Enlarge image

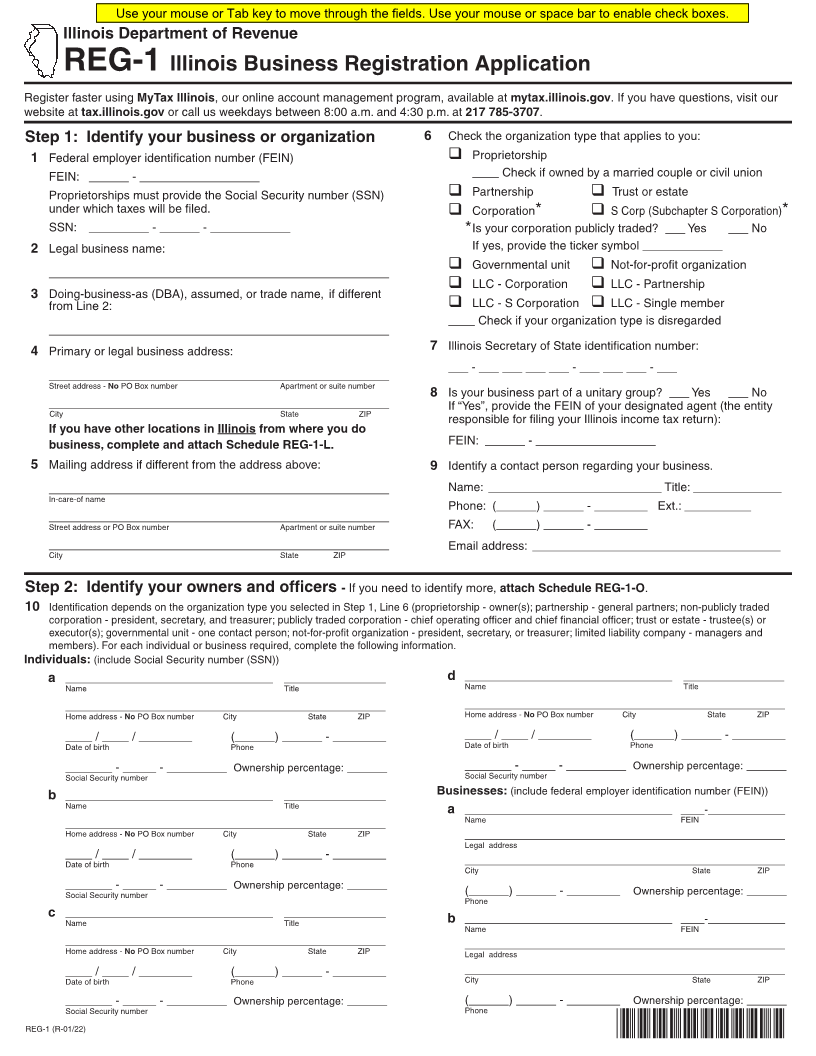

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

REG-1 Illinois Business Registration Application

Register faster using MyTax Illinois, our online account management program, available at mytax.illinois.gov . If you have questions, visit our

website at tax.illinois.gov or call us weekdays between 8:00 a.m. and 4:30 p.m. at 217 785-3707.

Step 1: Identify your business or organization 6 Check the organization type that applies to you:

1 Federal employer identification number (FEIN) q Proprietorship

FEIN: ______ - __________________ ____ Check if owned by a married couple or civil union

Proprietorships must provide the Social Security number (SSN) q Partnership q Trust or estate

under which taxes will be filed. q Corporation* q S Corp (Subchapter S Corporation)*

SSN: _________ - ______ - ____________ * Is your corporation publicly traded? ___ Yes ___ No

2 Legal business name: If yes, provide the ticker symbol ____________

q Governmental unit q Not-for-profit organization

___________________________________________________

q LLC - Corporation q LLC - Partnership

3 Doing-business-as (DBA), assumed, or trade name, if different

from Line 2: q LLC - S Corporation q LLC - Single member

____ Check if your organization type is disregarded

___________________________________________________

4 Primary or legal business address: 7 Illinois Secretary of State identification number:

___ - ___ ___ ___ ___ - ___ ___ ___ - ___

___________________________________________________

Street address - No PO Box number Apartment or suite number

8 Is your business part of a unitary group? ___ Yes ___ No

___________________________________________________ If “Yes”, provide the FEIN of your designated agent (the entity

City State ZIP

responsible for filing your Illinois income tax return):

If you have other locations in Illinois from where you do

business, complete and attach Schedule REG-1-L. FEIN: ______ - __________________

5 Mailing address if different from the address above: 9 Identify a contact person regarding your business.

___________________________________________________ Name: __________________________ Title: _____________

In-care-of name

Phone: (______) ______ - ________ Ext.: __________

___________________________________________________

Street address or PO Box number Apartment or suite number FAX: (______) ______ - ________

