Enlarge image

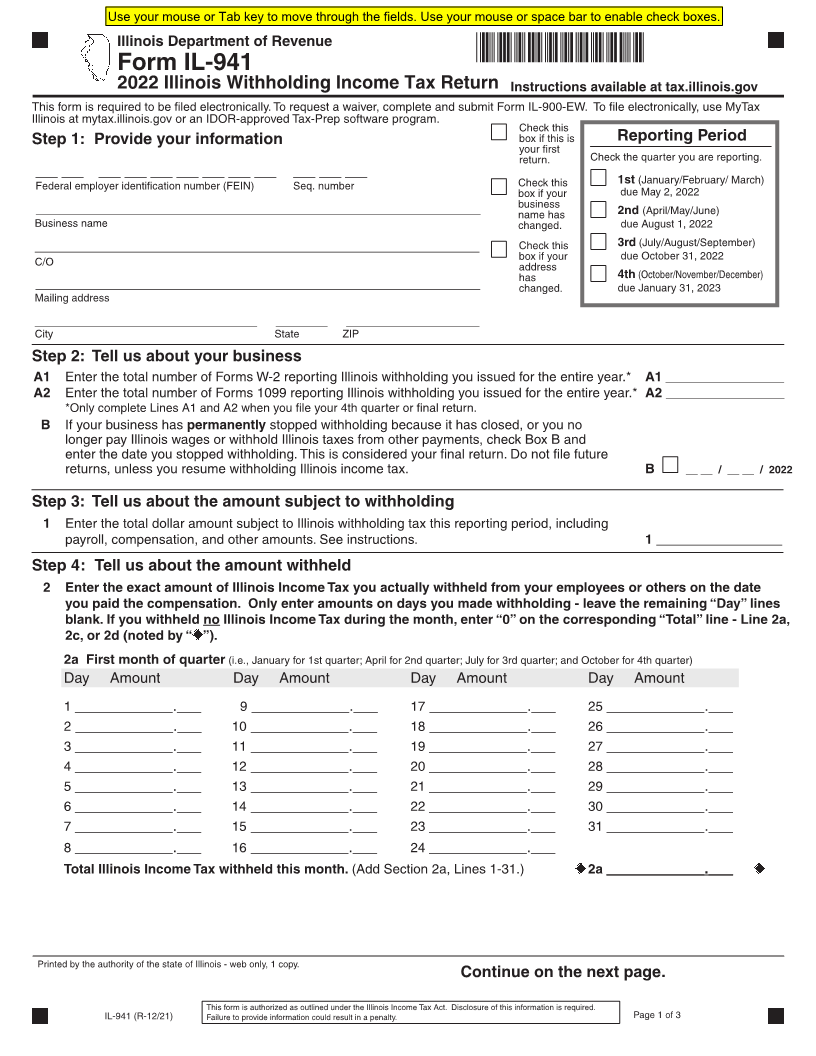

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

*71012221W*

Form IL-941

2022 Illinois Withholding Income Tax Return Instructions available at tax.illinois.gov

This form is required to be filed electronically. To request a waiver, complete and submit Form IL-900-EW. To file electronically, use MyTax

Illinois at mytax.illinois.gov or an IDOR-approved Tax-Prep software program.

Check this

Step 1: Provide your information box if this is Reporting Period

your first Check the quarter you are reporting.

return.

___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

Federal employer identification number (FEIN) Seq. number Check this 1st (January/February/ March)

box if your due May 2, 2022

____________________________________________________________ business 2nd (April/May/June)

name has

Business name changed. due August 1, 2022

____________________________________________________________ Check this 3rd (July/August/September)

C/O box if your due October 31, 2022

address

has 4th (October/November/December)

____________________________________________________________ changed. due January 31, 2023

Mailing address

______________________________ _______ __________________

City State ZIP

Step 2: Tell us about your business

A1 Enter the total number of Forms W-2 reporting Illinois withholding you issued for the entire year.* A1 ________________

A2 Enter the total number of Forms 1099 reporting Illinois withholding you issued for the entire year.* A2 ________________

*Only complete Lines A1 and A2 when you file your 4th quarter or final return.

