Enlarge image

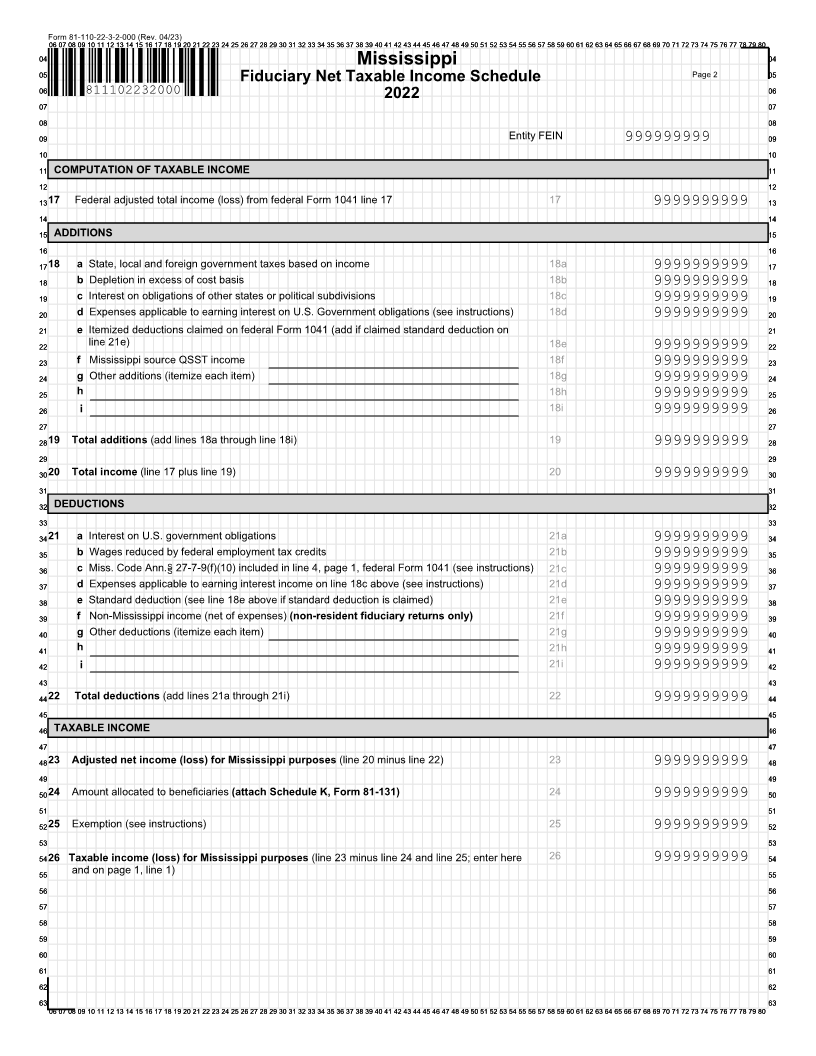

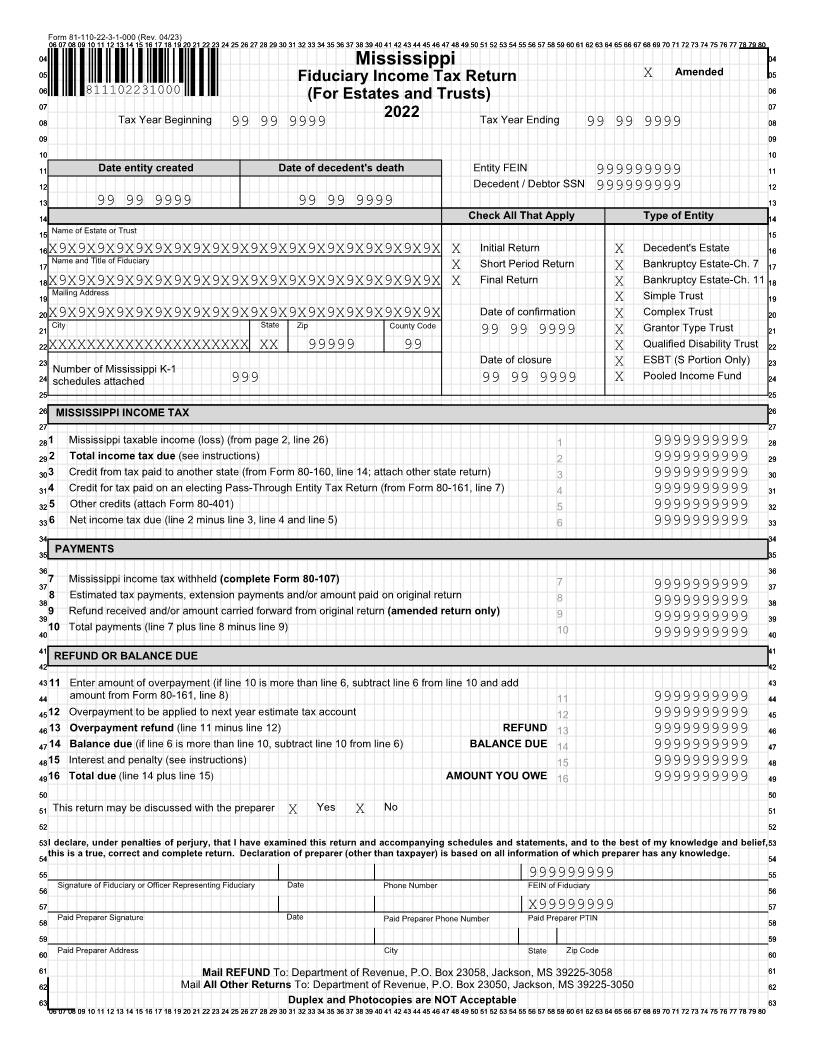

Form 81-110-22-3-1-000 (Rev. 04/23)

0606 0707 08009 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

0404 Mississippi 0404

Amended

0505 Fiduciary Income Tax Return X 0505

0606 811102231000 0606

(For Estates and Trusts)

0707 0707

2022

0808 Tax Year Beginning 99 99 9999 Tax Year Ending 99 99 9999 0808

0909 0909

1010 1010

1111 Date entity created Date of decedent's death Entity FEIN 999999999 1111

1212 Decedent / Debtor SSN 999999999 1212

1313 99 99 9999 99 99 9999 1313

1414 Check All That Apply Type of Entity 1414

1515 Name of Estate or Trust 1515

1616X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X X Initial Return X Decedent's Estate 1616

1717 Name and Title of Fiduciary X Short Period Return X Bankruptcy Estate-Ch. 7 1717

1818X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X X Final Return X Bankruptcy Estate-Ch. 11 1818

1919 Mailing Address Simple Trust 1919

X

2020X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X Date of confirmation X Complex Trust 2020

2121 City State Zip County Code Grantor Type Trust 2121

99 99 9999 X

2222XXXXXXXXXXXXXXXXXXXXX XX 99999 99 X Qualified Disability Trust 2222

2323 Date of closure X ESBT (S Portion Only) 2323

Number of Mississippi K-1

2424 schedules attached 999 99 99 9999 X Pooled Income Fund 2424

2525 2525

2626 MISSISSIPPI INCOME TAX 2626

2727 2727

28281 Mississippi taxable income (loss) (from page 2, line 26) 1 9999999999 2828

2929 2 Total income tax due (see instructions) 2 9999999999 2929

30303 Credit from tax paid to another state (from Form 80-160, line 14; attach other state return) 3 9999999999 3030

31314 Credit for tax paid on an electing Pass-Through Entity Tax Return (from Form 80-161, line 7) 4 9999999999 3131

3232 5 Other credits (attach Form 80-401) 5 9999999999 3232

3333 6 Net income tax due (line 2 minus line 3, line 4 and line 5) 6 9999999999 3333

