Enlarge image

Form IL-941 Information and Instructions

Important Information

Who must file Form IL-941?

You must file Form IL-941 if you paid amounts subject to Illinois withholding income tax (either required or by voluntary

agreement), such as:

• Wages and other employee compensation including bonus, overtime, and commission pay, usually reported to the recipient

on a Form W-2.

• Non-wage income such as pensions, annuities, unemployment income, and sick pay for which you have voluntarily agreed

to withhold Illinois taxes, usually reported to a recipient on a Form 1099.

• Gambling, lottery winnings, pari-mutuel wagering or sports wagering winnings over $1,000 (paid by the entity issuing the

winnings such as the Illinois Lottery or a casino), usually reported to a recipient on a Form W-2G.

• Amounts paid to purchase rights to Illinois lottery winnings reported on a Form 1099-MISC.

Note: Form IL-941 is the only form used to report Illinois income tax withholding with the exception of household employee

withholding, which can be reported on Form IL-1040, Individual Income Tax return. If you have household employees, see

Publication 121, Illinois Income Tax Withholding for Household Employees.

For more information, see Publication 130, Who is Required to Withhold Illinois Income Tax.

You must file Form IL-941 even if no tax was withheld during the reporting period (e.g., employees who are seasonal

workers). If you permanently discontinue having Illinois employees or payees, complete IL-941, Step 2, Line B, for your final

reporting period.

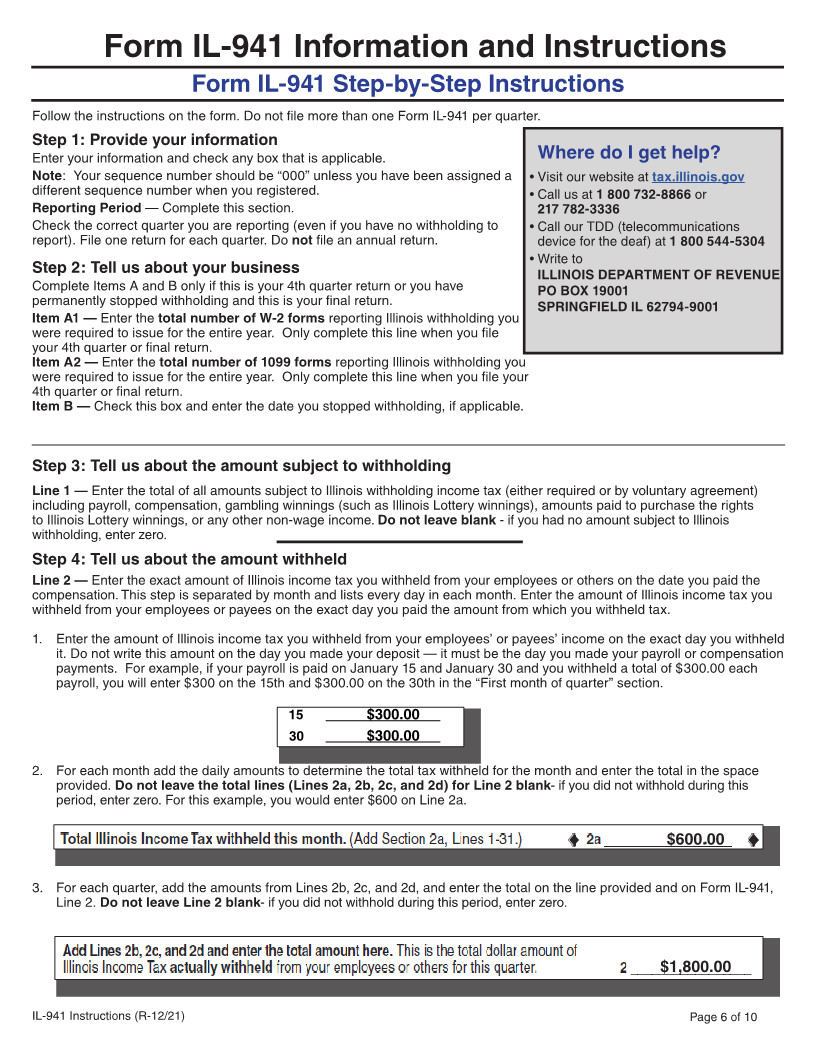

When is my Form IL-941 return due?

