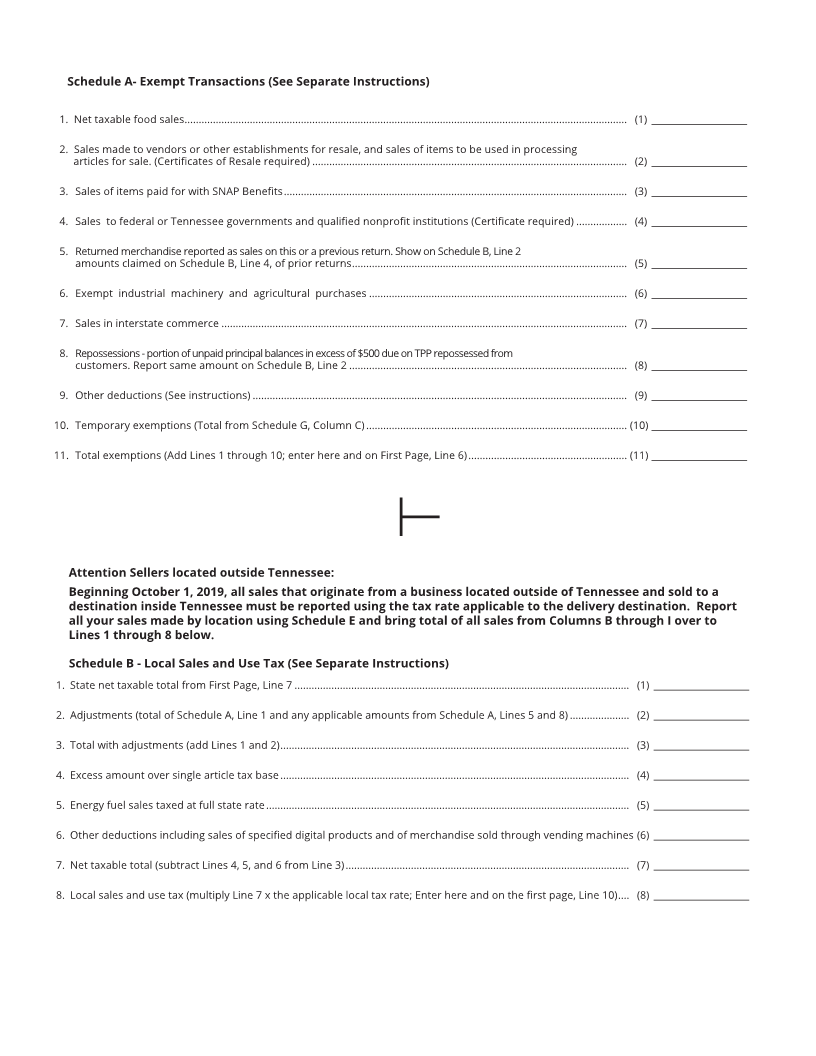

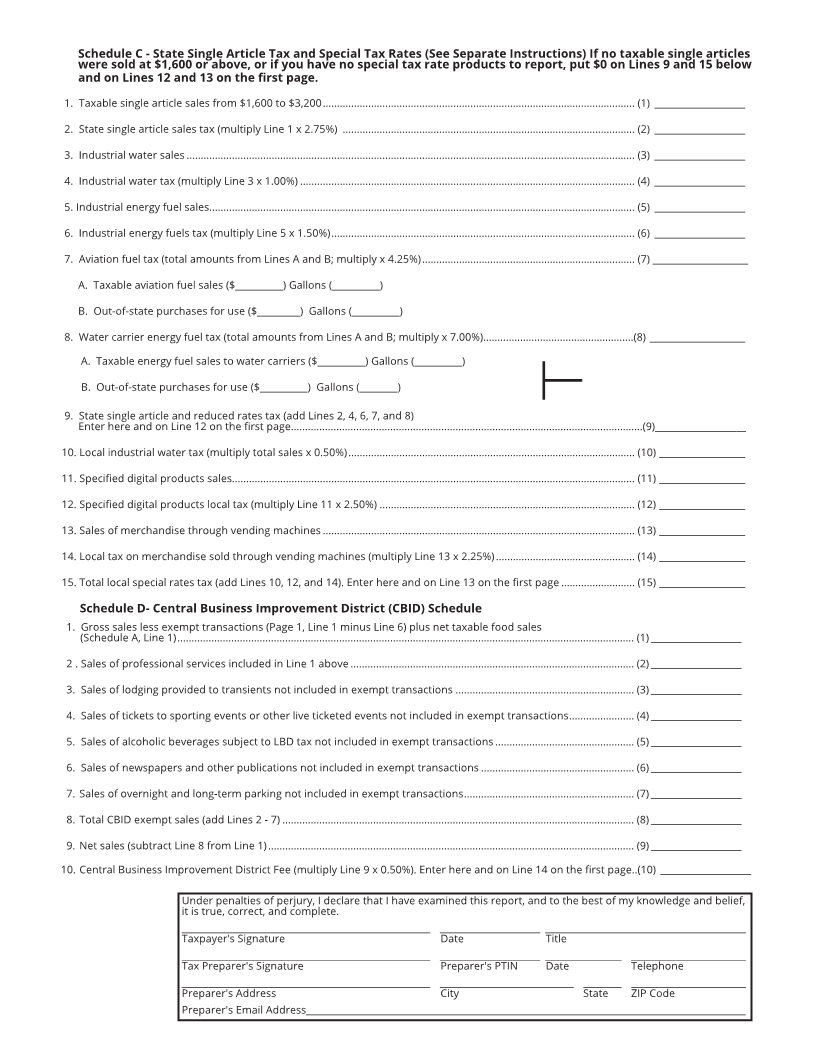

