Enlarge image

R. 06/23

-aqq

Florida Department of Revenue

2023 Alternative Forms Requirements

Guide

Ver.2023 2.0

Enlarge image |

R. 06/23

-aqq

Florida Department of Revenue

2023 Alternative Forms Requirements

Guide

Ver.2023 2.0

|

Enlarge image |

Contents

Changes ............................................................................................................................................................................... 4

1 Introduction .................................................................................................................................................................. 5

2 Purpose ......................................................................................................................................................................... 5

3 Definitions ..................................................................................................................................................................... 5

4 Responsibilities ............................................................................................................................................................. 6

5 Procedures .................................................................................................................................................................... 6

5.1 Submitting Forms to the Department for Approval ................................................................................................ 6

5.2 Resubmittals ......................................................................................................................................................... 7

5.3 Production Monitoring ........................................................................................................................................... 7

6 Guidelines and Specifications for Scannable Forms: F‐1120, F‐1120A, F‐1120ES, 7004,F‐and F-1120X........................ 7

6.1 General Information ............................................................................................................................................. 7

6.2 Company ID ........................................................................................................................................................... 8

6.3 Vendor ID .............................................................................................................................................................. 8

6.4 Paper Requirements .............................................................................................................................................. 8

6.5 Ink/Toner Requirements ......................................................................................................................................... 8

6.6 Layout ................................................................................................................................................................... 8

6.7 Worksheets and Schedules .................................................................................................................................... 8

6.8 Barcodes ............................................................................................................................................................... 8

6.9 Format .................................................................................................................................................................. 8

6.10 FEIN ....................................................................................................................................................................... 8

6.11 Data Placement and Specifications for Scannable Fields ........................................................................................ 8

6.11.1 Scannable Band .............................................................................................................................................. 9

6.11.2 Negative Values ............................................................................................................................................. 9

6.11.3 Decimals ........................................................................................................................................................ 9

6.12 Specifications for F-1120 Return (Coupon Page) Scannable Band ........................................................................ 10

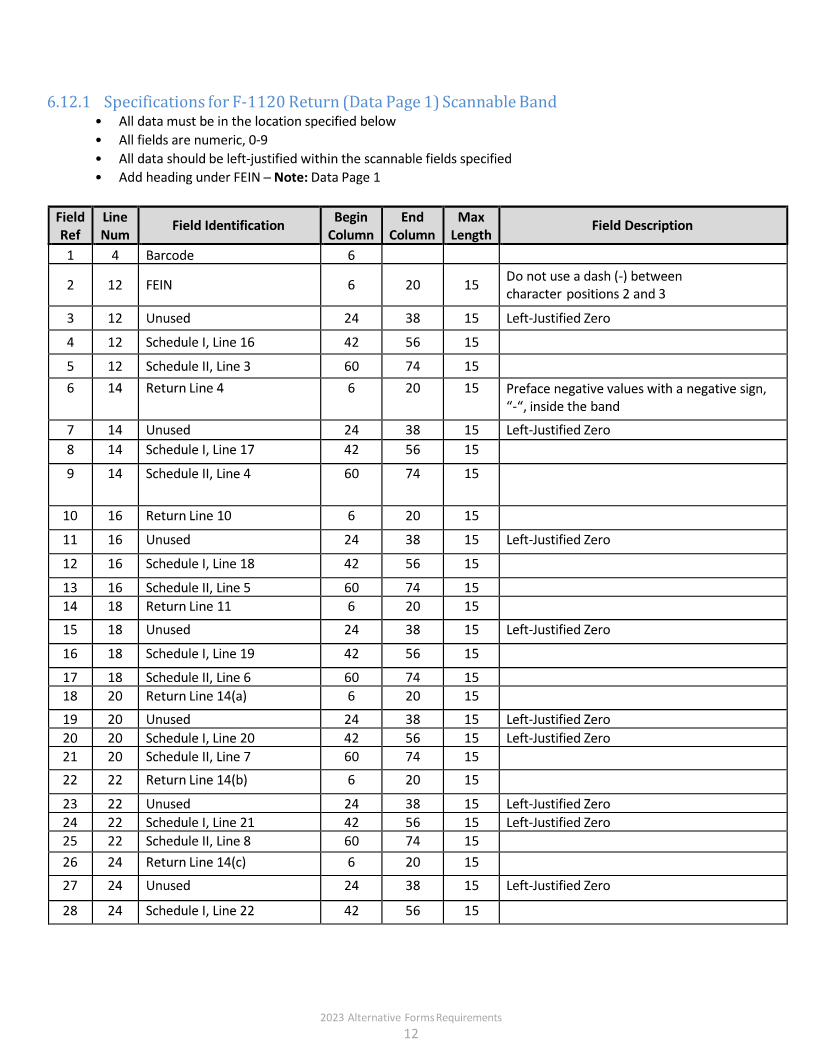

6.12.1 Specifications for F-1120 Return (Data Page 1) Scannable Band ................................................................... 12

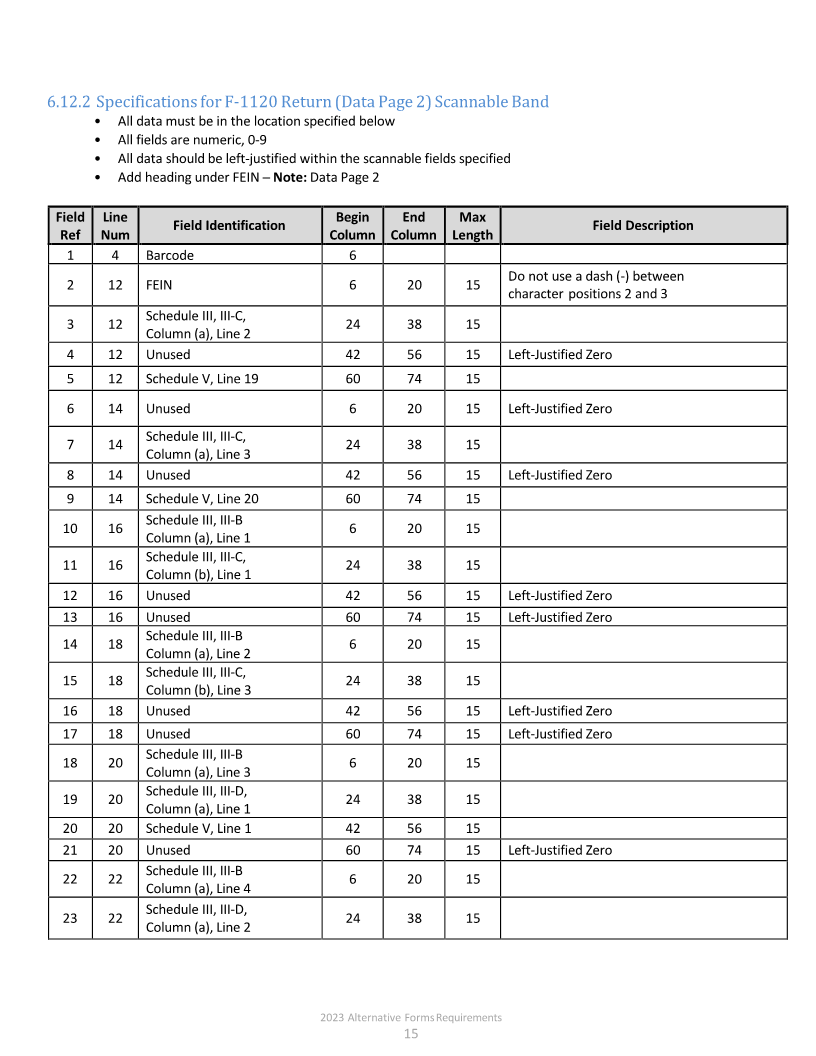

6.12.2 Specifications for F-1120 Return (Data Page 2) Scannable Band ................................................................... 15

6.13 Specifications for F-1120A Return (Coupon Page) Scannable Band ...................................................................... 18

6.14 Specifications for F-1120ES (Coupon Page) Scannable Band ................................................................................ 20

6.15 Specifications for F-7004 (Coupon Page) Scannable Band .................................................................................... 21

6.16 Specifications for F-1120X (Coupon Page) Scannable Band .................................................................................. 23

6.17 OCR Line Specifications for Payment CouponsF‐1120, F‐1120A,F‐1120ES, F‐7004, and F-1120X ....................... 24

6.18 Barcode Specifications for Form F-1120 Return and Schedules ............................................................................ 26

6.19 Components of Barcode for F-1120X Return ....................................................................................................... 27

2023 Alternative Forms Requirements

2

|

Enlarge image |

6.20 Guidelines and Specifications for 2D Barcode for Form F-1120 ........................................................................... 27

7 Guidelines and Specifications for Scannable Form RT‐6 .............................................................................................. 31

7.1 General Information ........................................................................................................................................... 31

7.2 Data Placement and Specifications for Scannable Band ....................................................................................... 32

7.3 Specifications for Form RT-6 Report (Coupon Page) Scannable Band ................................................................... 32

7.4 Specifications for Form RT-6A (Continuation Page) Scannable Band .................................................................... 33

7.5 Specifications for Form RT-6NF (Out-of-State Wages) Scannable Band ............................................................... 36

7.6 Specifications for Form RT-6EW (Employees Contracted to Government or Nonprofit Educational Institutions)

Scannable Band ................................................................................................................................................... 43

7.7 OCR Line Specifications for the Form RT-6 Coupon ............................................................................................ 47

7.8 Barcode Specifications for Forms RT-6, RT-6A, RT-6NF, and RT-6EW ................................................................. 49

7.9 Components for Forms RT-6, RT-6A, RT-6NF, and RT-6EW ................................................................................. 49

7.10 Guidelines and Specifications for 2D Barcode for Form RT-6 ............................................................................... 49

8 Guidelines for Non‐Scannable Forms and Forms That Require a Barcode and/or OCR Line ........................................ 52

8.1 Form DR-15MO: Out-of-State-Purchase Return .................................................................................................... 52

8.2 Form RT-8A: Correction to Employer's Quarterly or Annual Domestic Report ...................................................... 54

8.3 Barcode Specifications for Form RT-8A ................................................................................................................ 55

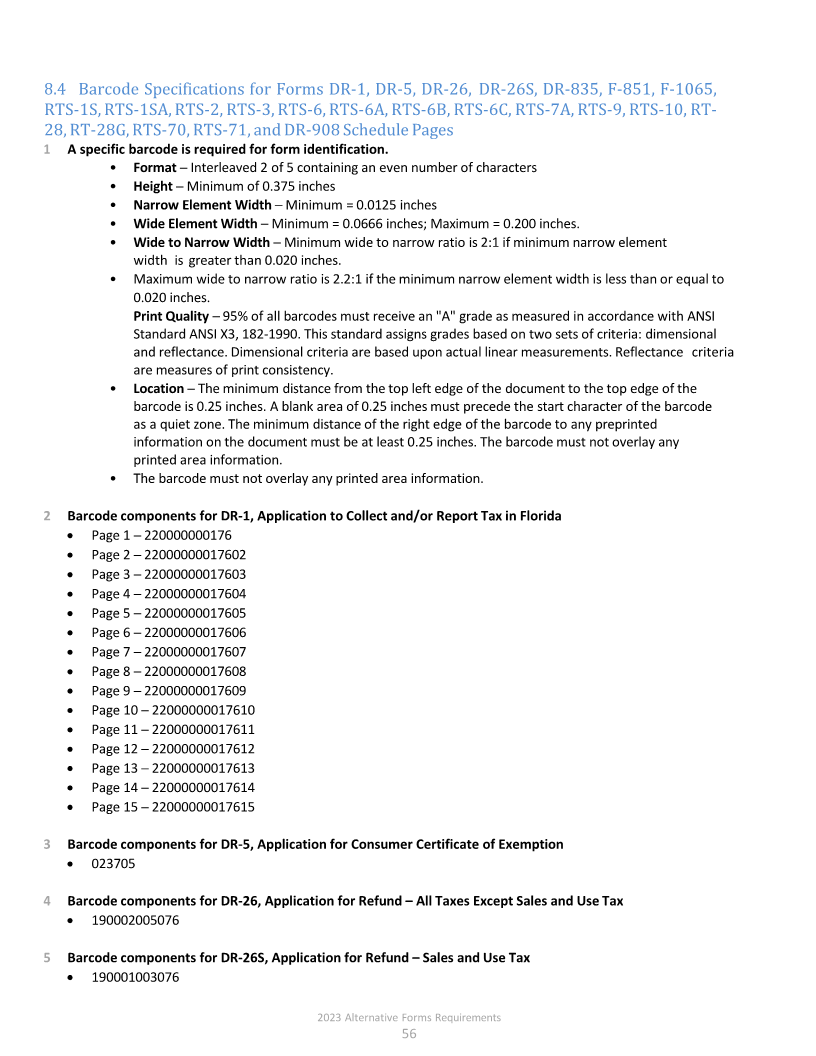

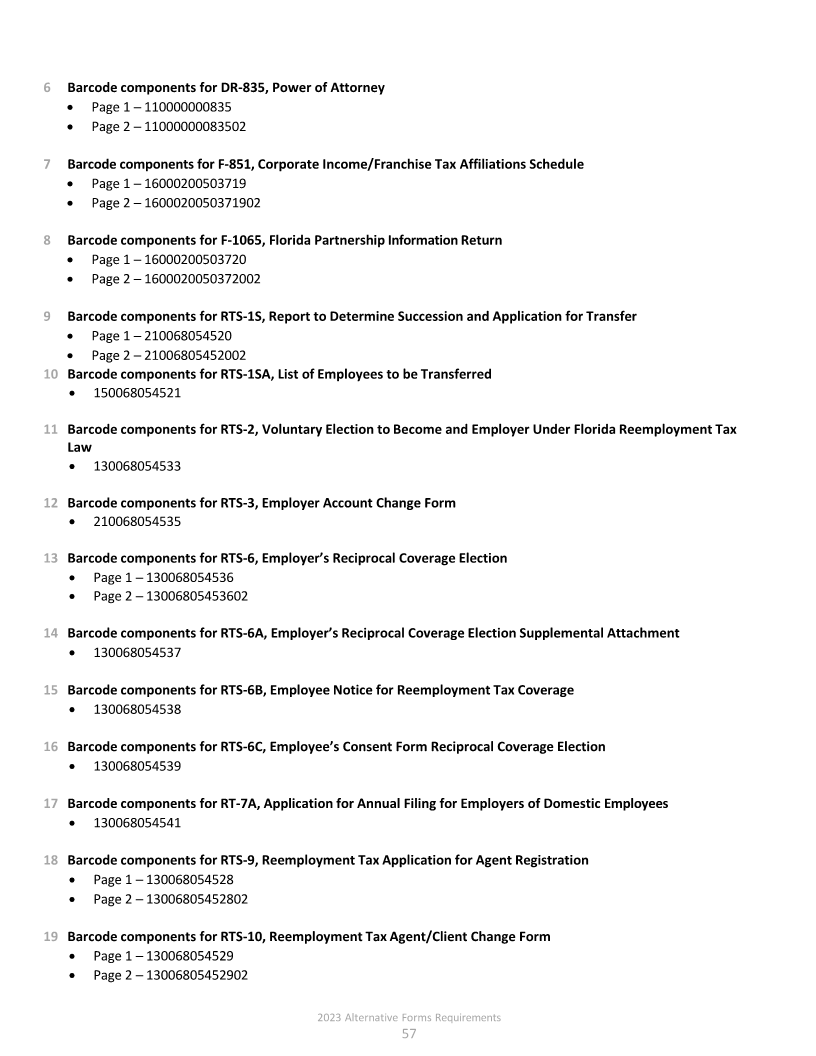

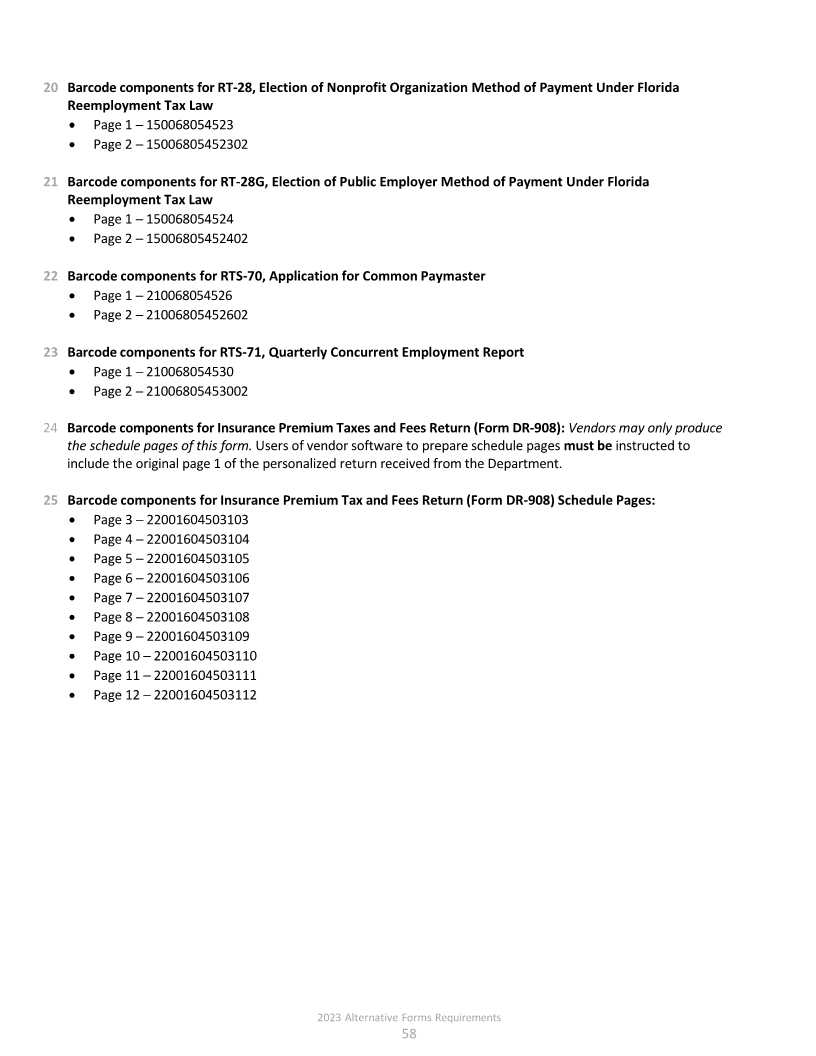

8.4 Barcode Specifications for FormsDR‐1,DR‐5,DR‐26, DR‐26S,DR‐835, F‐ 851,F‐1065, RTS‐1S,RTS‐1SA, RTS‐2,

RTS‐3, RTS‐6, RTS‐6A, RTS‐6B, RTS‐6C, RTS‐7A, RTS‐9, RTS‐10, RT‐28,RT‐ 28G,RTS‐70, RTS‐71, andDR‐908

Schedule Pages .................................................................................................................................................... 56

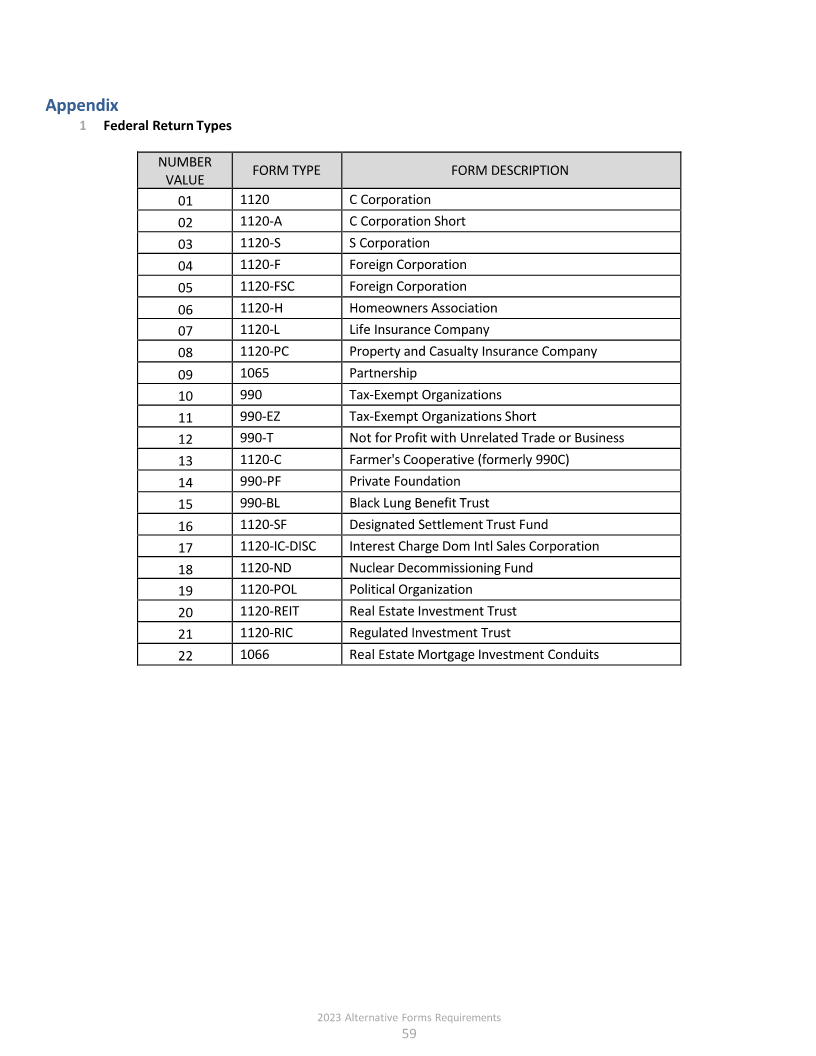

Appendix ........................................................................................................................................................................... 59

2023 Alternative Forms Requirements

3

|

Enlarge image |

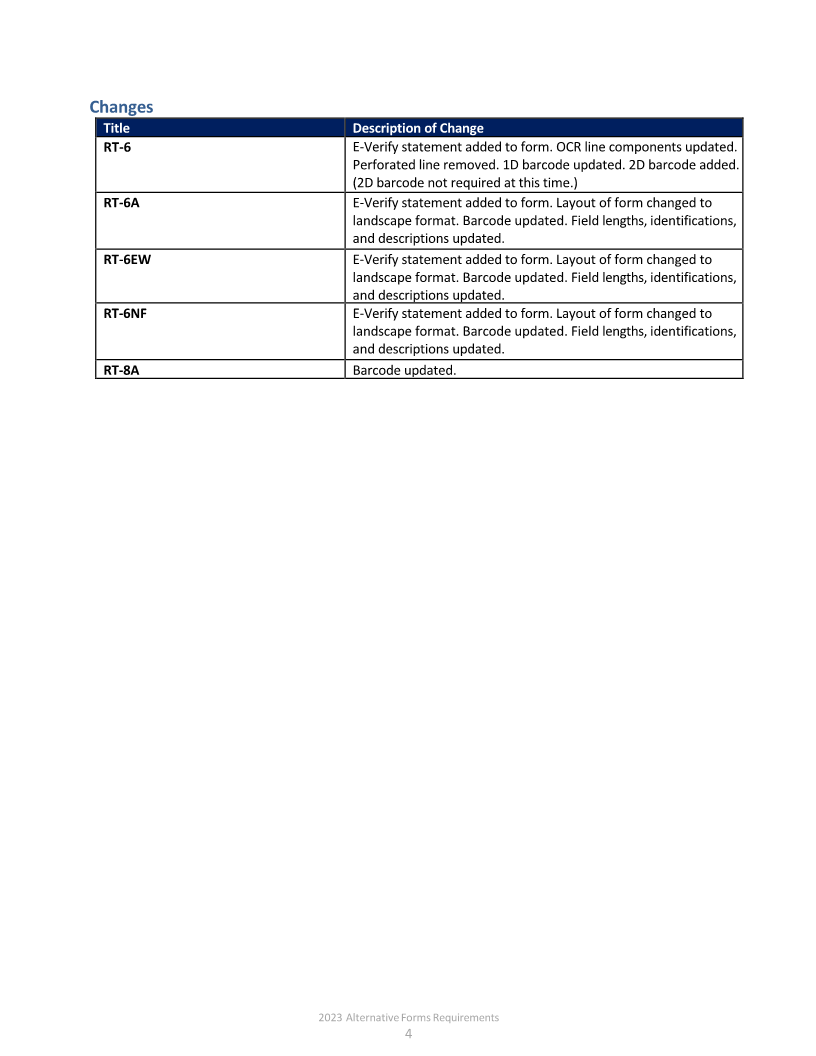

Changes

Title Description of Change

RT-6 E-Verify statement added to form. OCR line components updated.

Perforated line removed. 1D barcode updated. 2D barcode added.

(2D barcode not required at this time.)

RT-6A E-Verify statement added to form. Layout of form changed to

landscape format. Barcode updated. Field lengths, identifications,

and descriptions updated.

RT-6EW E-Verify statement added to form. Layout of form changed to

landscape format. Barcode updated. Field lengths, identifications,

and descriptions updated.

RT-6NF E-Verify statement added to form. Layout of form changed to

landscape format. Barcode updated. Field lengths, identifications,

and descriptions updated.

RT-8A Barcode updated.

2023 Alternative Forms Requirements

4

|

Enlarge image |

1 Introduction

1 The Florida Department of Revenue accepts alternative tax forms that are produced by computerized tax

processors, payroll processors, developers of tax software, computer programmers, commercial printers,

and other vendors who may create alternative tax forms.

2 Tax information is available on the Department’s website at floridarevenue.com/taxes/taxesfees.

3 Current and historic tax and interest rates are available on the Department’s website at

floridarevenue.com/taxes/rates.

4 Official Department forms are available at floridarevenue.com/forms.

2 Purpose

1 This guide provides vendors with the necessary information to be able to develop alternative tax forms that

are compatible with the Department’s automated processing system, including:

• Any company that develops scannable or non‐scannable alternative tax forms as a paper copy or as a part

of a software product for its customers or clients using its own tax software programs.

• Any company that develops tax software programs to be used with scannable alternative tax forms

developed by another company, as a paper copy, or as a part of a software product to its customers

or clients.

• Any company that develops scannable alternative tax forms for other companies to use with their

tax software programs as part of a software product for its customers or clients.

• Commercial printers or business forms companies that develop and use scannable alternative tax forms.

