Enlarge image

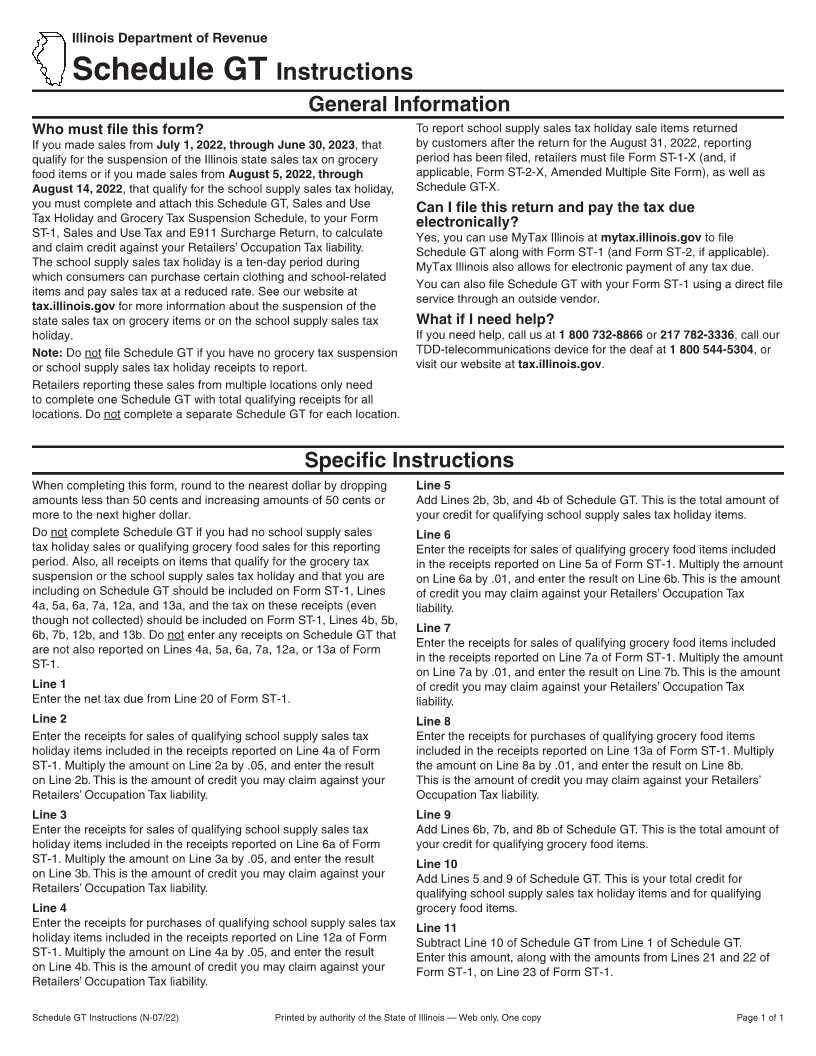

Illinois Department of Revenue

Schedule GT Instructions

General Information

Who must file this form? To report school supply sales tax holiday sale items returned

If you made sales from July 1, 2022, through June 30, 2023, that by customers after the return for the August 31, 2022, reporting

qualify for the suspension of the Illinois state sales tax on grocery period has been filed, retailers must file Form ST-1-X (and, if

food items or if you made sales from August 5, 2022, through applicable, Form ST-2-X, Amended Multiple Site Form), as well as

August 14, 2022, that qualify for the school supply sales tax holiday, Schedule GT-X.

you must complete and attach this Schedule GT, Sales and Use Can I file this return and pay the tax due

Tax Holiday and Grocery Tax Suspension Schedule, to your Form electronically?

ST-1, Sales and Use Tax and E911 Surcharge Return, to calculate Yes, you can use MyTax Illinois at mytax.illinois.gov to file

and claim credit against your Retailers’ Occupation Tax liability. Schedule GT along with Form ST-1 (and Form ST-2, if applicable).

