Enlarge image

Illinois Department of Revenue

2022 Schedule WC-I

Withholding Income Tax Credits Information and Worksheets

What’s New for 2022?

Under P.A. 101-0001, the minimum wage is set to increase to $12 as of January 1, 2022, and by another $1 per hour,

each calendar year after, until it reaches $15 on January 1, 2025. See Hourly Minimum Wage Rates by Year for a

complete schedule.

For taxable years beginning on or after January 1, 2022, P.A. 102-0669 created the Reimagining Electric Vehicles

(REV) Illinois Credit, a portion of which may be based on the incremental income tax withheld by an employer and

attributable to new or retained employees at a REV Illinois Project. On or after January 1, 2025, a taxpayer awarded REV

Illinois Credits by the Illinois Department of Commerce and Economic Opportunity may make an irrevocable election

to claim the credit against its obligation to pay withholding. For more information on the REV Illinois Program, visit

https://www2.illinois.gov/dceo/businesshelp/REV/Pages/default.aspx

General Information

If you are entitled to any of the following withholding income tax credits, use the instructions and worksheets in this

schedule to determine the amount of credit to list in Column E, Credit Earned, of Schedule WC, Withholding Income

Tax Credits:

• Minimum Wage Credit (See Pages 1-7)

• Economic Development for a Growing Economy Tax Credit Program (EDGE) (See Page 7)

• Illinois Small Business Job Creation Tax Credit (ILSBJC) (See Page 7)

Keep a copy of your worksheets or calculations and Schedule WC in your records. You may be required to submit

further information to support your filing.

Specific Instructions

NOTE: This form is to be used to determine the amount of credit to list on your Schedule WC. Use Column E,

ONLY for credits earned in the current quarter.

Use these instructions and the worksheets in this schedule to determine the correct amount of credit to list in Column

E of Schedule WC for credits earned in the current quarter.

All figures should be rounded to whole dollars. To do this, drop any amount less than 50 cents and increase any

amount of 50 cents or more to the next higher dollar.

Each credit has a four-digit code used to identify it on Schedule WC.

Credit Code Income Tax Credit Name

0900 Minimum Wage Credit

5900 Economic Development for a Growing Economy Tax Credit Program (EDGE)

5910 Illinois Small Business Job Creation Tax Credit (ILSBJC)

Tax Credit that must be used in the current quarter

NOTE: This section is to be completed only for credits earned and used in the current quarter. Enter “0” on

Schedule WC, Column A. This credit cannot be carried forward and cannot exceed the withholding reported for the

quarter.

Minimum Wage Credit (Credit Code 0900)

35 ILCS 5/704A(i) For tax quarters beginning on or after January 1, 2020, and ending on or before

December 31, 2027, each employer with 50 or fewer full-time equivalent employees during the reporting period

may claim a credit against the payments due for each qualified employee in an amount equal to the maximum

credit allowable. NOTE: If the Minimum Wage Credit exceeds the withholding amount, you may only claim the

withholding amount as the credit. You will not be able to carry the remaining balance forward to future periods.

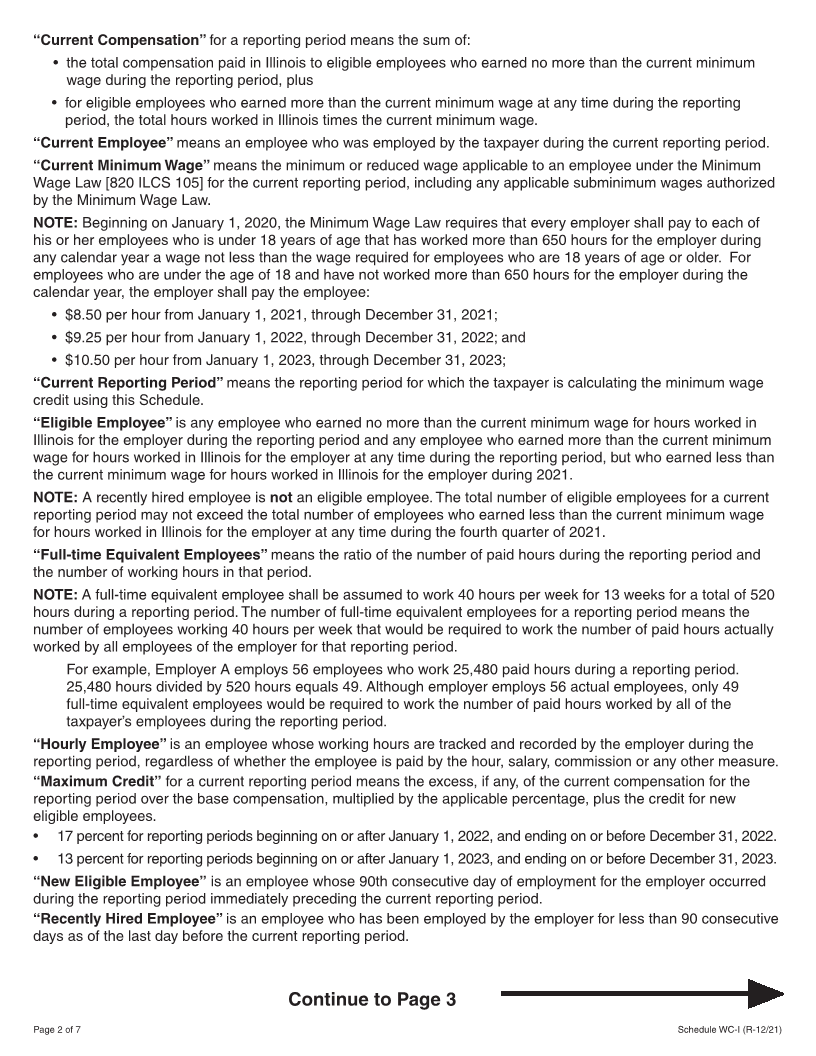

Definitions used in the calculation include the following:

“Applicable Percentage” means 17 percent for reporting periods beginning on or after January 1, 2022, and

ending on or before December 31, 2022.

“Base Compensation” for a reporting period means the total compensation paid in Illinois, during the fourth

quarter of 2021, to employees who earned less than the current minimum wage during that fourth quarter, including

employees earning a subminimum wage authorized by the Minimum Wage Law [820 ILCS 105].

Schedule WC-I (R-12/21) Printed by the authority of the state of Illinois - web only, 1 copy Page 1 of 7