- 3 -

Enlarge image

|

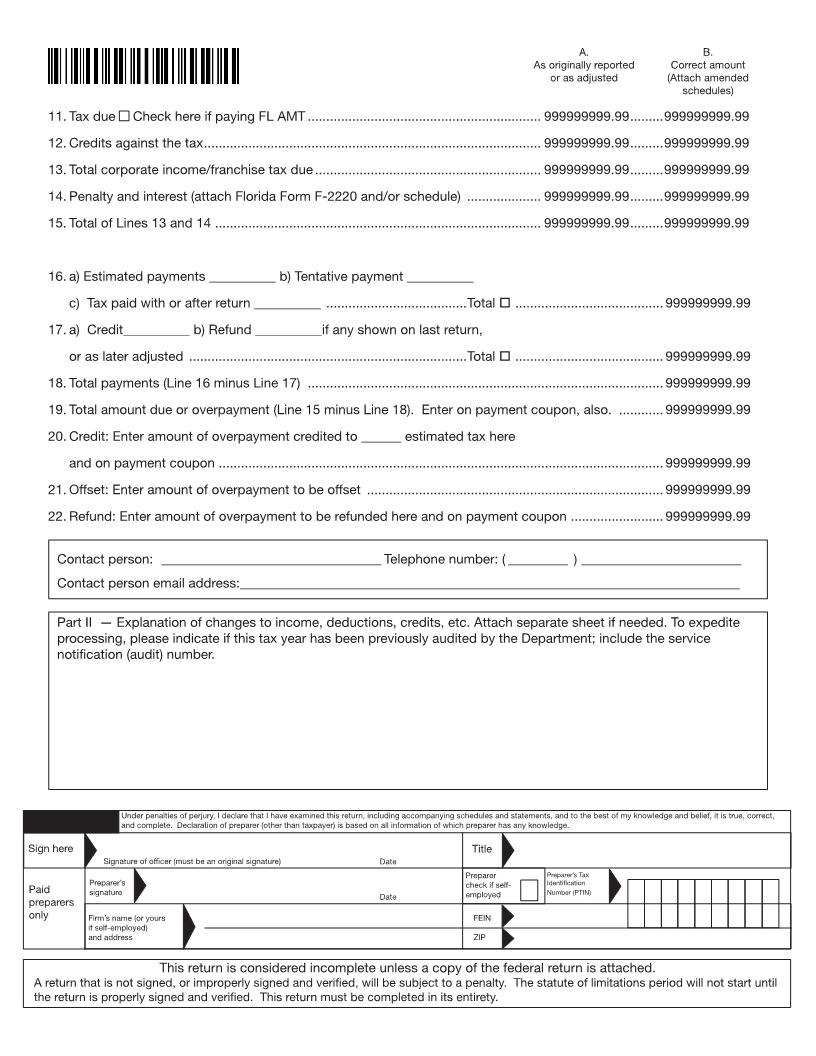

A. B.

As originally reported Correct amount

or as adjusted (Attach amended

schedules)

11. Tax due Check here if paying FL AMT ............................................................... 999999999.99 .........999999999.99

12. Credits against the tax ........................................................................................... 999999999.99 .........999999999.99

13. Total corporate income/franchise tax due ............................................................. 999999999.99 .........999999999.99

14. Penalty and interest (attach Florida Form F-2220 and/or schedule) .................... 999999999.99 .........999999999.99

15. Total of Lines 13 and 14 ........................................................................................ 999999999.99 .........999999999.99

16. a) Estimated payments __________ b) Tentative payment __________

c) Tax paid with or after return __________ ......................................Total o ........................................ 999999999.99

17. a) Credit__________ b) Refund __________if any shown on last return,

or as later adjusted ...........................................................................Total o........................................ 999999999.99

18. Total payments (Line 16 minus Line 17) ................................................................................................ 999999999.99

19. Total amount due or overpayment (Line 15 minus Line 18). Enter on payment coupon, also. ............ 999999999.99

20. Credit: Enter amount of overpayment credited to ______ estimated tax here

and on payment coupon ........................................................................................................................ 999999999.99

21. Offset: Enter amount of overpayment to be offset ................................................................................ 999999999.99

22. Refund: Enter amount of overpayment to be refunded here and on payment coupon ......................... 999999999.99

Contact person: _________________________________ Telephone number: ( _________ ) ________________________

Contact person email address:___________________________________________________________________________

Part II — Explanation of changes to income, deductions, credits, etc. Attach separate sheet if needed. To expedite

processing, please indicate if this tax year has been previously audited by the Department; include the service

notification (audit) number.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct,

and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign here Title

Signature of officer (must be an original signature) Date

Preparer Preparer’s Tax

signature employed Number (PTIN)

Paid Preparer’s Date check if self- Identification

preparers

only Firm’s name (or yours FEIN

if self-employed)

and address ZIP

This return is considered incomplete unless a copy of the federal return is attached.

A return that is not signed, or improperly signed and verified, will be subject to a penalty. The statute of limitations period will not start until

the return is properly signed and verified. This return must be completed in its entirety.

|