- 2 -

Enlarge image

|

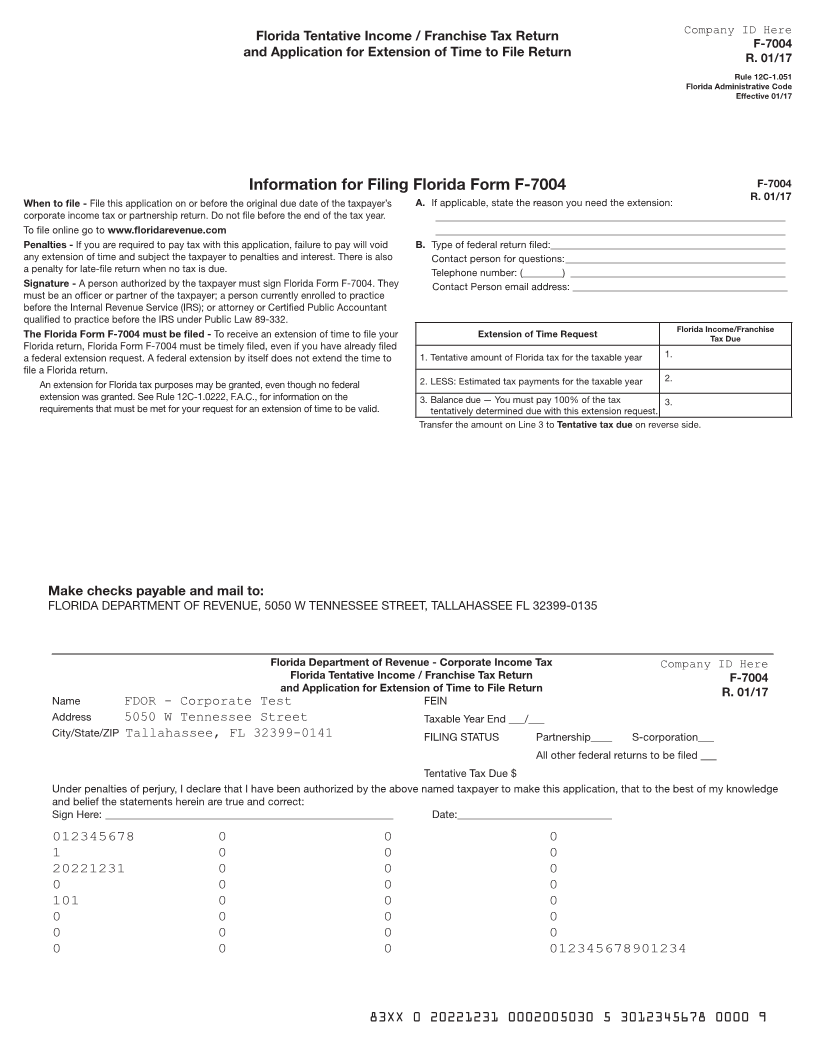

Florida Tentative Income / Franchise Tax Return Company ID Here

F-7004

and Application for Extension of Time to File Return R. 01/17

Rule 12C-1.051

Florida Administrative Code

Effective 01/17

Information for Filing Florida Form F-7004 F-7004

When to file - File this application on or before the original due date of the taxpayer’s A. If applicable, state the reason you need the extension: R. 01/17

corporate income tax or partnership return. Do not file before the end of the tax year. ______________________________________________________________________

To file online go to www.floridarevenue.com ______________________________________________________________________

Penalties - If you are required to pay tax with this application, failure to pay will void B. Type of federal return filed:_______________________________________________

any extension of time and subject the taxpayer to penalties and interest. There is also Contact person for questions: ____________________________________________

a penalty for late-file return when no tax is due. Telephone number: (________) ___________________________________________

Signature - A person authorized by the taxpayer must sign Florida Form F-7004. They Contact Person email address: ___________________________________________

must be an officer or partner of the taxpayer; a person currently enrolled to practice

before the Internal Revenue Service (IRS); or attorney or Certified Public Accountant

qualified to practice before the IRS under Public Law 89-332.

The Florida Form F-7004 must be filed - To receive an extension of time to file your Extension of Time Request Florida Income/Franchise

Tax Due

Florida return, Florida Form F-7004 must be timely filed, even if you have already filed

a federal extension request. A federal extension by itself does not extend the time to 1. Tentative amount of Florida tax for the taxable year 1.

file a Florida return.

An extension for Florida tax purposes may be granted, even though no federal 2. LESS: Estimated tax payments for the taxable year 2.

extension was granted. See Rule 12C-1.0222, F.A.C., for information on the 3. Balance due — You must pay 100% of the tax 3.

requirements that must be met for your request for an extension of time to be valid. tentatively determined due with this extension request.

Transfer the amount on Line 3 to Tentative tax due on reverse side.

Make checks payable and mail to:

FLORIDA DEPARTMENT OF REVENUE, 5050 W TENNESSEE STREET, TALLAHASSEE FL 32399-0135

Florida Department of Revenue - Corporate Income Tax Company ID Here

Florida Tentative Income / Franchise Tax Return F-7004

and Application for Extension of Time to File Return R. 01/17

Name FDOR - Corporate Test FEIN

Address 5050 W Tennessee Street Taxable Year End ___/___

City/State/ZIP Tallahassee, FL 32399-0141 FILING STATUS Partnership____ S-corporation___

All other federal returns to be filed ___

Tentative Tax Due $

Under penalties of perjury, I declare that I have been authorized by the above named taxpayer to make this application, that to the best of my knowledge

and belief the statements herein are true and correct:

Sign Here: ______________________________________________________ Date: _____________________________

012345678901234000 000000000000000000 000000000000000000 000000000000000000000000

112345678901234000 000000000000000000 000000000000000000 000000000000000000000000

202212318901234000 000000000000000000 000000000000000000 000000000000000000000000

000000000000000000 000000000000000000 000000000000000000 000000000000000000000000

101234567890123000 000000000000000000 000000000000000000 000000000000000000000000

000000000000000000 000000000000000000 000000000000000000 000000000000000000000000

000000000000000000 000000000000000000 000000000000000000 000000000000000000000000

000000000000000000 000000000000000000 000000000000000000 012345678901234

83XX 0 20221231 0002005030 5 3012345678 0000 9

|