Enlarge image

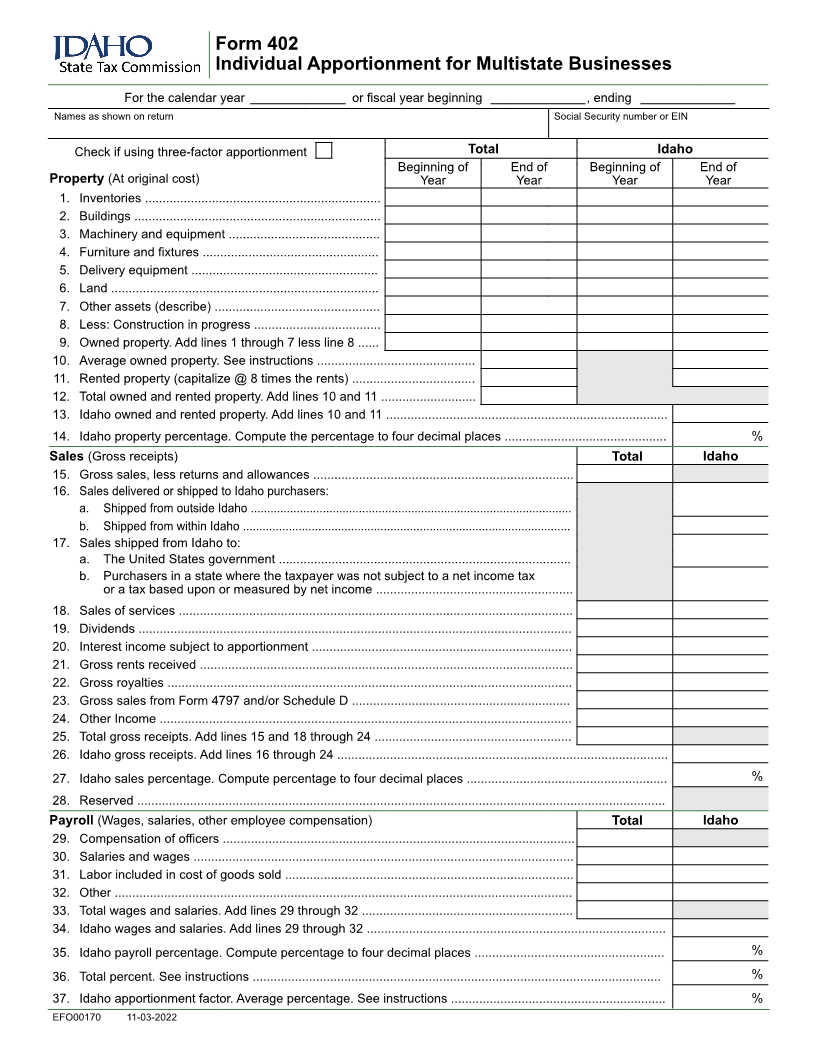

Form 402

Individual Apportionment for Multistate Businesses

For the calendar year or fiscal year beginning , ending

Names as shown on return Social Security number or EIN

Check if using three-factor apportionment Total Idaho

Beginning of End of Beginning of End of

Property (At original cost) Year Year Year Year

1. Inventories ...................................................................

2. Buildings ......................................................................

3. Machinery and equipment ...........................................

4. Furniture and fixtures ..................................................

5. Delivery equipment .....................................................

6. Land ............................................................................

7. Other assets (describe) ...............................................

8. Less: Construction in progress ....................................

9. Owned property. Add lines 1 through 7 less line 8 ......

10. Average owned property. See instructions .............................................

11. Rented property (capitalize @ 8 times the rents) ...................................

12. Total owned and rented property. Add lines 10 and 11 ...........................

13. Idaho owned and rented property. Add lines 10 and 11 ................................................................................

14. Idaho property percentage. Compute the percentage to four decimal places .............................................. %

Sales (Gross receipts) Total Idaho

15. Gross sales, less returns and allowances ..........................................................................

16. Sales delivered or shipped to Idaho purchasers:

a. Shipped from outside Idaho ..................................................................................................

b. Shipped from within Idaho ....................................................................................................

17. Sales shipped from Idaho to:

a. The United States government ...................................................................................

b. Purchasers in a state where the taxpayer was not subject to a net income tax

or a tax based upon or measured by net income ........................................................

18. Sales of services ................................................................................................................

19. Dividends ...........................................................................................................................

20. Interest income subject to apportionment ..........................................................................

21. Gross rents received ..........................................................................................................

22. Gross royalties ...................................................................................................................

23. Gross sales from Form 4797 and/or Schedule D ..............................................................

24. Other Income .....................................................................................................................

25. Total gross receipts. Add lines 15 and 18 through 24 ........................................................

26. Idaho gross receipts. Add lines 16 through 24 ..............................................................................................

27. Idaho sales percentage. Compute percentage to four decimal places ......................................................... %

28. Reserved ......................................................................................................................................................

Payroll (Wages, salaries, other employee compensation) Total Idaho

29. Compensation of officers ....................................................................................................

30. Salaries and wages ............................................................................................................

31. Labor included in cost of goods sold ..................................................................................

32. Other ..................................................................................................................................

33. Total wages and salaries. Add lines 29 through 32 ............................................................

34. Idaho wages and salaries. Add lines 29 through 32 .....................................................................................

35. Idaho payroll percentage. Compute percentage to four decimal places ...................................................... %

36. Total percent. See instructions .................................................................................................................... %

37. Idaho apportionment factor. Average percentage. See instructions ............................................................. %

EFO00170 11-03-2022