding upon my heirs, representatives, assigns, successors, executors and administrators. 40 41 41 42 42 43Signature of Non-Resident Shareholder Date 43 44 44 45 45 46 46 47 47 48• Do not file this agreement with the S Corporation Tax Return. 48 49 49 50 • Retain this agreement in your permanent tax files. 50 51 51 52• This form may be reproduced. 52 53 53 54 54 55 55 56 56 57 57 58 58 59 59 60 60 61 61 62 62 63 63 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80