Enlarge image

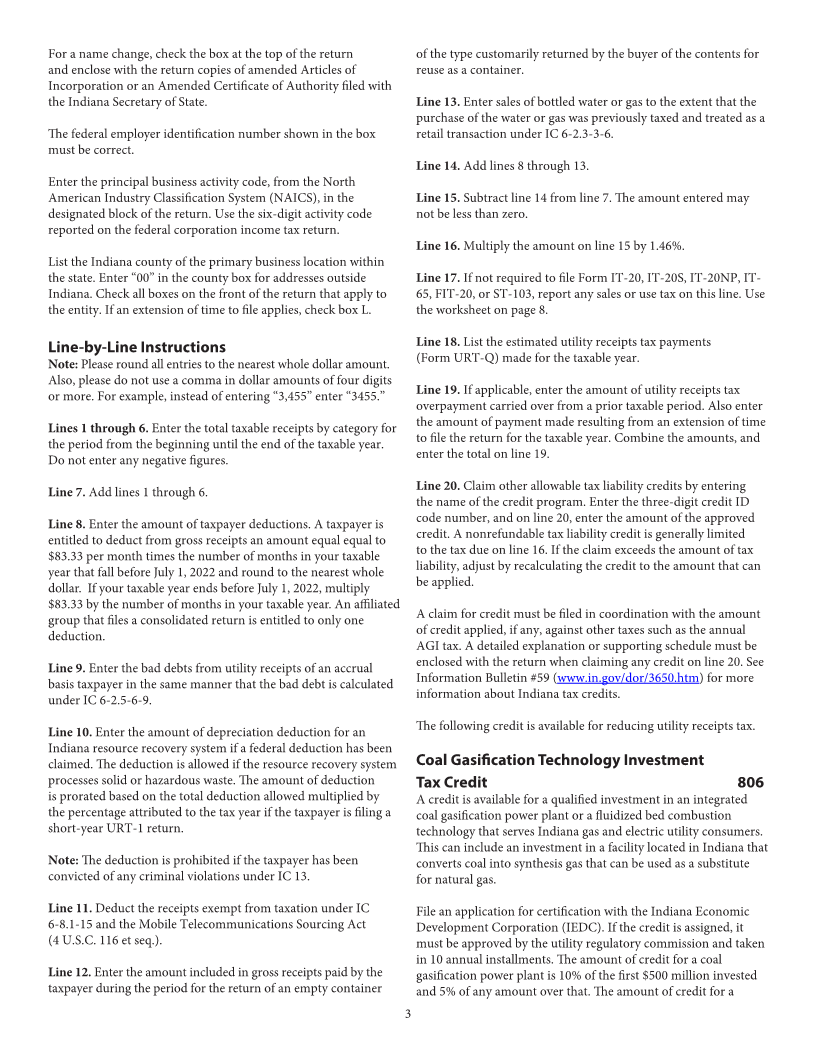

Form URT-1 Indiana Department of Revenue

State Form 51102

(R19 / 8-22) 2022 Indiana Utility Receipts Tax Return

Calendar Year Ending December 31, 2022 or Other Tax Year

Beginning 2021 and Ending

Check box if amended. □ Check box if name changed. □

Name Federal Employer Identification Number

Street Address Principal Business Activity Code Foreign Country 2-Character Code

City State ZIP Code 2-Digit County Code Telephone Number

K Check accounting method used: Cash □ Accrual □

L Do you have on file a valid extension of time to file your return (federal Form 7004 or an electronic extension of time)? Yes□ No □

M Check all boxes that apply to entity: Initial Return □ Final Return □ Consolidated Return □ In Bankruptcy □

Taxable Receipts for Indiana (list utility receipts received during your taxable year) Round all entries

1. Retail sale of utility services ....................................................................................................................................... 1 00

2. Judgments or settlements as compensation for lost retail sales ............................................................................... 2 00

3. Sales to a reseller if utility is used in hotels, mobile home parks, or marinas ........................................................... 3 00

4. Sales of water or gas to another for rebottling ........................................................................................................... 4 00

5. Installation, maintenance, repair, equipment, or leasing services provided and charges for removal ..................... 5 00

6. All other receipts not segregated between retail and nonretail transactions ............................................................ 6 00

7. Total Taxable Receipts (add lines 1 through 6) ....................................................................................................... 7 00

Deductions

8. Annual taxpayer deduction ($83.33 per month, see instructions) ............................................................................. 8 00

9. Bad debts on utility receipts of an accrual basis taxpayer ......................................................................................... 9 00

10. Depreciation on resource recovery systems prorated for amount attributed to taxable year ................................... 10 00

11. Receipts exempt from taxation if included in taxable receipts for the Mobile Telecommunications Sourcing Act

or IC 6-8.1-15. ............................................................................................................................................................. 11 00

12. Amount paid on customarily returned empty reusable containers ............................................................................ 12 00

13. Receipts from sale of bottled water or gas that was previously taxed....................................................................... 13 00

14. Total Deductions (add lines 8 through 13) ............................................................................................................... 14 00

15. Indiana Taxable Utility Receipts (subtract line 14 from line 7) ............................................................................... 15 00

Tax and Credits

16. Utility Receipts Tax Due for the Taxable Year: Multiply the amount on line 15 by 1.46% (.0146) ........................ 16 00

17. Sales/Use Tax Due on purchases subject to use tax (from worksheet) ................................................................... 17 00

18. Estimated payments made for utility receipts tax (list quarterly URT-Q payments below)

Qtr. 1 Qtr. 2 Qtr. 3 Qtr. 4 Enter Total ....................................... 18 00

19. Prior year overpayment credit and this year’s extension payment Enter Total................ 19 00

20. Enter name of other tax credit Code No. 20 00

21. Total Payments and Credits (add lines 18 through 20) ................................................................................... .......... 21 00

22. Net Tax Due (subtract line 21 from the sum of lines 16 and 17) ............................................................................... 22 00

23. Penalty for underpayment of estimated tax (from completed Schedule URT-2220) □ Exact Quarterly Payment Method .. 23 00

24. Interest: If payment is made after the original due date, add interest (for rates, refer to Departmental Notice #3)...... 24 00

25. Penalty for late payment (see instructions) ................................................................................................................ 25 00

26. Total Amount Owed (add lines 22 through 25) ........................................................................................................ 26 00

27. Overpayment (line 21 minus lines 16, 17, and 23-25) .............................................................................................. 27 00

28. Refund (portion of amount on line 27 to be refunded) .............................................................................................. 28 00

29. Overpayment Credit (carry over to the following year’s estimated URT account, line 27 minus line 28) ............... 29 00

Certification of Signatures and Authorization Section

Under penalties of perjury, I declare I have examined this return, including all accompanying schedules and statements, and to the best of my knowledge

and belief it is true, correct, and complete.

Paid Preparer’s Email Address ______________________________________________

__________________________________________________________ _________________________________________________________

Personal Representative’s Name (Print or Type) Paid Preparer: Firm’s Name (or yours if self-employed)

______________________________________________________________

Personal Representative’s Email Address PTIN

______________________________________________________________ _________________________________________________________

Signature of Corporate Officer Date Telephone Number

______________________________________________________________ _________________________________________________________

Print or Type Name of Corporate Officer Title Address

______________________________________________________________ _________________________________________________________

Signature of Paid Preparer Date City

______________________________________________________________ _________________________________________________________

Print or Type Name of Paid Preparer State ZIP Code + 4

Please mail your return to: Indiana Department of Revenue, P.O. Box 7228, Indianapolis, IN 46207-7228.

*24100000000*

24100000000