The school supply sales tax holiday is a ten-day period during MyTax Illinois also allows for electronic payment of any tax due.

which consumers can purchase certain clothing and school-related

You can also file Schedule GT with your Form ST-1 using a direct file

items and pay sales tax at a reduced rate. See our website at

service through an outside vendor.

tax.illinois.gov for more information about the suspension of the

state sales tax on grocery items or on the school supply sales tax What if I need help?

holiday. If you need help, call us at 1 800 732-8866 or 217 782-3336, call our

Note: Do not file Schedule GT if you have no grocery tax suspension TDD-telecommunications device for the deaf at 1 800 544-5304, or

or school supply sales tax holiday receipts to report. visit our website at tax.illinois.gov.

Retailers reporting these sales from multiple locations only need

to complete one Schedule GT with total qualifying receipts for all

locations. Do not complete a separate Schedule GT for each location.

Specific Instructions

When completing this form, round to the nearest dollar by dropping Line 5

amounts less than 50 cents and increasing amounts of 50 cents or Add Lines 2b, 3b, and 4b of Schedule GT. This is the total amount of

more to the next higher dollar. your credit for qualifying school supply sales tax holiday items.

Do not complete Schedule GT if you had no school supply sales Line 6

tax holiday sales or qualifying grocery food sales for this reporting Enter the receipts for sales of qualifying grocery food items included

period. Also, all receipts on items that qualify for the grocery tax in the receipts reported on Line 5a of Form ST-1. Multiply the amount

suspension or the school supply sales tax holiday and that you are on Line 6a by .01, and enter the result on Line 6b. This is the amount

including on Schedule GT should be included on Form ST-1, Lines of credit you may claim against your Retailers’ Occupation Tax

4a, 5a, 6a, 7a, 12a, and 13a, and the tax on these receipts (even liability.

though not collected) should be included on Form ST-1, Lines 4b, 5b,

6b, 7b, 12b, and 13b. Do not enter any receipts on Schedule GT that Line 7

Enter the receipts for sales of qualifying grocery food items included

are not also reported on Lines 4a, 5a, 6a, 7a, 12a, or 13a of Form

in the receipts reported on Line 7a of Form ST-1. Multiply the amount

ST-1.

on Line 7a by .01, and enter the result on Line 7b. This is the amount

Line 1 of credit you may claim against your Retailers’ Occupation Tax

Enter the net tax due from Line 20 of Form ST-1. liability.

Line 2 Line 8

Enter the receipts for sales of qualifying school supply sales tax Enter the receipts for purchases of qualifying grocery food items

holiday items included in the receipts reported on Line 4a of Form included in the receipts reported on Line 13a of Form ST-1. Multiply

ST-1. Multiply the amount on Line 2a by .05, and enter the result the amount on Line 8a by .01, and enter the result on Line 8b.

on Line 2b. This is the amount of credit you may claim against your This is the amount of credit you may claim against your Retailers’

Retailers’ Occupation Tax liability. Occupation Tax liability.

Line 3 Line 9

Enter the receipts for sales of qualifying school supply sales tax Add Lines 6b, 7b, and 8b of Schedule GT. This is the total amount of

holiday items included in the receipts reported on Line 6a of Form your credit for qualifying grocery food items.

ST-1. Multiply the amount on Line 3a by .05, and enter the result Line 10

on Line 3b. This is the amount of credit you may claim against your Add Lines 5 and 9 of Schedule GT. This is your total credit for

Retailers’ Occupation Tax liability. qualifying school supply sales tax holiday items and for qualifying

Line 4 grocery food items.

Enter the receipts for purchases of qualifying school supply sales tax Line 11

holiday items included in the receipts reported on Line 12a of Form Subtract Line 10 of Schedule GT from Line 1 of Schedule GT.

ST-1. Multiply the amount on Line 4a by .05, and enter the result Enter this amount, along with the amounts from Lines 21 and 22 of

on Line 4b. This is the amount of credit you may claim against your Form ST-1, on Line 23 of Form ST-1.

Retailers’ Occupation Tax liability.

Schedule GT Instructions (N-07/22) Printed by authority of the State of Illinois — Web only, One copy Page 1 of 1