Enlarge image

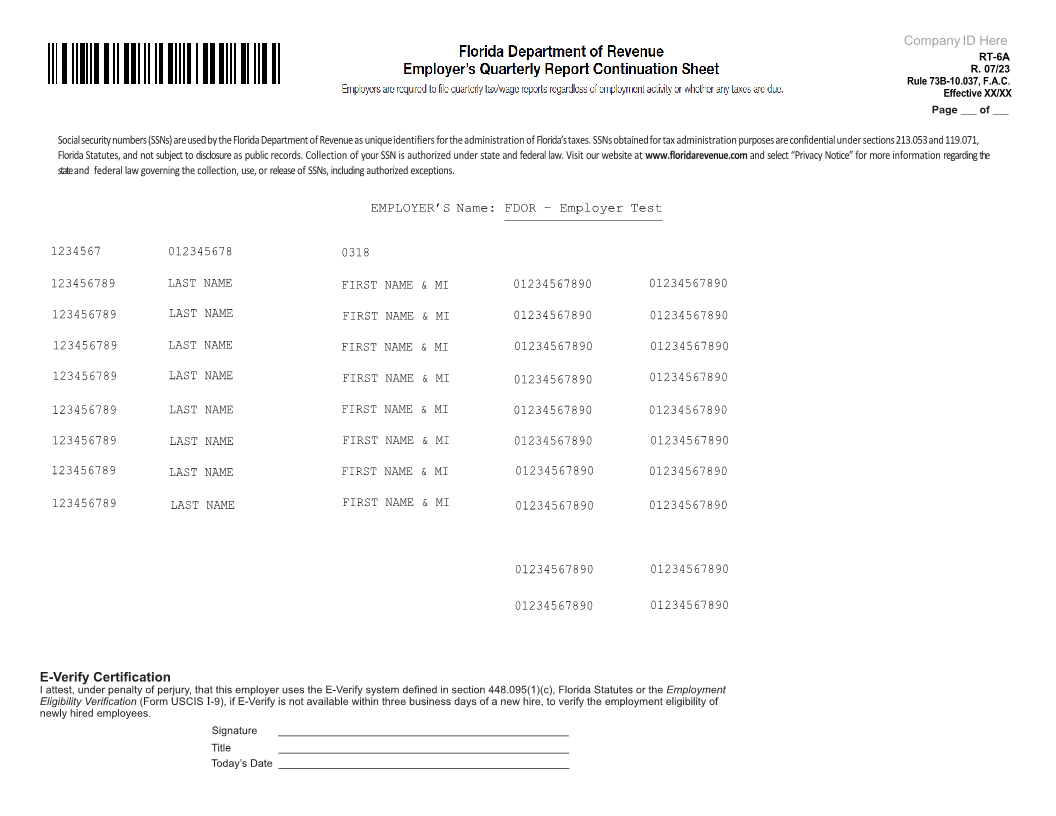

Company ID Here

RT-6A

R. 07/23

Rule 73B-10.037, F.A.C.

Effective XX/XX

Page ___ of ___

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the administration of Florida’s taxes. SSNs obtained for tax administration purposes are confidential under sections 213.053 and 119.071,

Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized under state and federal law. Visit our website at www.floridarevenue.com and select “Privacy Notice” for more information regarding the

stateand federal law governing the collection, use, or release of SSNs, including authorized exceptions.

EMPLOYER’S Name: FDOR – Employer Test

1234567 012345678 0318

123456789 LAST NAME FIRST NAME & MI 01234567890 01234567890

123456789 LAST NAME FIRST NAME & MI 01234567890 01234567890

123456789 LAST NAME FIRST NAME & MI 01234567890 01234567890

123456789 LAST NAME FIRST NAME & MI 01234567890 01234567890

123456789 LAST NAME FIRST NAME & MI 01234567890 01234567890

123456789 LAST NAME FIRST NAME & MI 01234567890 01234567890

123456789 LAST NAME FIRST NAME & MI 01234567890 01234567890

123456789 LAST NAME FIRST NAME & MI 01234567890 01234567890

01234567890 01234567890

01234567890 01234567890

E-Verify Certification

I attest, under penalty of perjury, that this employer uses the E-Verify system defined in section 448.095(1)(c), Florida Statutes or the Employment

Eligibility Verification (Form USCIS I-9), if E-Verify is not available within three business days of a new hire, to verify the employment eligibility of

newly hired employees.

Signature _________________________________________________

Title _________________________________________________

Today’s Date _________________________________________________