2 The Department will review, test, and approve alternative forms prior to vendor use and/or distribution.

3 All alternative forms vendors must submit an Alternative Form Vendors and Payroll Processors

Development Application (Form GT‐320227) annually, prior to the development and/or testing of

alternative forms.

4 Contact the Department at e‐vendor@floridarevenue.com for information concerning the testing and

approval process.

3 Definitions

• Alternative forms: Any form other than the official Department form that is computer produced,

computer programmed, and/or commercially printed

• Department: Florida Department of Revenue

• Official forms: Forms developed and created by the Department to be used by the taxpayer

• IRS: Internal Revenue Service

• RT: Reemployment tax

• Reporting period: The period being reported on a specific tax report

• Tax year: The year being reported on a specific tax return

• Vendor ID: A four‐digit identification value created by the Department to be placed in the OCR line

• Company ID: A four-character (alphanumeric) identifier chosen by the vendor to be placed in the upper right-

hand corner of each form page produced and the coupon section

2023 Alternative Forms Requirements

5

|

Enlarge image |

4 Responsibilities

1 The following compliance requirements must be met:

• Department

o Provide updated Vendor ID

o Record Company ID

o Review, test, and approve alternative forms

o Respond to inquiries within two business days

o Communicate tax rate and formatting changes

• Vendor’s Responsibility

o Annually submit developer’s application

o Develop products per State procedures, requirements, and specifications

o Provide the Department with 3copies of all forms being produced for review, testing, and approval prior to

use and/or distribution

• Vendor’s Responsibility to Customers and Clients

o Notify customers, clients, or taxpayers of the minimum computer hardware requirements, including

printers, printer fonts, font cartridges, etc., necessary to produce the company’s Department-approved

scannable and non‐scannable alternative tax forms.

o Provide customers, clients, or taxpayers with instructions for correctly producing the Department-approved

scannable and/or non‐scannable alternative tax forms. These instructions must include information on the

hardware requirements, including printing requirements and correct entry of taxpayer data.

o Upon request, provide customers, clients, or taxpayers using the alternative forms with a copy of the

Department’s approval notification.

5 Procedures

5.1 Submitting Forms to the Department for Approval

1 Prior to submitting your company's scannable and/or non‐scannable alternative tax forms, review the

guidelines for each form to be produced to ensure the forms meet the Department’s requirements.

2 Scannable forms must be mailed to the Department for the initial review.

Address for mailing through UPS, FedEx, or another courier:

Florida Department of Revenue

Attention: Alternative Forms Approval Team

Stop: 1-3230

2450 Shumard Oaks Blvd.

Tallahassee, FL 32399

Address for mailing through U.S. Postal Service (P.O. Box):

Florida Department of Revenue

Attention: Alternative Forms Approval Team

Stop: 1-3230

P.O. Box 7207

Tallahassee, FL 32314-7207

Do not include confidential tax information within the documents you submit for review. When mailing scannable

forms to the Department, send an email stating the courier and the associated tracking number to

e-vendor@floridarevenue.com.

2023 Alternative Forms Requirements

6

|

Enlarge image |

3 When the initial review is complete, the Department will notify you of approval or rejection. If rejected,

you will receive a list of issues for correction prior to resubmission. Section 5.2 covers resubmittals.

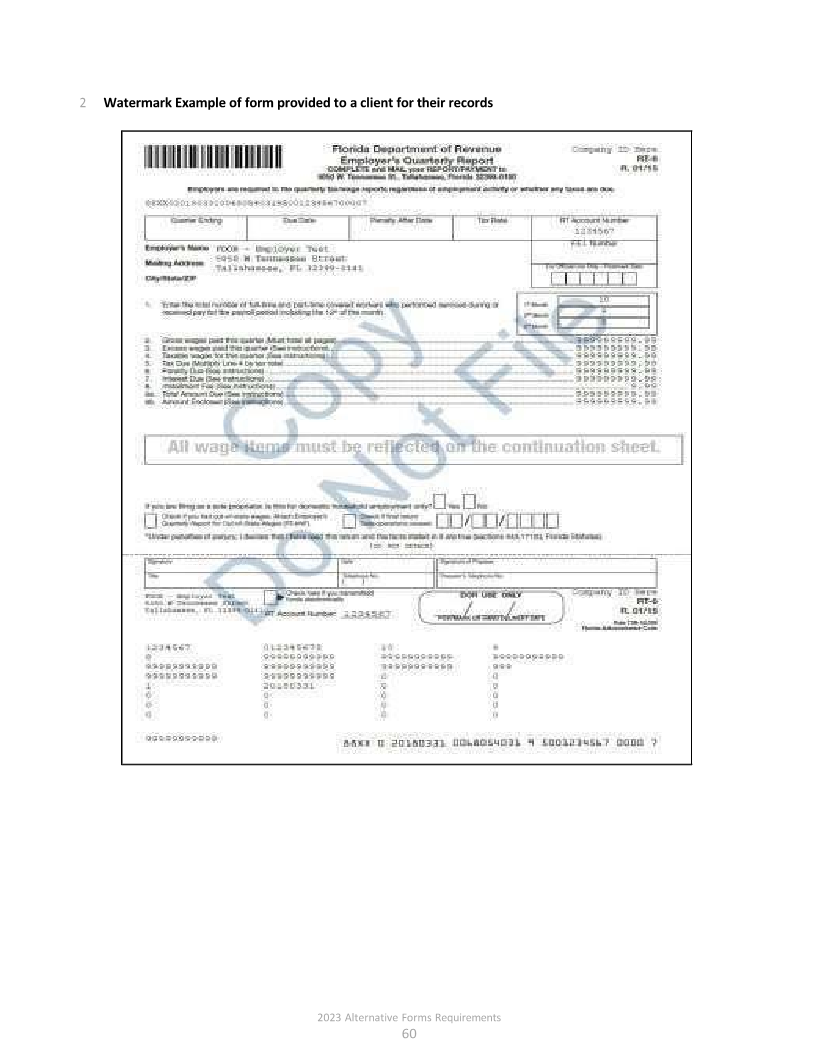

4 Forms produced solely for the purpose of providing a record of electronically filed returns must display a watermark

on each page of the return. This watermark will be navy blue with 25% opacity and centered at a 45‐degree angle.

(See Appendix.)

5 Publishers may reduce the size of the Department’s official forms to make them suitable for inclusion in reference

material. However, publishers must clearly state on the forms:

“THIS FORM IS FOR EXAMPLE PURPOSES ONLY AND IS NOT AN OFFICIAL FORM – DO NOT FILE THIS FORM”

5.2 Resubmittals

1 If a form is "rejected, ”correct any issues identified by the Department and resubmit the package. The expected

completion date for review of a resubmittal is five working days from the date the Department receives the

package.

2 Submit one new laser sample document with sample data printed on the form. If the business develops only

blank forms, submit one sample document without data.

Include a cover letter indicating "resubmittal." If the software does not support a field size, include this

information in the letter.

Note: If the cover letter does not indicate that the form is a resubmittal, it will be considered an original

submittal and the completion date of the Department’s review will be 10 working days from the date

received.

5.3 Production Monitoring

1 The Department has the authority to reject an alternative tax form that does not meet the guidelines detailed in this

publication or causes problems while being processed.

2 The Department may notify taxpayers of unapproved vendor software.

3 The users of unapproved vendor software may be subject to interest and/or penalties.

6 Guidelines and Specifications for Scannable Forms:F‐1120, F‐1120A, F‐1120ES, 7004,F‐and

F-1120X

6.1 General Information

1 The following forms are processed using the Opex Falcon V and Fujitsu I‐6670A:

• F‐1120 ─ Florida Corporate Income/Franchise Tax Return

• F‐1120A ─ Florida Corporate Short Form Income Tax Return

• F‐1120ES ─ Declaration/Installment of Florida Estimated Income/Franchise Tax

• F‐7004 ─ Florida Tentative Income/Franchise Tax Return and Application for Extension of Time to File Return

• F‐1120X ─ Amended Florida Corporate Income/Franchise and Tax Return

Note: Samples of the corporate income tax forms are available for informational purposes only. These forms

are not to specifications; therefore, they should not be used as a measurement tool.

2023 Alternative Forms Requirements

7

|

Enlarge image |

6.2 Company ID

1 Scannable and non‐scannable alternative tax forms must include the company ID code. The company ID used is

provided in the Developer’s Application.

6.3 Vendor ID

1 A new vendor ID is assigned each calendar year by the Department. This number must be included in both the upper

and lower OCR lines on FormsF‐1120, F‐1120A, F‐1120ES, F‐1120X, andF‐7004.(See “OCR Line Specifications.”)

6.4 Paper Requirements

1 The paper used must be good quality 8 1/2" x 11" white bond, minimum #20.

6.5 Ink/Toner Requirements

1 Black, non‐magnetic ink/toner must be used to print the forms.

6.6 Layout

1 All scannable alternative tax forms must follow the content format of the official Department form. (See "Data

Placement and Specifications for Scannable Band.” )

6.7 Worksheets and Schedules

1 The Department requires a printed copy of all F‐1120 schedules to be submitted with the F‐1120 Return.

Note: Taxpayers who qualify to file the Florida Corporate Short Form Income Tax Return (Form F-1120A) are

not required to submit schedules with their return.

2 The F‐1120 contains:

• The return coupon page

• The return questions A‐L page

• Data pages 1 and 2

• F‐1120 Schedules I, II, III, IV, V, and R

6.8 Barcodes

1 A specific barcode is required on each page of the F‐1120 Return and F‐1120 Schedules. A total of 9 barcodes are

used. (See “Barcode Specifications.”)

6.9 Format

1 Vendors must follow the Department’s format of the F‐1120 schedules. Taxpayers are required to

submit schedules with their return.

Note: Taxpayers who qualify to file the Florida Corporate Short Form Income Tax Return (Form F-1120A) are not

required to submit schedules with their return.

6.10 FEIN

1 If a taxpayer has applied for a FEIN, nine zeros (000000000) should appear in the FEIN field of the scan band on the

coupon and the FEIN field on the OCR line.

6.11 Data Placement and Specifications for Scannable Fields

• Courier font ─10-point

• Vertical spacing ─Six lines per inch

• Horizontal Spacing ─10 characters per inch

2023 Alternative Forms Requirements

8

|

Enlarge image |

• The scan band contains eight rows − row 53 through 60 − and four columns (columns 6, 24, 42, and 60) of data

fields.

• Field references 14, 18, and 22 contain multiple data.

• The area between the last row (row 60) of data fields and the OCR line should be clear.

6.11.1 Scannable Band

1 The data found in the scannable band and the scannable band themselves are in a fixed format. The placement of

that information must correspond to the return and schedule pages per individual specifications.

Note: Do not leave fields blank.

2 The default value for unused fields in the scannable band must be a single left‐justified zero unless otherwise stated.

3 Data fields with multiple responses require the spaces between the character positions to be filled with zeros (e.g.,

character position #1 = address changes; character position #8 = form request, would be entered as 10000001).

Note: Do not leave fields blank.

6.11.2 Negative Values

1 Negative (‐)values are only allowed inside the scannable band on the F‐1120 return. Negative values should be

prefaced with a “–“ symbol and account for a default decimal value of two, e.g., ‐2000 = ($20.00).

6.11.3 Decimals

1 Decimals for apportionment fractions are allowed inside the scannable band on the F-1120 return; however, only

in specified locations.

2 An implied decimal format must be used for all monetary amounts. The negative (-) symbol and/or decimal point

(when applicable) are the only punctuation marks allowed in the scan band or data pages. Examples:

• $1,234.56 would appear as 123456

• $78.00 would appear as 7800

• ($20.00) would appear as -2000

• 5/8 would appear as .625

3 Do not add leading zeros.

4 Non‐monetary fields (i.e., Florida Apportionment Factor) should appear as .012345 (this value is for

illustration purposes only). The data in this field must be a number between zero and one with a maximum

of six digits, i.e., 1, 0, or .098766. The decimal point for an apportionment fraction should be included within

the data field. There should be no zeros to the left of the decimal point.

2023 Alternative Forms Requirements

9

|

Enlarge image |

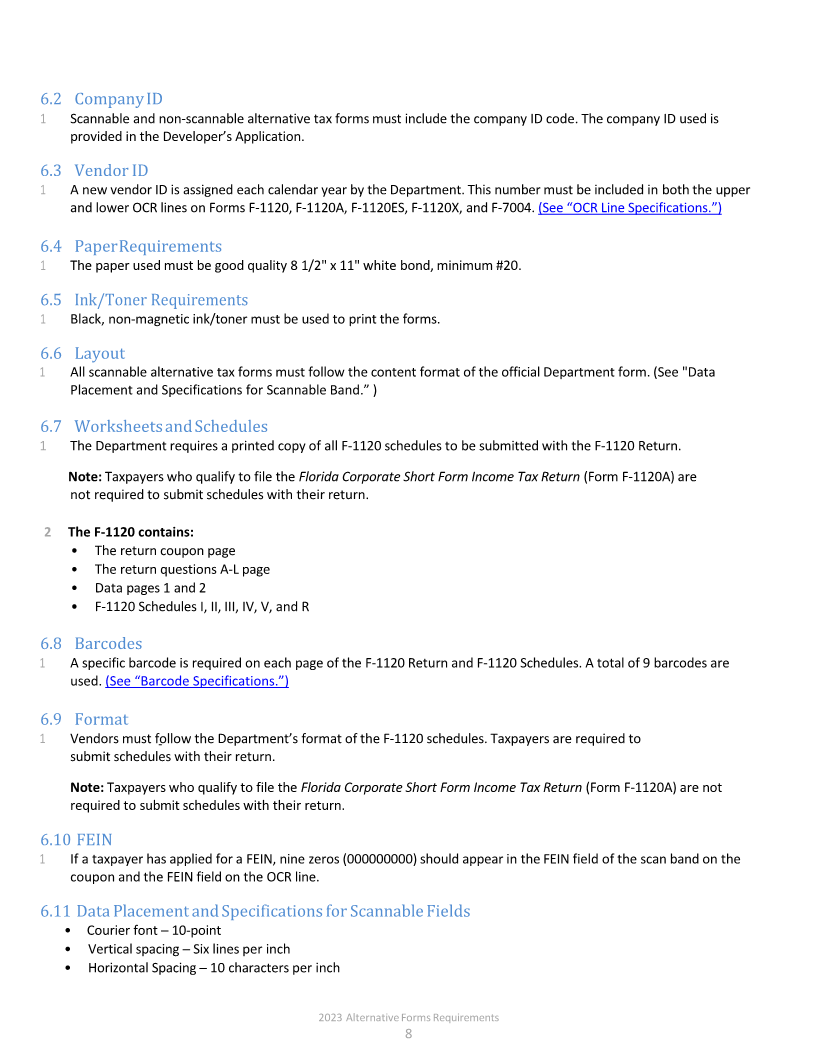

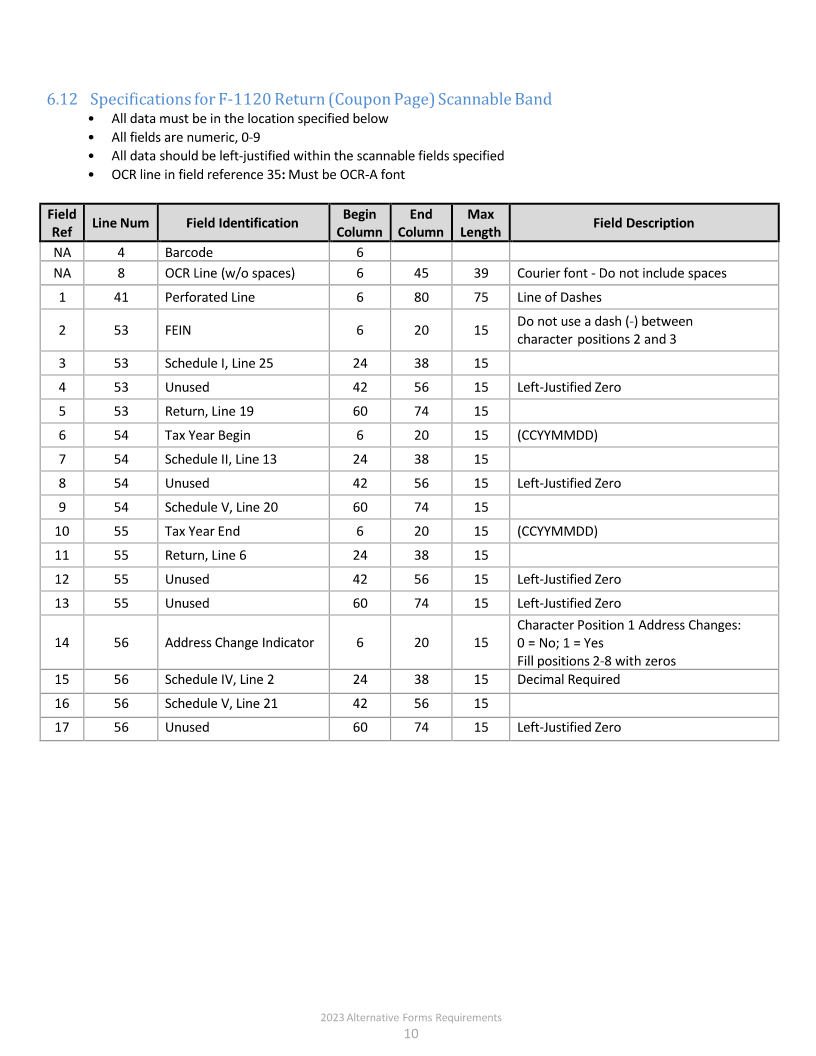

6.12 Specifications for F-1120 Return (Coupon Page) Scannable Band

• All data must be in the location specified below

• All fields are numeric, 0‐9

• All data should be left‐justified within the scannable fields specified

• OCR line in field reference 35: Must beOCR‐A font

Field Begin End Max

Line Num Field Identification Field Description

Ref Column Column Length

NA 4 Barcode 6

NA 8 OCR Line (w/o spaces) 6 45 39 Courier font - Do not include spaces

1 41 Perforated Line 6 80 75 Line of Dashes

Do not use a dash (-) between

2 53 FEIN 6 20 15

character positions 2 and 3

3 53 Schedule I, Line 25 24 38 15

4 53 Unused 42 56 15 Left-Justified Zero

5 53 Return, Line 19 60 74 15

6 54 Tax Year Begin 6 20 15 (CCYYMMDD)

7 54 Schedule II, Line 13 24 38 15

8 54 Unused 42 56 15 Left-Justified Zero

9 54 Schedule V, Line 20 60 74 15

10 55 Tax Year End 6 20 15 (CCYYMMDD)

11 55 Return, Line 6 24 38 15

12 55 Unused 42 56 15 Left-Justified Zero

13 55 Unused 60 74 15 Left-Justified Zero

Character Position 1 Address Changes:

14 56 Address Change Indicator 6 20 15 0 = No; 1 = Yes

Fill positions 2-8 with zeros

15 56 Schedule IV, Line 2 24 38 15 Decimal Required

16 56 Schedule V, Line 21 42 56 15

17 56 Unused 60 74 15 Left-Justified Zero

2023 Alternative Forms Requirements

10

|

Enlarge image |

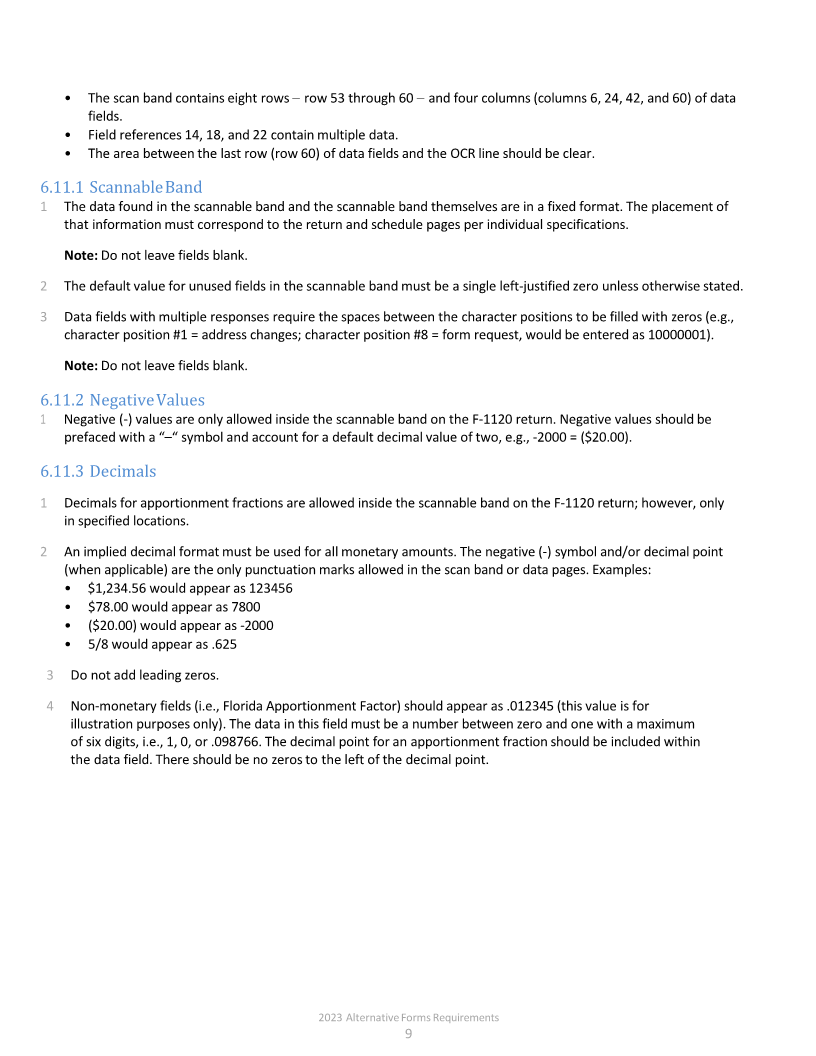

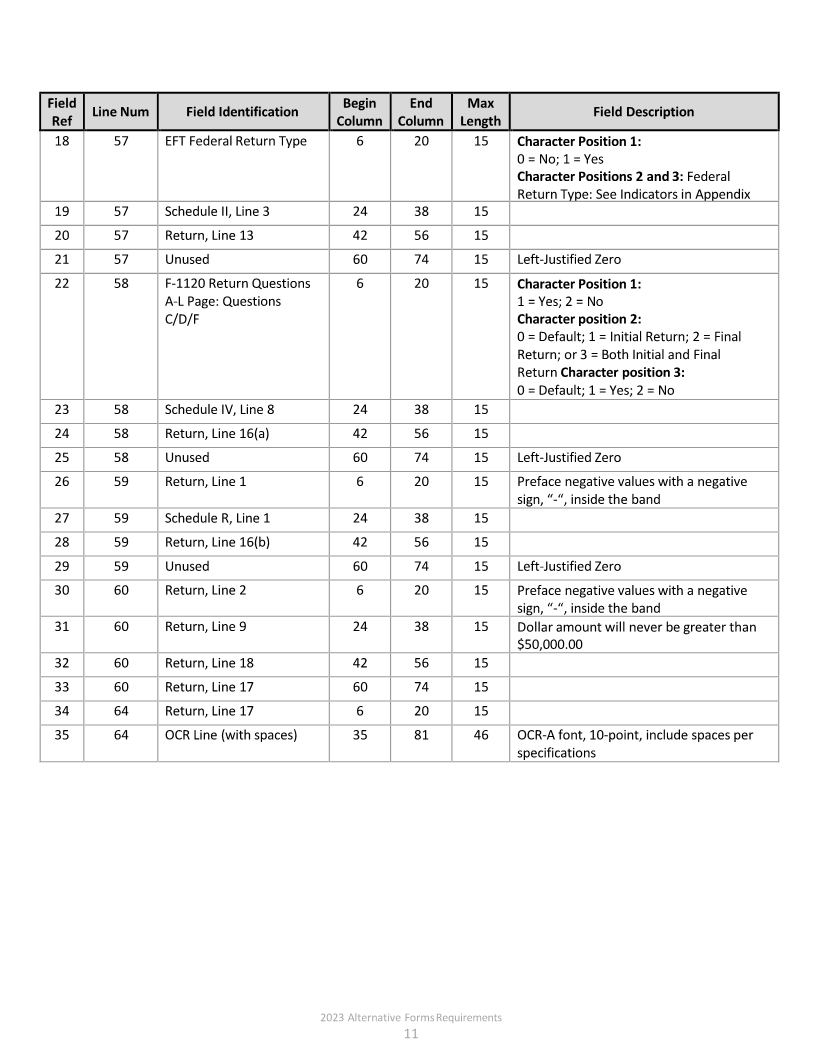

Field Begin End Max

Line Num Field Identification Field Description

Ref Column Column Length

18 57 EFT Federal Return Type 6 20 15 Character Position 1:

0 = No; 1 = Yes

Character Positions 2 and 3: Federal

Return Type: See Indicators in Appendix

19 57 Schedule II, Line 3 24 38 15

20 57 Return, Line 13 42 56 15

21 57 Unused 60 74 15 Left-Justified Zero

22 58 F-1120 Return Questions 6 20 15 Character Position 1:

A-L Page: Questions 1 = Yes; 2 = No

C/D/F Character position 2:

0 = Default; 1 = Initial Return; 2 = Final

Return; or 3 = Both Initial and Final

Return Character position 3:

