Enlarge image

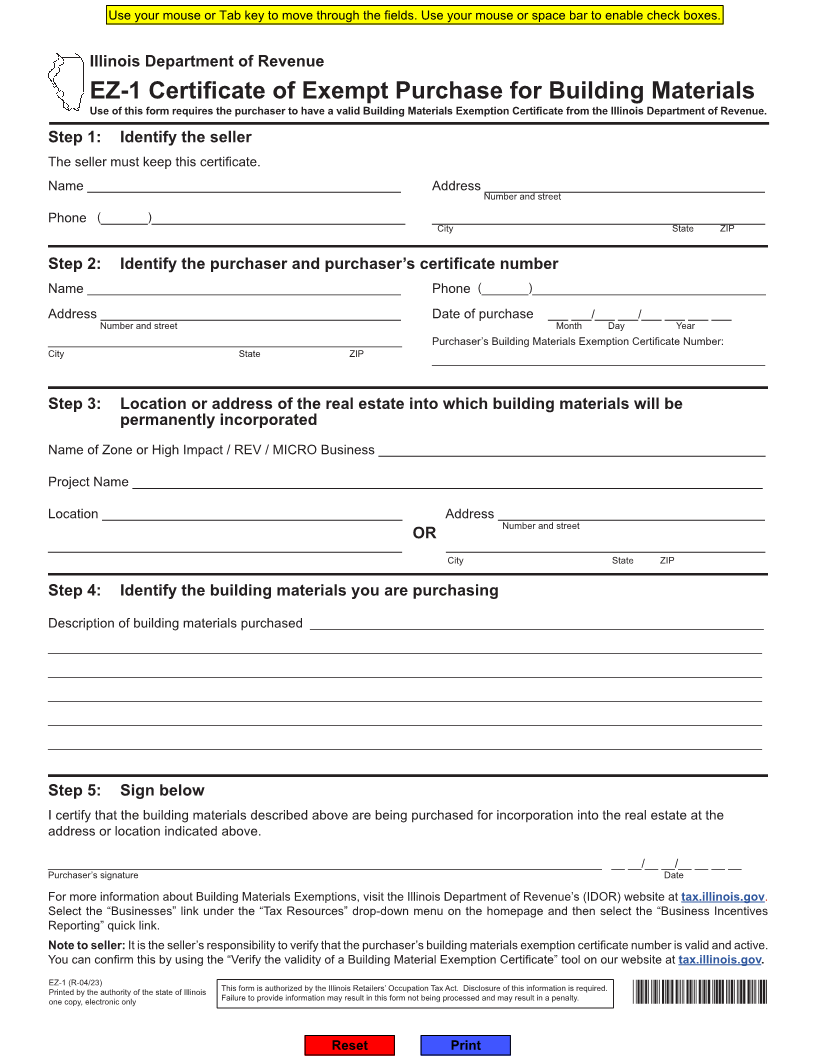

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

EZ-1 Certificate of Exempt Purchase for Building Materials

Use of this form requires the purchaser to have a valid Building Materials Exemption Certificate from the Illinois Department of Revenue.

Step 1: Identify the seller

The seller must keep this certificate.

Name _______________________________________________ Address __________________________________________

Number and street

Phone (_______)______________________________________ ________________________________________________

City State ZIP

Step 2: Identify the purchaser and purchaser’s certificate number

Name _______________________________________________ Phone (_______)___________________________________

Address _____________________________________________ Date of purchase ___ ___/___ ___/___ ___ ___ ___

Number and street Month Day Year

___________________________________________________ Purchaser’s Building Materials Exemption Certificate Number:

City State ZIP

________________________________________________

Step 3: Location or address of the real estate into which building materials will be

permanently incorporated

Name of Zone or High Impact / REV / MICRO Business __________________________________________________________

Project Name _____________________________________________________________________________________

Location _____________________________________________ Address ________________________________________

Number and street

OR

___________________________________________________ ______________________________________________

City State ZIP

Step 4: Identify the building materials you are purchasing

Description of building materials purchased ____________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

Step 5: Sign below

I certify that the building materials described above are being purchased for incorporation into the real estate at the

address or location indicated above.

___________________________________________________________________________________ __ __/__ __/__ __ __ __

Purchaser’s signature Date

For more information about Building Materials Exemptions, visit the Illinois Department of Revenue’s (IDOR) website at tax.illinois.gov.

Select the “Businesses” link under the “Tax Resources” drop-down menu on the homepage and then select the “Business Incentives

Reporting” quick link.

Note to seller: It is the seller’s responsibility to verify that the purchaser’s building materials exemption certificate number isvalid and active.

You can confirm this by using the “Verify the validity of a Building Material Exemption Certificate” tool on our website at tax.illinois.gov.

EZ-1 (R-04/23) This form is authorized by the Illinois Retailers’ Occupation Tax Act. Disclosure of this information is required.

Printed by the authority of the state of Illinois Failure to provide information may result in this form not being processed and may result in a penalty. *14604231W*

one copy, electronic only

Reset Print