Enlarge image

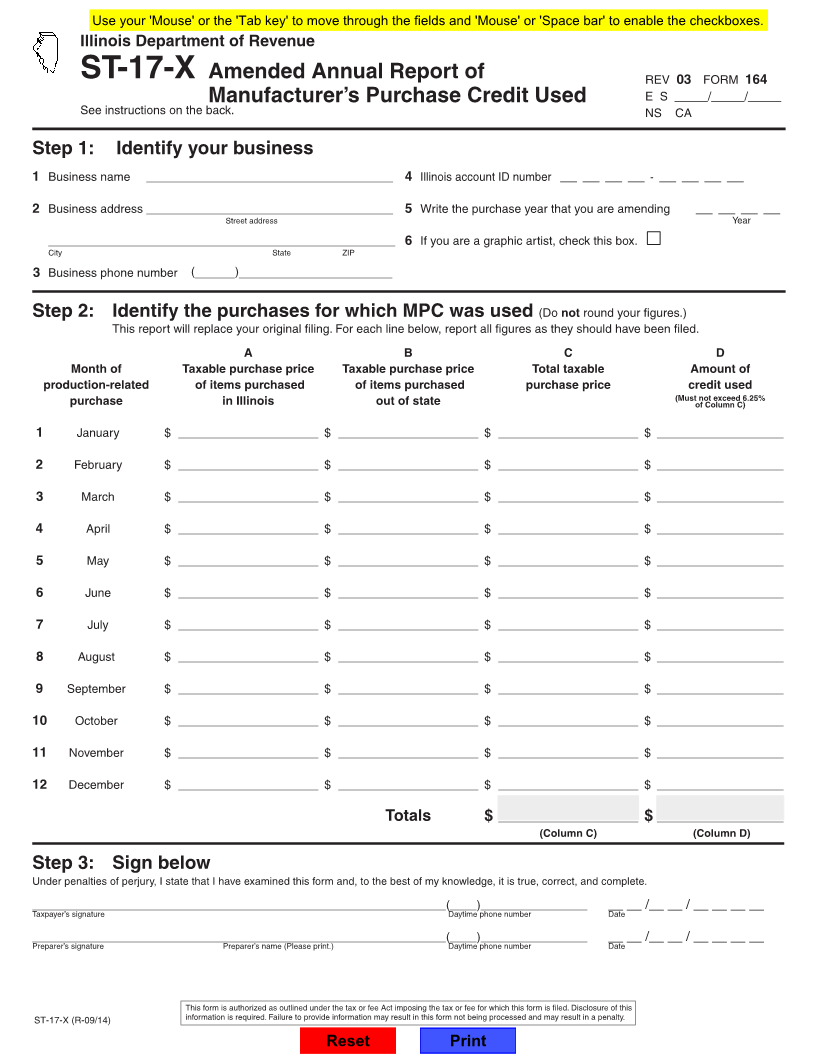

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

ST-17-X Amended Annual Report of REV 03 FORM 164

Manufacturer’s Purchase Credit Used E S _____/_____/_____

See instructions on the back. NS CA

Step 1: Identify your business

1 Business name _____________________________________ 4 Illinois account ID number ___ ___ ___ ___ - ___ ___ ___ ___

2 Business address _____________________________________ 5 Write the purchase year that you are amending ___ ___ ___ ___

Street address Year

____________________________________________________ 6 If you are a graphic artist, check this box.

City State ZIP

3 Business phone number (______)_______________________

Step 2: Identify the purchases for which MPC was used (Do not round your figures.)

This report will replace your original filing. For each line below, report all figures as they should have been filed.

A B C D

Month of Taxable purchase price Taxable purchase price Total taxable Amount of

production-related of items purchased of items purchased purchase price credit used

purchase in Illinois out of state (Must not exceed 6.25%

of Column C)

1 January $ _____________________ $ _____________________ $ _____________________ $ ___________________

2 February $ _____________________ $ _____________________ $ _____________________ $ ___________________

3 March $ _____________________ $ _____________________ $ _____________________ $ ___________________

4 April $ _____________________ $ _____________________ $ _____________________ $ ___________________

5 May $ _____________________ $ _____________________ $ _____________________ $ ___________________

6 June $ _____________________ $ _____________________ $ _____________________ $ ___________________

7 July $ _____________________ $ _____________________ $ _____________________ $ ___________________

8 August $ _____________________ $ _____________________ $ _____________________ $ ___________________

9 September $ _____________________ $ _____________________ $ _____________________ $ ___________________

10 October $ _____________________ $ _____________________ $ _____________________ $ ___________________

11 November $ _____________________ $ _____________________ $ _____________________ $ ___________________

12 December $ _____________________ $ _____________________ $ _____________________ $ ___________________

Totals $ _____________________ $___________________

(Column C) (Column D)

Step 3: Sign below

Under penalties of perjury, I state that I have examined this form and, to the best of my knowledge, it is true, correct, and complete.

______________________________________________________________(____)________________ __ __ /__ __ / __ __ __ __

Taxpayer’s signature Daytime phone number Date

______________________________________________________________(____)________________ __ __ /__ __ / __ __ __ __

Preparer’s signature Preparer’s name (Please print.) Daytime phone number Date

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this

ST-17-X (R-09/14) information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

Reset Print