0 = Default; 1 = Yes; 2 = No

23 58 Schedule IV, Line 8 24 38 15

24 58 Return, Line 16(a) 42 56 15

25 58 Unused 60 74 15 Left-Justified Zero

26 59 Return, Line 1 6 20 15 Preface negative values with a negative

sign, “- “,inside the band

27 59 Schedule R, Line 1 24 38 15

28 59 Return, Line 16(b) 42 56 15

29 59 Unused 60 74 15 Left-Justified Zero

30 60 Return, Line 2 6 20 15 Preface negative values with a negative

sign, “- “,inside the band

31 60 Return, Line 9 24 38 15 Dollar amount will never be greater than

$50,000.00

32 60 Return, Line 18 42 56 15

33 60 Return, Line 17 60 74 15

34 64 Return, Line 17 6 20 15

35 64 OCR Line (with spaces) 35 81 46 OCR-A font, 10-point, include spaces per

specifications

2023 Alternative Forms Requirements

11

|

Enlarge image |

6.12.1 Specifications for F-1120 Return (Data Page 1) Scannable Band

• All data must be in the location specified below

• All fields are numeric, 0‐9

• All data should be left‐justified within the scannable fields specified

• Add heading under FEIN ─ Note: Data Page 1

Field Line Begin End Max

Field Identification Field Description

Ref Num Column Column Length

1 4 Barcode 6

Do not use a dash (-) between

2 12 FEIN 6 20 15

character positions 2 and 3

3 12 Unused 24 38 15 Left-Justified Zero

4 12 Schedule I, Line 16 42 56 15

5 12 Schedule II, Line 3 60 74 15

6 14 Return Line 4 6 20 15 Preface negative values with a negative sign,

“ “,- inside the band

7 14 Unused 24 38 15 Left-Justified Zero

8 14 Schedule I, Line 17 42 56 15

9 14 Schedule II, Line 4 60 74 15

10 16 Return Line 10 6 20 15

11 16 Unused 24 38 15 Left-Justified Zero

12 16 Schedule I, Line 18 42 56 15

13 16 Schedule II, Line 5 60 74 15

14 18 Return Line 11 6 20 15

15 18 Unused 24 38 15 Left-Justified Zero

16 18 Schedule I, Line 19 42 56 15

17 18 Schedule II, Line 6 60 74 15

18 20 Return Line 14(a) 6 20 15

19 20 Unused 24 38 15 Left-Justified Zero

20 20 Schedule I, Line 20 42 56 15 Left-Justified Zero

21 20 Schedule II, Line 7 60 74 15

22 22 Return Line 14(b) 6 20 15

23 22 Unused 24 38 15 Left-Justified Zero

24 22 Schedule I, Line 21 42 56 15 Left-Justified Zero

25 22 Schedule II, Line 8 60 74 15

26 24 Return Line 14(c) 6 20 15

27 24 Unused 24 38 15 Left-Justified Zero

28 24 Schedule I, Line 22 42 56 15

2023 Alternative Forms Requirements

12

|

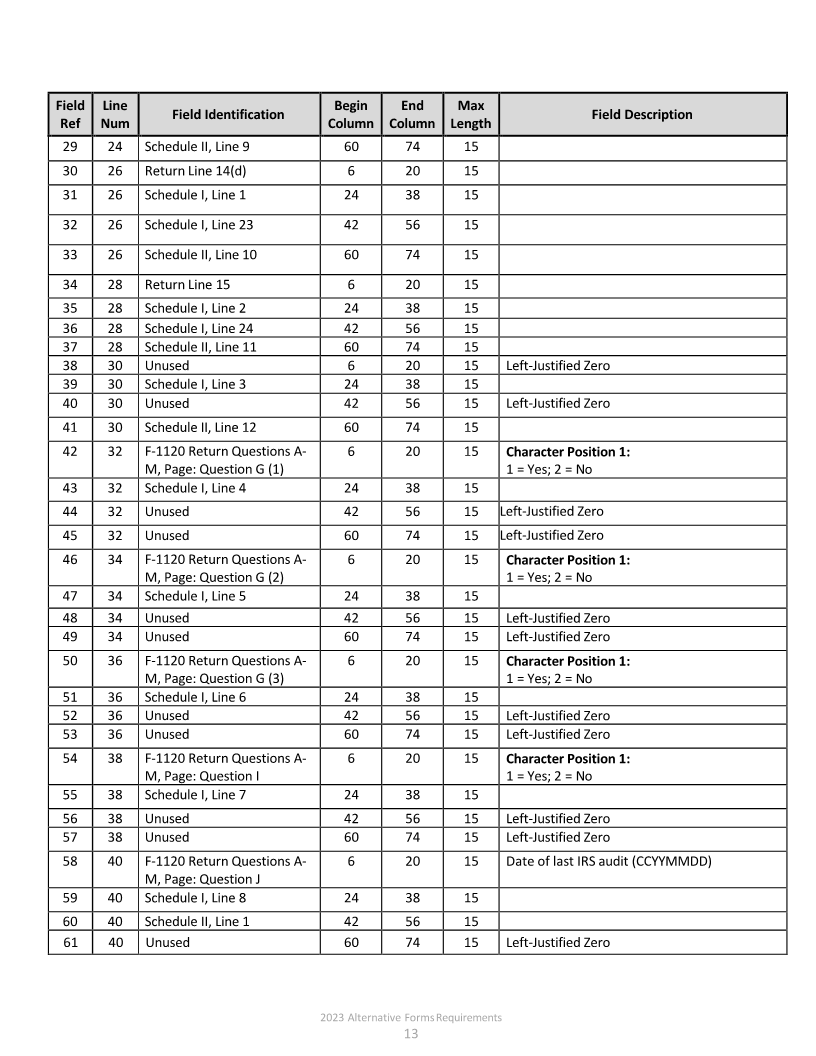

Enlarge image |

Field Line Begin End Max

Field Identification Field Description

Ref Num Column Column Length

29 24 Schedule II, Line 9 60 74 15

30 26 Return Line 14(d) 6 20 15

31 26 Schedule I, Line 1 24 38 15

32 26 Schedule I, Line 23 42 56 15

33 26 Schedule II, Line 10 60 74 15

34 28 Return Line 15 6 20 15

35 28 Schedule I, Line 2 24 38 15

36 28 Schedule I, Line 24 42 56 15

37 28 Schedule II, Line 11 60 74 15

38 30 Unused 6 20 15 Left-Justified Zero

39 30 Schedule I, Line 3 24 38 15

40 30 Unused 42 56 15 Left-Justified Zero

41 30 Schedule II, Line 12 60 74 15

42 32 F-1120 Return Questions A- 6 20 15 Character Position 1:

M, Page: Question G (1) 1 = Yes; 2 = No

43 32 Schedule I, Line 4 24 38 15

44 32 Unused 42 56 15 Left-Justified Zero

45 32 Unused 60 74 15 Left-Justified Zero

46 34 F-1120 Return Questions A- 6 20 15 Character Position 1:

M, Page: Question G (2) 1 = Yes; 2 = No

47 34 Schedule I, Line 5 24 38 15

48 34 Unused 42 56 15 Left-Justified Zero

49 34 Unused 60 74 15 Left-Justified Zero

50 36 F-1120 Return Questions A- 6 20 15 Character Position 1:

M, Page: Question G (3) 1 = Yes; 2 = No

51 36 Schedule I, Line 6 24 38 15

52 36 Unused 42 56 15 Left-Justified Zero

53 36 Unused 60 74 15 Left-Justified Zero

54 38 F-1120 Return Questions A- 6 20 15 Character Position 1:

M, Page: Question I 1 = Yes; 2 = No

55 38 Schedule I, Line 7 24 38 15

56 38 Unused 42 56 15 Left-Justified Zero

57 38 Unused 60 74 15 Left-Justified Zero

58 40 F-1120 Return Questions A- 6 20 15 Date of last IRS audit (CCYYMMDD)

M, Page: Question J

59 40 Schedule I, Line 8 24 38 15

60 40 Schedule II, Line 1 42 56 15

61 40 Unused 60 74 15 Left-Justified Zero

2023 Alternative Forms Requirements

13

|

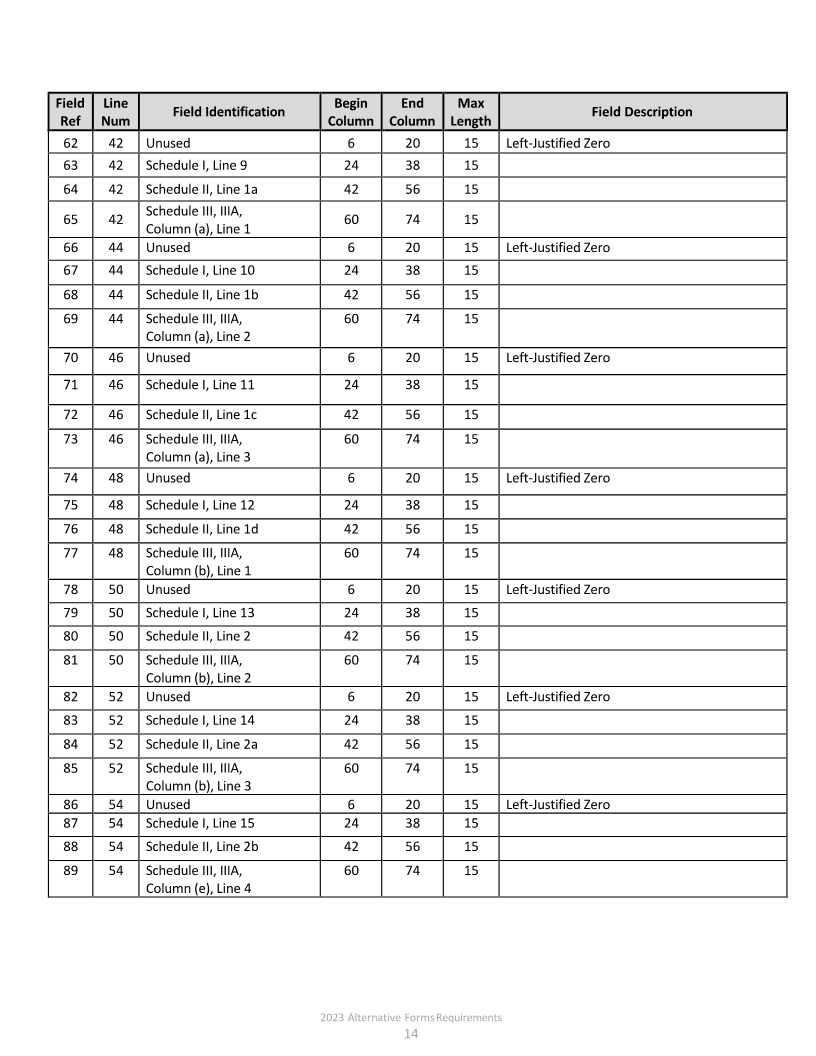

Enlarge image |

Field Line Begin End Max

Field Identification Field Description

Ref Num Column Column Length

62 42 Unused 6 20 15 Left-Justified Zero

63 42 Schedule I, Line 9 24 38 15

64 42 Schedule II, Line 1a 42 56 15

Schedule III, IIIA,

65 42 60 74 15

Column (a), Line 1

66 44 Unused 6 20 15 Left-Justified Zero

67 44 Schedule I, Line 10 24 38 15

68 44 Schedule II, Line 1b 42 56 15

69 44 Schedule III, IIIA, 60 74 15

Column (a), Line 2

70 46 Unused 6 20 15 Left-Justified Zero

71 46 Schedule I, Line 11 24 38 15

72 46 Schedule II, Line 1c 42 56 15

73 46 Schedule III, IIIA, 60 74 15

Column (a), Line 3

74 48 Unused 6 20 15 Left-Justified Zero

75 48 Schedule I, Line 12 24 38 15

76 48 Schedule II, Line 1d 42 56 15

77 48 Schedule III, IIIA, 60 74 15

Column (b), Line 1

78 50 Unused 6 20 15 Left-Justified Zero

79 50 Schedule I, Line 13 24 38 15

80 50 Schedule II, Line 2 42 56 15

81 50 Schedule III, IIIA, 60 74 15

Column (b), Line 2

82 52 Unused 6 20 15 Left-Justified Zero

83 52 Schedule I, Line 14 24 38 15

84 52 Schedule II, Line 2a 42 56 15

85 52 Schedule III, IIIA, 60 74 15

Column (b), Line 3

86 54 Unused 6 20 15 Left-Justified Zero

87 54 Schedule I, Line 15 24 38 15

88 54 Schedule II, Line 2b 42 56 15

89 54 Schedule III, IIIA, 60 74 15

Column (e), Line 4

2023 Alternative Forms Requirements

14

|

Enlarge image |

6.12.2 Specifications for F-1120 Return (Data Page 2) Scannable Band

• All data must be in the location specified below

• All fields are numeric, 0‐9

• All data should be left‐justified within the scannable fields specified

• Add heading under FEIN ─ Note: Data Page 2

Field Line Begin End Max

Field Identification Field Description

Ref Num Column Column Length

1 4 Barcode 6

Do not use a dash (-) between

2 12 FEIN 6 20 15

character positions 2 and 3

Schedule III, III-C,

3 12 24 38 15

Column (a), Line 2

4 12 Unused 42 56 15 Left-Justified Zero

5 12 Schedule V, Line 19 60 74 15

6 14 Unused 6 20 15 Left-Justified Zero

Schedule III, III-C,

7 14 24 38 15

Column (a), Line 3

8 14 Unused 42 56 15 Left-Justified Zero

9 14 Schedule V, Line 20 60 74 15

Schedule III, III-B

10 16 6 20 15

Column (a), Line 1

Schedule III, III-C,

11 16 24 38 15

Column (b), Line 1

12 16 Unused 42 56 15 Left-Justified Zero

13 16 Unused 60 74 15 Left-Justified Zero

Schedule III, III-B

14 18 6 20 15

Column (a), Line 2

Schedule III, III-C,

15 18 24 38 15

Column (b), Line 3

16 18 Unused 42 56 15 Left-Justified Zero

17 18 Unused 60 74 15 Left-Justified Zero

Schedule III, III-B

18 20 6 20 15

Column (a), Line 3

Schedule III, III-D,

19 20 24 38 15

Column (a), Line 1

20 20 Schedule V, Line 1 42 56 15

21 20 Unused 60 74 15 Left-Justified Zero

Schedule III, III-B

22 22 6 20 15

Column (a), Line 4

Schedule III, III-D,

23 22 24 38 15

Column (a), Line 2

2023 Alternative Forms Requirements

15

|

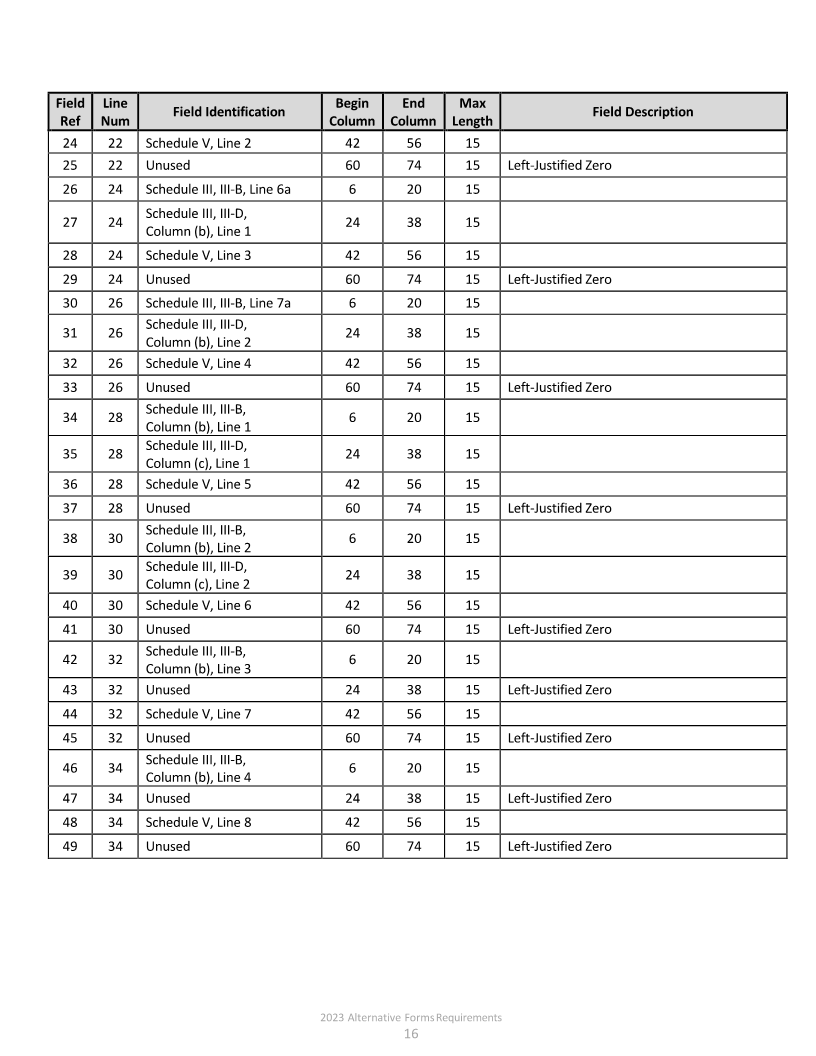

Enlarge image |

Field Line Begin End Max

Field Identification Field Description

Ref Num Column Column Length

24 22 Schedule V, Line 2 42 56 15

25 22 Unused 60 74 15 Left-Justified Zero

26 24 Schedule III, III-B, Line 6a 6 20 15

Schedule III, III-D,

27 24 24 38 15

Column (b), Line 1

28 24 Schedule V, Line 3 42 56 15

29 24 Unused 60 74 15 Left-Justified Zero

30 26 Schedule III, III-B, Line 7a 6 20 15

Schedule III, III-D,

31 26 24 38 15

Column (b), Line 2

32 26 Schedule V, Line 4 42 56 15

33 26 Unused 60 74 15 Left-Justified Zero

Schedule III, III-B,

34 28 6 20 15

Column (b), Line 1

Schedule III, III-D,

35 28 24 38 15

Column (c), Line 1

36 28 Schedule V, Line 5 42 56 15

37 28 Unused 60 74 15 Left-Justified Zero

Schedule III, III-B,

38 30 6 20 15

Column (b), Line 2

Schedule III, III-D,

39 30 24 38 15

Column (c), Line 2

40 30 Schedule V, Line 6 42 56 15

41 30 Unused 60 74 15 Left-Justified Zero

Schedule III, III-B,

42 32 6 20 15

Column (b), Line 3

43 32 Unused 24 38 15 Left-Justified Zero

44 32 Schedule V, Line 7 42 56 15

45 32 Unused 60 74 15 Left-Justified Zero

Schedule III, III-B,

46 34 6 20 15

Column (b), Line 4

47 34 Unused 24 38 15 Left-Justified Zero

48 34 Schedule V, Line 8 42 56 15

49 34 Unused 60 74 15 Left-Justified Zero

2023 Alternative Forms Requirements

16

|

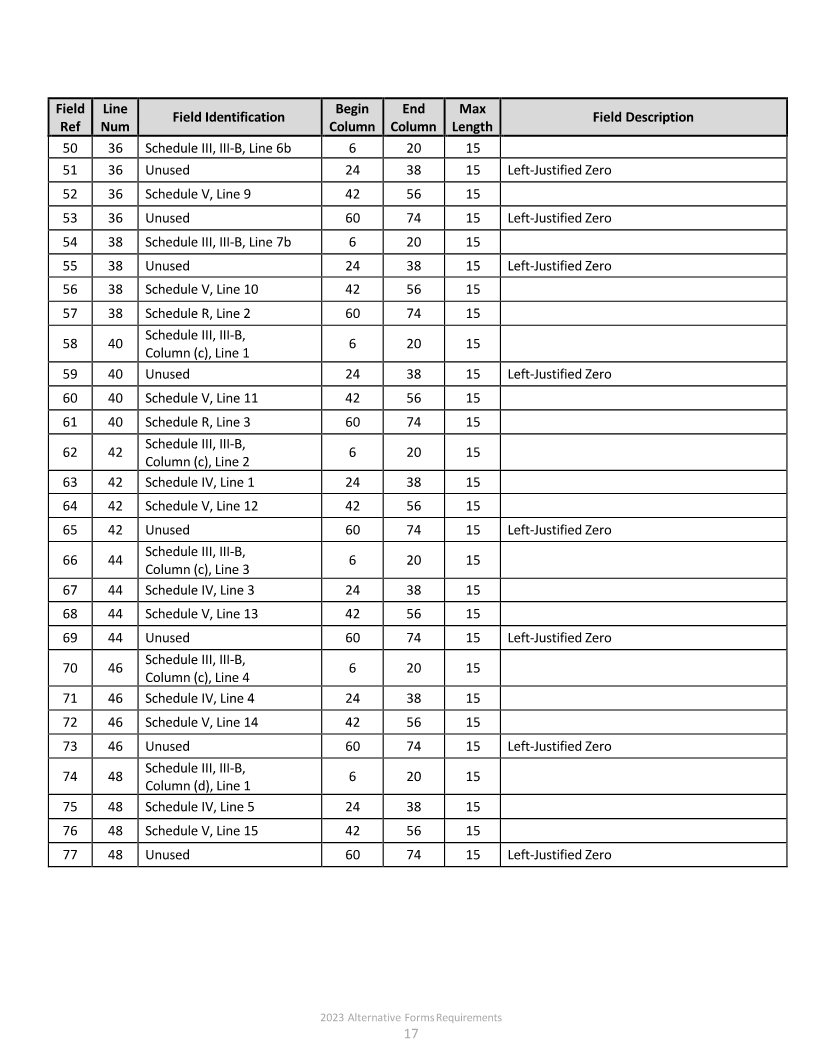

Enlarge image |

Field Line Begin End Max

Field Identification Field Description

Ref Num Column Column Length

50 36 Schedule III, III-B, Line 6b 6 20 15

51 36 Unused 24 38 15 Left-Justified Zero

52 36 Schedule V, Line 9 42 56 15

53 36 Unused 60 74 15 Left-Justified Zero

54 38 Schedule III, III-B, Line 7b 6 20 15

55 38 Unused 24 38 15 Left-Justified Zero

56 38 Schedule V, Line 10 42 56 15

57 38 Schedule R, Line 2 60 74 15

Schedule III, III-B,

58 40 6 20 15

Column (c), Line 1

59 40 Unused 24 38 15 Left-Justified Zero

60 40 Schedule V, Line 11 42 56 15

61 40 Schedule R, Line 3 60 74 15

Schedule III, III-B,

62 42 6 20 15

Column (c), Line 2

63 42 Schedule IV, Line 1 24 38 15

64 42 Schedule V, Line 12 42 56 15

65 42 Unused 60 74 15 Left-Justified Zero

Schedule III, III-B,

66 44 6 20 15

Column (c), Line 3

67 44 Schedule IV, Line 3 24 38 15

68 44 Schedule V, Line 13 42 56 15

69 44 Unused 60 74 15 Left-Justified Zero

Schedule III, III-B,

70 46 6 20 15

Column (c), Line 4

71 46 Schedule IV, Line 4 24 38 15

72 46 Schedule V, Line 14 42 56 15

73 46 Unused 60 74 15 Left-Justified Zero

Schedule III, III-B,

74 48 6 20 15

Column (d), Line 1

75 48 Schedule IV, Line 5 24 38 15

76 48 Schedule V, Line 15 42 56 15

77 48 Unused 60 74 15 Left-Justified Zero

2023 Alternative Forms Requirements

17

|

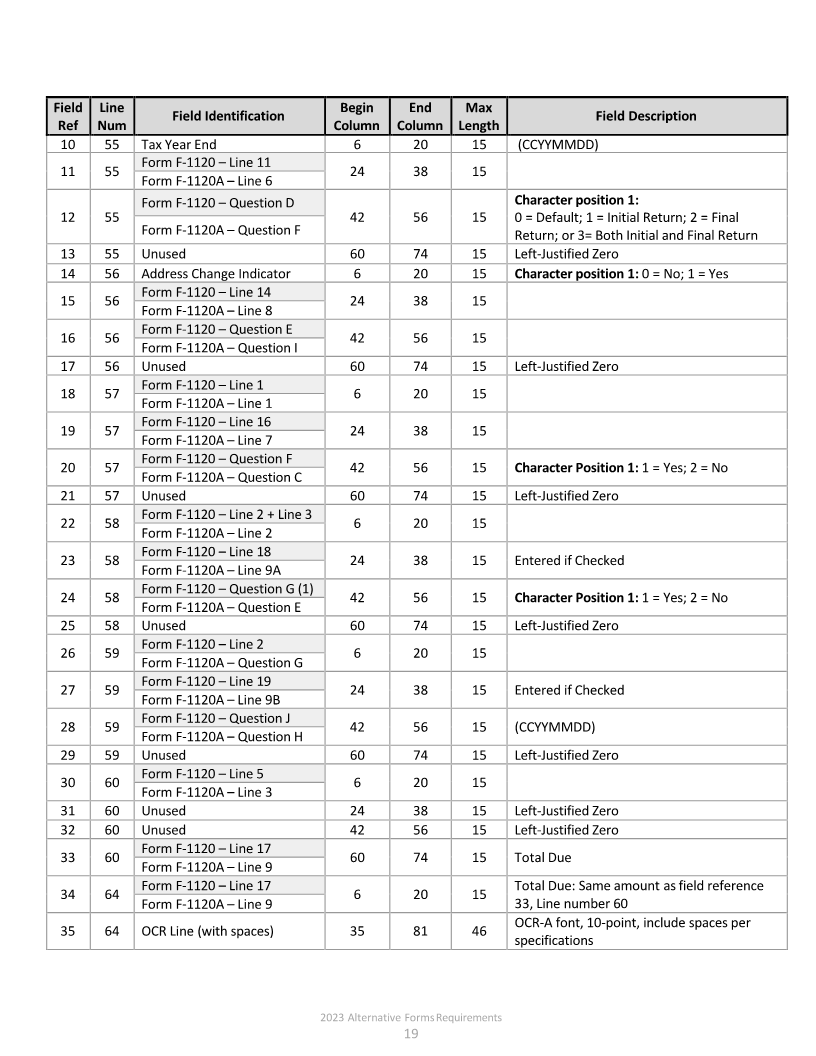

Enlarge image |

Field Line Begin End Max

Field Identification Field Description

Ref Num Column Column Length

Schedule III, III-B,

78 50 6 20 15

Column (d), Line 2

79 50 Schedule IV, Line 6 24 38 15

80 50 Schedule V, Line 16 42 56 15

81 50 Unused 60 74 15 Left-Justified Zero

Schedule III, III-B,

82 52 6 20 15

Column (d), Line 3

83 52 Schedule IV, Line 7 24 38 15

84 52 Schedule V, Line 17 42 56 15

85 52 Unused 60 74 15 Left-Justified Zero

Schedule III, III-B,

86 54 6 20 15

Column (d), Line 4

87 54 Schedule IV, Line 9 24 38 15

88 54 Schedule V, Line 18 42 56 15

89 54 Unused 60 74 15 Left-Justified Zero

6.13 Specifications for F-1120A Return (Coupon Page) Scannable Band

• All data must be in the location specified below

• All fields are numeric, 0‐9

• All data should be left‐justified within the scannable fields specified

• OCR line in field reference 35: Must beOCR‐A font

Field Line Begin End Max

Field Identification Field Description

Ref Num Column Column Length

1 41 Perforated Line 6 80 75 Line of Dashes

Do not use a dash (-) between

2 53 FEIN 6 20 15

character positions 2 and 3

Form F-1120 –Line 9

3 53 24 38 15

Form F-1120A – Line 4

Form F-1120 –Question A

4 53 42 56 15 Character Position 1: 0 = No; 1 = Yes

Form F-1120A – Question A

Form F-1120 –Question L Character Positions 1 and 2:Federal Return

5 53 60 74 15

Form F-1120A –Question J Type: See Indicators in Appendix

6 54 Tax Year Begin 6 20 15 (CCYYMMDD)

