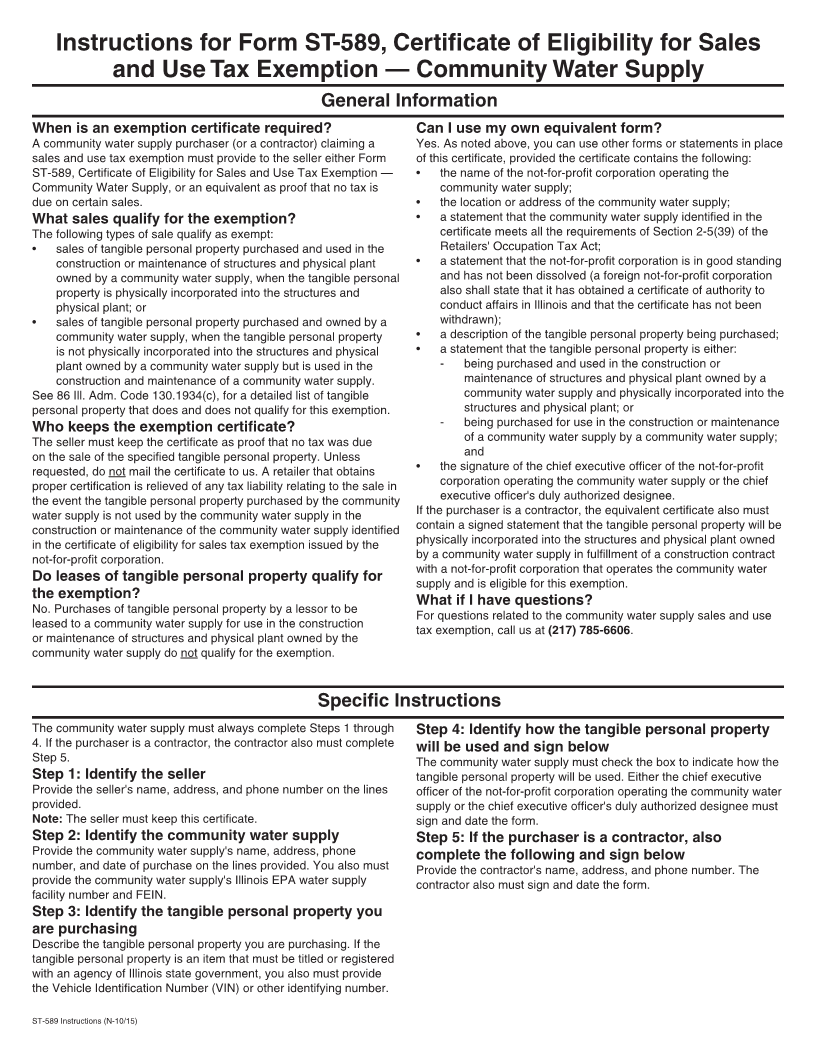

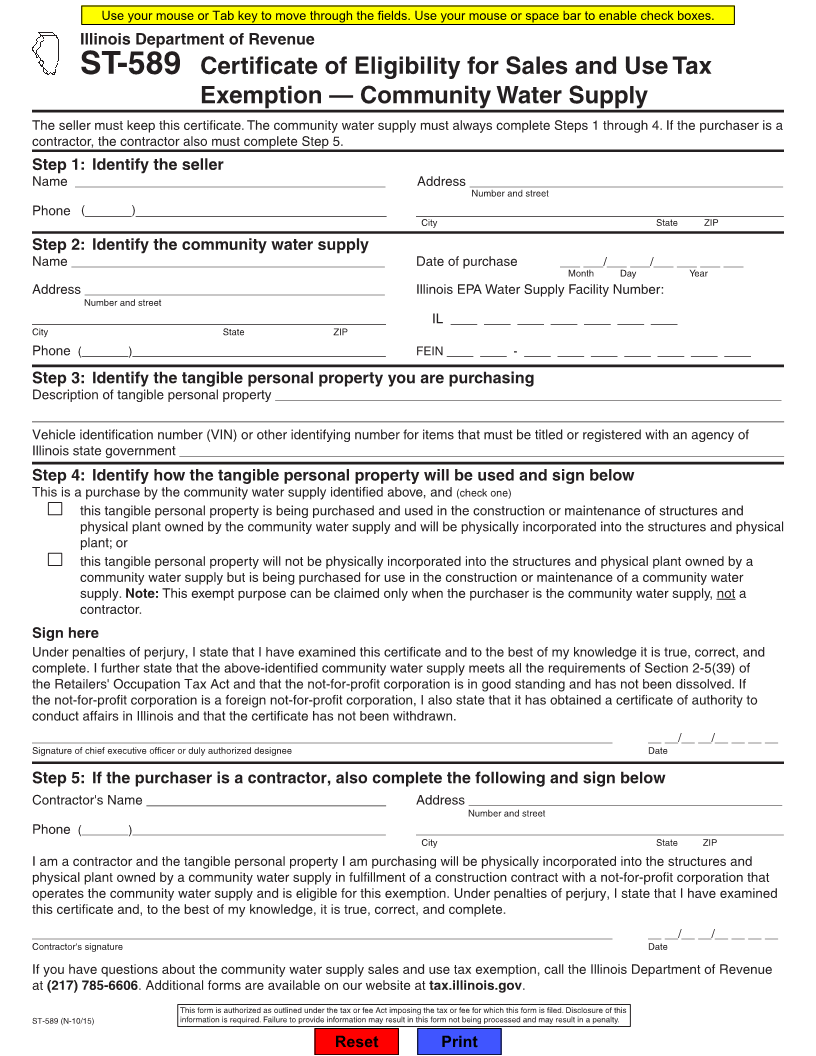

Enlarge image

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

ST-589 Certificate of Eligibility for Sales and Use Tax

Exemption — Community Water Supply

The seller must keep this certificate. The community water supply must always complete Steps 1 through 4. If the purchaser is a

contractor, the contractor also must complete Step 5.

Step 1: Identify the seller

Name _______________________________________________ Address _______________________________________________

Number and street

Phone (_______)______________________________________ _____________________________________________________

City State ZIP

Step 2: Identify the community water supply

Name _______________________________________________ Date of purchase ___ ___/___ ___/___ ___ ___ ___

Month Day Year

Address _____________________________________________ Illinois EPA Water Supply Facility Number:

Number and street

___________________________________________________ IL ____ ____ ____ ____ ____ ____ ____

City State ZIP

Phone (_______)______________________________________ FEIN ____ ____ - ____ ____ ____ ____ ____ ____ ____

Step 3: Identify the tangible personal property you are purchasing

Description of tangible personal property _____________________________________________________________________

_______________________________________________________________________________________________________

Vehicle identification number (VIN) or other identifying number for items that must be titled or registered with an agency of

Illinois state government __________________________________________________________________________________

Step 4: Identify how the tangible personal property will be used and sign below

This is a purchase by the community water supply identified above, and (check one)

this tangible personal property is being purchased and used in the construction or maintenance of structures and

physical plant owned by the community water supply and will be physically incorporated into the structures and physical

plant; or

this tangible personal property will not be physically incorporated into the structures and physical plant owned by a

