Enlarge image

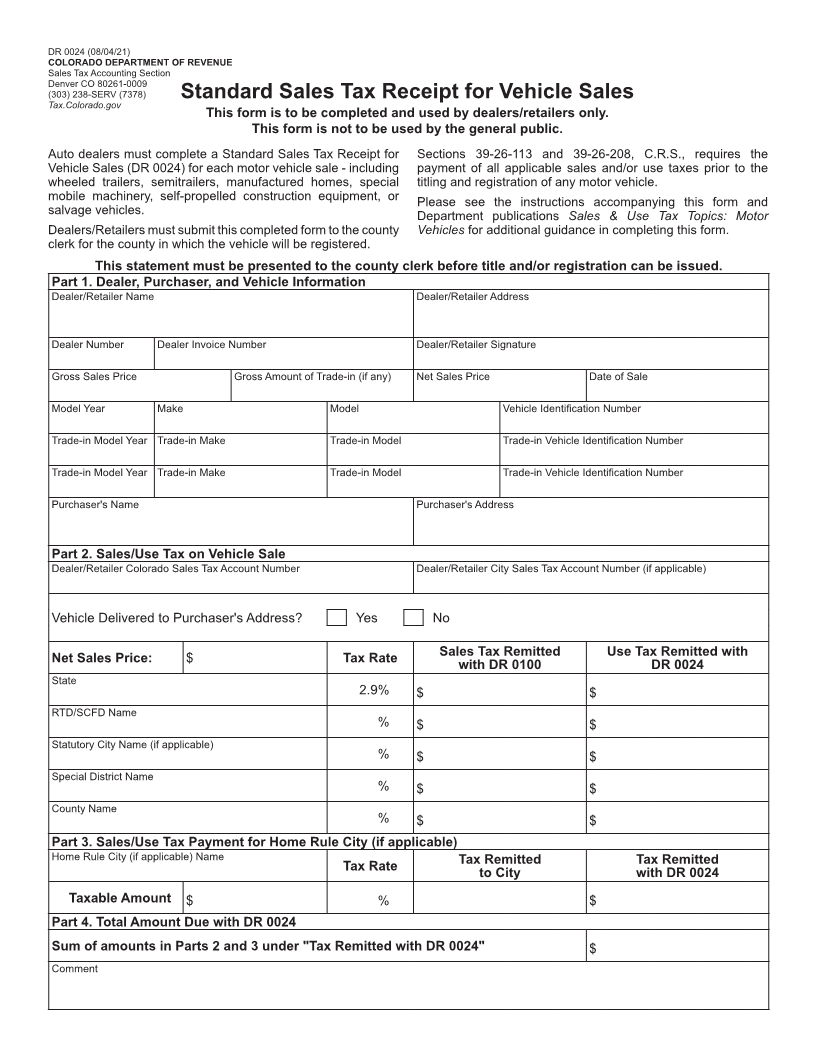

DR 0024 (08/04/21)

COLORADO DEPARTMENT OF REVENUE

Sales Tax Accounting Section

Denver CO 80261-0009

(303) 238-SERV (7378) Standard Sales Tax Receipt for Vehicle Sales

Tax.Colorado.gov

This form is to be completed and used by dealers/retailers only.

This form is not to be used by the general public.

Auto dealers must complete a Standard Sales Tax Receipt for Sections 39-26-113 and 39-26-208, C.R.S., requires the

Vehicle Sales (DR 0024) for each motor vehicle sale - including payment of all applicable sales and/or use taxes prior to the

wheeled trailers, semitrailers, manufactured homes, special titling and registration of any motor vehicle.

mobile machinery, self-propelled construction equipment, or Please see the instructions accompanying this form and

salvage vehicles. Department publications Sales & Use Tax Topics: Motor

Dealers/Retailers must submit this completed form to the county Vehicles for additional guidance in completing this form.

clerk for the county in which the vehicle will be registered.

This statement must be presented to the county clerk before title and/or registration can be issued.

Part 1. Dealer, Purchaser, and Vehicle Information

Dealer/Retailer Name Dealer/Retailer Address

Dealer Number Dealer Invoice Number Dealer/Retailer Signature

Gross Sales Price Gross Amount of Trade-in (if any) Net Sales Price Date of Sale

Model Year Make Model Vehicle Identification Number

Trade-in Model Year Trade-in Make Trade-in Model Trade-in Vehicle Identification Number

Trade-in Model Year Trade-in Make Trade-in Model Trade-in Vehicle Identification Number

Purchaser's Name Purchaser's Address

Part 2. Sales/Use Tax on Vehicle Sale

Dealer/Retailer Colorado Sales Tax Account Number Dealer/Retailer City Sales Tax Account Number (if applicable)

Vehicle Delivered to Purchaser's Address? Yes No

Sales Tax Remitted Use Tax Remitted with

Net Sales Price: $ Tax Rate

with DR 0100 DR 0024

State

2.9% $ $

RTD/SCFD Name

% $ $

Statutory City Name (if applicable)

% $ $

Special District Name

% $ $

County Name

% $ $

Part 3. Sales/Use Tax Payment for Home Rule City (if applicable)

Home Rule City (if applicable) Name Tax Remitted Tax Remitted

Tax Rate

to City with DR 0024

Taxable Amount $ % $

Part 4. Total Amount Due with DR 0024

Sum of amounts in Parts 2 and 3 under "Tax Remitted with DR 0024" $

Comment