Enlarge image

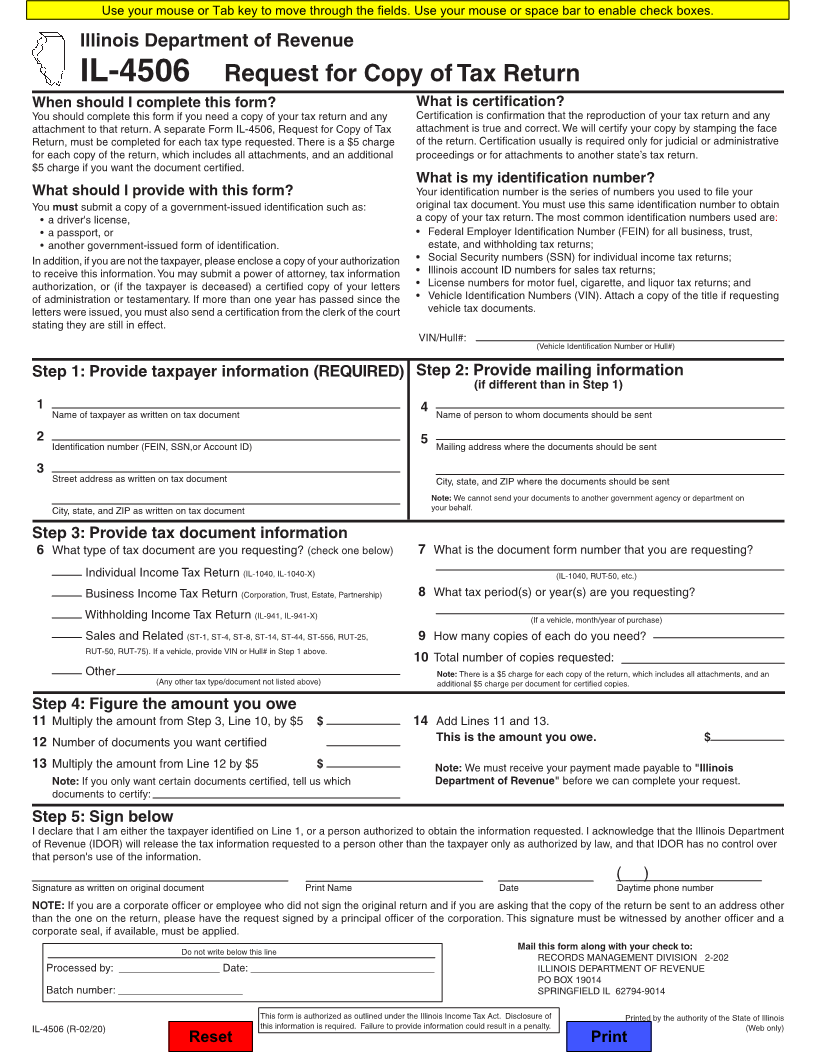

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

IL-4506 Request for Copy of Tax Return

When should I complete this form? What is certification?

You should complete this form if you need a copy of your tax return and any Certification is confirmation that the reproduction of your tax return and any

attachment to that return. A separate Form IL-4506, Request for Copy of Tax attachment is true and correct. We will certify your copy by stamping the face

Return, must be completed for each tax type requested. There is a $5 charge of the return. Certification usually is required only for judicial or administrative

for each copy of the return, which includes all attachments, and an additional proceedings or for attachments to another state’s tax return.

$5 charge if you want the document certified.

What is my identification number?

What should I provide with this form? Your identification number is the series of numbers you used to file your

You must submit a copy of a government-issued identification such as: original tax document. You must use this same identification number to obtain

• a driver's license, a copy of your tax return. The most common identification numbers used are:

• a passport, or • Federal Employer Identification Number (FEIN) for all business, trust,

• another government-issued form of identification. estate, and withholding tax returns;

In addition, if you are not the taxpayer, please enclose a copy of your authorization • Social Security numbers (SSN) for individual income tax returns;

to receive this information. You may submit a power of attorney, tax information • Illinois account ID numbers for sales tax returns;

authorization, or (if the taxpayer is deceased) a certified copy of your letters • License numbers for motor fuel, cigarette, and liquor tax returns; and

of administration or testamentary. If more than one year has passed since the • Vehicle Identification Numbers (VIN). Attach a copy of the title if requesting

letters were issued, you must also send a certification from the clerk of the court vehicle tax documents.

stating they are still in effect.

VIN/Hull#:

(Vehicle Identification Number or Hull#)

Step 1: Provide taxpayer information (REQUIRED) Step 2: Provide mailing information

(if different than in Step 1)

Name of taxpayer as written on tax document

1 4 Name of person to whom documents should be sent

Identification number (FEIN, SSN,or Account ID)

2 5 Mailing address where the documents should be sent

3

Street address as written on tax document City, state, and ZIP where the documents should be sent

Note: We cannot send your documents to another government agency or department on

City, state, and ZIP as written on tax document your behalf.

Step 3: Provide tax document information

6 What type of tax document are you requesting? (check one below) 7 What is the document form number that you are requesting?

Individual Income Tax Return (IL-1040, IL-1040-X) (IL-1040, RUT-50, etc.)

Business Income Tax Return (Corporation, Trust, Estate, Partnership) 8 What tax period(s) or year(s) are you requesting?

Withholding Income Tax Return (IL-941, IL-941-X) (If a vehicle, month/year of purchase)

Sales and Related (ST-1, ST-4, ST-8, ST-14, ST-44, ST-556, RUT-25, 9 How many copies of each do you need?

RUT-50, RUT-75). If a vehicle, provide VIN or Hull# in Step 1 above.

10 Total number of copies requested:

Other Note: There is a $5 charge for each copy of the return, which includes all attachments, and an

(Any other tax type/document not listed above) additional $5 charge per document for certified copies.

Step 4: Figure the amount you owe

11 Multiply the amount from Step 3, Line 10, by $5 $ 14 Add Lines 11 and 13.

12 Number of documents you want certified This is the amount you owe. $

13 Multiply the amount from Line 12 by $5 $ Note: We must receive your payment made payable to"Illinois

Note: If you only want certain documents certified, tell us which Department of Revenue" before we can complete your request.

documents to certify:

Step 5: Sign below

I declare that I am either the taxpayer identified on Line 1, or a person authorized to obtain the information requested. I acknowledge that the Illinois Department

of Revenue (IDOR) will release the tax information requested to a person other than the taxpayer only as authorized by law, and that IDOR has no control over

that person's use of the information.

( )

Signature as written on original document Print Name Date Daytime phone number

NOTE: If you are a corporate officer or employee who did not sign the original return and if you are asking that the copy of the return be sent to an address other

than the one on the return, please have the request signed by a principal officer of the corporation. This signature must be witnessed by another officer and a

corporate seal, if available, must be applied.

Do not write below this line Mail this form along with your check to:

RECORDS MANAGEMENT DIVISION 2-202

Processed by: _________________ Date: _______________________________ ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19014

Batch number: _____________________ SPRINGFIELD IL 62794-9014

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of Printed by the authority of the State of Illinois

IL-4506 (R-02/20) this information is required. Failure to provide information could result in a penalty. (Web only)

Reset Print