Enlarge image

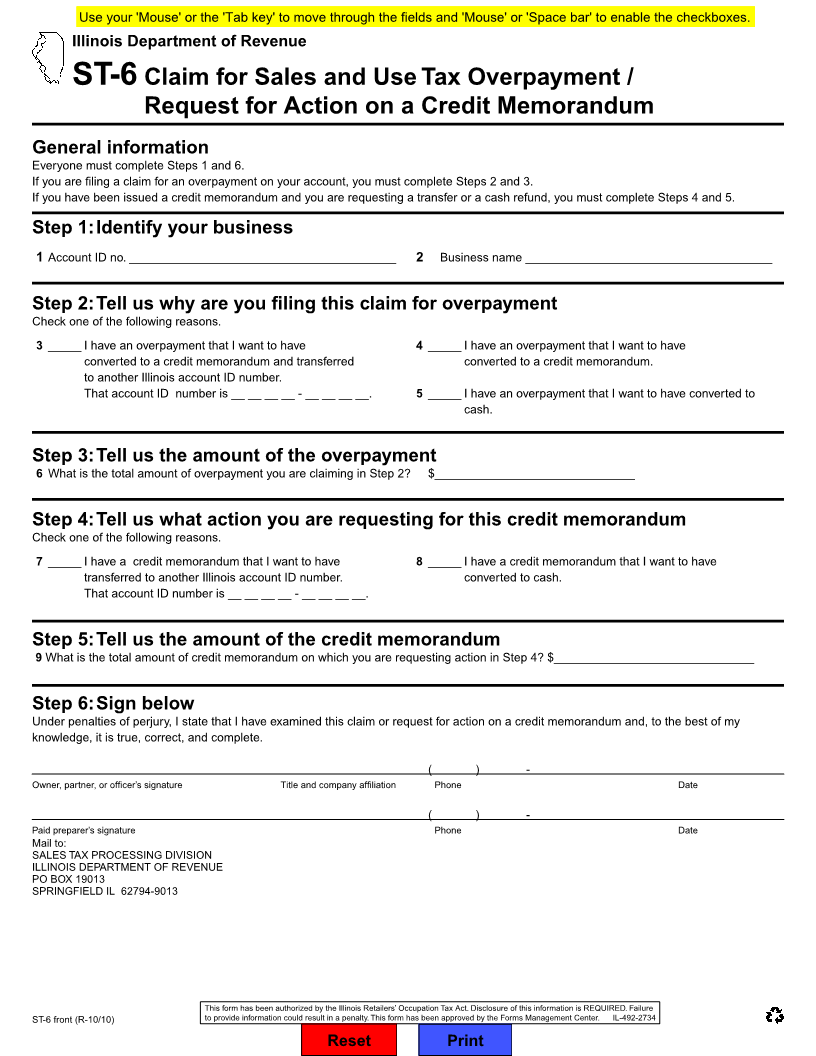

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

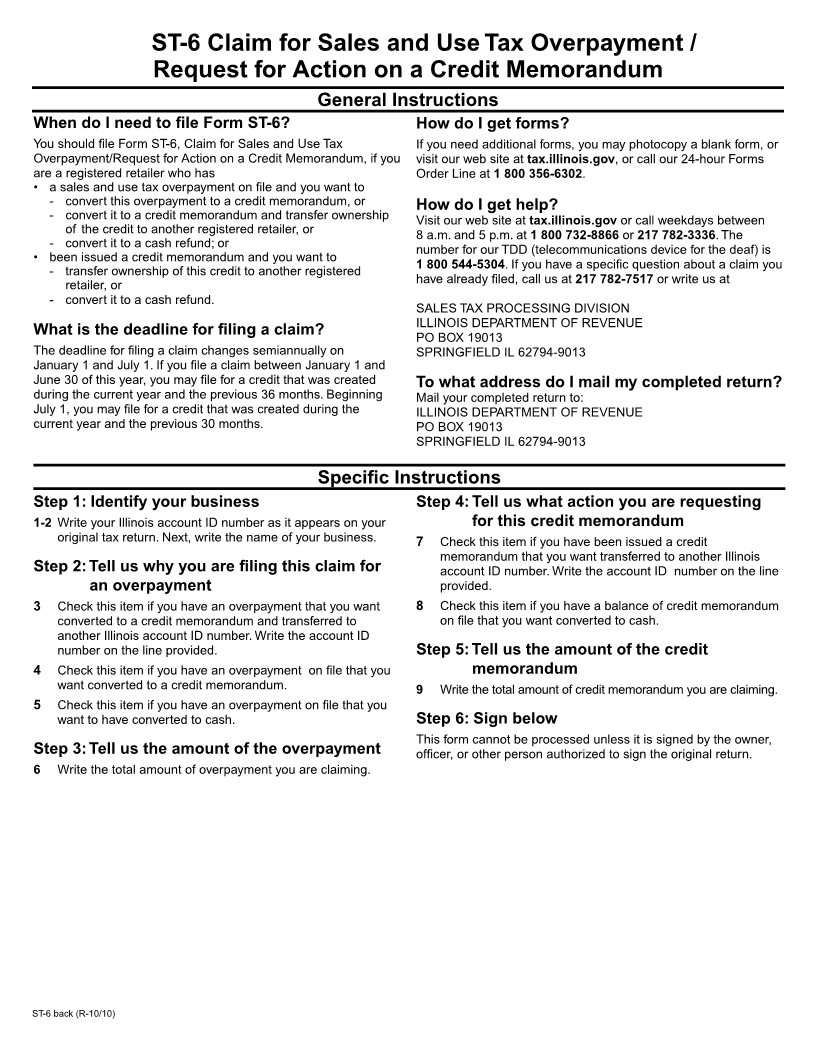

ST-6 Claim for Sales and Use Tax Overpayment /

Request for Action on a Credit Memorandum

General information

Everyone must complete Steps 1 and 6.

If you are fi ling a claim for an overpayment on your account, you must complete Steps 2 and 3.

If you have been issued a credit memorandum and you are requesting a transfer or a cash refund, you must complete Steps 4 and 5.

Step 1: Identify your business

1 Account ID no. ________________________________________ 2 Business name _____________________________________

Step 2: Tell us why are you fi ling this claim for overpayment

Check one of the following reasons.

3 _____ I have an overpayment that I want to have 4 _____ I have an overpayment that I want to have

converted to a credit memorandum and transferred converted to a credit memorandum.

to another Illinois account ID number.

That account ID number is __ __ __ __ - __ __ __ __. 5 _____ I have an overpayment that I want to have converted to

cash.

Step 3: Tell us the amount of the overpayment

6 What is the total amount of overpayment you are claiming in Step 2? $______________________________

Step 4: Tell us what action you are requesting for this credit memorandum

Check one of the following reasons.

7 _____ I have a credit memorandum that I want to have 8 _____ I have a credit memorandum that I want to have

transferred to another Illinois account ID number. converted to cash.

That account ID number is __ __ __ __ - __ __ __ __.

Step 5: Tell us the amount of the credit memorandum

9 What is the total amount of credit memorandum on which you are requesting action in Step 4? $______________________________

Step 6: Sign below

Under penalties of perjury, I state that I have examined this claim or request for action on a credit memorandum and, to the best of my

knowledge, it is true, correct, and complete.

( ) -

Owner, partner, or offi cer’s signature Title and company affi liation Phone Date

( ) -

Paid preparer’s signature Phone Date

Mail to:

SALES TAX PROCESSING DIVISION

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19013

SPRINGFIELD IL 62794-9013

This form has been authorized by the Illinois Retailers’ Occupation Tax Act. Disclosure of this information is REQUIRED. Failure

ST-6 front (R-10/10) to provide information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-2734

Reset Print