Enlarge image

Illinois Department of Revenue

2022 Schedule WC Instructions

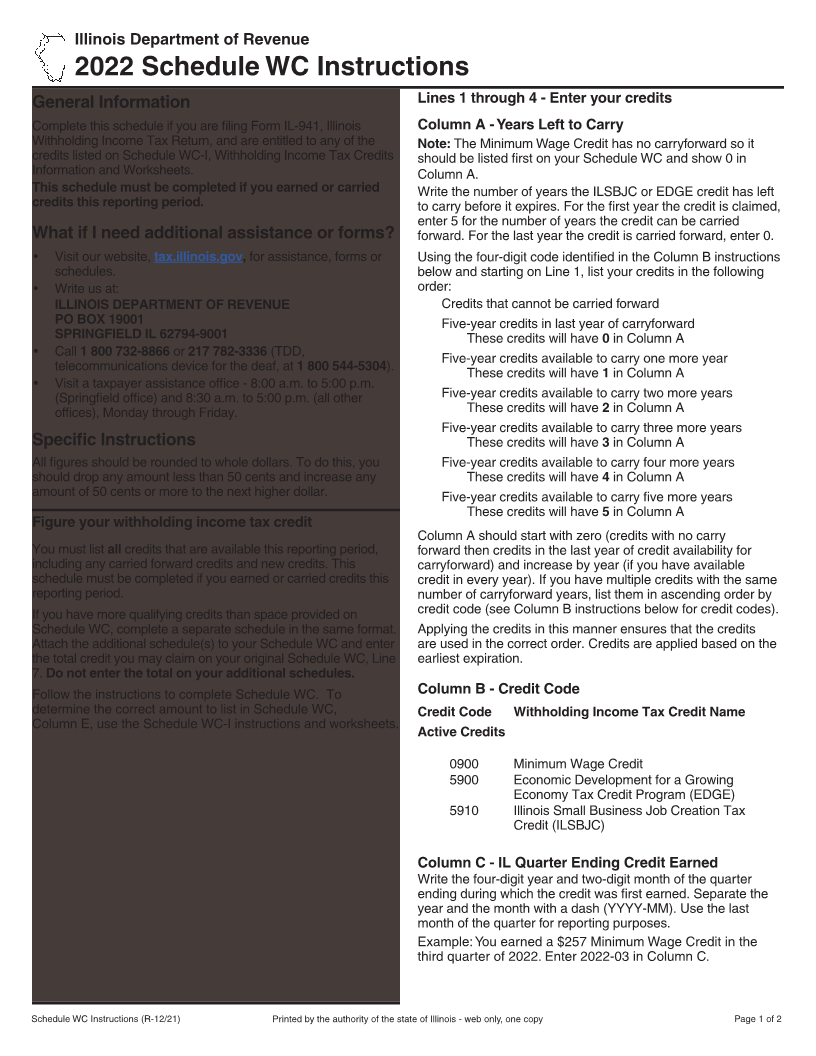

General Information Lines 1 through 4 - Enter your credits

Complete this schedule if you are filing Form IL-941, Illinois Column A - Years Left to Carry

Withholding Income Tax Return, and are entitled to any of the Note: The Minimum Wage Credit has no carryforward so it

credits listed on Schedule WC-I, Withholding Income Tax Credits should be listed first on your Schedule WC and show 0 in

Information and Worksheets. Column A.

This schedule must be completed if you earned or carried Write the number of years the ILSBJC or EDGE credit has left

credits this reporting period. to carry before it expires. For the first year the credit is claimed,

enter 5 for the number of years the credit can be carried

What if I need additional assistance or forms? forward. For the last year the credit is carried forward, enter 0.

• Visit our website, tax.illinois.gov, for assistance, forms or Using the four-digit code identified in the Column B instructions

schedules. below and starting on Line 1, list your credits in the following

• Write us at: order:

ILLINOIS DEPARTMENT OF REVENUE Credits that cannot be carried forward

PO BOX 19001 Five-year credits in last year of carryforward

SPRINGFIELD IL 62794-9001 These credits will have 0in Column A

• Call 1 800 732-8866 or 217 782-3336 (TDD,

Five-year credits available to carry one more year

telecommunications device for the deaf, at 1 800 544-5304).

These credits will have 1 in Column A

• Visit a taxpayer assistance office - 8:00 a.m. to 5:00 p.m.

(Springfield office) and 8:30 a.m. to 5:00 p.m. (all other Five-year credits available to carry two more years

offices), Monday through Friday. These credits will have 2 in Column A

Five-year credits available to carry three more years

Specific Instructions These credits will have 3 in Column A

All figures should be rounded to whole dollars. To do this, you Five-year credits available to carry four more years

should drop any amount less than 50 cents and increase any These credits will have 4 in Column A

amount of 50 cents or more to the next higher dollar. Five-year credits available to carry five more years

These credits will have 5 in Column A

Figure your withholding income tax credit

Column A should start with zero (credits with no carry

You must list all credits that are available this reporting period, forward then credits in the last year of credit availability for

including any carried forward credits and new credits. This carryforward) and increase by year (if you have available

schedule must be completed if you earned or carried credits this credit in every year). If you have multiple credits with the same

reporting period. number of carryforward years, list them in ascending order by

If you have more qualifying credits than space provided on credit code (see Column B instructions below for credit codes).

Schedule WC, complete a separate schedule in the same format. Applying the credits in this manner ensures that the credits

Attach the additional schedule(s) to your Schedule WC and enter are used in the correct order. Credits are applied based on the

the total credit you may claim on your original Schedule WC, Line earliest expiration.

7. Do not enter the total on your additional schedules.

Follow the instructions to complete Schedule WC. To Column B - Credit Code

determine the correct amount to list in Schedule WC, Credit Code Withholding Income Tax Credit Name

Column E, use the Schedule WC-I instructions and worksheets.

Active Credits

0900 Minimum Wage Credit

5900 Economic Development for a Growing

Economy Tax Credit Program (EDGE)

5910 Illinois Small Business Job Creation Tax

Credit (ILSBJC)

Column C - IL Quarter Ending Credit Earned

Write the four-digit year and two-digit month of the quarter

ending during which the credit was first earned. Separate the

year and the month with a dash (YYYY-MM). Use the last

month of the quarter for reporting purposes.

Example: You earned a $257 Minimum Wage Credit in the

third quarter of 2022. Enter 2022-03 in Column C.

Schedule WC Instructions (R-12/21) Printed by the authority of the state of Illinois - web only, one copy Page 1 of 2