Enlarge image

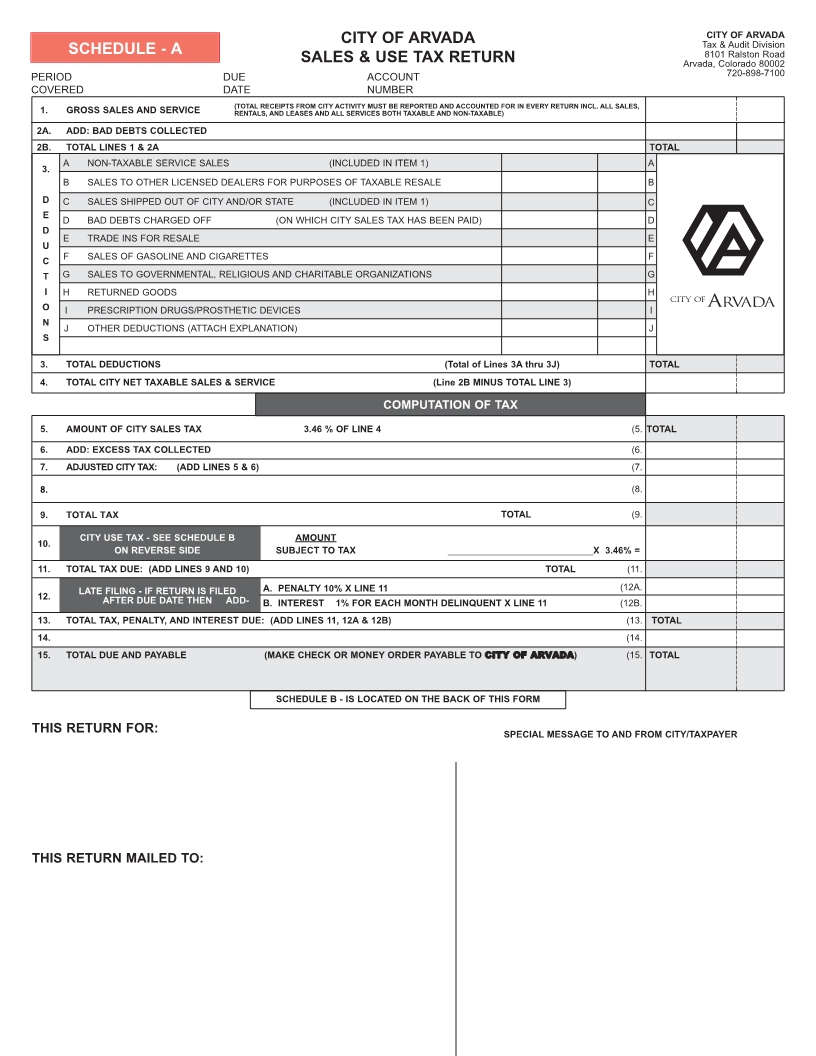

CITY OF ARVADA CITY OF ARVADA

Tax & Audit Division

SCHEDULE - A SALES & USE TAX RETURN 8101 Ralston Road

Arvada, Colorado 80002

PERIOD DUE ACCOUNT 720-898-7100

COVERED DATE NUMBER

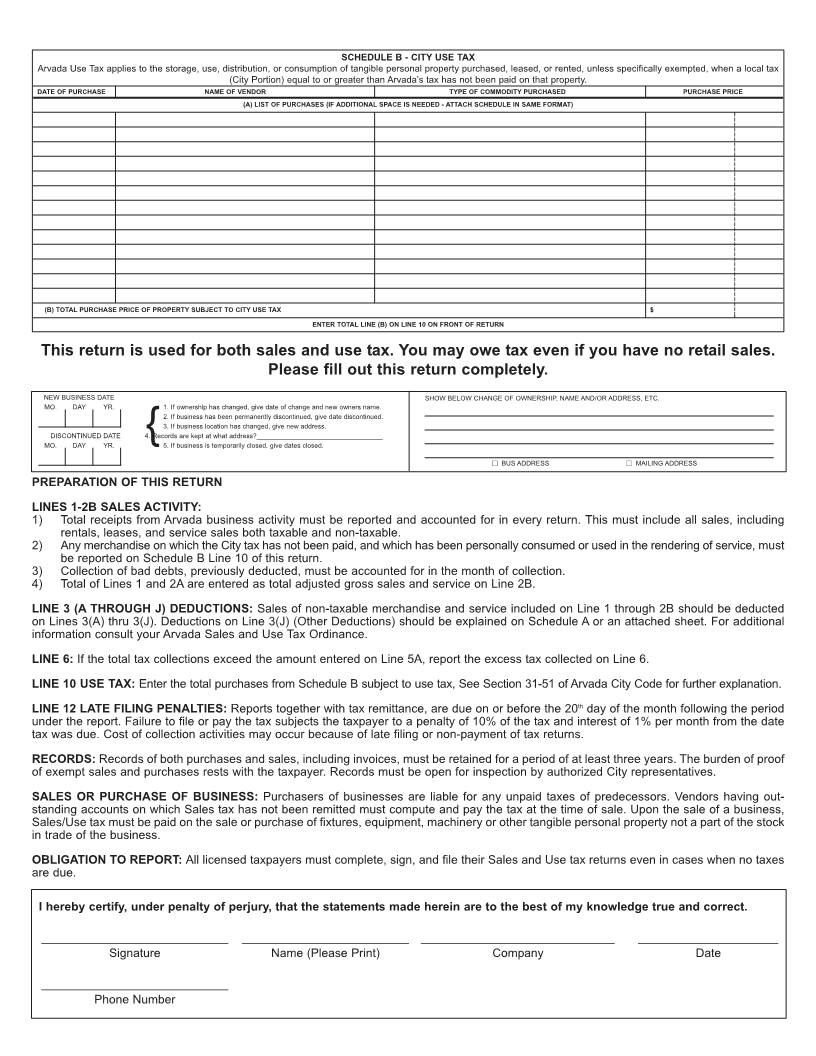

1. GROSS SALES AND SERVICE (TOTAL RECEIPTS FROM CITY ACTIVITY MUST BE REPORTED AND ACCOUNTED FOR IN EVERY RETURN INCL. ALL SALES,

RENTALS, AND LEASES AND ALL SERVICES BOTH TAXABLE AND NON-TAXABLE)

2A. ADD: BAD DEBTS COLLECTED

2B. TOTAL LINES 1 & 2A TOTAL

3. A NON-TAXABLE SERVICE SALES (INCLUDED IN ITEM 1) A

B SALES TO OTHER LICENSED DEALERS FOR PURPOSES OF TAXABLE RESALE B

D C SALES SHIPPED OUT OF CITY AND/OR STATE (INCLUDED IN ITEM 1) C

E D BAD DEBTS CHARGED OFF (ON WHICH CITY SALES TAX HAS BEEN PAID) D

D

E TRADE INS FOR RESALE E

U

C F SALES OF GASOLINE AND CIGARETTES F

T G SALES TO GOVERNMENTAL, RELIGIOUS AND CHARITABLE ORGANIZATIONS G

I H RETURNED GOODS H

O I PRESCRIPTION DRUGS/PROSTHETIC DEVICES I

N J OTHER DEDUCTIONS (ATTACH EXPLANATION) J