Form F-1120 –Line 10

7 54 24 38 15

Form F-1120A – Line 5

8 54 Unused 42 56 15 Left-Justified Zero

9 54 Unused 60 74 15 Left-Justified Zero

2023 Alternative Forms Requirements

18

|

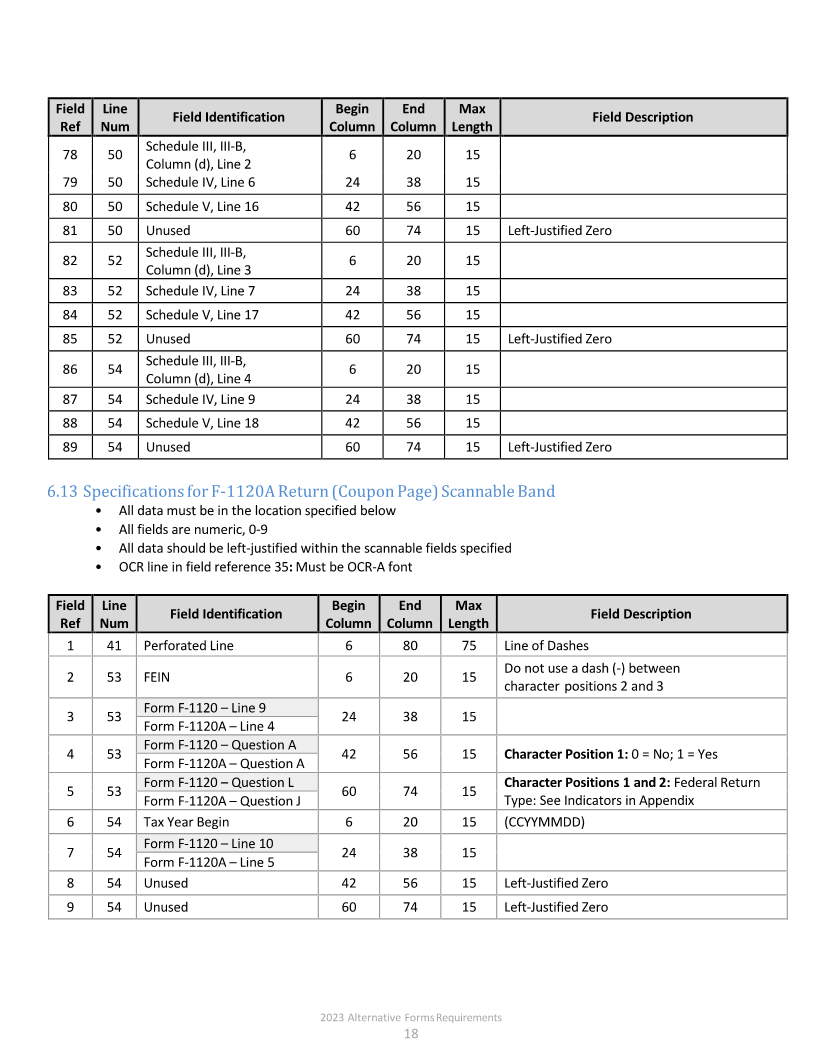

Enlarge image |

Field Line Begin End Max

Field Identification Field Description

Ref Num Column Column Length

10 55 Tax Year End 6 20 15 (CCYYMMDD)

Form F-1120 –Line 11

11 55 24 38 15

Form F-1120A –Line 6

Form F-1120 –Question D Character position 1:

12 55 42 56 15 0 = Default; 1 = Initial Return; 2 = Final

Form F-1120A –Question F Return; or 3= Both Initial and Final Return

13 55 Unused 60 74 15 Left-Justified Zero

14 56 Address Change Indicator 6 20 15 Character position 1: 0 = No; 1 = Yes

Form F-1120 –Line 14

15 56 24 38 15

Form F-1120A –Line 8

Form F-1120 –Question E

16 56 42 56 15

Form F-1120A –Question I

17 56 Unused 60 74 15 Left-Justified Zero

Form F-1120 –Line 1

18 57 6 20 15

Form F-1120A –Line 1

Form F-1120 –Line 16

19 57 24 38 15

Form F-1120A –Line 7

Form F-1120 –Question F

20 57 42 56 15 Character Position 1: 1 = Yes; 2 = No

Form F-1120A –Question C

21 57 Unused 60 74 15 Left-Justified Zero

Form F-1120 –Line 2 + Line 3

22 58 6 20 15

Form F-1120A –Line 2

Form F-1120 –Line 18

23 58 24 38 15 Entered if Checked

Form F-1120A –Line 9A

Form F-1120 –Question G (1)

24 58 42 56 15 Character Position 1: 1 = Yes; 2 = No

Form F-1120A –Question E

25 58 Unused 60 74 15 Left-Justified Zero

Form F-1120 –Line 2

26 59 6 20 15

Form F-1120A –Question G

Form F-1120 –Line 19

27 59 24 38 15 Entered if Checked

Form F-1120A –Line 9B

Form F-1120 –Question J

28 59 42 56 15 (CCYYMMDD)

Form F-1120A –Question H

29 59 Unused 60 74 15 Left-Justified Zero

Form F-1120 –Line 5

30 60 6 20 15

Form F-1120A –Line 3

31 60 Unused 24 38 15 Left-Justified Zero

32 60 Unused 42 56 15 Left-Justified Zero

Form F-1120 –Line 17

33 60 60 74 15 Total Due

Form F-1120A –Line 9

Form F-1120 –Line 17 Total Due: Same amount as field reference

34 64 6 20 15

Form F-1120A –Line 9 33, Line number 60

OCR-A font, 10-point, include spaces per

35 64 OCR Line (with spaces) 35 81 46

specifications

2023 Alternative Forms Requirements

19

|

Enlarge image |

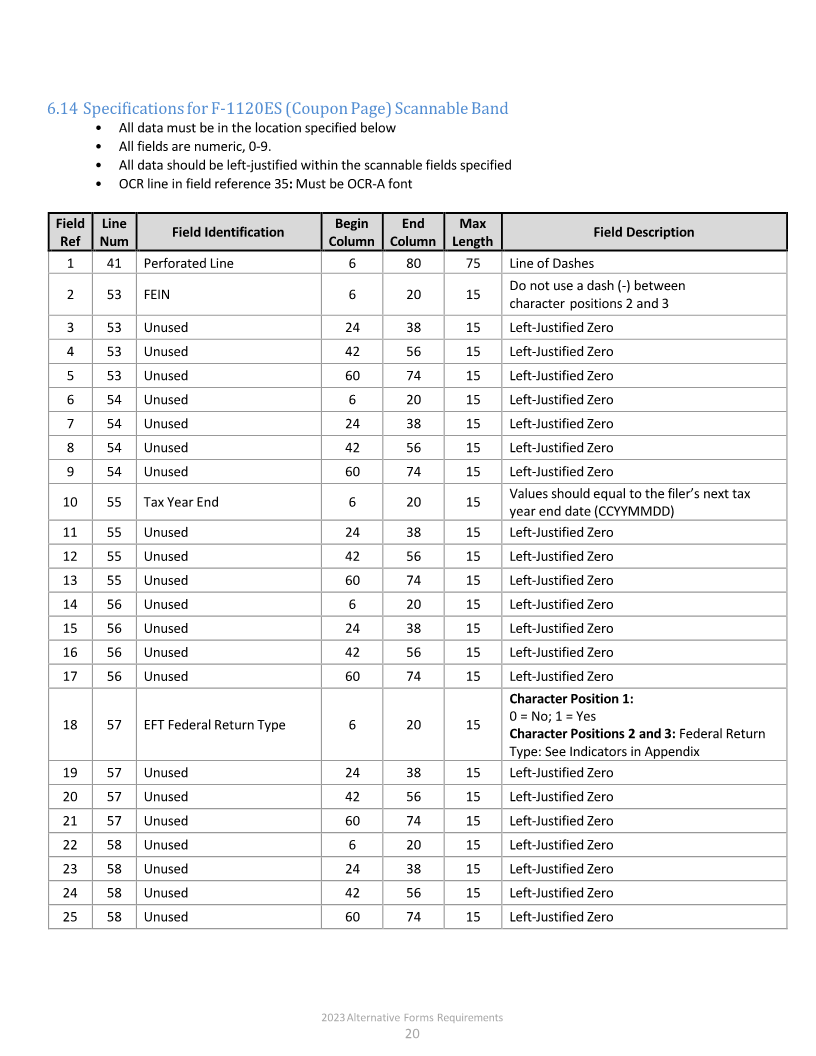

6.14 Specifications for F-1120ES (Coupon Page) Scannable Band

• All data must be in the location specified below

• All fields are numeric, 0‐9.

• All data should be left‐justified within the scannable fields specified

• OCR line in field reference 35: Must beOCR‐A font

Field Line Begin End Max

Field Identification Field Description

Ref Num Column Column Length

1 41 Perforated Line 6 80 75 Line of Dashes

Do not use a dash (-) between

2 53 FEIN 6 20 15

character positions 2 and 3

3 53 Unused 24 38 15 Left-Justified Zero

4 53 Unused 42 56 15 Left-Justified Zero

5 53 Unused 60 74 15 Left-Justified Zero

6 54 Unused 6 20 15 Left-Justified Zero

7 54 Unused 24 38 15 Left-Justified Zero

8 54 Unused 42 56 15 Left-Justified Zero

9 54 Unused 60 74 15 Left-Justified Zero

Values should equal to the filer’s next tax

10 55 Tax Year End 6 20 15

year end date (CCYYMMDD)

11 55 Unused 24 38 15 Left-Justified Zero

12 55 Unused 42 56 15 Left-Justified Zero

13 55 Unused 60 74 15 Left-Justified Zero

14 56 Unused 6 20 15 Left-Justified Zero

15 56 Unused 24 38 15 Left-Justified Zero

16 56 Unused 42 56 15 Left-Justified Zero

17 56 Unused 60 74 15 Left-Justified Zero

Character Position 1:

0 = No; 1 = Yes

18 57 EFT Federal Return Type 6 20 15

Character Positions 2 and 3: Federal Return

Type: See Indicators in Appendix

19 57 Unused 24 38 15 Left-Justified Zero

20 57 Unused 42 56 15 Left-Justified Zero

21 57 Unused 60 74 15 Left-Justified Zero

22 58 Unused 6 20 15 Left-Justified Zero

23 58 Unused 24 38 15 Left-Justified Zero

24 58 Unused 42 56 15 Left-Justified Zero

25 58 Unused 60 74 15 Left-Justified Zero

2023 Alternative Forms Requirements

20

|

Enlarge image |

Field Line Begin End Max

Field Identification Field Description

Ref Num Column Column Length

26 59 Unused 6 20 15 Left-Justified Zero

27 59 Unused 24 38 15 Left-Justified Zero

28 59 Unused 42 56 15 Left-Justified Zero

29 59 Unused 60 74 15 Left-Justified Zero

30 60 Unused 6 20 15 Left-Justified Zero

31 60 Unused 24 38 15 Left-Justified Zero

32 60 Unused 42 56 15 Left-Justified Zero

33 60 Estimated Tax Payment 60 74 15

Same amount as field reference 33,

34 64 Estimated Tax Payment 6 20 15

Line 60

OCR-A font, 10-point, include spaces per

35 64 OCR Line (with spaces) 35 81 46

specifications

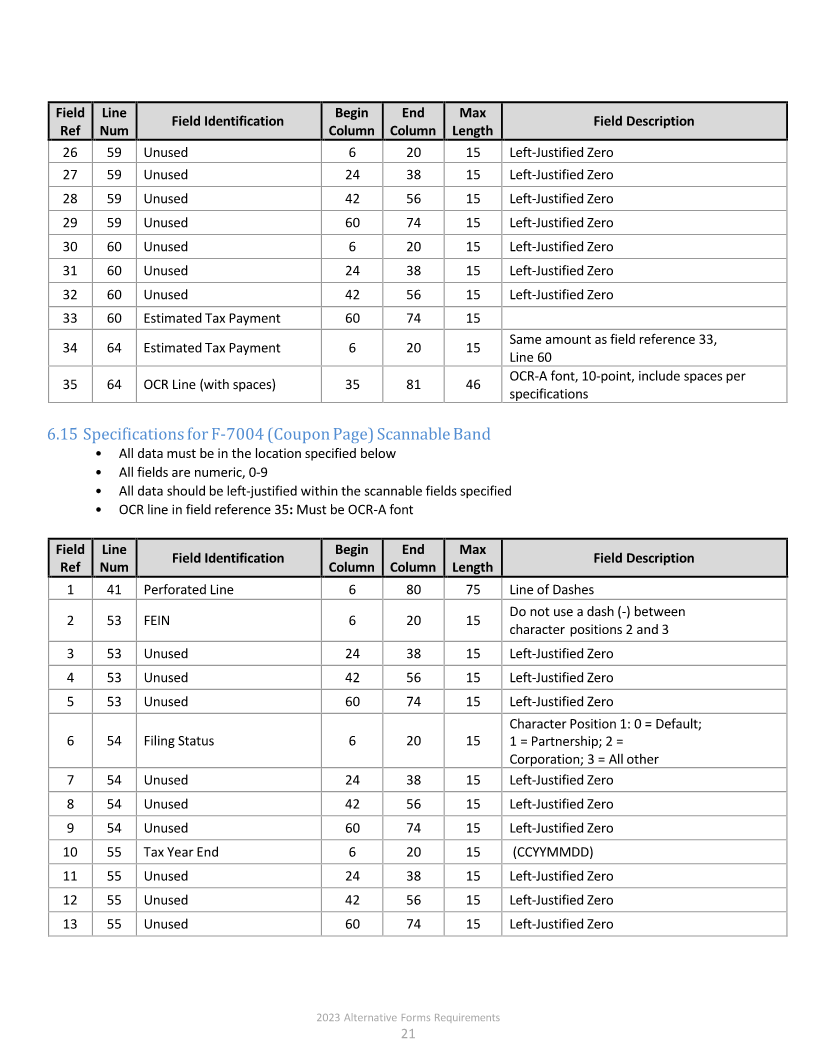

6.15 Specifications for F-7004 (Coupon Page) Scannable Band

• All data must be in the location specified below

• All fields are numeric, 0‐9

• All data should be left‐justified within the scannable fields specified

• OCR line in field reference 35: Must beOCR‐A font

Field Line Begin End Max

Field Identification Field Description

Ref Num Column Column Length

1 41 Perforated Line 6 80 75 Line of Dashes

Do not use a dash (-) between

2 53 FEIN 6 20 15

character positions 2 and 3

3 53 Unused 24 38 15 Left-Justified Zero

4 53 Unused 42 56 15 Left-Justified Zero

5 53 Unused 60 74 15 Left-Justified Zero

Character Position 1: 0 = Default;

6 54 Filing Status 6 20 15 1 = Partnership; 2 =

Corporation; 3 = All other

7 54 Unused 24 38 15 Left-Justified Zero

8 54 Unused 42 56 15 Left-Justified Zero

9 54 Unused 60 74 15 Left-Justified Zero

10 55 Tax Year End 6 20 15 (CCYYMMDD)

11 55 Unused 24 38 15 Left-Justified Zero

12 55 Unused 42 56 15 Left-Justified Zero

13 55 Unused 60 74 15 Left-Justified Zero

2023 Alternative Forms Requirements

21

|

Enlarge image |

Field Line Begin End Max

Field Identification Field Description

Ref Num Column Column Length

14 56 Unused 6 20 15 Left-Justified Zero

15 56 Unused 24 38 15 Left-Justified Zero

16 56 Unused 42 56 15 Left-Justified Zero

17 56 Unused 60 74 15 Left-Justified Zero

Character Position 1:

0 = No; 1= Yes

18 57 EFT Federal Return Type 6 20 15

Character Positions 2 and 3: Federal Return

Type: See Indicators in Appendix

19 57 Unused 24 38 15 Left-Justified Zero

20 57 Unused 42 56 15 Left-Justified Zero

21 57 Unused 60 74 15 Left-Justified Zero

22 58 Unused 6 20 15 Left-Justified Zero

23 58 Unused 24 38 15 Left-Justified Zero

24 58 Unused 42 56 15 Left-Justified Zero

25 58 Unused 60 74 15 Left-Justified Zero

26 59 Unused 6 20 15 Left-Justified Zero

27 59 Unused 24 38 15 Left-Justified Zero

28 59 Unused 42 56 15 Left-Justified Zero

29 59 Unused 60 74 15 Left-Justified Zero

30 60 Unused 6 20 15 Left-Justified Zero

31 60 Unused 24 38 15 Left-Justified Zero

32 60 Unused 42 56 15 Left-Justified Zero

33 60 Tentative Tax Due 60 74 15

Same amount as field reference 33,

34 64 Tentative Tax Due 6 20 15

Line 60

OCR-A font, 10-point, include spaces per

35 64 OCR Line (with spaces) 35 81 46

specifications

2023 Alternative Forms Requirements

22

|

Enlarge image |

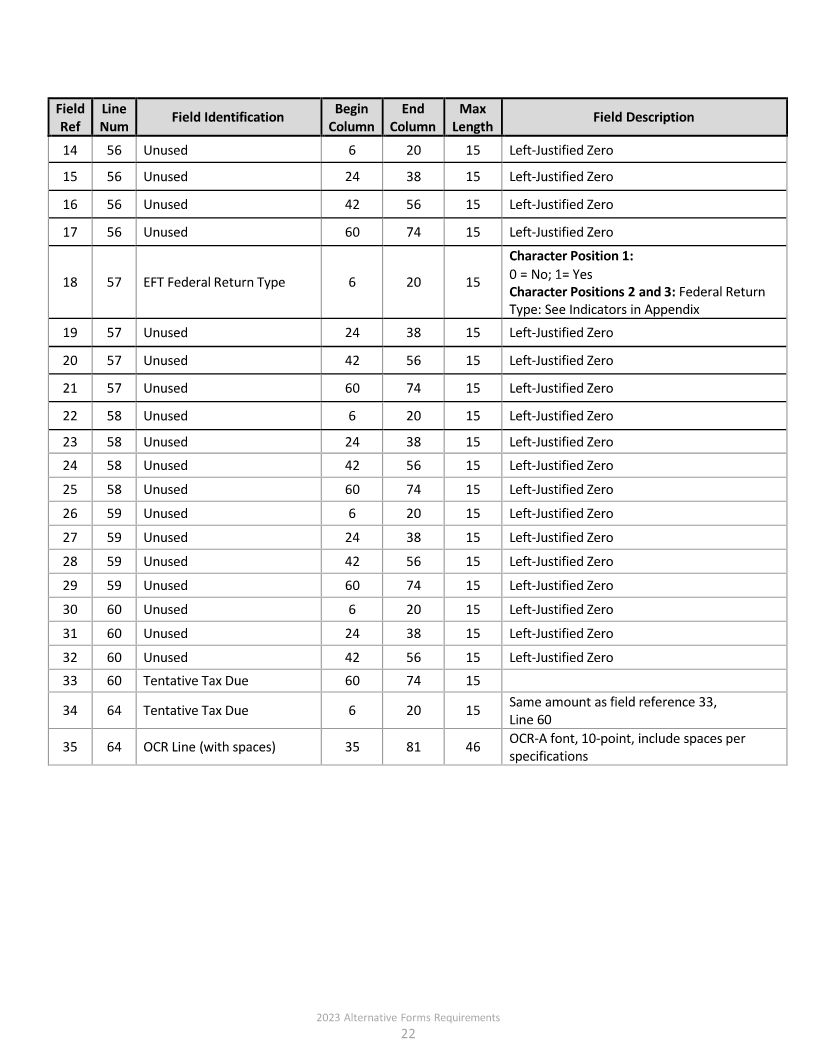

6.16 Specifications for F-1120X (Coupon Page) Scannable Band

• All data must be in the location specified below

• All fields are numeric, 0‐9

• All data should be left‐justified within the scannable fields specified

• OCR line in field reference 35: Must beOCR‐A font

Field Line Begin End Max

Field Identification Field Description

Ref Num Column Column Length

NA 4 Barcode 6

NA 8 OCR Line 6 45 39 Courier Font: Do Not Include Spaces

1 41 Perforated Line 6 80 75 Line of Dashes

Do not use a dash (-) between

2 53 FEIN 6 20 15

character positions 2 and 3

3 53 Line 1, Column B 24 38 15 Federal Taxable Income

4 53 Line 9, Column B 42 56 15 Florida Exemption

5 53 Unused 60 74 15 Left-Justified Zero

6 54 Tax Year Begin 6 20 15 (CCYYMMDD)

7 54 Line 2, Column B 24 38 15 State Income Taxes Deducted

8 54 Line 10, Column B 42 56 15 Florida Net Income

9 54 Unused 60 74 15 Left-Justified Zero

10 55 Tax Year End 6 20 15 (CCYYMMDD)

11 55 Line 3, Column B 24 38 15 Additions to Federal Taxable Income

12 55 Line 11, Column B 42 56 15 Tax Due

13 55 Unused 60 74 15 Left-Justified Zero

Character Position 1:

1= Amended Federal Return

Reason for Amended 2= IRS Audit Adjustment *

14 56 6 20 15

Return 3= Other Adjustment

*Requires Date of Revenue Agent Report in

Field Reference 18

15 56 Unused 24 38 15 Left-Justified Zero

16 56 Line 12, Column B 42 56 15 Credits against tax

17 56 Unused 60 74 15 Left-Justified Zero

Date of Revenue Agent Date required only if “2” is entered in field

18 57 6 20 15

Report (RAR) reference 14 (CCYYMMDD)

19 57 Line 5, Column B 24 38 15 Subtractions from Federal Taxable Income

20 57 Line 13, Column B 42 56 15 Total Income/Franchise Tax Due

21 57 Line 20, Column B 60 74 15 Credit

2023 Alternative Forms Requirements

23

|

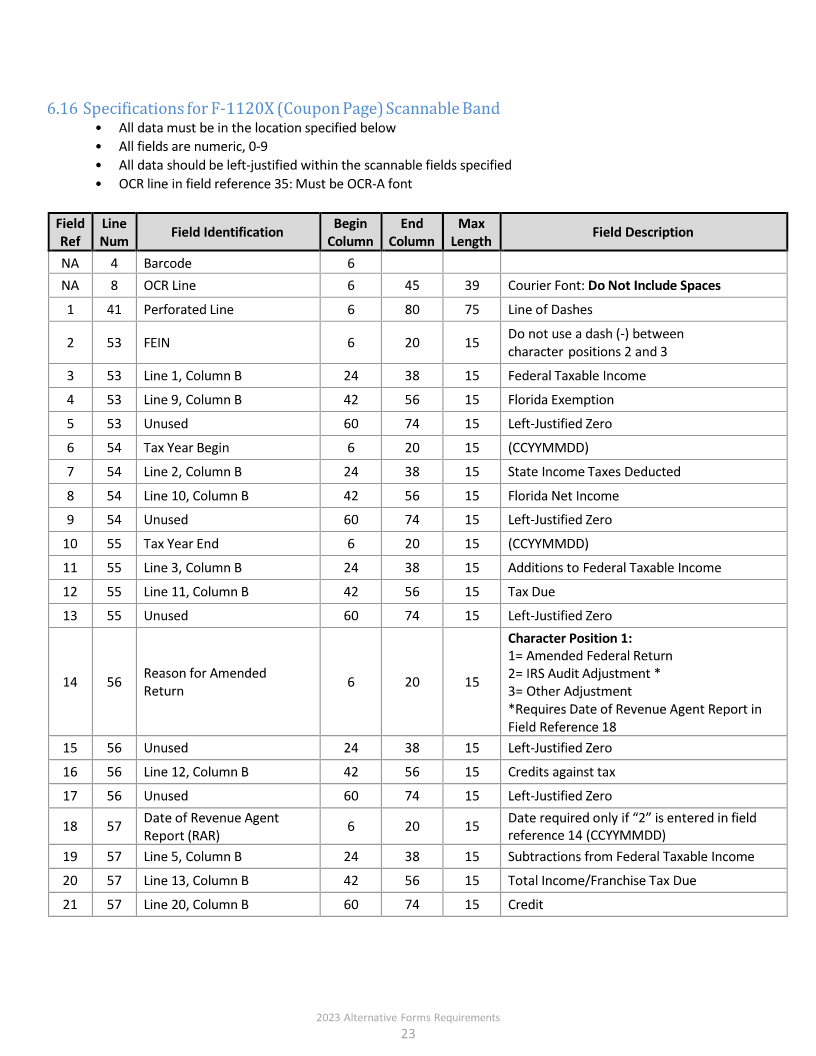

Enlarge image |

Field Line Begin End Max

Field Identification Field Description

Ref Num Column Column Length

Character Position 1:

Type of Florida Return 1= F-1120

22 58 6 20 15

Being Amended 2= F-1120A

3= F-1120X

23 58 Line 6, Column B 24 38 15 Adjusted Federal Income

24 58 Unused 42 56 15 Left-Justified Zero

25 58 Line 21, Column B 60 74 15 Offset

26 59 Date Last Return Filed 6 20 15 (CCYYMMDD)

27 59 Line 7, Column B 24 38 15 Florida Portion of Adjusted Federal Income

28 59 Unused 42 56 15 Left-Justified Zero

29 59 Line 22, Column B 60 74 15 Refund Amount

Overpayment Credited to

30 60 6 20 15 (CCYYMMDD)

Tax Year

31 60 Line 8, Column B 24 38 15 Nonbusiness Income Allocated to Florida

32 60 Line 14, Column B 42 56 15 Penalty Interest Total

33 60 Line 19, Column B 60 74 15 Total Amount Due or Overpayment

Same amount as field reference 33,

34 64 Line 19, Column B 6 20 15

Line 60

OCR-A font, 10-point, include spaces per

35 64 OCR Line (with spaces) 35 81 46

specifications

6.17 OCR Line Specifications for Payment CouponsF‐1120, F‐1120A, F‐1120ES, F‐7004 , and F-1120X

1 OCR scan line must appear on the third line from the bottom (based on six lines per inch) and five

spaces from the right edge (based on 10 characters per inch) of the coupon. No other writing or

printing should appear in this area.

