Enlarge image

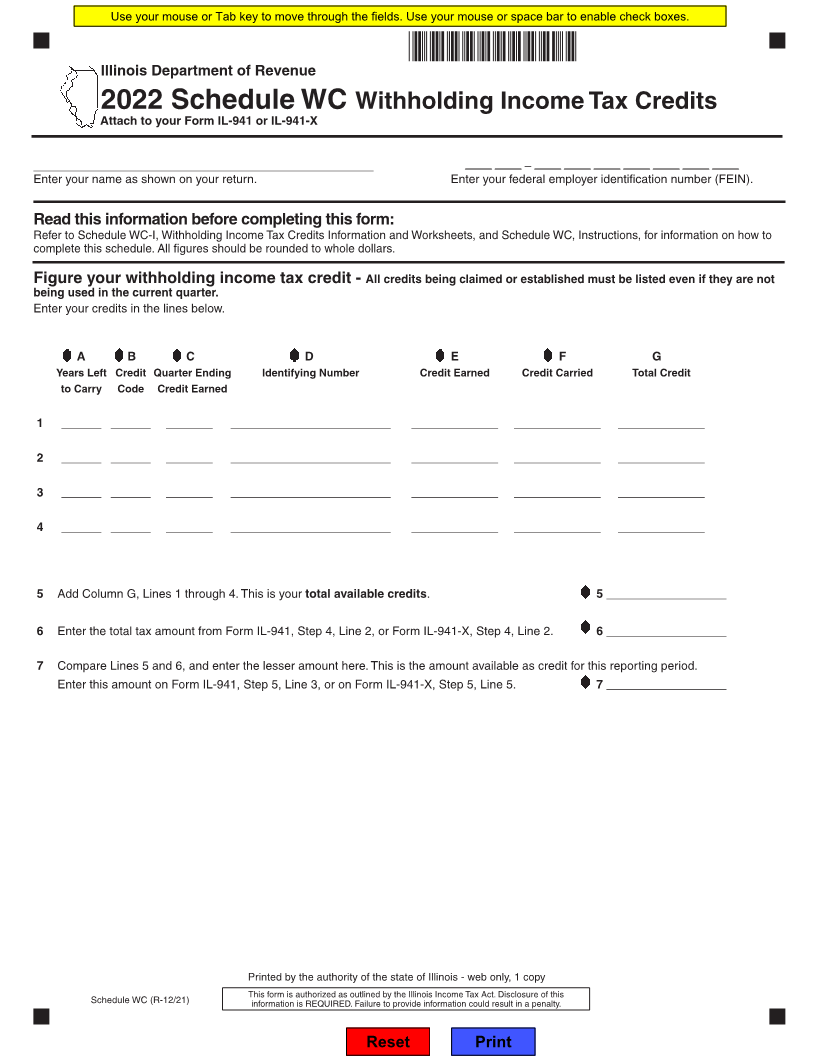

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

*72112221W*

Illinois Department of Revenue

2022 Schedule WC Withholding Income Tax Credits

Attach to your Form IL-941 or IL-941-X

___________________________________________________ –

Enter your name as shown on your return. Enter your federal employer identification number (FEIN).

Read this information before completing this form:

Refer to Schedule WC-I, Withholding Income Tax Credits Information and Worksheets, and Schedule WC, Instructions, for information on how to

complete this schedule. All figures should be rounded to whole dollars.

Figure your withholding income tax credit - All credits being claimed or established must be listed even if they are not

being used in the current quarter.

Enter your credits in the lines below.

A B C D E F G

Years Left Credit Quarter Ending Identifying Number Credit Earned Credit Carried Total Credit

to Carry Code Credit Earned

1 ______ ______ _______ ________________________ _____________ _____________ _____________

2 ______ ______ _______ ________________________ _____________ _____________ _____________

3 ______ ______ _______ ________________________ _____________ _____________ _____________

4 ______ ______ _______ ________________________ _____________ _____________ _____________

5 Add Column G, Lines 1 through 4. This is your total available credits. 5 __________________

6 Enter the total tax amount from Form IL-941, Step 4, Line 2, or Form IL-941-X, Step 4, Line 2. 6 __________________

7 Compare Lines 5 and 6, and enter the lesser amount here. This is the amount available as credit for this reporting period.

Enter this amount on Form IL-941, Step 5, Line 3, or on Form IL-941-X, Step 5, Line 5. 7 __________________

Printed by the authority of the state of Illinois - web only, 1 copy

Schedule WC (R-12/21) This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

information is REQUIRED. Failure to provide information could result in a penalty.

Reset Print