- 2 -

Enlarge image

|

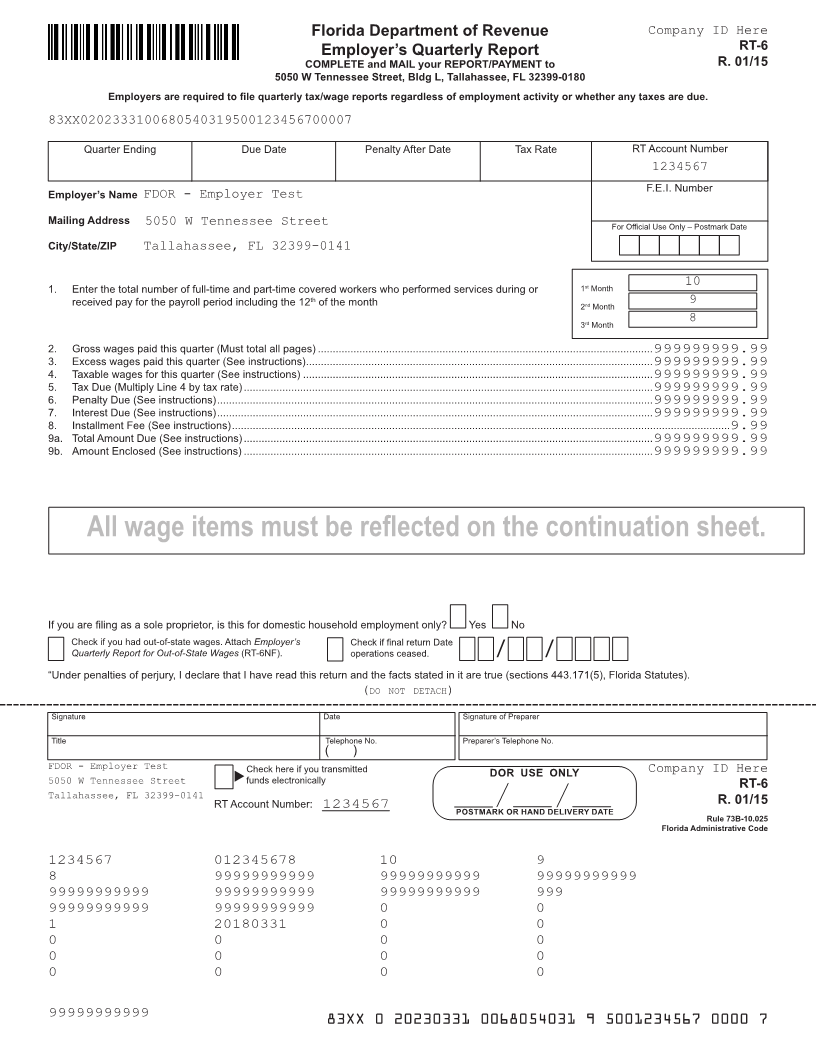

Florida Department of Revenue Company ID Here

Employer’s Quarterly Report RT-6

COMPLETE and MAIL your REPORT/PAYMENT to R. 01/15

5050 W Tennessee Street, Bldg L, Tallahassee, FL 32399-0180

Employers are required to file quarterly tax/wage reports regardless of employment activity or whether any taxes are due.

83XX0202333100680540319500123456700007

Quarter Ending Due Date Penalty After Date Tax Rate RT Account Number

1234567

F.E.I. Number

Employer’s Name FDOR - Employer Test

Mailing Address 5050 W Tennessee Street For Official Use Only – Postmark Date

City/State/ZIP Tallahassee, FL 32399-0141

1. Enter the total number of full-time and part-time covered workers who performed services during or 1st Month 10

received pay for the payroll period including the 12 thof the month nd Month 9

2

3 rdMonth 8

2. Gross wages paid this quarter (Must total all pages) .................................................................................................................999999999.99

3. Excess wages paid this quarter (See instructions) .....................................................................................................................999999999.99

4. Taxable wages for this quarter (See instructions) ......................................................................................................................999999999.99

5. Tax Due (Multiply Line 4 by tax rate) ..........................................................................................................................................999999999.99

6. Penalty Due (See instructions) ...................................................................................................................................................999999999.99

7. Interest Due (See instructions) ...................................................................................................................................................999999999.99

8. Installment Fee (See instructions) ........................................................................................................................................................................9.99

9a. Total Amount Due (See instructions) ..........................................................................................................................................999999999.99

9b. Amount Enclosed (See instructions) ..........................................................................................................................................999999999.99

All wage items must be reflected on the continuation sheet.

If you are filing as a sole proprietor, is this for domestic household employment only? Yes No

Check if you had out-of-state wages. Attach Employer’s Check if final return Date

Quarterly Report for Out-of-State Wages (RT-6NF). operations ceased.

“Under penalties of perjury, I declare that I have read this return and the facts stated in it are true (sections 443.171(5), Florida Statutes).

detach( do ) not

Signature Date Signature of Preparer

Title Telephone No. Preparer’s Telephone No.

( )

FDOR - Employer Test t Company ID Here

Check here if you transmitted

5050 W Tennessee Street funds electronically DOR USE ONLY RT-6

Tallahassee, FL 32399-0141

RT Account Number: 1234567 POSTMARK OR HAND DELIVERY DATE R. 01/15

Rule 73B-10.025

Florida Administrative Code

12345678901234000001234567890123400010234567890123400 123456789012340000000009

82345678901234000099999999999999900099999999999999900999999999999999000000000

99999999999999900099999999999999900099999999999999900999 9999000000000

99999999999 99999999999 0 0 000000000

1 01234000020180331 230 000 000000000

0 0 0 0 000000000

0234567890123400000 2340000000 000 000000000

0 0 0 0 000000000

99999999999 83XX 0 20230331 0068054031 9 5001234567 0000 7

|