community water supply but is being purchased for use in the construction or maintenance of a community water

supply. Note: This exempt purpose can be claimed only when the purchaser is the community water supply, not a

contractor.

Sign here

Under penalties of perjury, I state that I have examined this certificate and to the best of my knowledge it is true, correct, and

complete. I further state that the above-identified community water supply meets all the requirements of Section 2-5(39) of

the Retailers' Occupation Tax Act and that the not-for-profit corporation is in good standing and has not been dissolved. If

the not-for-profit corporation is a foreign not-for-profit corporation, I also state that it has obtained a certificate of authority to

conduct affairs in Illinois and that the certificate has not been withdrawn.

_______________________________________________________________________________________ __ __/__ __/__ __ __ __

Signature of chief executive officer or duly authorized designee Date

Step 5: If the purchaser is a contractor, also complete the following and sign below

Contractor's Name _________________________________ Address _______________________________________________

Number and street

Phone (_______)______________________________________ _____________________________________________________

City State ZIP

I am a contractor and the tangible personal property I am purchasing will be physically incorporated into the structures and

physical plant owned by a community water supply in fulfillment of a construction contract with a not-for-profit corporation that

operates the community water supply and is eligible for this exemption. Under penalties of perjury, I state that I have examined

this certificate and, to the best of my knowledge, it is true, correct, and complete.

_______________________________________________________________________________________ __ __/__ __/__ __ __ __

Contractor's signature Date

If you have questions about the community water supply sales and use tax exemption, call the Illinois Department of Revenue

at (217) 785-6606. Additional forms are available on our website at tax.illinois.gov.

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this

ST-589 (N-10/15) information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

Reset Print