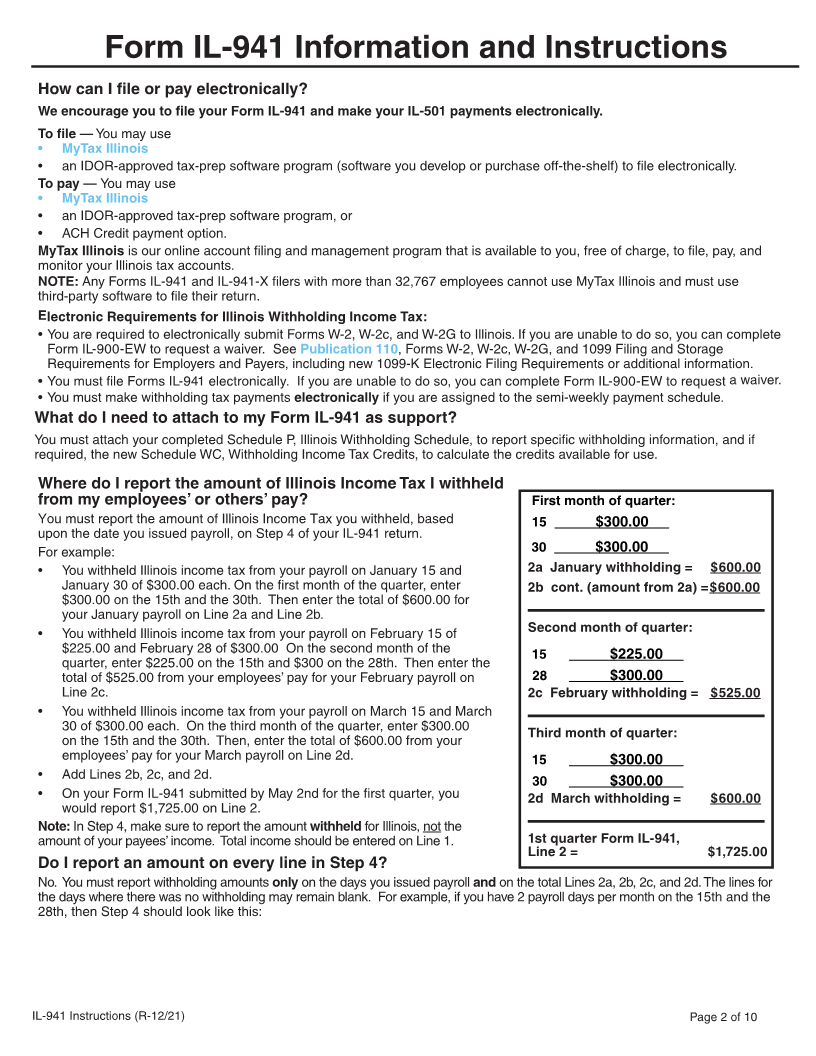

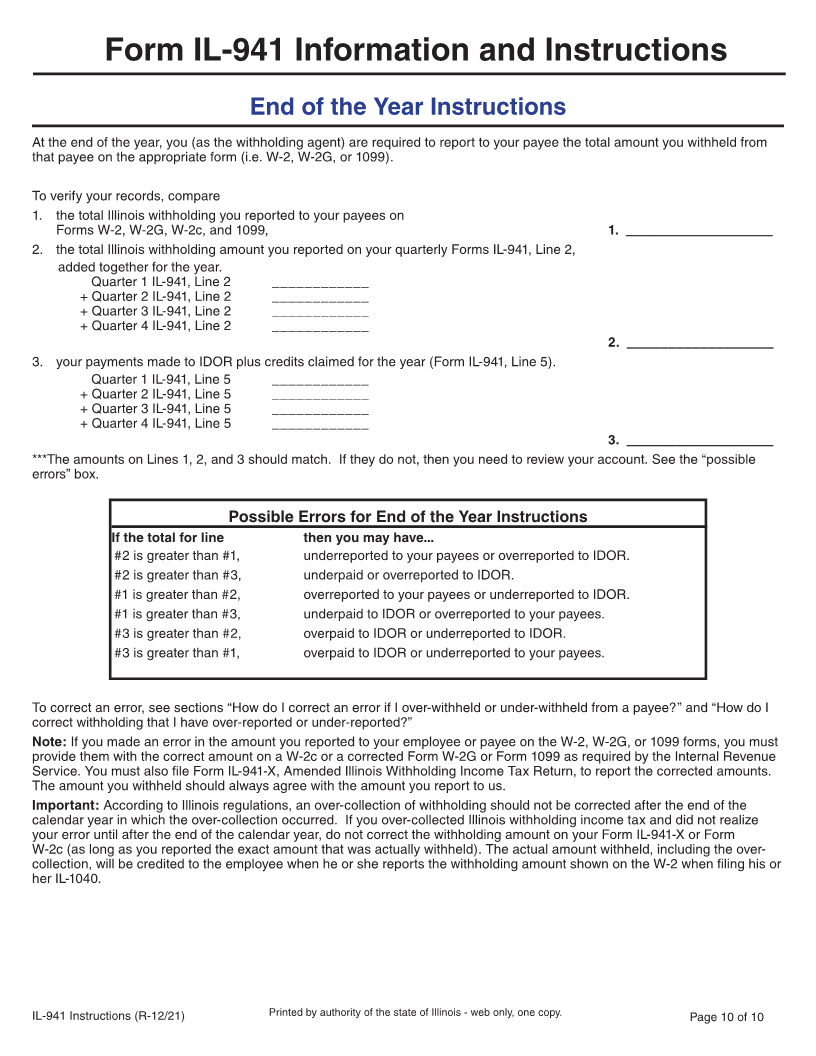

Your Form IL-941 is due quarterly. See the box to the When to File Form IL-941

right. 2022 Withholding Income Tax Payment and Filing Your Form IL-941 is due by the last day of the month that follows the end

Due Dates. of the quarter.

Unlike the federal government, Illinois does not require

an annual reconciliation return. If you submit an annual The quarter includes... Quarter ends IL-941 is due

reconciliation return, it will cause processing delays and an

error on your withholding account. 1. January, February, March March 31 May 2

2. April, May, June June 30 August 1

For more information, see the “End of the Year Instructions,”

after the “Step by Step Instructions” section. 3. July, August, September September 30 October 31

4. October, November, December December 31 January 31

*Note: If the due date falls on a weekend or holiday, the

return is due on the next business day.

IL-941 Instructions (R-12/21) Page 1 of 10