2 The OCR line should print in OCR‐A font, 10-point in the following format.

Note: This example is not to scale.

8XXX 0 20221231 0002005037 7 3123456789 0000 6

(1) (2) (3) (4) (5) (6) (7) (8)

3 The numbers above are defined as follows:

1) Vendor Identification Number:

8xxx assigned to vendor by the Department

2) Payment Method:

0 = Non‐EFT; 1= EFT

2023 Alternative Forms Requirements

24

|

Enlarge image |

3) Format = CCYYMMDD (e.g., 20221231) (DD is the last day of the month)

Note: The date for the F‐1120ES is the filer’s next tax year date.

4) Tax Category/Tax Fund/DocType:

• 0002005037 = F‐1120

• 0002005033 = F‐1120ES

• 0002005030 = F‐7004

• 0002005043 = F‐1120A

• 0002005049 = F‐1120X

Note: This is a constant field that does not allow for changes.

5) First Check Digit: Calculated on the previous 23 digits 10 ‐ (MOD(10)). Weights = 7,1,3

(see calculation below)

6) Format/Account Number: 3XXXXXXXXX (3 followed by the 9‐digit FEIN)

Note: The 3 is a constant field that does not allow for changes.

7) Location: 0000

Note: This is a constant field that does not allow for changes.

8) Second Check Digit: Calculated on the previous 23 digits 10 ‐ (MOD(10)). Weights = 7,1,3

(see calculation below)

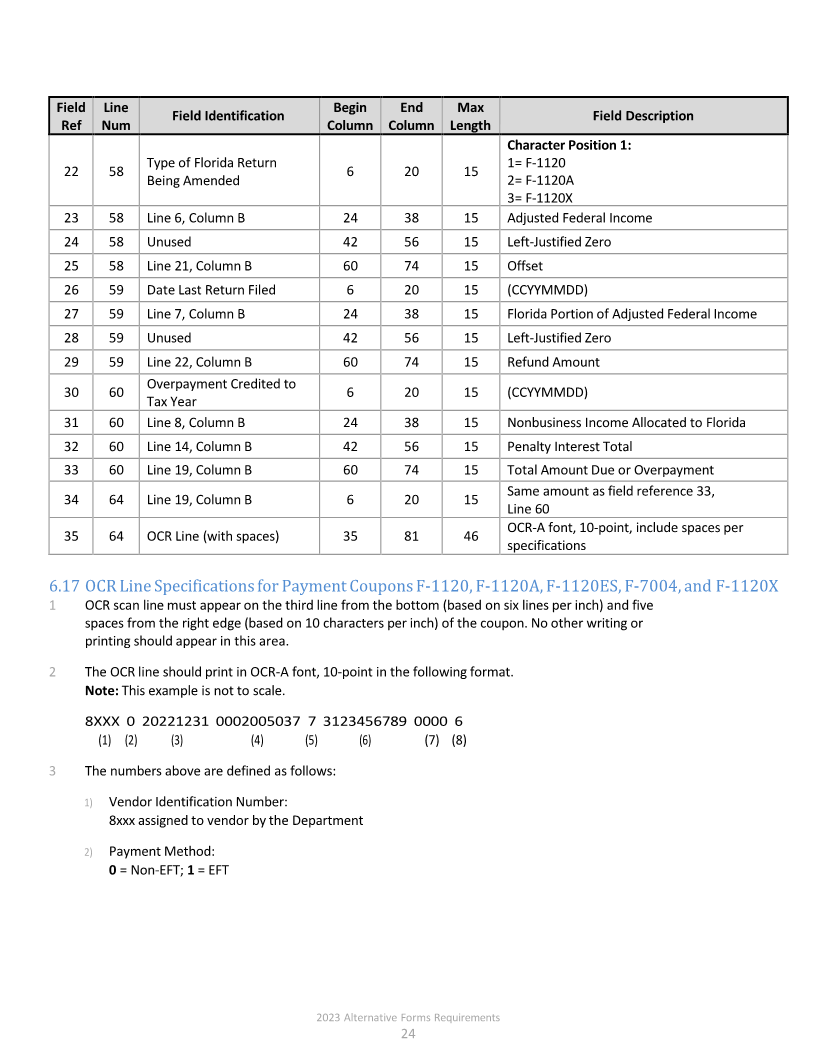

4 1st Check Digit Calculation: Multiply the first 23 digits individually by the appropriate weights and

add together.

8 1 0 0 0 2 0 0 0 0 1 3 1 0 0 0 2 0 0 5 0 3 7

x7 x1 x3 x7 x1 x3 x7 x1 x3 x7 x1 x3 x7 x1 x3 x7 x1 x3 x7 x1 x3 x7 x1

56 +1 +0 +0 +0 +6 +0 +0 +0 +0 +1 +9 +7 +0 +0 +0 +2 +0 +0 +5 +0 +21 +7 115

• Divide the sum by 10.

115 / 10 = 11.5

• Subtract the remainder from 10. The result is the value for the check digit.

10 –5 = 5 (the check digit is 5)

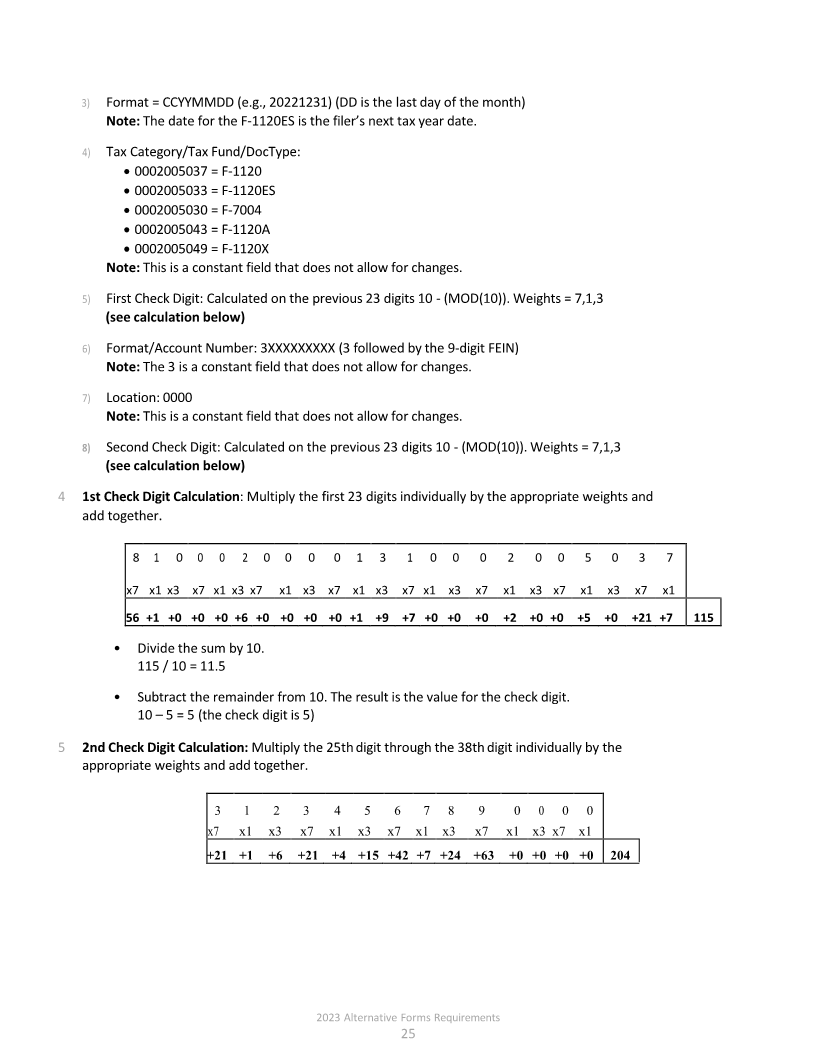

5 2nd Check Digit Calculation: Multiply the 25th digit through the 38th digit individually by the

appropriate weights and add together.

3 1 2 3 4 5 6 7 8 9 0 0 0 0

x7 x1 x3 x7 x1 x3 x7 x1 x3 x7 x1 x3 x7 x1

+21 +1 +6 +21 +4 +15 +42 +7 +24 +63 +0 +0 +0 +0 204

2023 Alternative Forms Requirements

25

|

Enlarge image |

• Divide the sum by 10.

204 / 10 = 20.4

• Subtract the remainder from 10.

10 –4 = 6 (the check digit is 6)

Note: If the result is 10, then the Check Digit would be 0.

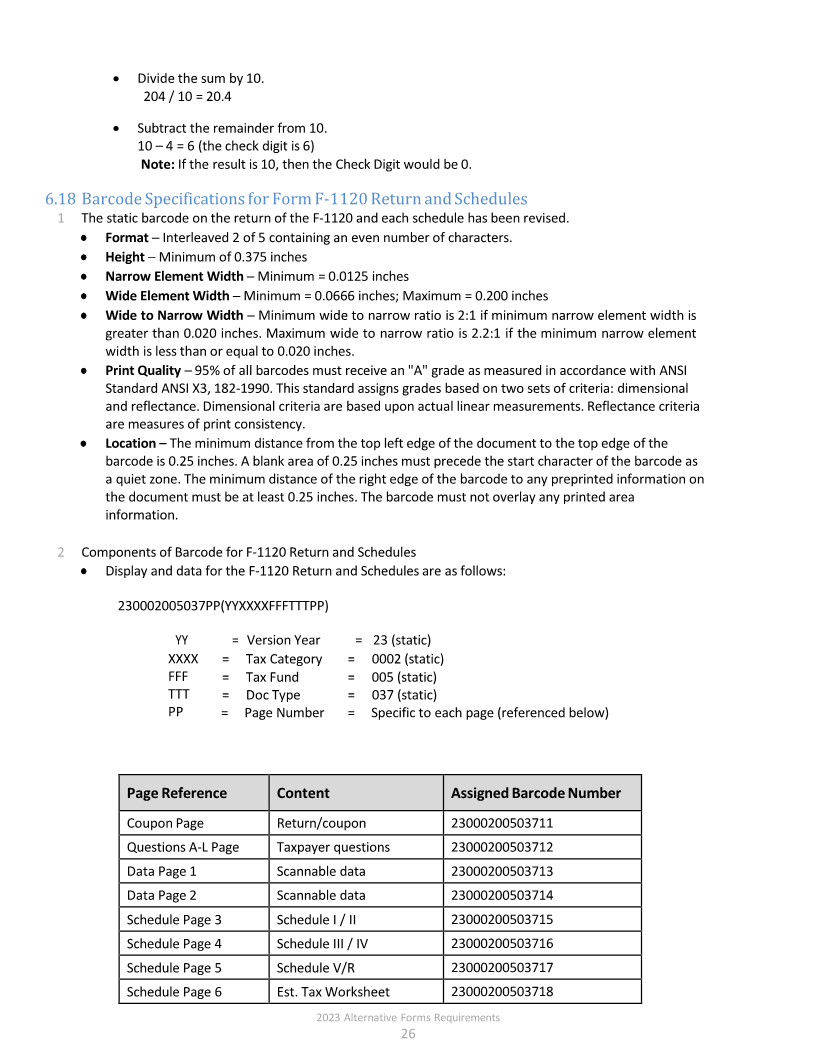

6.18 Barcode Specifications for Form F-1120 Return and Schedules

1 The static barcode on the return of the F‐1120 and each schedule has been revised.

• Format ─ Interleaved 2 of 5 containing an even number of characters.

• Height ─ Minimum of 0.375 inches

• Narrow Element Width ─ Minimum = 0.0125 inches

• Wide Element Width ─ Minimum = 0.0666 inches; Maximum = 0.200 inches

• Wide to Narrow Width ─ Minimum wide to narrow ratio is 2:1 if minimum narrow element width is

greater than 0.020 inches. Maximum wide to narrow ratio is 2.2:1 if the minimum narrow element

width is less than or equal to 0.020 inches.

• Print Quality ─ 95% of all barcodes must receive an "A" grade as measured in accordance with ANSI

Standard ANSI X3, 182‐1990. This standard assigns grades based on two sets of criteria: dimensional

and reflectance. Dimensional criteria are based upon actual linear measurements. Reflectance criteria

are measures of print consistency.

• Location – The minimum distance from the top left edge of the document to the top edge of the

barcode is 0.25 inches. A blank area of 0.25 inches must precede the start character of the barcode as

a quiet zone. The minimum distance of the right edge of the barcode to any preprinted information on

the document must be at least 0.25 inches. The barcode must not overlay any printed area

information.

2 Components of Barcode for F-1120 Return and Schedules

• Display and data for the F‐1120 Return and Schedules are as follows:

230002005037PP(YYXXXXFFFTTTPP)

YY = Version Year = 23 (static)

XXXX = Tax Category = 0002 (static)

FFF = Tax Fund = 005 (static)

TTT = Doc Type = 037 (static)

PP = Page Number = Specific to each page (referenced below)

Page Reference Content Assigned Barcode Number

Coupon Page Return/coupon 23000200503711

Questions A‐L Page Taxpayer questions 23000200503712

Data Page 1 Scannable data 23000200503713

Data Page 2 Scannable data 23000200503714

Schedule Page 3 Schedule I / II 23000200503715

Schedule Page 4 Schedule III / IV 23000200503716

Schedule Page 5 Schedule V/R 23000200503717

Schedule Page 6 Est. Tax Worksheet 23000200503718

2023 Alternative Forms Requirements

26

|

Enlarge image |

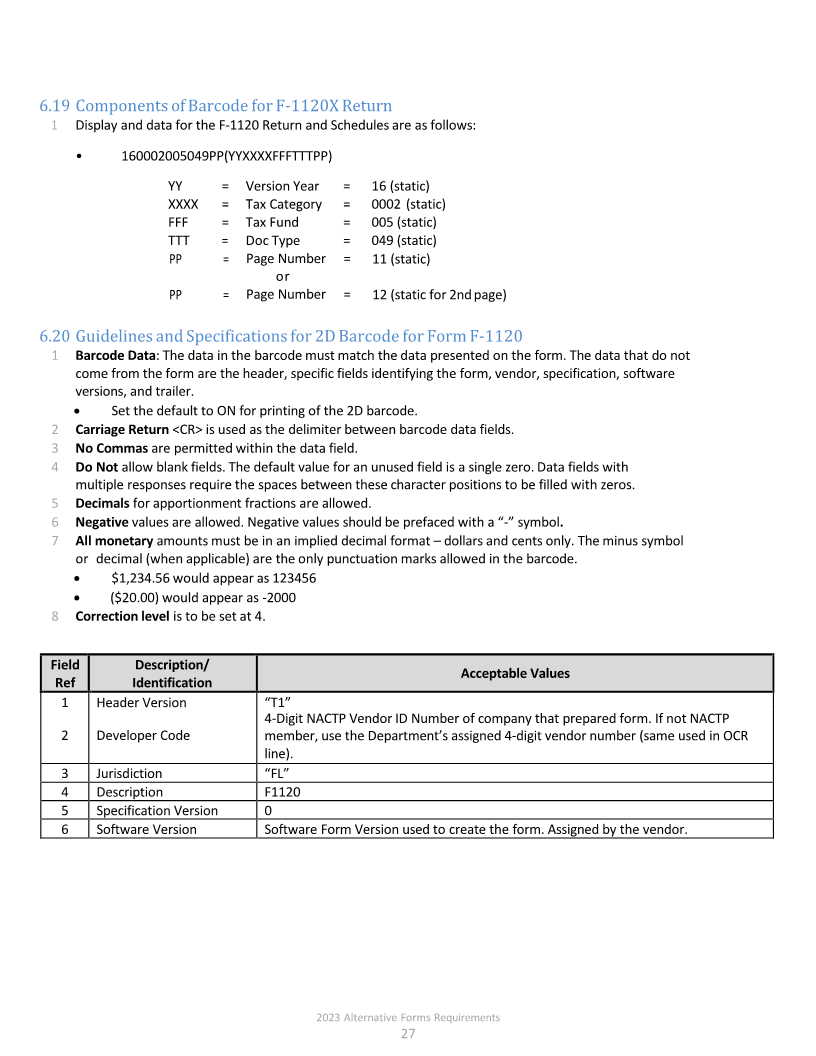

6.19 Components of Barcode for F-1120X Return

1 Display and data for the F‐1120 Return and Schedules are as follows:

• 160002005049PP(YYXXXXFFFTTTPP)

YY = Version Year = 16 (static)

XXXX = Tax Category = 0002 (static)

FFF = Tax Fund = 005 (static)

TTT = Doc Type = 049 (static)

PP = Page Number = 11 (static)

or

PP = Page Number = 12 (static for 2nd page)

6.20 Guidelines and Specifications for 2D Barcode for Form F-1120

1 Barcode Data: The data in the barcode must match the data presented on the form. The data that do not

come from the form are the header, specific fields identifying the form, vendor, specification, software

versions, and trailer.

• Set the default to ON for printing of the 2D barcode.

2 Carriage Return <CR> is used as the delimiter between barcode data fields.

3 No Commas are permitted within the data field.

4 Do Not allow blank fields. The default value for an unused field is a single zero. Data fields with

multiple responses require the spaces between these character positions to be filled with zeros.

5 Decimals for apportionment fractions are allowed.

6 Negativevalues are allowed. Negative values should be prefaced with a“‐” symbol .

7 All monetaryamounts must be in an implied decimal format – dollars and cents only. The minus symbol

or decimal (when applicable) are the only punctuation marks allowed in the barcode.

• $1,234.56 would appear as 123456

• ($20.00) would appear as ‐2000

8 Correction level is to be set at 4.

Field Description/

Acceptable Values

Ref Identification

1 Header Version “T1”

4-Digit NACTP Vendor ID Number of company that prepared form. If not NACTP

2 Developer Code member, use the Department’s assigned 4-digit vendor number (same used in OCR

line).

3 Jurisdiction “FL”

4 Description F1120

5 Specification Version 0

6 Software Version Software Form Version used to create the form. Assigned by the vendor.

2023 Alternative Forms Requirements

27

|

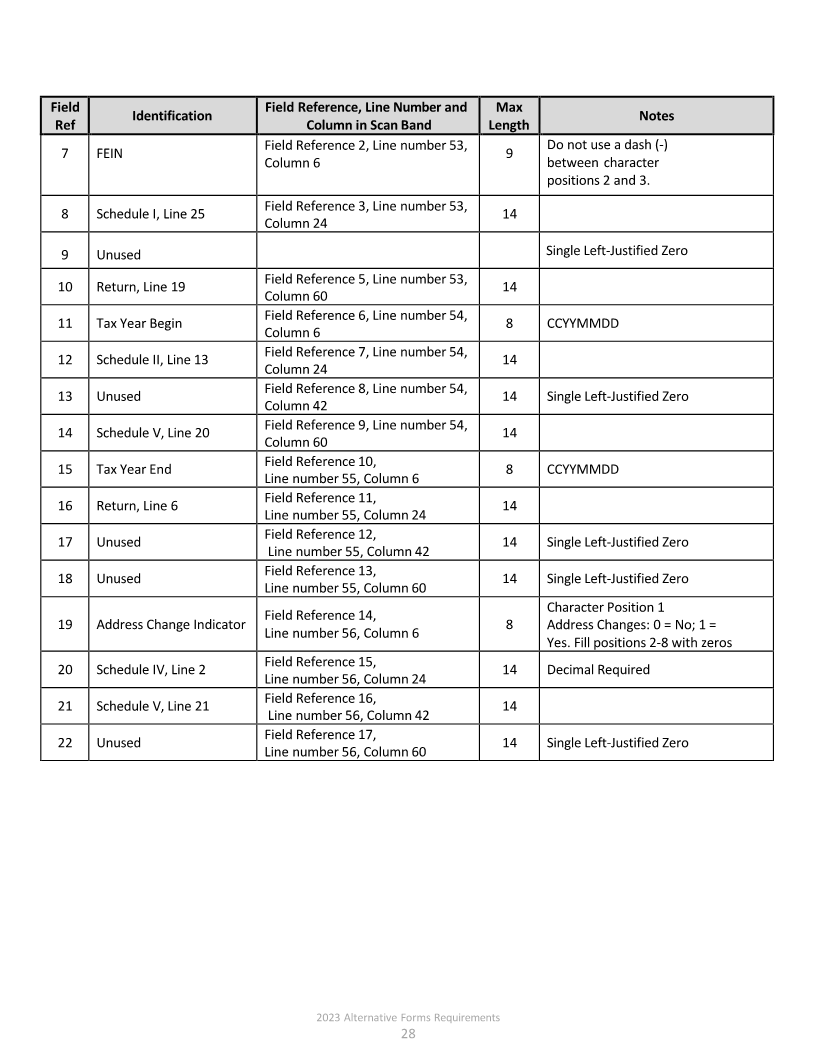

Enlarge image |

Field Field Reference, Line Number and Max

Identification Notes

Ref Column in Scan Band Length

Field Reference 2, Line number 53, Do not use a dash (-)

7 FEIN 9

Column 6 between character

positions 2 and 3.

Field Reference 3, Line number 53,

8 Schedule I, Line 25 14

Column 24

9 Unused Single Left-Justified Zero

Field Reference 5, Line number 53,

10 Return, Line 19 14

Column 60

Field Reference 6, Line number 54,

11 Tax Year Begin 8 CCYYMMDD

Column 6

Field Reference 7, Line number 54,

12 Schedule II, Line 13 14

Column 24

Field Reference 8, Line number 54,

13 Unused 14 Single Left-Justified Zero

Column 42

Field Reference 9, Line number 54,

14 Schedule V, Line 20 14

Column 60

Field Reference 10,

15 Tax Year End 8 CCYYMMDD

Line number 55, Column 6

Field Reference 11,

16 Return, Line 6 14

Line number 55, Column 24

Field Reference 12,

17 Unused 14 Single Left-Justified Zero

Line number 55, Column 42

Field Reference 13,

18 Unused 14 Single Left-Justified Zero

Line number 55, Column 60

Character Position 1

Field Reference 14,

19 Address Change Indicator 8 Address Changes: 0 = No; 1 =

Line number 56, Column 6

Yes. Fill positions 2-8 with zeros

Field Reference 15,

20 Schedule IV, Line 2 14 Decimal Required

Line number 56, Column 24

Field Reference 16,

21 Schedule V, Line 21 14

Line number 56, Column 42

Field Reference 17,

22 Unused 14 Single Left-Justified Zero

Line number 56, Column 60

2023 Alternative Forms Requirements

28

|

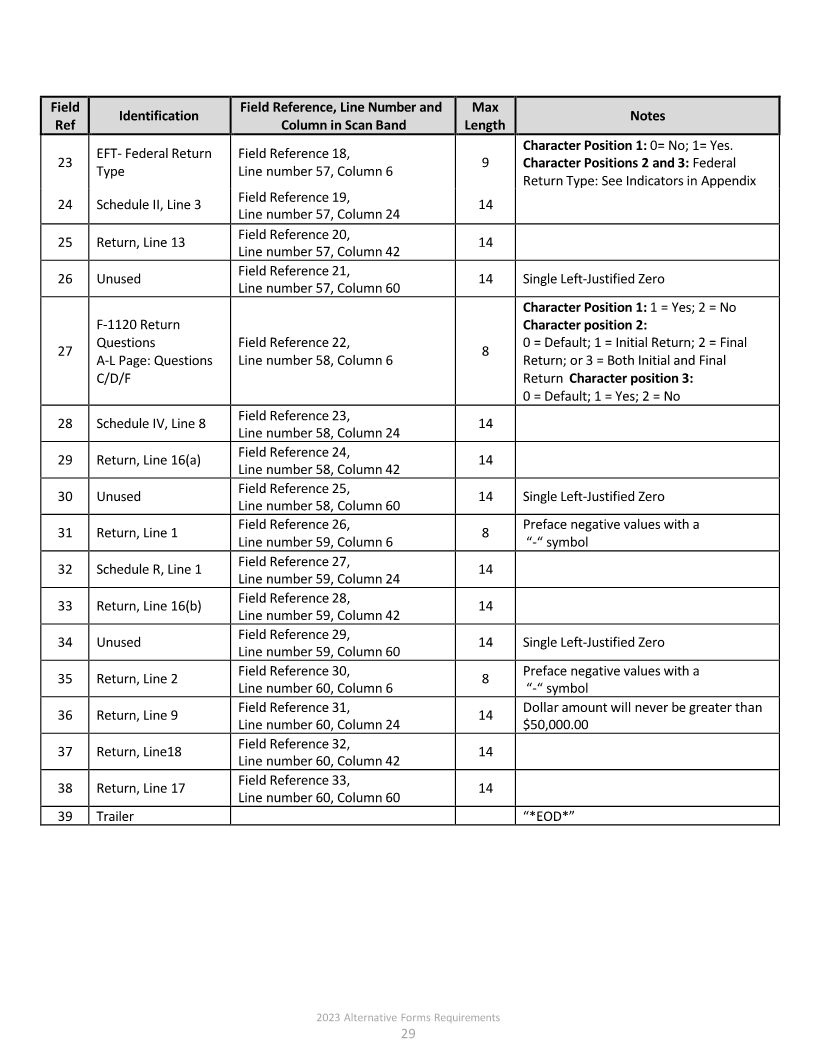

Enlarge image |

Field Field Reference, Line Number and Max

Identification Notes

Ref Column in Scan Band Length

Character Position 1: 0= No; 1= Yes.