3434 3434

3535 PAYMENTS 3535

3636 3636

37377 Mississippi income tax withheld (complete Form 80-107) 7 9999999999 3737

3838 8 Estimated tax payments, extension payments and/or amount paid on original return 8 9999999999 3838

39399 Refund received and/or amount carried forward from original return (amended return only) 9 3939

9999999999

404010 Total payments (line 7 plus line 8 minus line 9) 10 4040

9999999999

4141 REFUND OR BALANCE DUE 4141

4242 4242

4343 11 Enter amount of overpayment (if line 10 is more than line 6, subtract line 6 from line 10 and add 4343

4444 amount from Form 80-161, line 8) 11 9999999999 4444

454512 Overpayment to be applied to next year estimate tax account 12 9999999999 4545

464613 Overpayment refund (line 11 minus line 12) REFUND 13 9999999999 4646

474714 Balance due (if line 6 is more than line 10, subtract line 10 from line 6) BALANCE DUE 14 9999999999 4747

484815 Interest and penalty (see instructions) 15 9999999999 4848

494916 Total due (line 14 plus line 15) AMOUNT YOU OWE 16 9999999999 4949

5050 5050

5151 This return may be discussed with the preparer X Yes X No 5151

5252 5252

5353I declare, under penalties of perjury, that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, 5353

5454this is a true, correct and complete return. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. 5454

5555 999999999 5555

5656 Signature of Fiduciary or Officer Representing Fiduciary Date Phone Number FEIN of Fiduciary 5656

5757 X99999999 5757

5858 Paid Preparer Signature Date Paid Preparer Phone Number Paid Preparer PTIN 5858

5959 5959

6060 Paid Preparer Address City State Zip Code 6060

6161 Mail REFUND To: Department of Revenue, P.O. Box 23058, Jackson, MS 39225-3058 6161

6262 Mail All Other Returns To: Department of Revenue, P.O. Box 23050, Jackson, MS 39225-3050 6262

6363 Duplex and Photocopies are NOT Acceptable 6363

0606 0707 08009 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80