Enlarge image

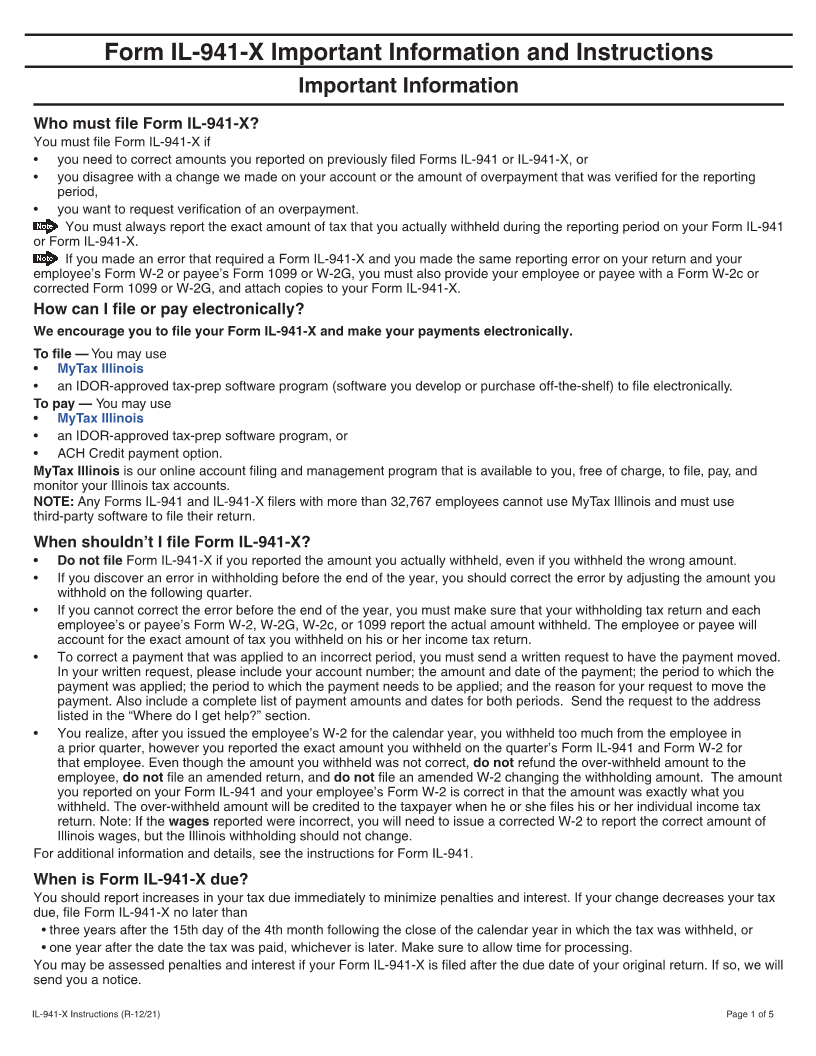

Form IL-941-X Important Information and Instructions

Important Information

Who must file Form IL-941-X?

You must file Form IL-941-X if

• you need to correct amounts you reported on previously filed Forms IL-941 or IL-941-X, or

• you disagree with a change we made on your account or the amount of overpayment that was verified for the reporting

period,

• you want to request verification of an overpayment.

You must always report the exact amount of tax that you actually withheld during the reporting period on your Form IL-941

or Form IL-941-X.

If you made an error that required a Form IL-941-X and you made the same reporting error on your return and your

employee’s Form W-2 or payee’s Form 1099 or W-2G, you must also provide your employee or payee with a Form W-2c or

corrected Form 1099 or W-2G, and attach copies to your Form IL-941-X.

How can I file or pay electronically?

We encourage you to file your Form IL-941-X and make your payments electronically.

To file — You may use

• MyTax Illinois

• an IDOR-approved tax-prep software program (software you develop or purchase off-the-shelf) to file electronically.

To pay — You may use

• MyTax Illinois

• an IDOR-approved tax-prep software program, or

• ACH Credit payment option.

MyTax Illinois is our online account filing and management program that is available to you, free of charge, to file, pay, and

monitor your Illinois tax accounts.

NOTE: Any Forms IL-941 and IL-941-X filers with more than 32,767 employees cannot use MyTax Illinois and must use

third-party software to file their return.

When shouldn’t I file Form IL-941-X?

• Do not file Form IL-941-X if you reported the amount you actually withheld, even if you withheld the wrong amount.

• If you discover an error in withholding before the end of the year, you should correct the error by adjusting the amount you

withhold on the following quarter.

• If you cannot correct the error before the end of the year, you must make sure that your withholding tax return and each

employee’s or payee’s Form W-2, W-2G, W-2c, or 1099 report the actual amount withheld. The employee or payee will

account for the exact amount of tax you withheld on his or her income tax return.

• To correct a payment that was applied to an incorrect period, you must send a written request to have the payment moved.

In your written request, please include your account number; the amount and date of the payment; the period to which the

payment was applied; the period to which the payment needs to be applied; and the reason for your request to move the

payment. Also include a complete list of payment amounts and dates for both periods. Send the request to the address

listed in the “Where do I get help?” section.

• You realize, after you issued the employee’s W-2 for the calendar year, you withheld too much from the employee in

a prior quarter, however you reported the exact amount you withheld on the quarter’s Form IL-941 and Form W-2 for

that employee. Even though the amount you withheld was not correct, do not refund the over-withheld amount to the

employee, do not file an amended return, and do not file an amended W-2 changing the withholding amount. The amount

you reported on your Form IL-941 and your employee’s Form W-2 is correct in that the amount was exactly what you

withheld. The over-withheld amount will be credited to the taxpayer when he or she files his or her individual income tax

return. Note: If the wages reported were incorrect, you will need to issue a corrected W-2 to report the correct amount of

Illinois wages, but the Illinois withholding should not change.

For additional information and details, see the instructions for Form IL-941.

When is Form IL-941-X due?

You should report increases in your tax due immediately to minimize penalties and interest. If your change decreases your tax

due, file Form IL-941-X no later than

• three years after the 15th day of the 4th month following the close of the calendar year in which the tax was withheld, or

• one year after the date the tax was paid, whichever is later. Make sure to allow time for processing.

You may be assessed penalties and interest if your Form IL-941-X is filed after the due date of your original return. If so, we will

send you a notice.

IL-941-X Instructions (R-12/21) Page 1 of 5