- 2 -

Enlarge image

|

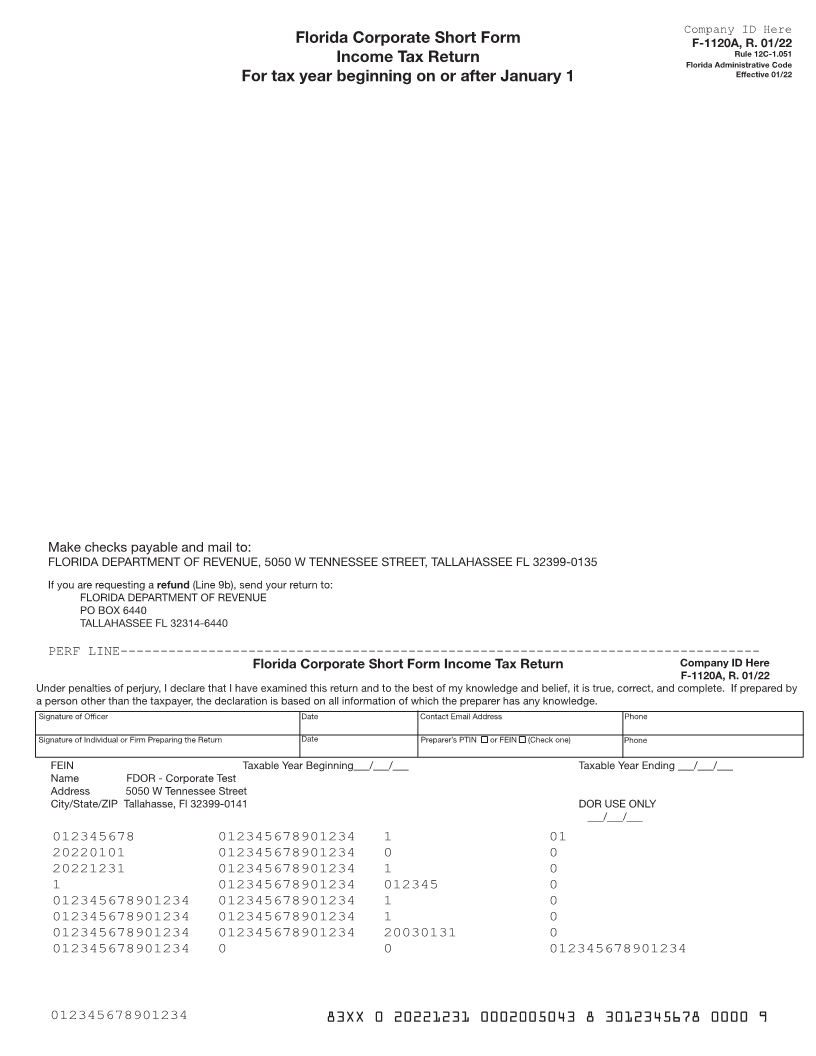

Company ID Here

Florida Corporate Short Form F-1120A, R. 01/22

Rule 12C-1.051

Income Tax Return Florida Administrative Code

For tax year beginning on or after January 1 Effective 01/22

Make checks payable and mail to:

FLORIDA DEPARTMENT OF REVENUE, 5050 W TENNESSEE STREET, TALLAHASSEE FL 32399-0135

If you are requesting a refund (Line 9b), send your return to:

FLORIDA DEPARTMENT OF REVENUE

PO BOX 6440

TALLAHASSEE FL 32314-6440

PERF LINE--------------------------------------------------------------------------------

Florida Corporate Short Form Income Tax Return Company ID Here

F-1120A, R. 01/22

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief, it is true, correct, and complete. If prepared by

a person other than the taxpayer, the declaration is based on all information of which the preparer has any knowledge.

Signature of Officer Date Contact Email Address Phone

Signature of Individual or Firm Preparing the Return Date Preparer’s PTIN or FEIN (Check one) Phone

FEIN Taxable Year Beginning___/___/___ Taxable Year Ending ___/___/___

Name FDOR - Corporate Test

Address 5050 W Tennessee Street

City/State/ZIP Tallahasse, Fl 32399-0141 DOR USE ONLY

___/___/___

012345678901234000012345678901234000123456789012345000 012345678901234000

2022010189012340000123456789012340000 00012345678901234000

202212318901234000012345678901234000123456789012345000 123456789012340000

112345678901234000012345678901234000012345678901234000 123456789012340000

012345678901234000012345678901234000123456789012345000 123456789012340000

012345678901234000012345678901234000123456789012345000 123456789012340000

012345678901234000012345678901234000200301318901234000 123456789012340000

012345678901234000012345678901234000 123456789012340000 0123456789012340

012345678901234 83XX 0 20221231 0002005043 8 3012345678 0000 9

|