EFT- Federal Return Field Reference 18,

23 9 Character Positions 2 and 3: Federal

Type Line number 57, Column 6

Return Type: See Indicators in Appendix

Field Reference 19,

24 Schedule II, Line 3 14

Line number 57, Column 24

Field Reference 20,

25 Return, Line 13 14

Line number 57, Column 42

Field Reference 21,

26 Unused 14 Single Left-Justified Zero

Line number 57, Column 60

Character Position 1: 1 = Yes; 2 = No

F-1120 Return Character position 2:

Questions Field Reference 22, 0 = Default; 1 = Initial Return; 2 = Final

27 8

A-L Page: Questions Line number 58, Column 6 Return; or 3 = Both Initial and Final

C/D/F Return Character position 3:

0 = Default; 1 = Yes; 2 = No

Field Reference 23,

28 Schedule IV, Line 8 14

Line number 58, Column 24

Field Reference 24,

29 Return, Line 16(a) 14

Line number 58, Column 42

Field Reference 25,

30 Unused 14 Single Left-Justified Zero

Line number 58, Column 60

Field Reference 26, Preface negative values with a

31 Return, Line 1 8

Line number 59, Column 6 “ “- symbol

Field Reference 27,

32 Schedule R, Line 1 14

Line number 59, Column 24

Field Reference 28,

33 Return, Line 16(b) 14

Line number 59, Column 42

Field Reference 29,

34 Unused 14 Single Left-Justified Zero

Line number 59, Column 60

Field Reference 30, Preface negative values with a

35 Return, Line 2 8

Line number 60, Column 6 “ “- symbol

Field Reference 31, Dollar amount will never be greater than

36 Return, Line 9 14

Line number 60, Column 24 $50,000.00

Field Reference 32,

37 Return, Line18 14

Line number 60, Column 42

Field Reference 33,

38 Return, Line 17 14

Line number 60, Column 60

39 Trailer “*EOD*”

2023 Alternative Forms Requirements

29

|

Enlarge image |

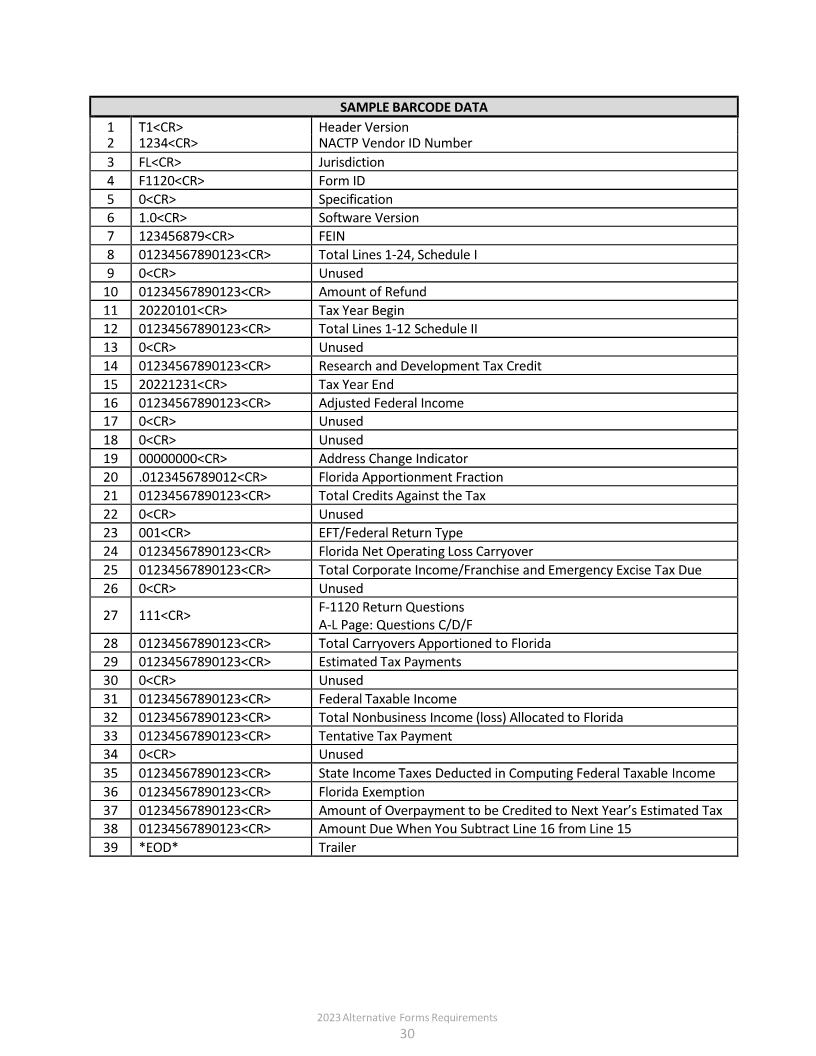

SAMPLE BARCODE DATA

1 T1<CR> Header Version

2 1234<CR> NACTP Vendor ID Number

3 FL<CR> Jurisdiction

4 F1120<CR> Form ID

5 0<CR> Specification

6 1.0<CR> Software Version

7 123456879<CR> FEIN

8 01234567890123<CR> Total Lines 1-24, Schedule I

9 0<CR> Unused

10 01234567890123<CR> Amount of Refund

11 20220101<CR> Tax Year Begin

12 01234567890123<CR> Total Lines 1-12 Schedule II

13 0<CR> Unused

14 01234567890123<CR> Research and Development Tax Credit

15 20221231<CR> Tax Year End

16 01234567890123<CR> Adjusted Federal Income

17 0<CR> Unused

18 0<CR> Unused

19 00000000<CR> Address Change Indicator

20 .0123456789012<CR> Florida Apportionment Fraction

21 01234567890123<CR> Total Credits Against the Tax

22 0<CR> Unused

23 001<CR> EFT/Federal Return Type

24 01234567890123<CR> Florida Net Operating Loss Carryover

25 01234567890123<CR> Total Corporate Income/Franchise and Emergency Excise Tax Due

26 0<CR> Unused

F-1120 Return Questions

27 111<CR>

A-L Page: Questions C/D/F

28 01234567890123<CR> Total Carryovers Apportioned to Florida

29 01234567890123<CR> Estimated Tax Payments

30 0<CR> Unused

31 01234567890123<CR> Federal Taxable Income

32 01234567890123<CR> Total Nonbusiness Income (loss) Allocated to Florida

33 01234567890123<CR> Tentative Tax Payment

34 0<CR> Unused

35 01234567890123<CR> State Income Taxes Deducted in Computing Federal Taxable Income

36 01234567890123<CR> Florida Exemption

37 01234567890123<CR> Amount of Overpayment to be Credited to Next Year’s Estimated Tax

38 01234567890123<CR> Amount Due When You Subtract Line 16 from Line 15

39 *EOD* Trailer

2023 Alternative Forms Requirements

30

|

Enlarge image |

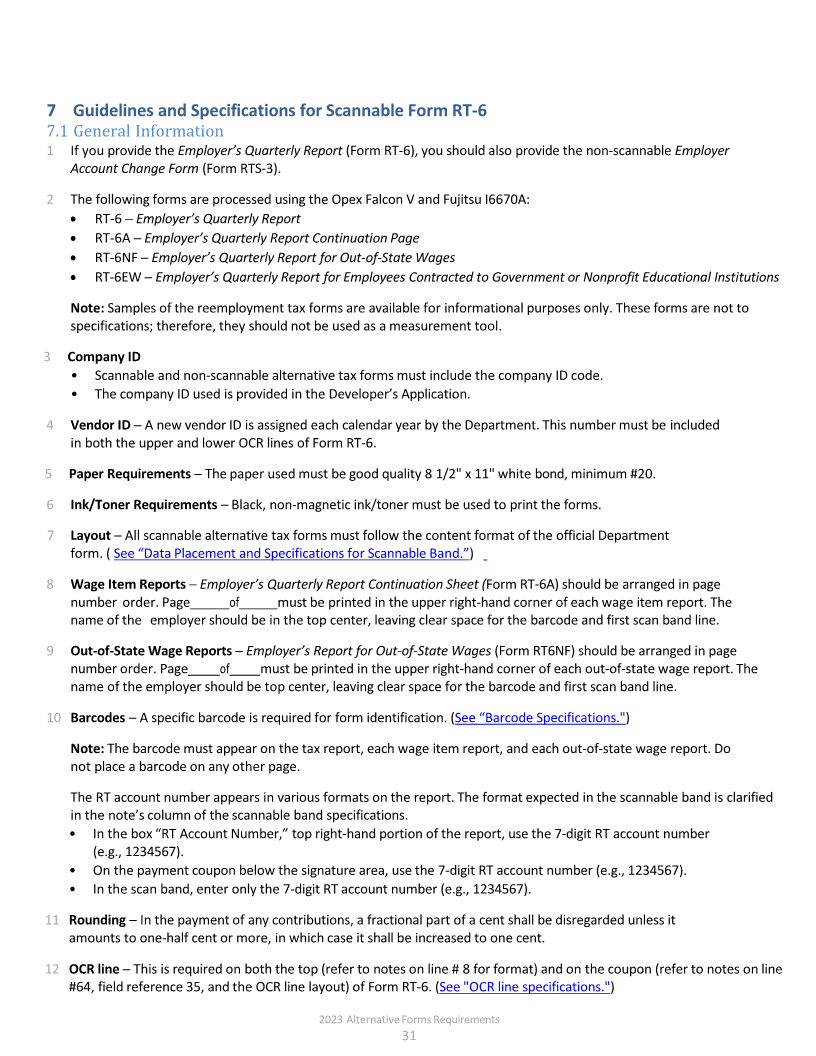

7 Guidelines and Specifications for Scannable Form RT‐6

7.1 General Information

1 If you provide the Employer’s Quarterly Report (Form RT-6), you should also provide the non‐scannable Employer

Account Change Form (Form RTS-3).

2 The following forms are processed using the Opex Falcon V and Fujitsu I6670A:

• RT‐6 ─ Employer’s Quarterly Report

• RT‐6A ─ Employer’s Quarterly Report Continuation Page

• RT-6NF ─ Employer’s Quarterly Report for Out-of-State Wages

• RT-6EW ─ Employer’s Quarterly Report for Employees Contracted to Government or Nonprofit Educational Institutions

Note: Samples of the reemployment tax forms are available for informational purposes only. These forms are not to

specifications; therefore, they should not be used as a measurement tool.

3 Company ID

• Scannable and non‐scannable alternative tax forms must include the company ID code.

• The company ID used is provided in the Developer’s Application.

4 Vendor ID ─ A new vendor ID is assigned each calendar year by the Department. This number must be included

in both the upper and lower OCR lines of Form RT‐6.

5 Paper Requirements ─ The paper used must be good quality 8 1/2" x 11" white bond, minimum #20.

6 Ink/Toner Requirements ─ Black, non‐magnetic ink/toner must be used to print the forms.

7 Layout ─ All scannable alternative tax forms must follow the content format of the official Department

form. (See “Data Placement and Specifications for Scannable Ba nd.” )

8 Wage Item Reports ─ Employer’s Quarterly Report Continuation Sheet (Form RT‐6A) should be arranged in page

number order. Page of must be printed in the upper right-hand corner of each wage item report. The

name of the employer should be in the top center, leaving clear space for the barcode and first scan band line.

9 Out‐of‐State Wage Reports ─ Employer’s Report forOut‐of‐State Wages(Form RT6NF) should be arranged in page

number order. Page of must be printed in the upper right-hand corner of each out‐of‐state wage report. The

name of the employer should be top center, leaving clear space for the barcode and first scan band line.

10 Barcodes ─ A specific barcode is required for form identification.See ( “Barcode Specifications.")

Note: The barcode must appear on the tax report, each wage item report, and each out‐of‐state wage report. Do

not place a barcode on any other page.

The RT account number appears in various formats on the report. The format expected in the scannable band is clarified

in the note’s column of the scannable band specifications.

• In the box “RT Account Number,” top right-hand portion of the report, use the 7‐digit RT account number

(e.g., 1234567).

• On the payment coupon below the signature area, use the 7‐digit RT account number (e.g., 1234567).

• In the scan band, enter only the 7‐digit RT account number (e.g., 1234567).

11 Rounding ─ In the payment of any contributions, a fractional part of a cent shall be disregarded unless it

amounts to one‐half cent or more, in which case it shall be increased to one cent.

12 OCR line ─ This is required on both the top (refer to notes on line # 8 for format) and on the coupon (refer to notes on line

#64, field reference 35, and the OCR line layout) of Form RT‐6. (See "OCR line specifications.")

2023 Alternative Forms Requirements

31

|

Enlarge image |

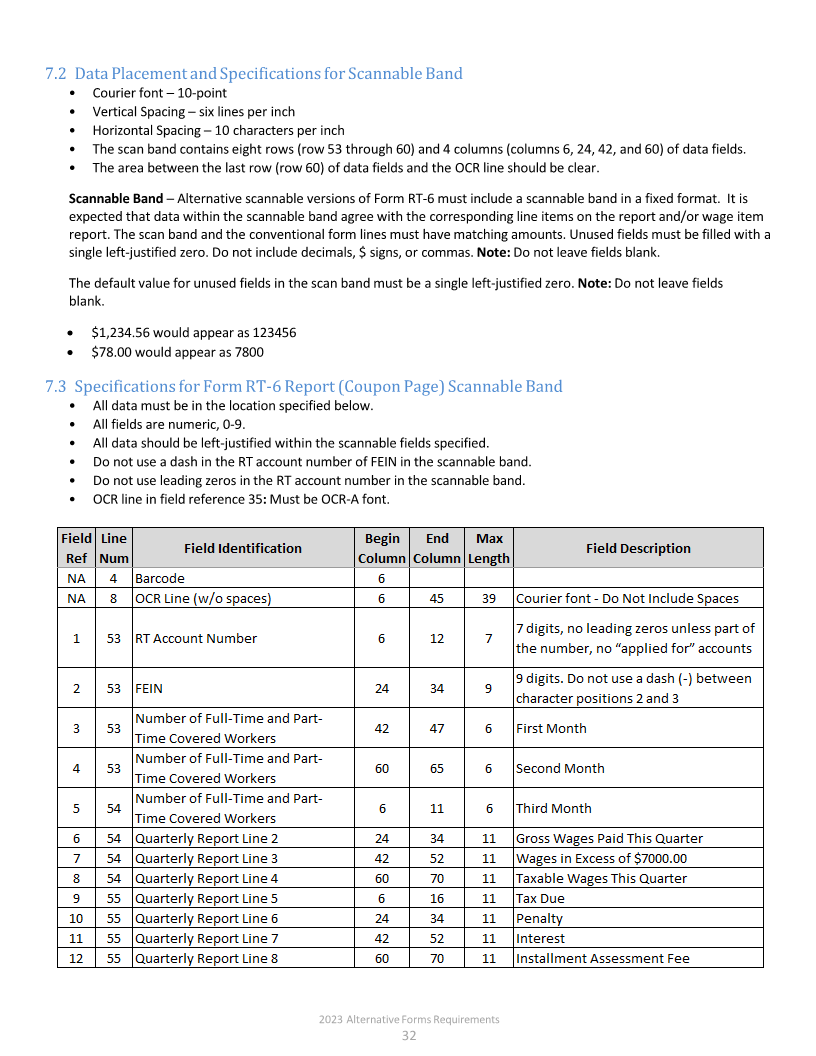

7.2 Data Placement and Specifications for Scannable Band

• Courier font ─10-point

• Vertical Spacing ─six lines per inch

• Horizontal Spacing ─ 10 characters per inch

• The scan band contains eight rows (row 53 through 60) and 4 columns (columns 6, 24, 42, and 60) of data fields.

• The area between the last row (row 60) of data fields and the OCR line should be clear.

Scannable Band ─ Alternative scannable versions of Form RT‐6 must include a scannable band in a fixed format. It is

expected that data within the scannable band agree with the corresponding line items on the report and/or wage item

report. The scan band and the conventional form lines must have matching amounts. Unused fields must be filled with a

single left‐justified zero. Do not include decimals, $ signs, or commas. Note: Do not leave fields blank.

The default value for unused fields in the scan band must be a single left‐justified zero. Note: Do not leave fields

blank.

• $1,234.56 would appear as 123456

• $78.00 would appear as 7800

7.3 Specifications for Form RT-6 Report (Coupon Page) Scannable Band

• All data must be in the location specified below.

• All fields are numeric, 0‐9.

• All data should be left‐justified within the scannable fields specified.

• Do not use a dash in the RT account number of FEIN in the scannable band.

• Do not use leading zeros in the RT account number in the scannable band.

• OCR line in field reference 35: Must beOCR‐A font.

2023 Alternative Forms Requirements

32

|

Enlarge image |

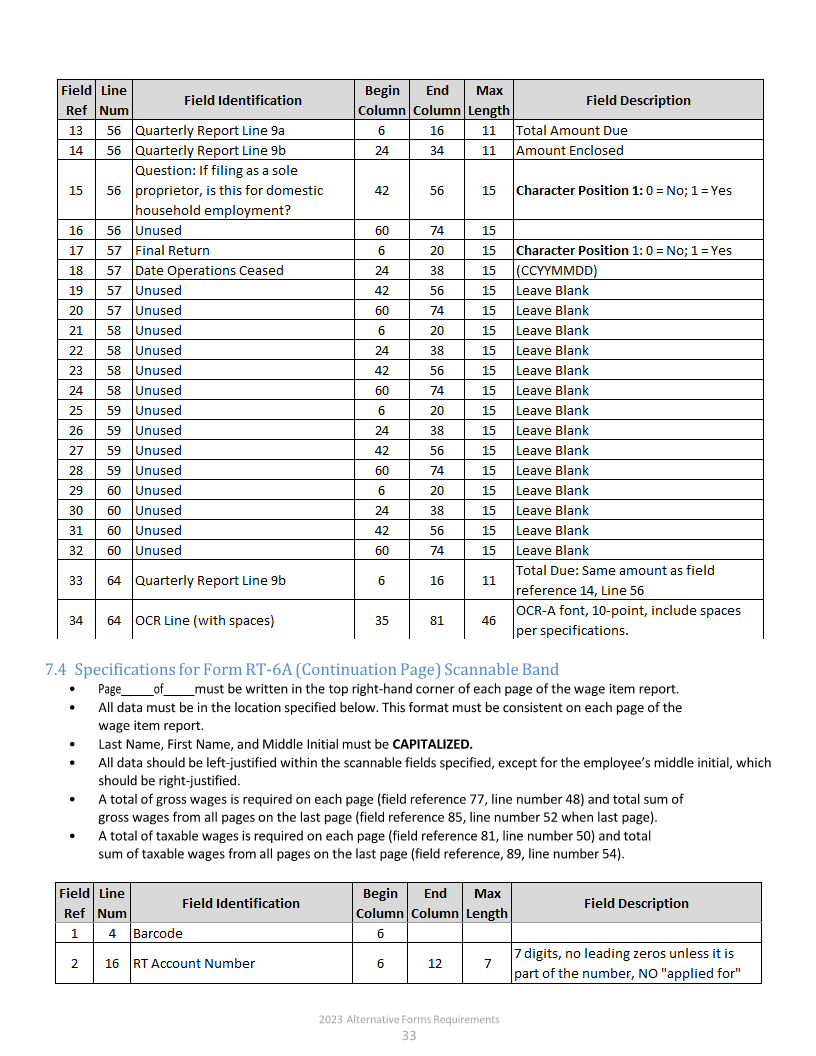

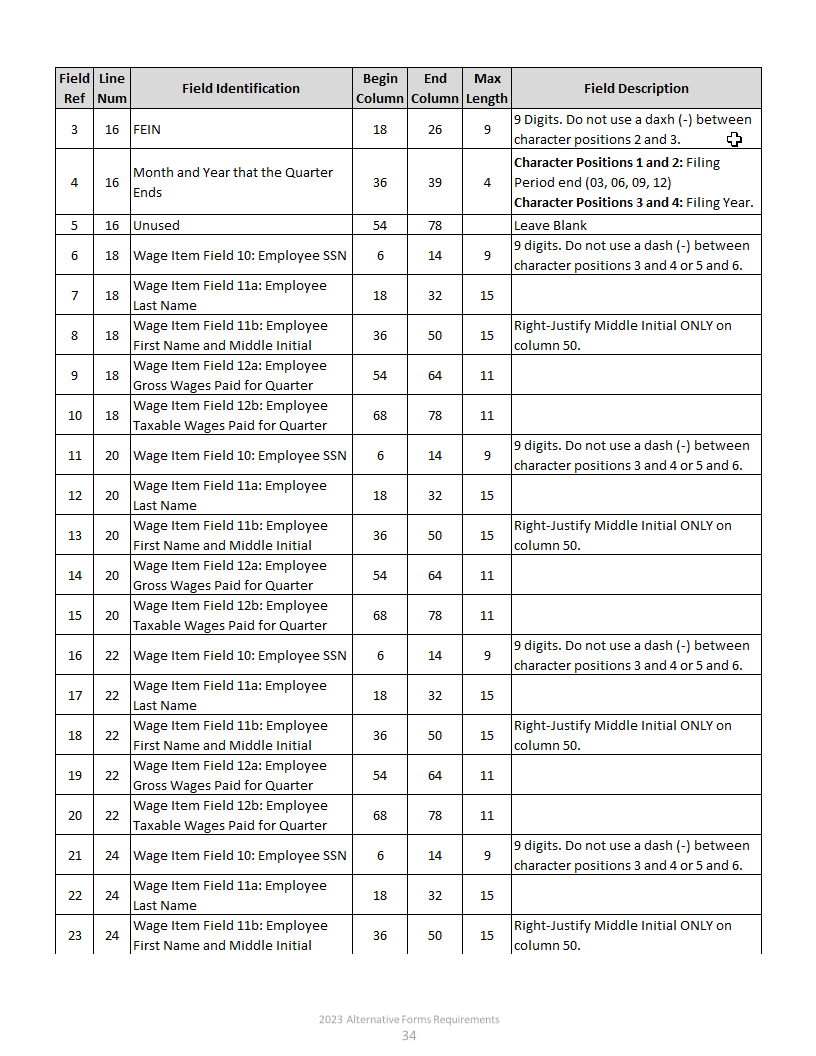

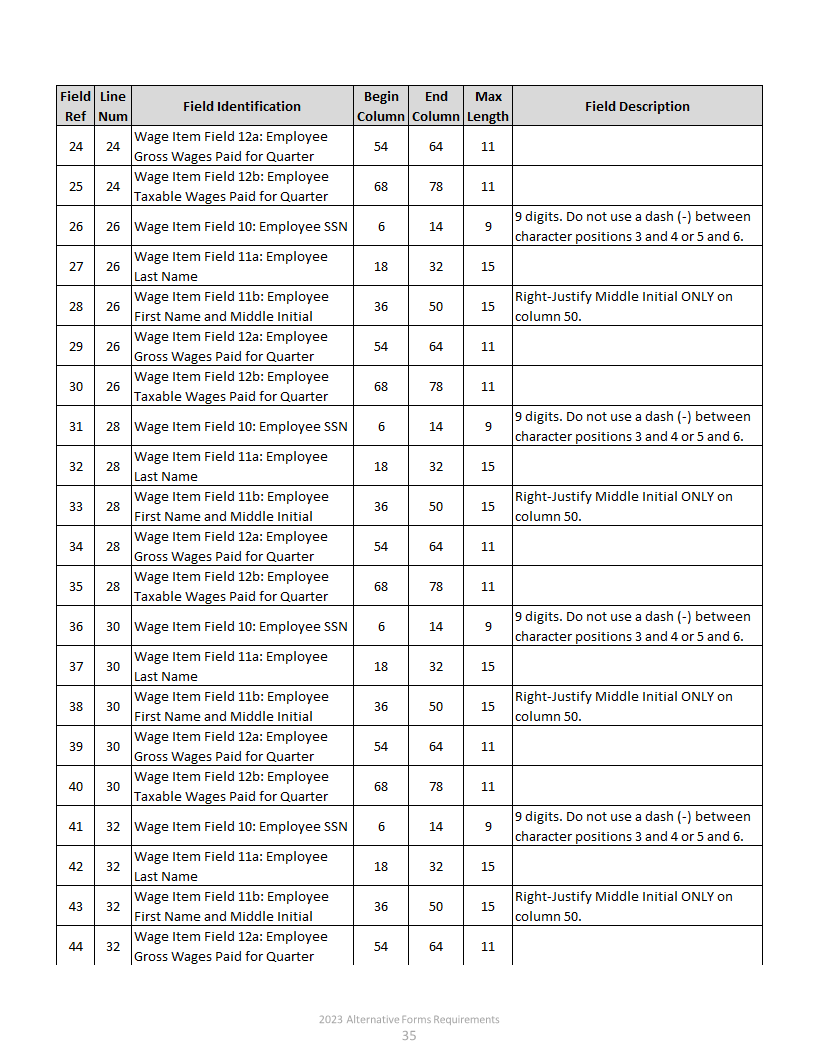

7.4 Specifications for Form RT-6A (Continuation Page) Scannable Band

• Page of must be written in the top right-hand corner of each page of the wage item report.

• All data must be in the location specified below. This format must be consistent on each page of the

wage item report.

• Last Name, First Name, and Middle Initial must be CAPITALIZED.

• All data should be left‐justified within the scannable fields specified, except for the employee’s middle initial, which

should be right‐justified.

• A total of gross wages is required on each page (field reference 77, line number 48) and total sum of

gross wages from all pages on the last page (field reference 85, line number 52 when last page).

• A total of taxable wages is required on each page (field reference 81, line number 50) and total

sum of taxable wages from all pages on the last page (field reference, 89, line number 54).

2023 Alternative Forms Requirements

33

|

Enlarge image |

2023 Alternative Forms Requirements

34

|

Enlarge image |

2023 Alternative Forms Requirements

35

|

Enlarge image |

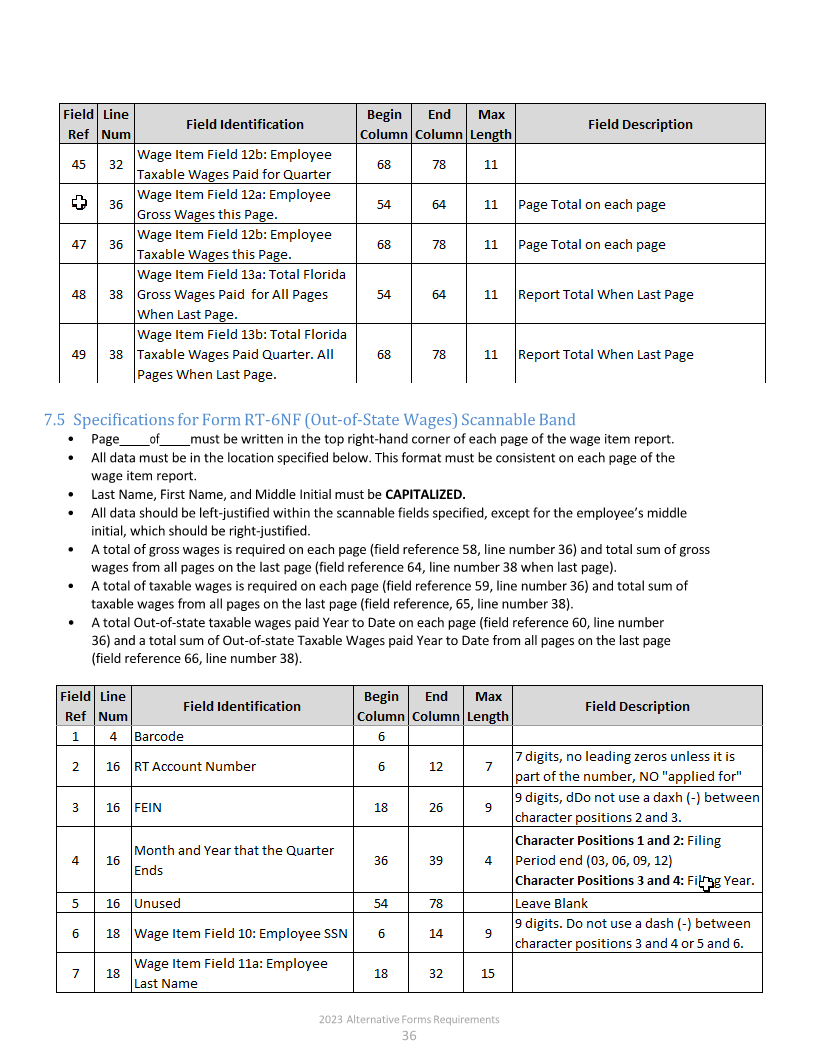

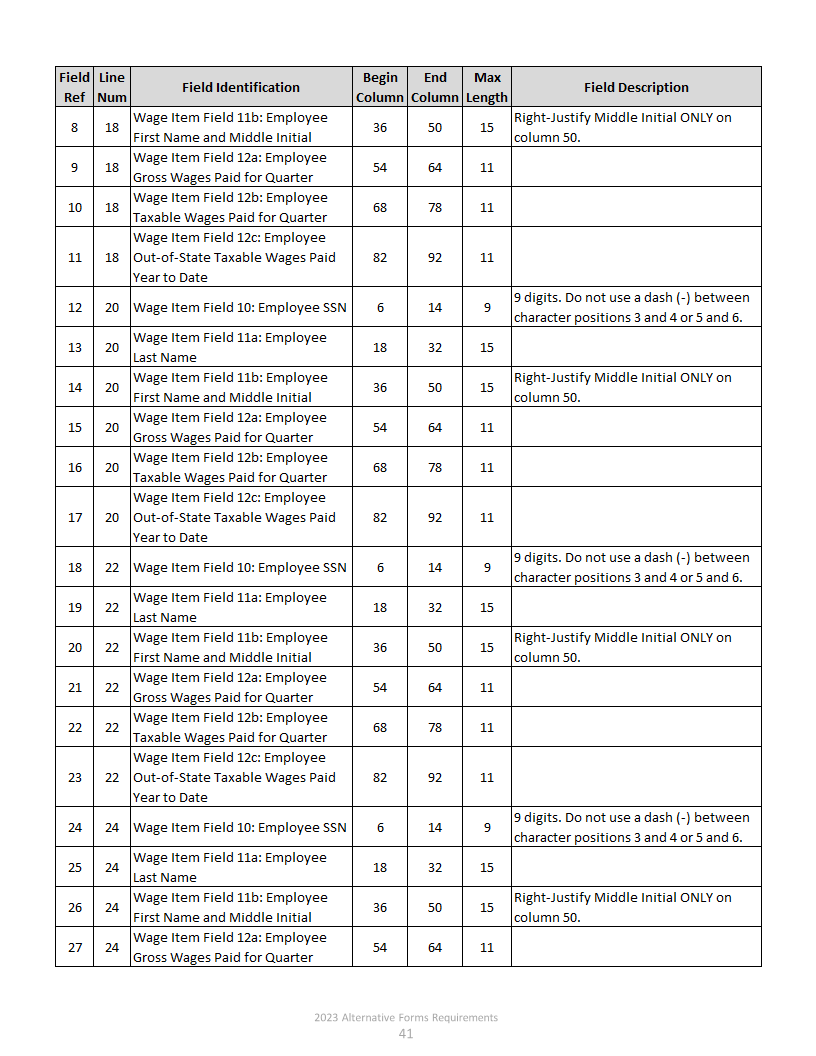

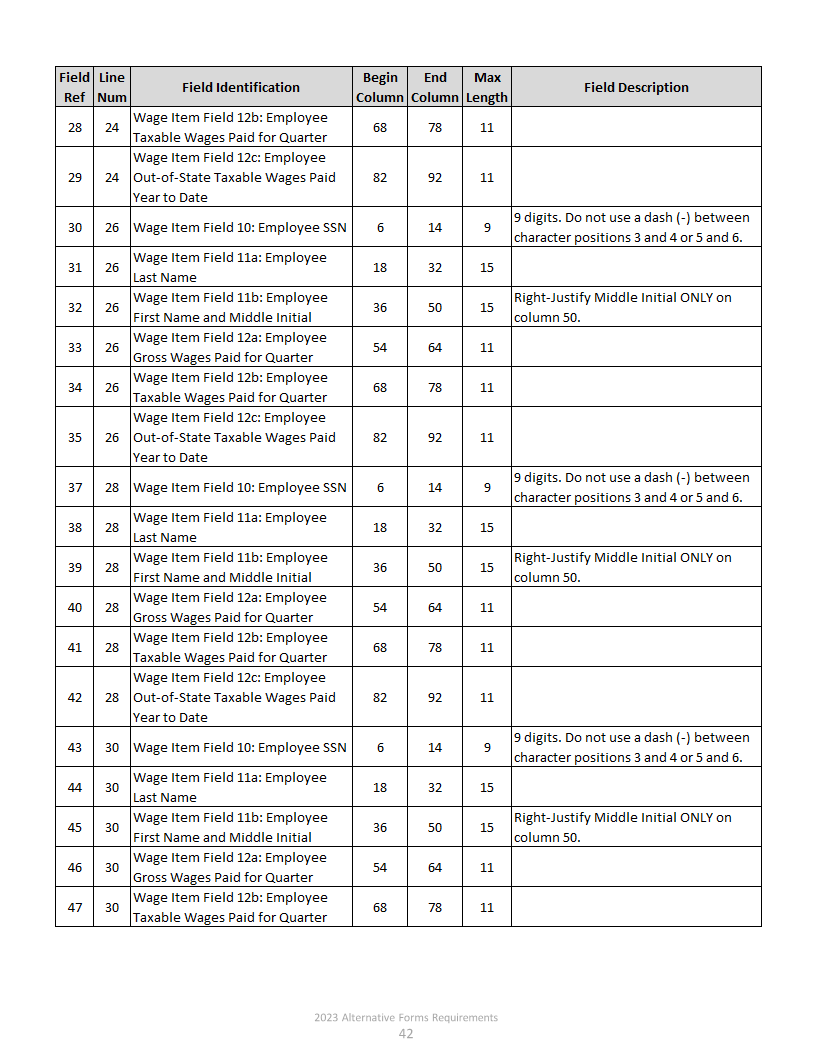

7.5 Specifications for Form RT-6NF (Out-of-State Wages) Scannable Band

• Page of must be written in the top right-hand corner of each page of the wage item report.

• All data must be in the location specified below. This format must be consistent on each page of the

wage item report.

• Last Name, First Name, and Middle Initial must be CAPITALIZED.

• All data should be left‐justified within the scannable fields specified, except for the employee’s middle

initial, which should be right‐justified.

• A total of gross wages is required on each page (field reference 58, line number 36) and total sum of gross

wages from all pages on the last page (field reference 64, line number 38 when last page).

• A total of taxable wages is required on each page (field reference 59, line number 36) and total sum of

taxable wages from all pages on the last page (field reference, 65, line number 38).

• A total Out-of-state taxable wages paid Year to Date on each page (field reference 60, line number

36) and a total sum of Out-of-state Taxable Wages paid Year to Date from all pages on the last page

(field reference 66, line number 38).

2023 Alternative Forms Requirements

36

|

Enlarge image | 2023 Alternative Forms Requirements 41 |

Enlarge image | 2023 Alternative Forms Requirements 42 |

Enlarge image |

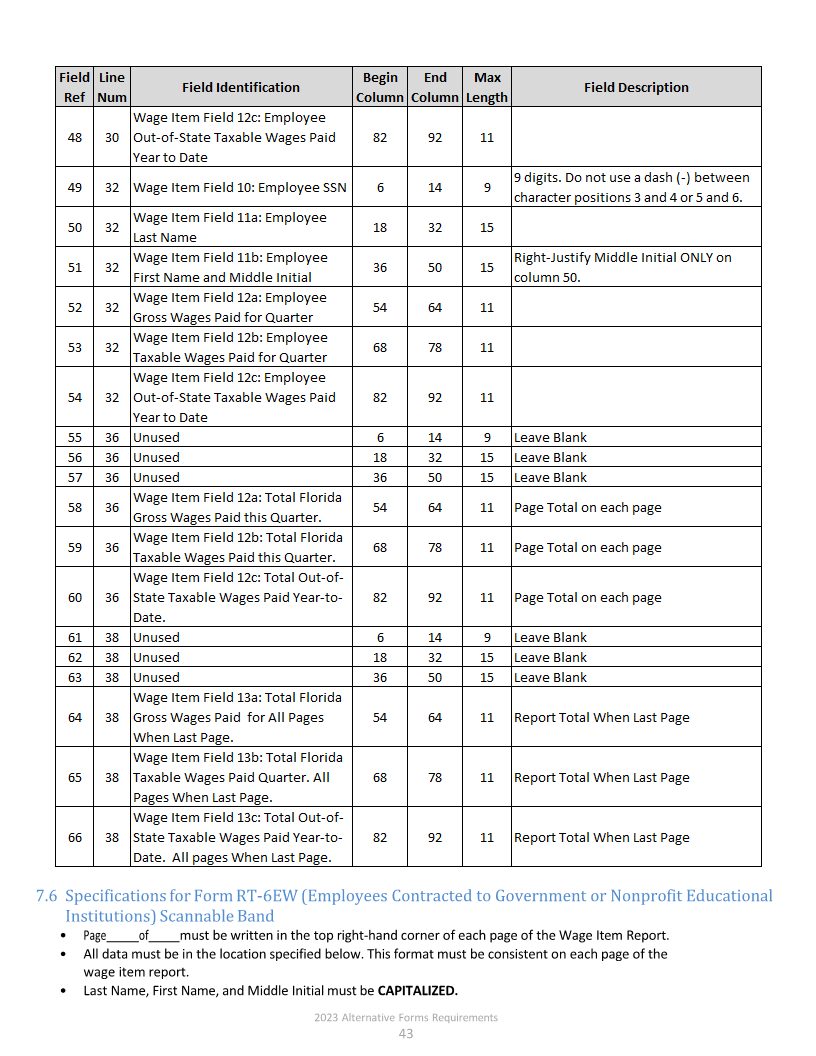

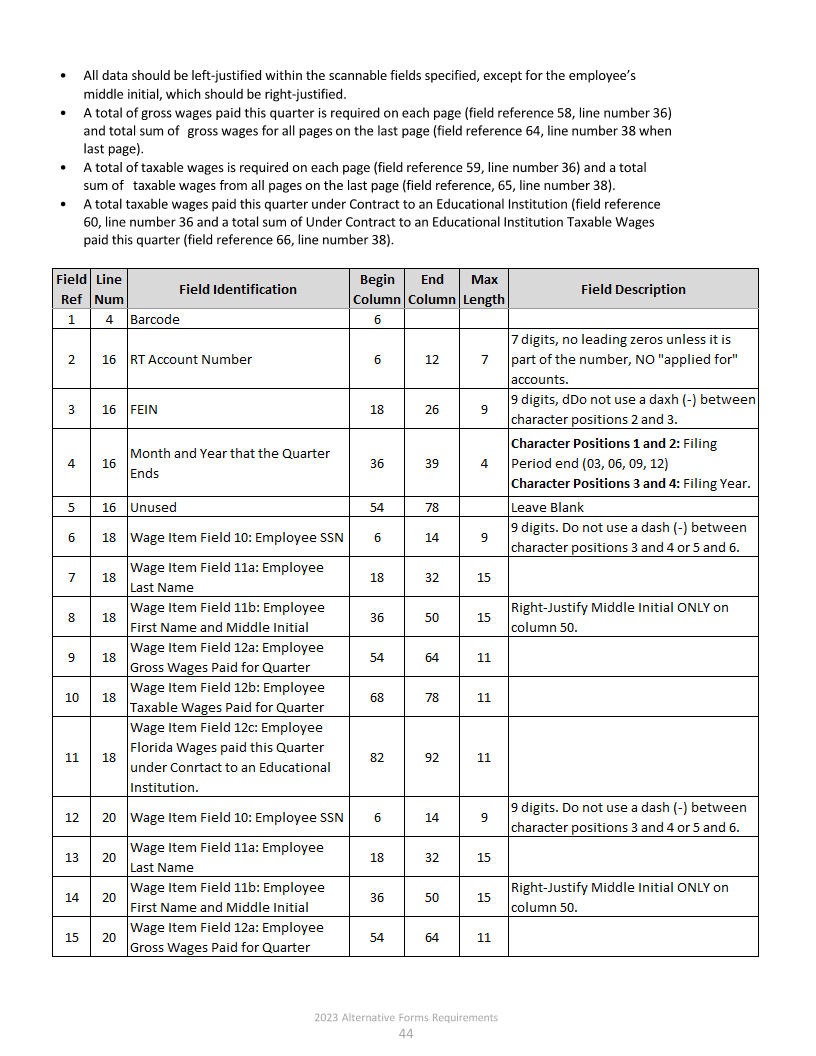

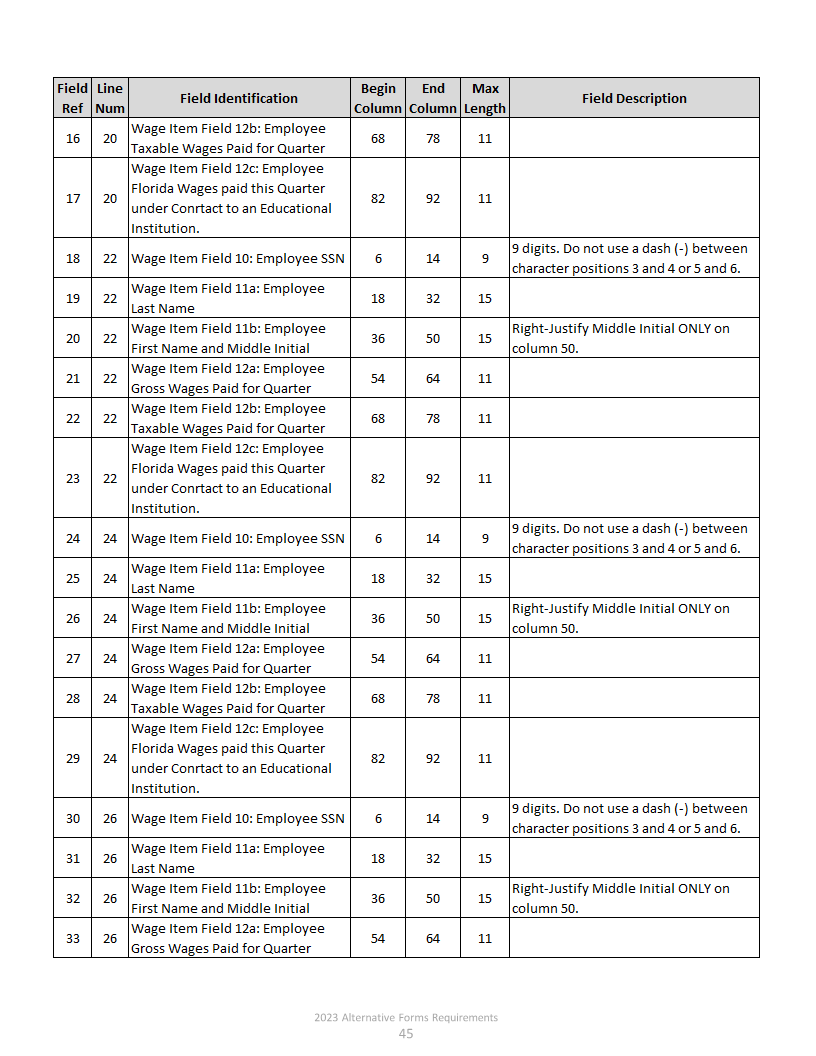

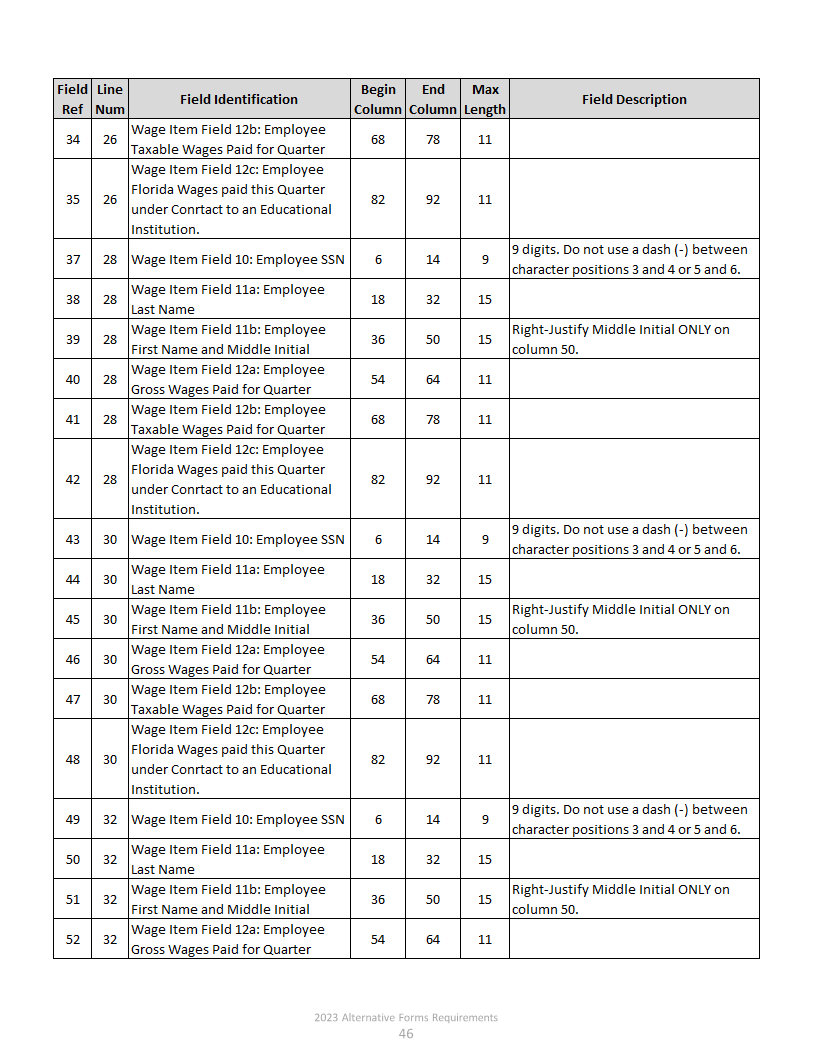

7.6 Specifications for Form RT-6EW (Employees Contracted to Government or Nonprofit Educational

Institutions) Scannable Band

• Page of must be written in the top right-hand corner of each page of the Wage Item Report.

• All data must be in the location specified below. This format must be consistent on each page of the

wage item report.

• Last Name, First Name, and Middle Initial must be CAPITALIZED.

2023 Alternative Forms Requirements

43

|

Enlarge image |

• All data should be left‐justified within the scannable fields specified, except for the employee’s

middle initial, which should be right‐justified.

• A total of gross wages paid this quarter is required on each page (field reference 58, line number 36)

and total sum of gross wages for all pages on the last page (field reference 64, line number 38 when

last page).

• A total of taxable wages is required on each page (field reference 59, line number 36) and a total

sum of taxable wages from all pages on the last page (field reference, 65, line number 38).

• A total taxable wages paid this quarter under Contract to an Educational Institution (field reference

60, line number 36 and a total sum of Under Contract to an Educational Institution Taxable Wages

paid this quarter (field reference 66, line number 38).

2023 Alternative Forms Requirements

44

|

Enlarge image | 2023 Alternative Forms Requirements 45 |

Enlarge image |

2023 Alternative Forms Requirements

46

|

Enlarge image |

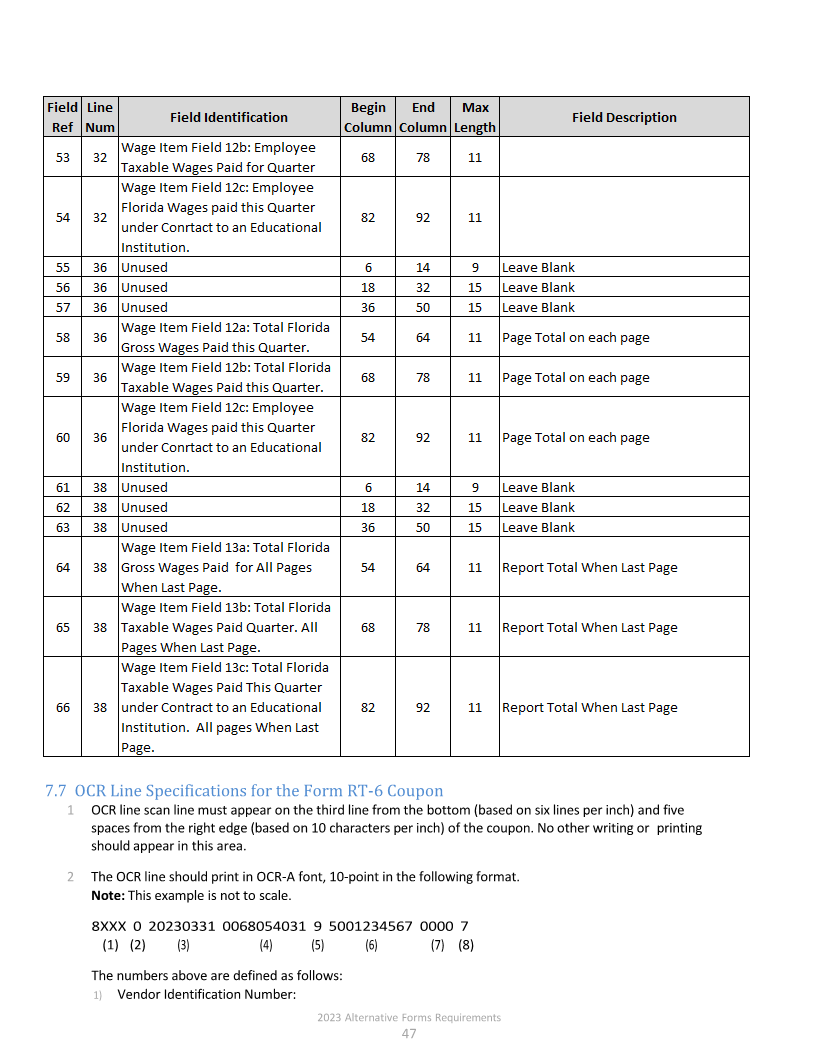

7.7 OCR Line Specifications for the Form RT-6 Coupon

1 OCR line scan line must appear on the third line from the bottom (based on six lines per inch) and five

spaces from the right edge (based on 10 characters per inch) of the coupon. No other writing or printing

should appear in this area.

2 The OCR line should print in OCR‐A font, 10-point in the following format.

Note: This example is not to scale.

8XXX 0 20230331 0068054031 9 5001234567 0000 7

(1) (2) (3) (4) (5) (6) (7) (8)

The numbers above are defined as follows:

1) Vendor Identification Number:

2023 Alternative Forms Requirements

47

|

Enlarge image |

8xxx assigned to vendor by the Department

2) Payment Method:

0 = Non‐EFT; 1= EFT

3) Applied Date:

Format = CCYYMMDD (e.g., 20230331)

(MM is 2‐digit month)

(DD is the last day of the month)

• 03 is Jan 1 –Mar 31

• 06 is Apr 1 –Jun 30

• 09 is July 1 –Sept 30

• 12 is Oct 1 –Dec 31

4) Tax Category/Tax Fund/DocType: 0068054031

Note: This is a constant field that does not allow for changes.

5) First Check Digit: Calculated on the previous 23 digits 10 ‐ (MOD(10)). Weights = 7, 1, 3

(see calculation below)

6) Format/Account number: 500xxxxxxx (500 followed by 7‐digit RT account number)

Note: 500 is a constant in this field which is followed by the 7‐digit RT number.

7) Location: 0000

Note: This is a constant in this field and does not allow for changes.

