Enlarge image

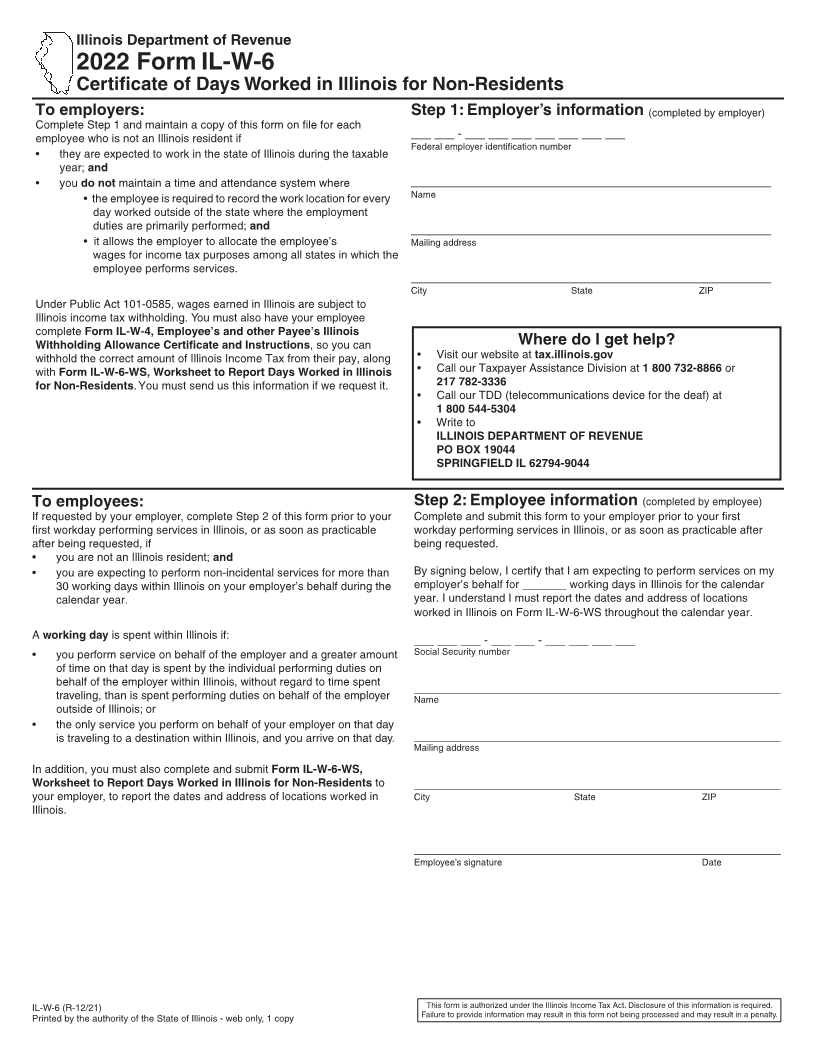

Illinois Department of Revenue

2022 Form IL-W-6

Certificate of Days Worked in Illinois for Non-Residents

To employers: Step 1: Employer’s information (completed by employer)

Complete Step 1 and maintain a copy of this form on file for each

employee who is not an Illinois resident if ___ ___ - ___ ___ ___ ___ ___ ___ ___

Federal employer identification number

• they are expected to work in the state of Illinois during the taxable

year; and

• youdo not maintain a time and attendance system where ______________________________________________________

• the employee is required to record the work location for every Name

day worked outside of the state where the employment

duties are primarily performed; and ______________________________________________________

• it allows the employer to allocate the employee’s Mailing address

wages for income tax purposes among all states in which the

employee performs services.

______________________________________________________

City State ZIP

Under Public Act 101-0585, wages earned in Illinois are subject to

Illinois income tax withholding. You must also have your employee

complete Form IL-W-4, Employee’s and other Payee’s Illinois

Withholding Allowance Certificate and Instructions, so you can Where do I get help?

withhold the correct amount of Illinois Income Tax from their pay, along • Visit our website at tax.illinois.gov

with Form IL-W-6-WS, Worksheet to Report Days Worked in Illinois • Call our Taxpayer Assistance Division at1 800 732-8866 or

for Non-Residents. You must send us this information if we request it. 217 782-3336

• Call our TDD (telecommunications device for the deaf) at

1 800 544-5304

• Write to

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19044

SPRINGFIELD IL 62794-9044

To employees: Step 2: Employee information (completed by employee)

If requested by your employer, complete Step 2 of this form prior to your Complete and submit this form to your employer prior to your first

first workday performing services in Illinois, or as soon as practicable workday performing services in Illinois, or as soon as practicable after

after being requested, if being requested.

• you are not an Illinois resident; and

• you are expecting to perform non-incidental services for more than By signing below, I certify that I am expecting to perform services on my

30 working days within Illinois on your employer’s behalf during the employer’s behalf for _______ working days in Illinois for the calendar

calendar year. year. I understand I must report the dates and address of locations

worked in Illinois on Form IL-W-6-WS throughout the calendar year.

A working day is spent within Illinois if: ___ ___ ___ - ___ ___ - ___ ___ ___ ___

• you perform service on behalf of the employer and a greater amount Social Security number

of time on that day is spent by the individual performing duties on

behalf of the employer within Illinois, without regard to time spent

_______________________________________________________

traveling, than is spent performing duties on behalf of the employer Name

outside of Illinois; or

• the only service you perform on behalf of your employer on that day

is traveling to a destination within Illinois, and you arrive on that day. _______________________________________________________

Mailing address

In addition, you must also complete and submit Form IL-W-6-WS,

Worksheet to Report Days Worked in Illinois for Non-Residents to _______________________________________________________

your employer, to report the dates and address of locations worked in City State ZIP

Illinois.

_______________________________________________________

Employee’s signature Date

IL-W-6 (R-12/21) This form is authorized under the Illinois Income Tax Act. Disclosure of this information is required.

Printed by the authority of the State of Illinois - web only, 1 copy Failure to provide information may result in this form not being processed and may result in a penalty.