S

3. TOTAL DEDUCTIONS (Total of Lines 3A thru 3J) TOTAL

4. TOTAL CITY NET TAXABLE SALES & SERVICE (Line 2B MINUS TOTAL LINE 3)

COMPUTATION OF TAX

5. AMOUNT OF CITY SALES TAX 3.46 % OF LINE 4 (5. TOTAL

6. ADD: EXCESS TAX COLLECTED (6.

7. ADJUSTED CITY TAX: (ADD LINES 5 & 6) (7.

8. DEDUCT 3.0% OF LINE 7 (VENDORS FEE, IF PAID BY DUE DATE) TO $100.00 (8.

9. TOTAL TAX (ITEM 7 MINUS 8) TOTAL (9.

10. CITY USE TAX - SEE SCHEDULE B AMOUNT

ON REVERSE SIDE SUBJECT TO TAX ____________________________X 3.46% =

11. TOTAL TAX DUE: (ADD LINES 9 AND 10) TOTAL (11.

12. LATE FILING - IF RETURN IS FILED A. PENALTY 10% X LINE 11 (12A.

AFTER DUE DATE THEN ADD- B. INTEREST 1% FOR EACH MONTH DELINQUENT X LINE 11 (12B.

13. TOTAL TAX, PENALTY, AND INTEREST DUE: (ADD LINES 11, 12A & 12B) (13. TOTAL

14. (14.

15. TOTAL DUE AND PAYABLE CITY OF ARVADA(MAKE CHECK OR MONEY ORDER PAYABLE TO ) (15. TOTAL

SCHEDULE B - IS LOCATED ON THE BACK OF THIS FORM

THIS RETURN FOR: SPECIAL MESSAGE TO AND FROM CITY/TAXPAYER

THIS RETURN MAILED TO: