Enlarge image

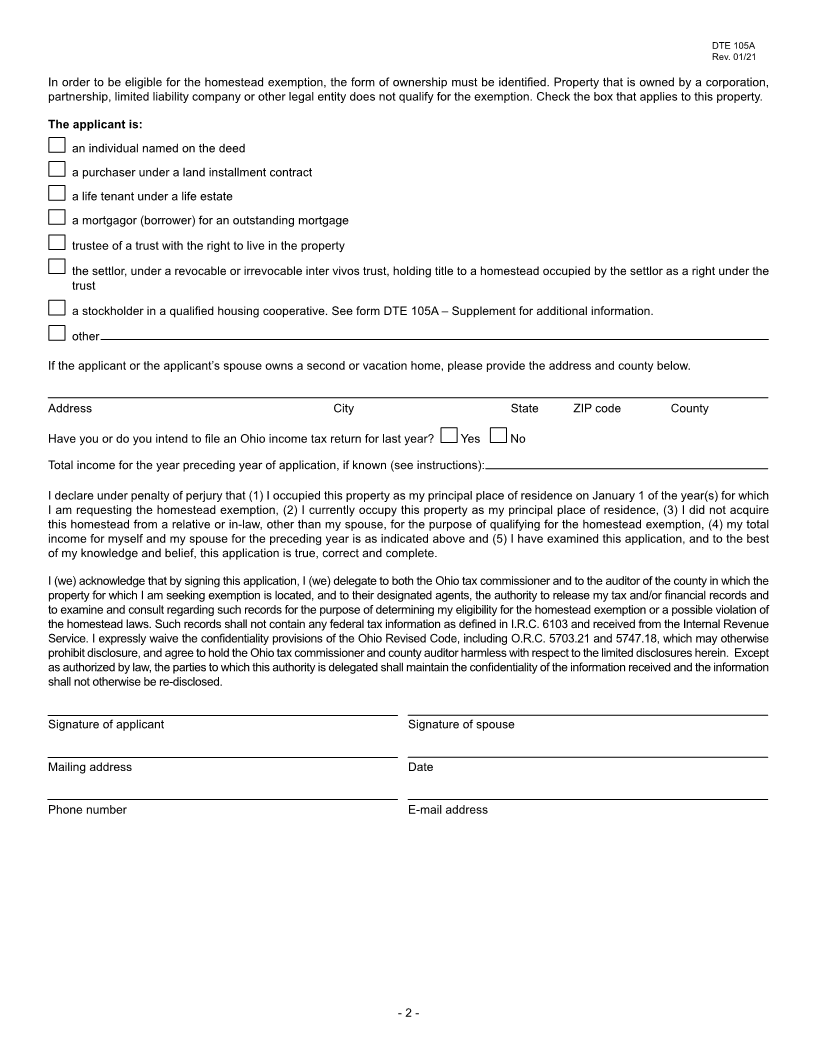

DTE 105A

Rev. 01/21

Homestead Exemption Application for Senior Citizens,

Disabled Persons and Surviving Spouses

For real property, file on or before December 31 of the year for which the exemption is sought. For manufactured or mobile

homes, this form must be filed on or before December 31 of the year prior to the year for which the exemption is sought.

Please read the instructions on the back of this form before you complete it. Disabled applicants must complete form DTE 105E,

Certificate of Disability for the Homestead Exemption, and attach it or a separate certification of disability status from an eligible state or

federal agency to this application. See the instructions on page 3 of this form.

Current application

Late application for prior year

Application of person who received homestead reduction for 2013 or for 2014 for manufactured or mobile homes. Form DTE 105G

must accompany this application.

Application of person who received the homestead reduction for 2006 that is greater than the reduction calculated under the current law.

Form DTE 105G must accompany this application.

Type of application:

Senior citizen (must be at least age 65 by December 31st of the year for which the exemption is sought)

Disabled person (must be permanently and totally disabled on January 1 of the year for which exemption is sought)

Surviving spouse (must have been at least 59 years old on the date of the spouse’s death and must meet all other homestead exemp-

tion requirements)

Type of home:

Single family dwelling Unit in a multi-unit dwelling Condominium Unit in a housing cooperative

Manufactured or mobile home Land under a manufactured or mobile home

Applicant’s name Applicant’s date of birth SSN

Name of spouse Spouse’s date of birth SSN

Home address

County in which home is located

Taxing district and parcel or registration number

from tax bill or available from county auditor

FOR COUNTY AUDITOR’S USE ONLY:

Taxing district and parcel or registration number Auditor’s application number

First year for homestead exemption

Date filed

Name on tax duplicate

Taxable value of homestead: Taxable land Taxable bldg. Taxable total

Method of Verification (must complete one):

Tax commissioner portal: Year Total MAGI No information returned

Ohio tax return (line 3 plus line 11 of Ohio Schedule A): Year Total MAGI

Federal tax return (line 4, 1040EZ): Year Total FAGI

(line 21, 1040A): Year Total FAGI

(line 37, 1040): Year Total FAGI

Worksheet (attached): Estimated MAGI

Granted Denied

County auditor (or representative) Date

- 1 -