___________________________________________________ Email address: ______________________________________

City State ZIP

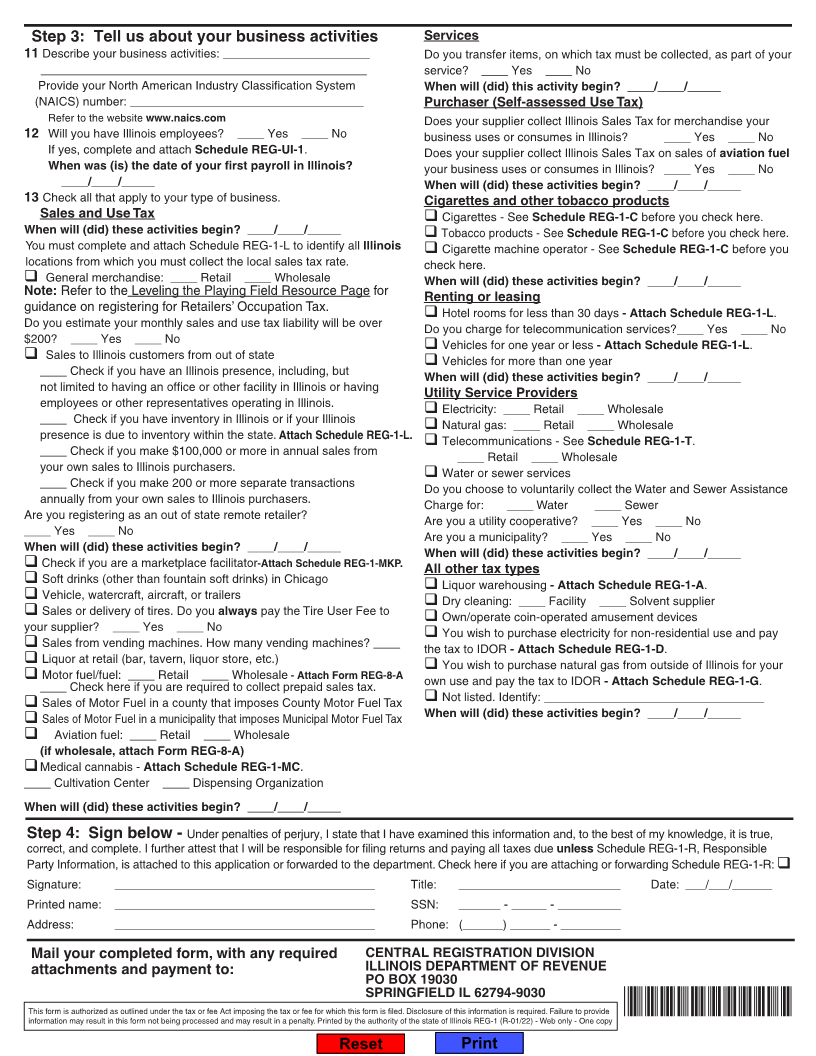

Step 2: Identify your owners and officers - If you need to identify more, attach Schedule REG-1-O.

10 Identification depends on the organization type you selected in Step 1, Line 6 (proprietorship - owner(s); partnership - general partners; non-publicly traded

corporation - president, secretary, and treasurer; publicly traded corporation - chief operating officer and chief financial officer; trust or estate - trustee(s) or

executor(s); governmental unit - one contact person; not-for-profit organization - president, secretary, or treasurer; limited liability company - managers and

members). For each individual or business required, complete the following information.

Individuals: (include Social Security number (SSN))

a ___________________________________ _________________ d ___________________________________ _________________

Name Title Name Title

______________________________________________________ ______________________________________________________

Home address - No PO Box number City State ZIP Home address - No PO Box number City State ZIP

____ / ____ / ________ (______) ______ - ________ ____ / ____ / ________ (______) ______ - ________

Date of birth Phone Date of birth Phone

_______ - _____ - _________ Ownership percentage: ______ _______ - _____ - _________ Ownership percentage: ______

Social Security number Social Security number

b ___________________________________ _________________ Businesses:(include federal employer identification number (FEIN))

Name Title a ___________________________________ ____-_____________

______________________________________________________ Name FEIN

Home address - No PO Box number City State ZIP ______________________________________________________

Legal address

____ / ____ / ________ (______) ______ - ________ ______________________________________________________

Date of birth Phone City State ZIP

_______ - _____ - _________ Ownership percentage: ______ (______) ______ - ________ Ownership percentage: ______

Social Security number Phone

c ___________________________________ _________________ b ___________________________________ ____-_____________

Name Title Name FEIN

______________________________________________________ ______________________________________________________

Home address - No PO Box number City State ZIP Legal address

____ / ____ / ________ (______) ______ - ________ ______________________________________________________

Date of birth Phone City State ZIP

_______ - _____ - _________ Ownership percentage: ______ (______) ______ - ________ Ownership percentage: ______

Social Security number Phone

REG-1 (R-01/22) *74501221W*