Enlarge image

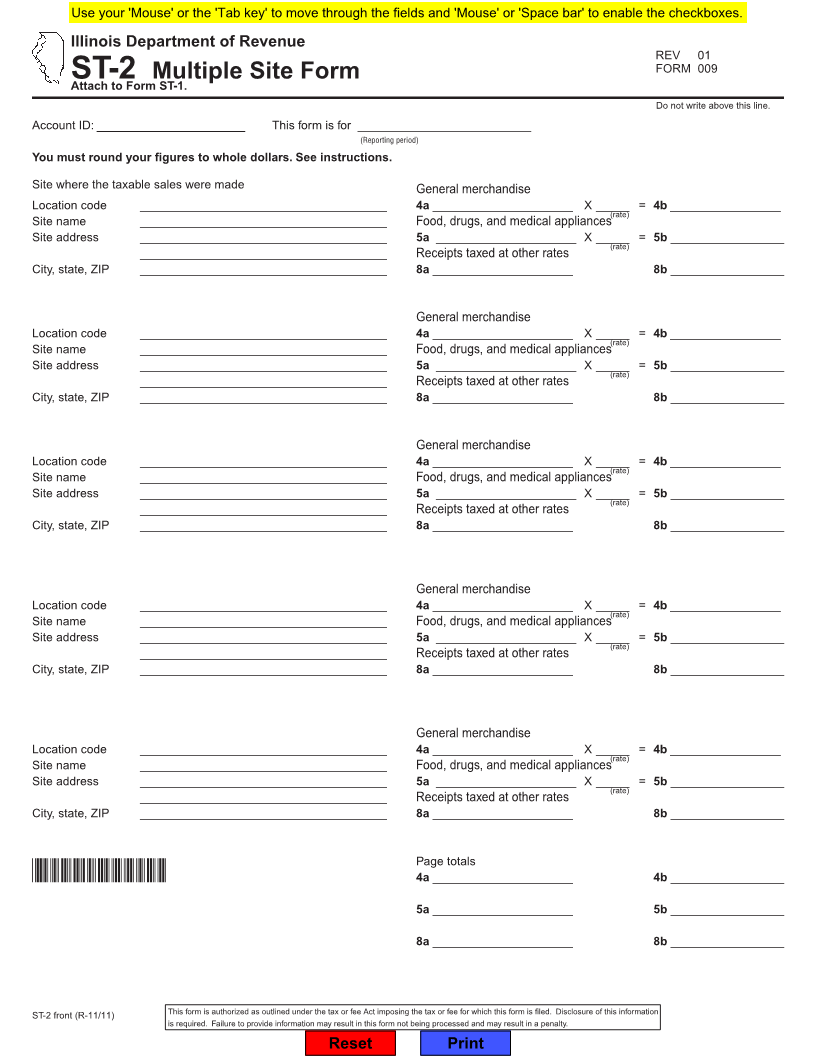

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

REV 01

ST-2 Multiple Site Form FORM 009

Attach to Form ST-1.

Do not write above this line.

Account ID: ____________________ This form is for __________________________

(Reporting period)

You must round your figures to whole dollars. See instructions.

Site where the taxable sales were made General merchandise

Location code _____________________________________ 4a _____________________ X _____ = 4b _________________

(rate)

Site name _____________________________________ Food, drugs, and medical appliances

Site address _____________________________________ 5a _____________________ X _____ = 5b _________________

(rate)

_____________________________________ Receipts taxed at other rates

City, state, ZIP _____________________________________ 8a _____________________ 8b _________________

General merchandise

Location code _____________________________________ 4a _____________________ X _____ = 4b _________________

(rate)

Site name _____________________________________ Food, drugs, and medical appliances

Site address _____________________________________ 5a _____________________ X _____ = 5b _________________

(rate)

_____________________________________ Receipts taxed at other rates

City, state, ZIP _____________________________________ 8a _____________________ 8b _________________

General merchandise

Location code _____________________________________ 4a _____________________ X _____ = 4b _________________

(rate)

Site name _____________________________________ Food, drugs, and medical appliances

Site address _____________________________________ 5a _____________________ X _____ = 5b _________________

(rate)

_____________________________________ Receipts taxed at other rates

City, state, ZIP _____________________________________ 8a _____________________ 8b _________________

General merchandise

Location code _____________________________________ 4a _____________________ X _____ = 4b _________________

(rate)

Site name _____________________________________ Food, drugs, and medical appliances

Site address _____________________________________ 5a _____________________ X _____ = 5b _________________

(rate)

_____________________________________ Receipts taxed at other rates

City, state, ZIP _____________________________________ 8a _____________________ 8b _________________

General merchandise

Location code _____________________________________ 4a _____________________ X _____ = 4b _________________

(rate)

Site name _____________________________________ Food, drugs, and medical appliances

Site address _____________________________________ 5a _____________________ X _____ = 5b _________________

(rate)

_____________________________________ Receipts taxed at other rates

City, state, ZIP _____________________________________ 8a _____________________ 8b _________________

Page totals

*100901110* 4a _____________________ 4b_________________

5a _____________________ 5b _________________

8a _____________________ 8b _________________

ST-2 front (R-11/11) This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this information

is required. Failure to provide information may result in this form not being processed and may result in a penalty.

Reset Print