8) Second Check Digit: Calculated on the previous 14 digits 10 ‐ (MOD(10)). Weights = 7, 1, 3

(see calculation below)

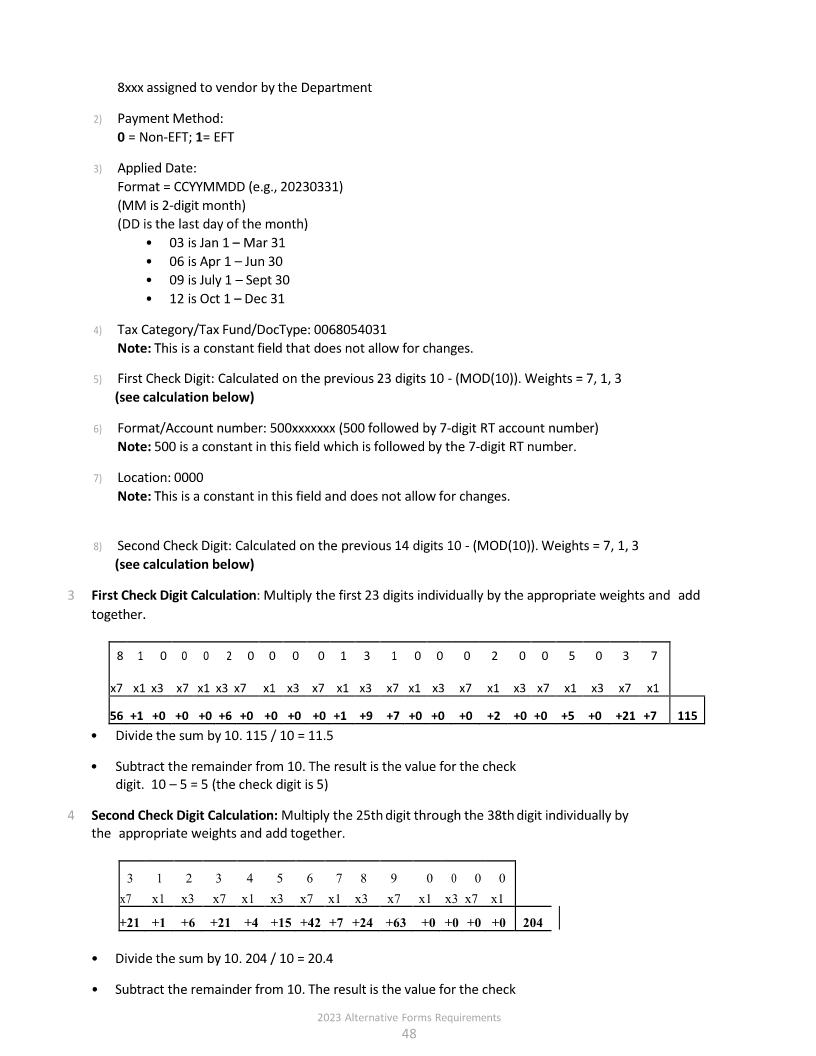

3 First Check Digit Calculation: Multiply the first 23 digits individually by the appropriate weights and add

together.

8 1 0 0 0 2 0 0 0 0 1 3 1 0 0 0 2 0 0 5 0 3 7

x7 x1 x3 x7 x1 x3 x7 x1 x3 x7 x1 x3 x7 x1 x3 x7 x1 x3 x7 x1 x3 x7 x1

56 +1 +0 +0 +0 +6 +0 +0 +0 +0 +1 +9 +7 +0 +0 +0 +2 +0 +0 +5 +0 +21 +7 115

• Divide the sum by 10. 115 / 10 = 11.5

• Subtract the remainder from 10. The result is the value for the check

digit. 10 –5 = 5 (the check digit is 5)

4 Second Check Digit Calculation: Multiply the 25th digit through the 38th digit individually by

the appropriate weights and add together.

3 1 2 3 4 5 6 7 8 9 0 0 0 0

x7 x1 x3 x7 x1 x3 x7 x1 x3 x7 x1 x3 x7 x1

+21 +1 +6 +21 +4 +15 +42 +7 +24 +63 +0 +0 +0 +0 204

• Divide the sum by 10. 204 / 10 = 20.4

• Subtract the remainder from 10. The result is the value for the check

2023 Alternative Forms Requirements

48

|

Enlarge image |

digit. 10 –4 = 6 (the check digit is 6)

Note: If the result is 10, then the Check Digit would be 0.

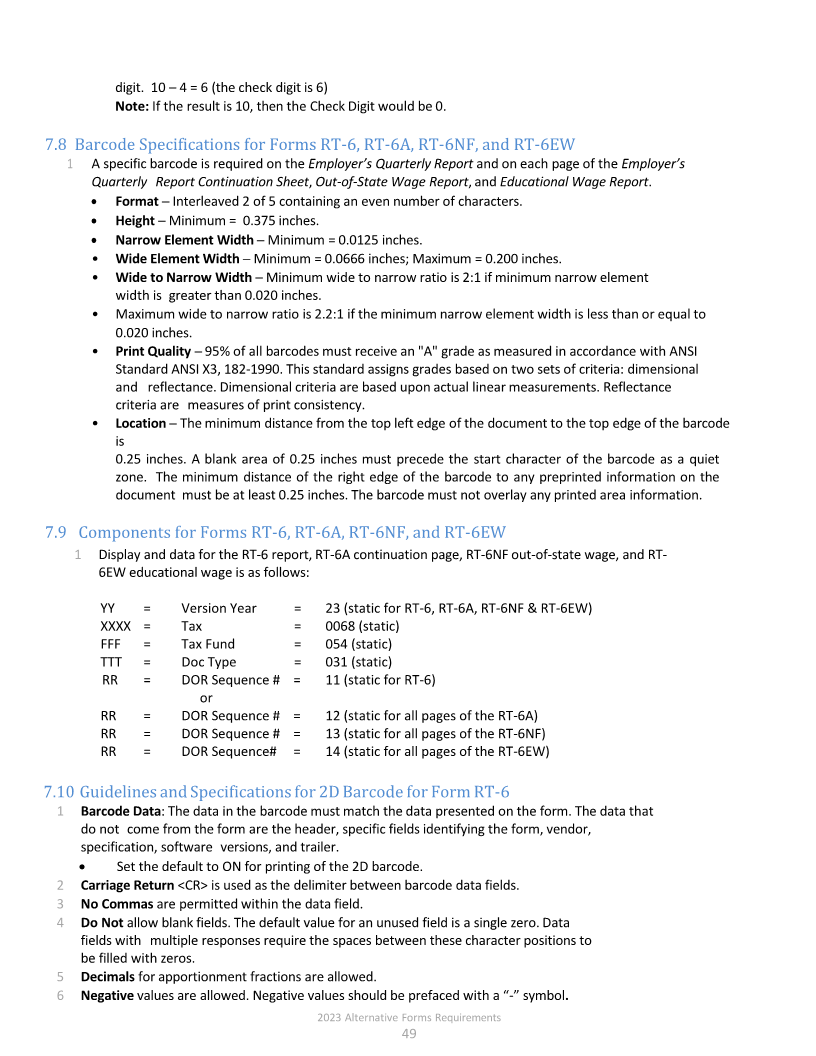

7.8 Barcode Specifications for Forms RT-6, RT-6A, RT-6NF, and RT-6EW

1 A specific barcode is required on the Employer’s Quarterly Report and on each page of the Employer’s

Quarterly Report Continuation Sheet, Out‐of‐State Wage Report, and Educational Wage Report.

• Format ─ Interleaved 2 of 5 containing an even number of characters.

• Height ─ Minimum = 0.375 inches.

• Narrow Element Width ─ Minimum = 0.0125 inches.

• Wide Element Width ─ Minimum = 0.0666 inches; Maximum = 0.200 inches.

• Wide to Narrow Width ─ Minimum wide to narrow ratio is 2:1 if minimum narrow element

width is greater than 0.020 inches.

• Maximum wide to narrow ratio is 2.2:1 if the minimum narrow element width is less than or equal to

0.020 inches.

• Print Quality ─ 95% of all barcodes must receive an "A" grade as measured in accordance with ANSI

Standard ANSI X3, 182‐1990. This standard assigns grades based on two sets of criteria: dimensional

and reflectance. Dimensional criteria are based upon actual linear measurements. Reflectance

criteria are measures of print consistency.

• Location ─ The minimum distance from the top left edge of the document to the top edge of the barcode

is

0.25 inches. A blank area of 0.25 inches must precede the start character of the barcode as a quiet

zone. The minimum distance of the right edge of the barcode to any preprinted information on the

document must be at least 0.25 inches. The barcode must not overlay any printed area information.

7.9 Components for Forms RT-6, RT-6A, RT-6NF, and RT-6EW

1 Display and data for theRT‐6 report,RT‐6A continuation page,RT‐6NF out‐of‐state wage, andRT‐

6EW educational wage is as follows:

YY = Version Year = 23 (static for RT-6, RT-6A, RT-6NF & RT-6EW)

XXXX = Tax = 0068 (static)

FFF = Tax Fund = 054 (static)

TTT = Doc Type = 031 (static)

RR = DOR Sequence # = 11 (static for RT-6)

or

RR = DOR Sequence # = 12 (static for all pages of the RT-6A)

RR = DOR Sequence # = 13 (static for all pages of the RT-6NF)

RR = DOR Sequence# = 14 (static for all pages of the RT-6EW)

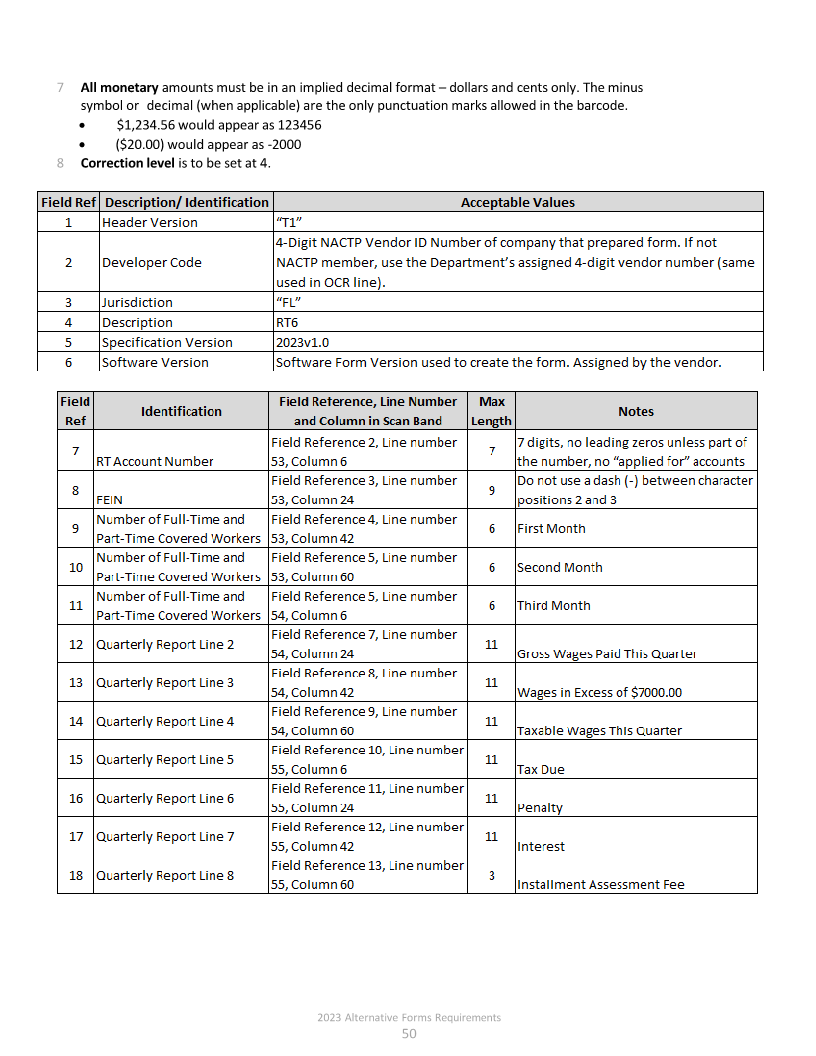

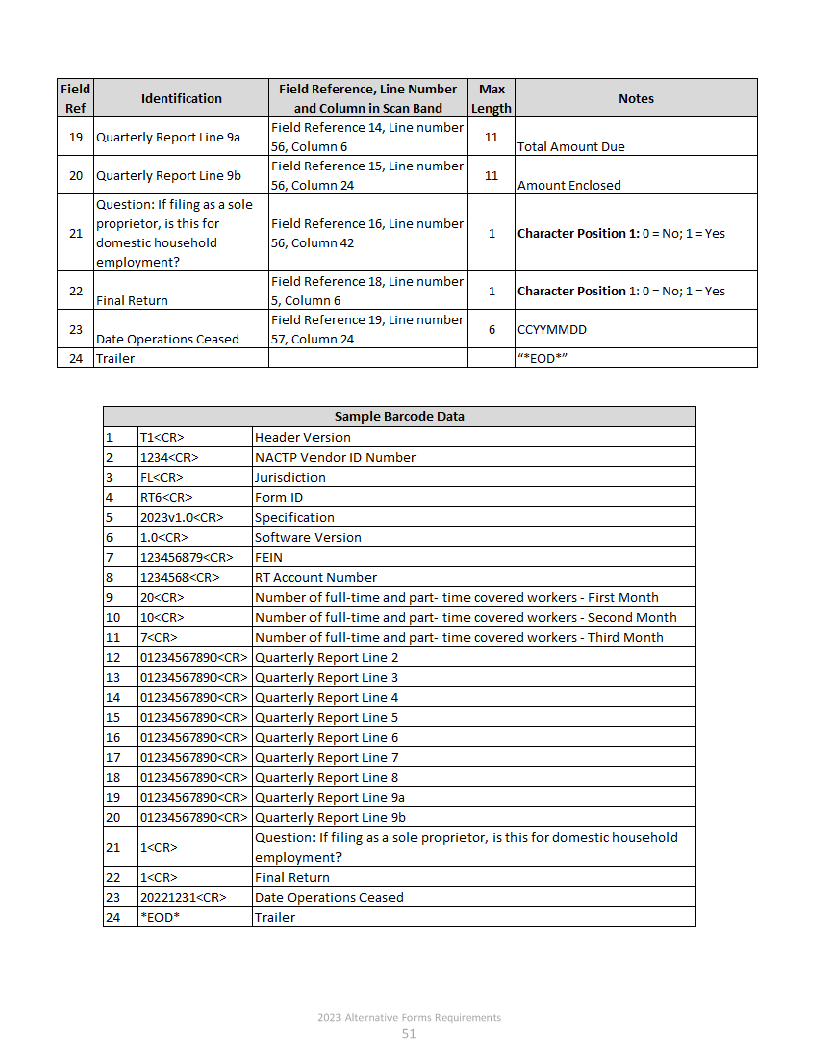

7.10 Guidelines and Specifications for 2D Barcode for Form RT-6

1 Barcode Data: The data in the barcode must match the data presented on the form. The data that

do not come from the form are the header, specific fields identifying the form, vendor,

specification, software versions, and trailer.

• Set the default to ON for printing of the 2D barcode.

2 Carriage Return <CR> is used as the delimiter between barcode data fields.

3 No Commas are permitted within the data field.

4 Do Not allow blank fields. The default value for an unused field is a single zero. Data

fields with multiple responses require the spaces between these character positions to

be filled with zeros.

5 Decimals for apportionment fractions are allowed.

6 Negativevalues are allowed. Negative values should be prefaced with a“‐” symbol .

2023 Alternative Forms Requirements

49

|

Enlarge image |

7 All monetaryamounts must be in an implied decimal format –dollars and cents only. The minus

symbol or decimal (when applicable) are the only punctuation marks allowed in the barcode.

• $1,234.56 would appear as 123456

• ($20.00) would appear as ‐2000

8 Correction level is to be set at 4.

2023 Alternative Forms Requirements

50

|

Enlarge image | 2023 Alternative Forms Requirements 51 |

Enlarge image |

8 Guidelines for Non‐Scannable Forms and Forms That Require a Barcode and/or OCR

Line

General Information:

• The Department must be able to process non‐scannable alternative tax forms in the same manner

as the official forms.

• To ensure taxpayers receive the most current version of Department forms, vendors are requested

to submit to the Department all non‐scannable forms they plan to release, sell, license, or

distribute during each tax year.

• Vendors may submit a list of non‐scannable forms, with the revision date approved for their

specific company in the previous year, for approval by the Department.

• There are no line-by-line specifications for these forms. Prepare forms to match the Department’s

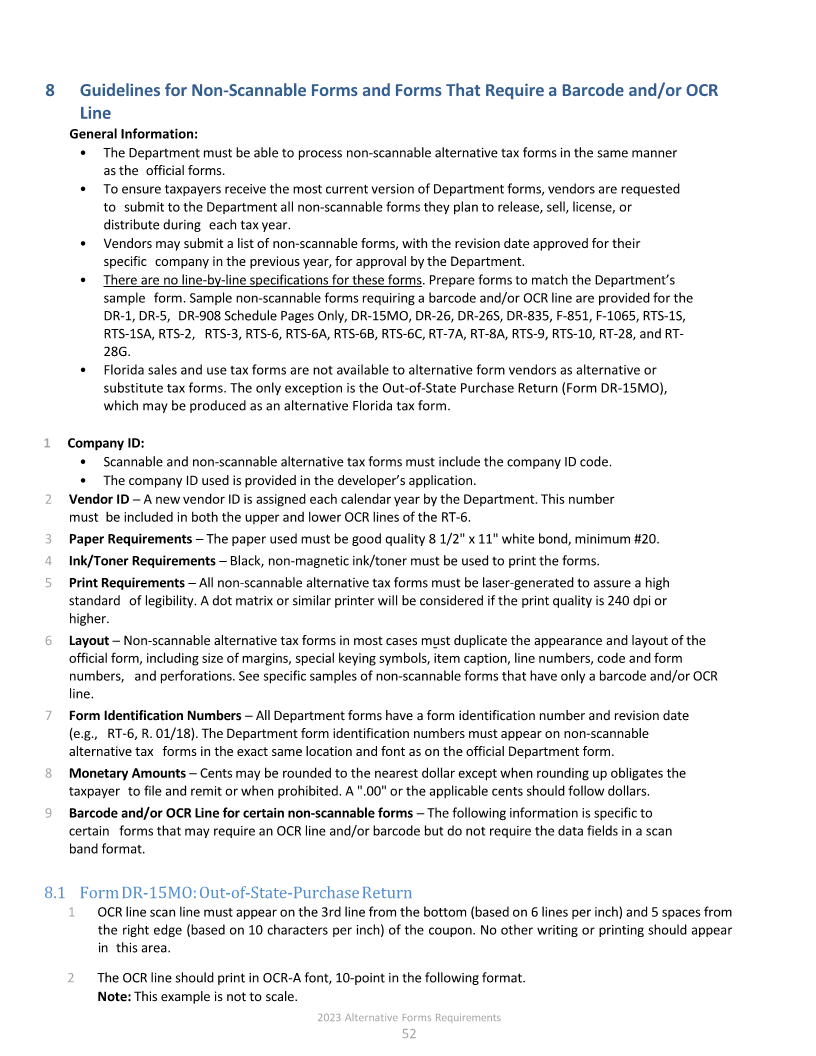

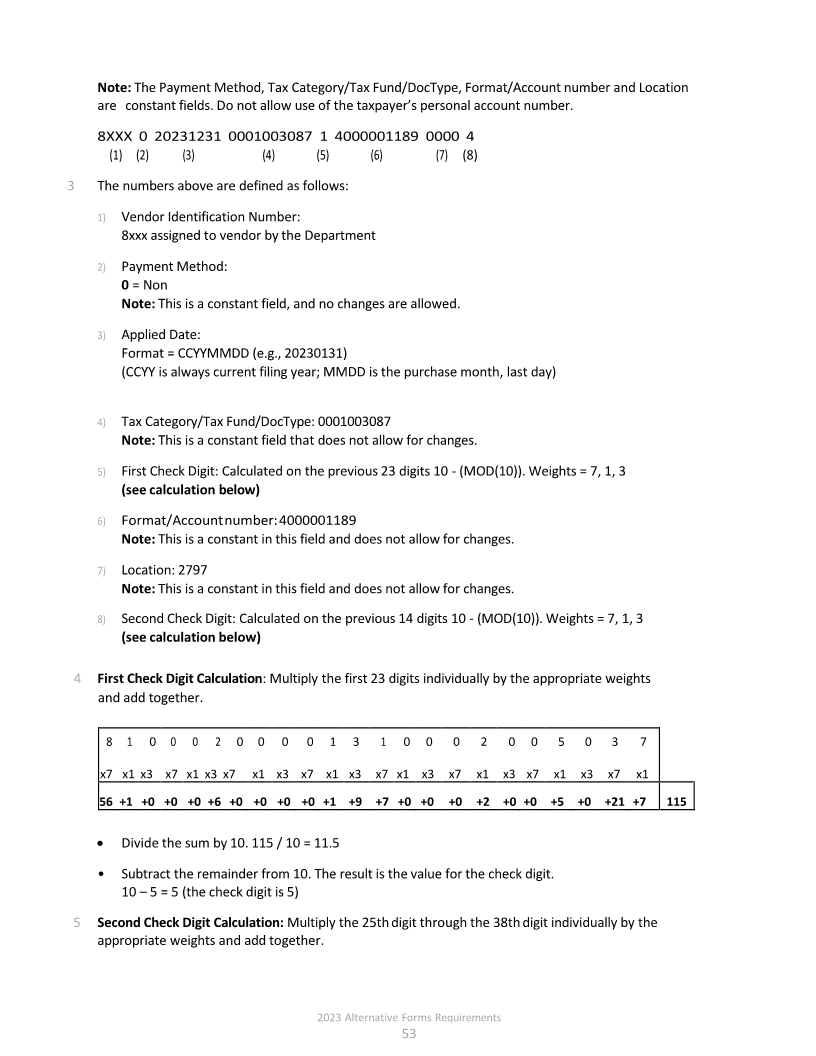

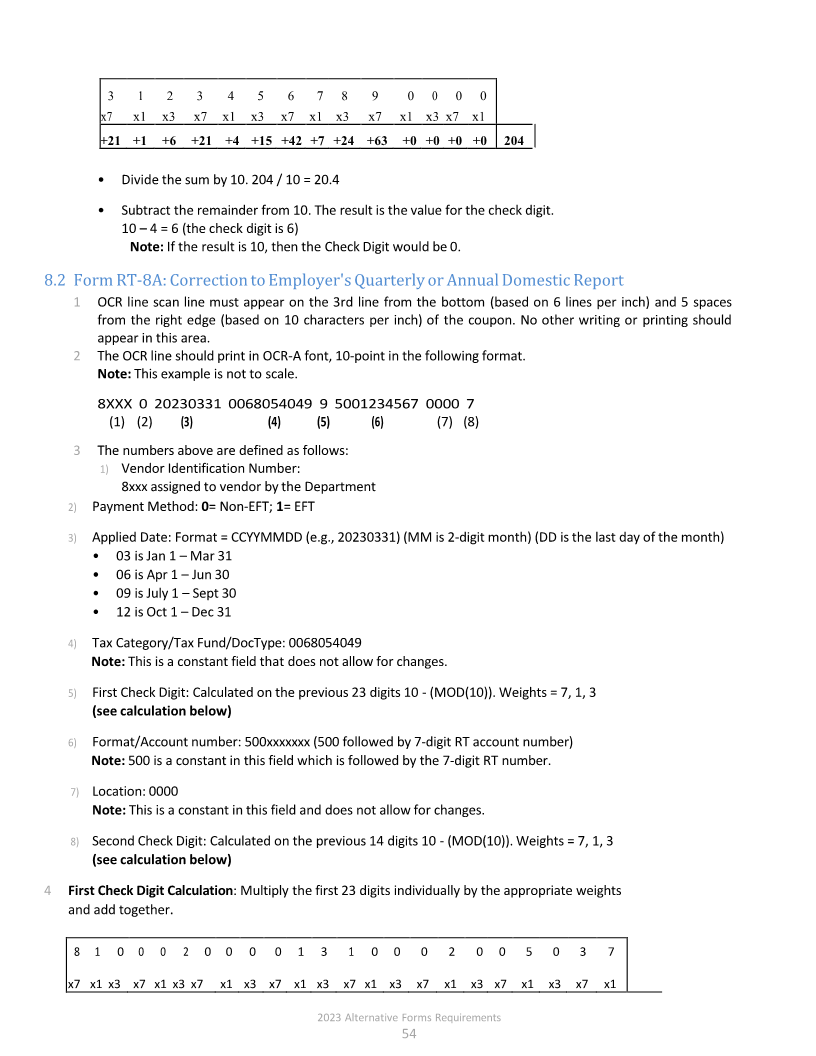

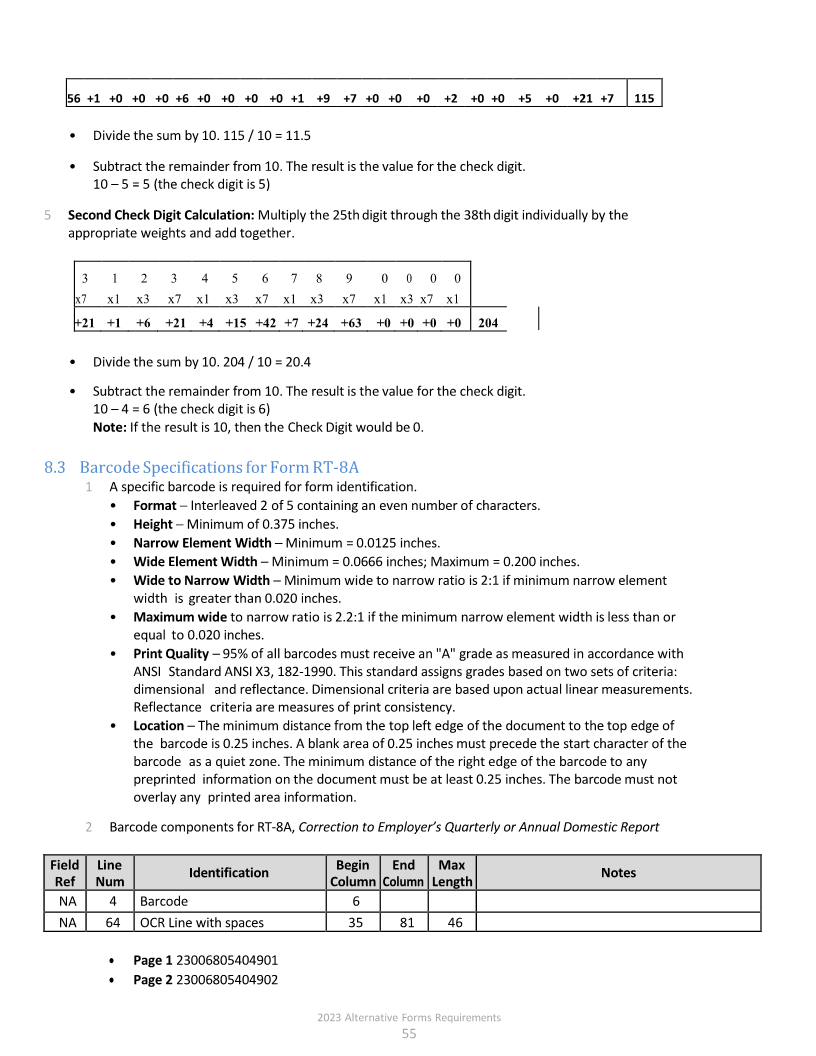

sample form. Sample non‐scannable forms requiring a barcode and/or OCR line are provided for the