B If your business has permanently stopped withholding because it has closed, or you no

longer pay Illinois wages or withhold Illinois taxes from other payments, check Box B and

enter the date you stopped withholding. This is considered your final return. Do not file future

returns, unless you resume withholding Illinois income tax. B __ __ / __ __ / 2022

Step 3: Tell us about the amount subject to withholding

1 Enter the total dollar amount subject to Illinois withholding tax this reporting period, including

payroll, compensation, and other amounts. See instructions. 1 _________________

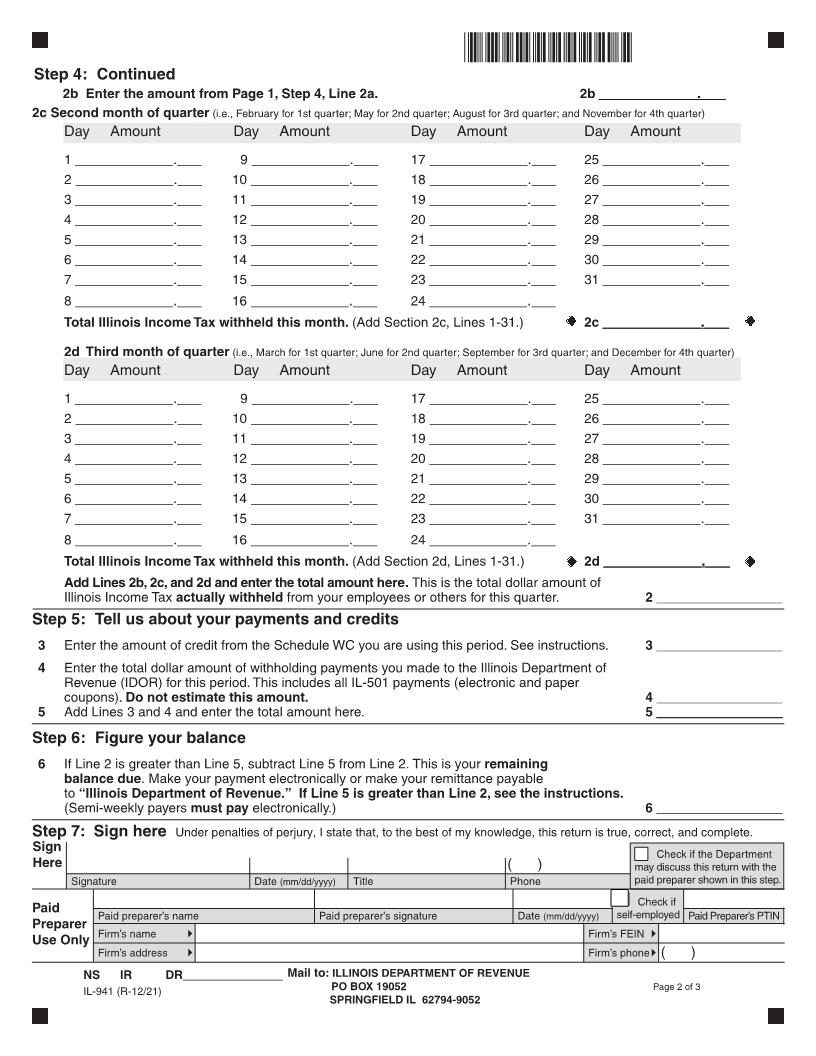

Step 4: Tell us about the amount withheld

2 Enter the exact amount of Illinois Income Tax you actually withheld from your employees or others on the date

you paid the compensation. Only enter amounts on days you made withholding - leave the remaining “Day” lines

blank. If you withheld no Illinois Income Tax during the month, enter “0” on the corresponding “Total” line - Line 2a,

2c, or 2d (noted by “ ”).

2a First month of quarter (i.e., January for 1st quarter; April for 2nd quarter; July for 3rd quarter; and October for 4th quarter)

Day Amount Day Amount Day Amount Day Amount

1 ____________.___ ____________.___9 17 ____________.___ 25 ____________.___

2 ____________.___ 10 ____________.___ 18 ____________.___ 26 ____________.___

3 ____________.___ 11 ____________.___ 19 ____________.___ 27 ____________.___

4 ____________.___ 12 ____________.___ 20 ____________.___ 28 ____________.___

5 ____________.___ 13 ____________.___ 21 ____________.___ 29 ____________.___

6 ____________.___ 14 ____________.___ 22 ____________.___ 30 ____________.___

7 ____________.___ 15 ____________.___ 23 ____________.___ 31 ____________.___

8 ____________.___ 16 ____________.___ 24 ____________.___

Total Illinois Income Tax withheld this month. (Add Section 2a, Lines 1-31.) 2a ____________.___

Printed by the authority of the state of Illinois - web only, 1 copy.

Continue on the next page.

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of this information is required.

IL-941 (R-12/21) Failure to provide information could result in a penalty. Page 1 of 3