Enlarge image

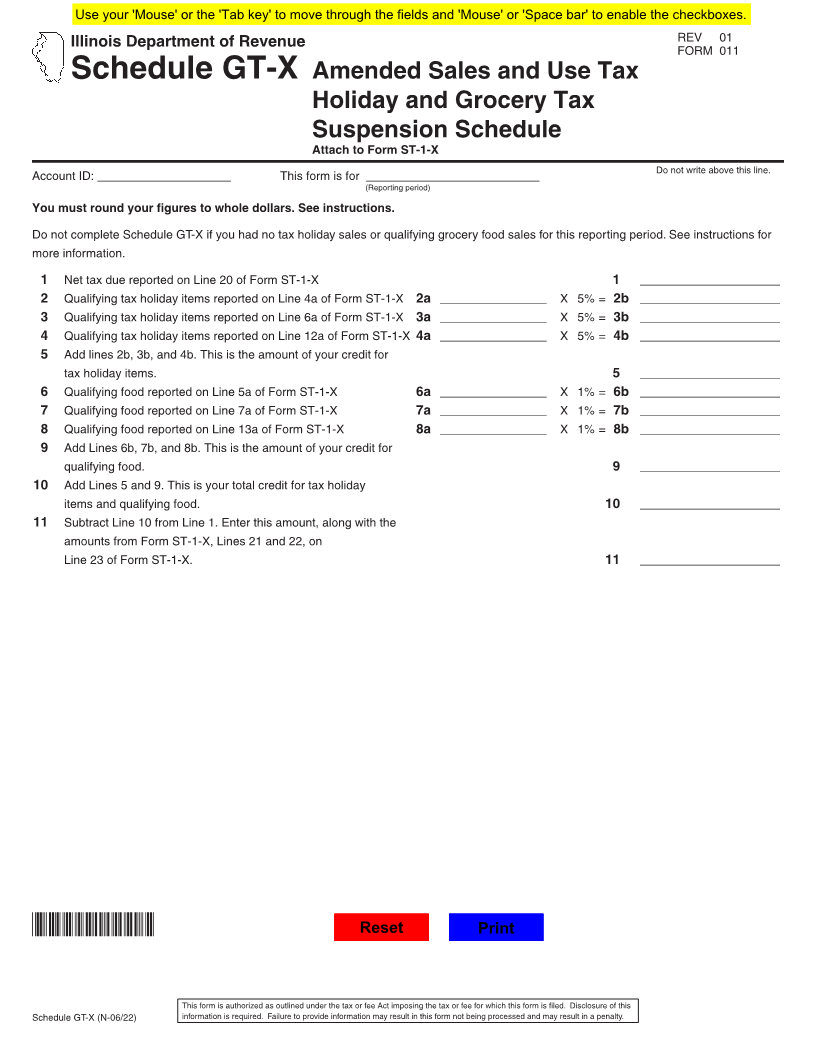

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue REV 01

FORM 011

Schedule GT-X Amended Sales and Use Tax

Holiday and Grocery Tax

Suspension Schedule

Attach to Form ST-1-X

Do not write above this line.

Account ID: ____________________ This form is for __________________________

(Reporting period)

You must round your figures to whole dollars. See instructions.

Do not complete Schedule GT-X if you had no tax holiday sales or qualifying grocery food sales for this reporting period. See instructions for

more information.

1 Net tax due reported on Line 20 of Form ST-1-X 1 _____________________

2 Qualifying tax holiday items reported on Line 4a of Form ST-1-X 2a ________________ X 5% = 2b _____________________

3 Qualifying tax holiday items reported on Line 6a of Form ST-1-X 3a ________________ X 5% = 3b _____________________

4 Qualifying tax holiday items reported on Line 12a of Form ST-1-X 4a ________________ X 5% = 4b _____________________

5 Add lines 2b, 3b, and 4b. This is the amount of your credit for

tax holiday items. 5 _____________________

6 Qualifying food reported on Line 5a of Form ST-1-X 6a ________________ X 1% = 6b _____________________

7 Qualifying food reported on Line 7a of Form ST-1-X 7a ________________ X 1% = 7b _____________________

8 Qualifying food reported on Line 13a of Form ST-1-X 8a ________________ X 1% = 8b _____________________

9 Add Lines 6b, 7b, and 8b. This is the amount of your credit for

qualifying food. 9 _____________________

10 Add Lines 5 and 9. This is your total credit for tax holiday

items and qualifying food. 10 _____________________

11 Subtract Line 10 from Line 1. Enter this amount, along with the

amounts from Form ST-1-X, Lines 21 and 22, on

Line 23 of Form ST-1-X. 11 _____________________

*0110622W* Reset Print

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this

Schedule GT-X (N-06/22) information is required. Failure to provide information may result in this form not being processed and may result in a penalty.