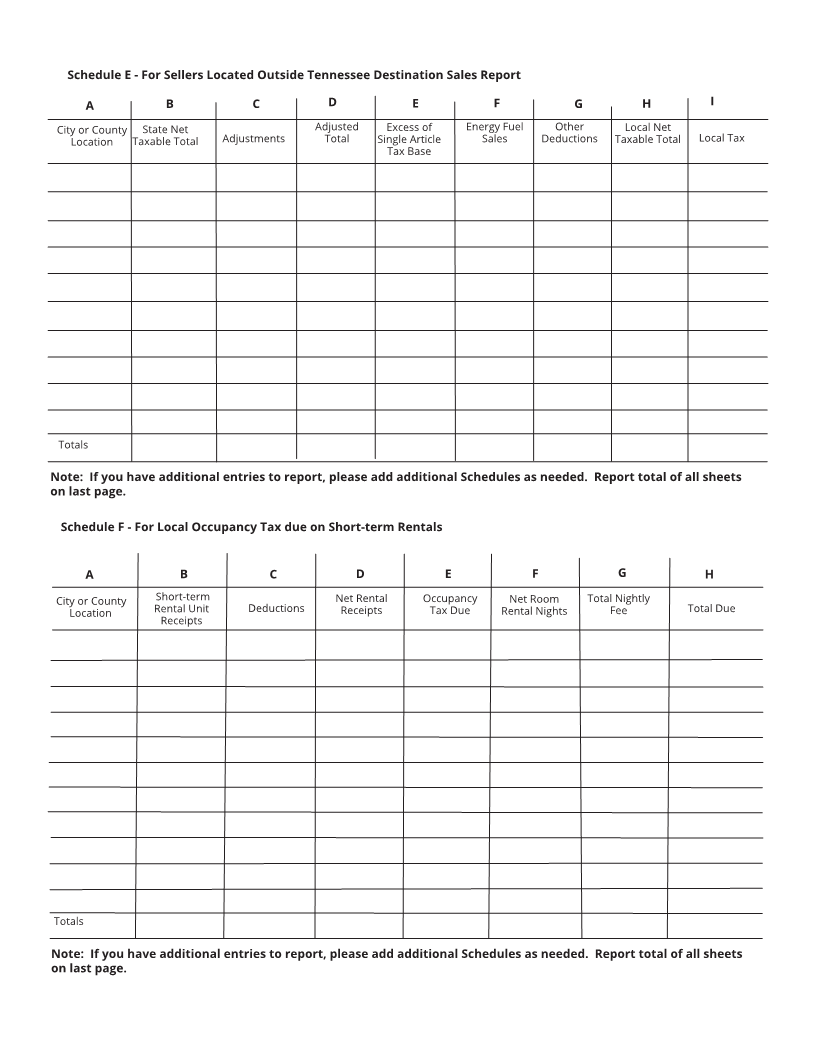

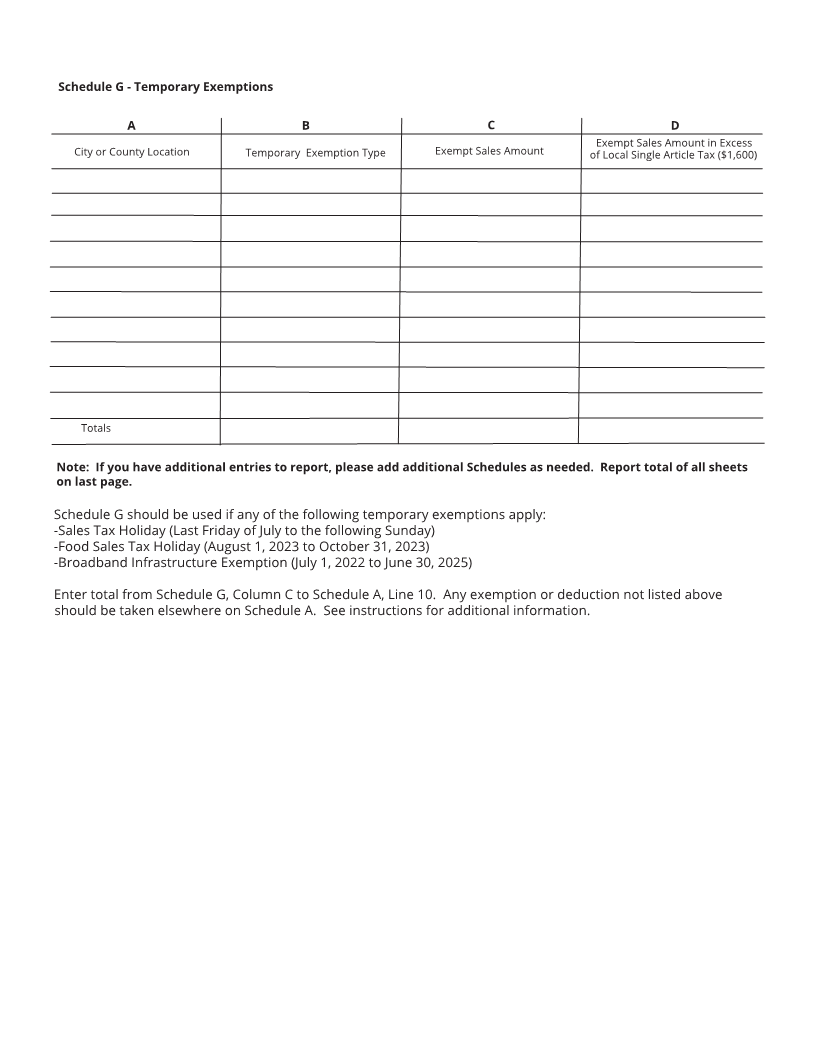

Enlarge image

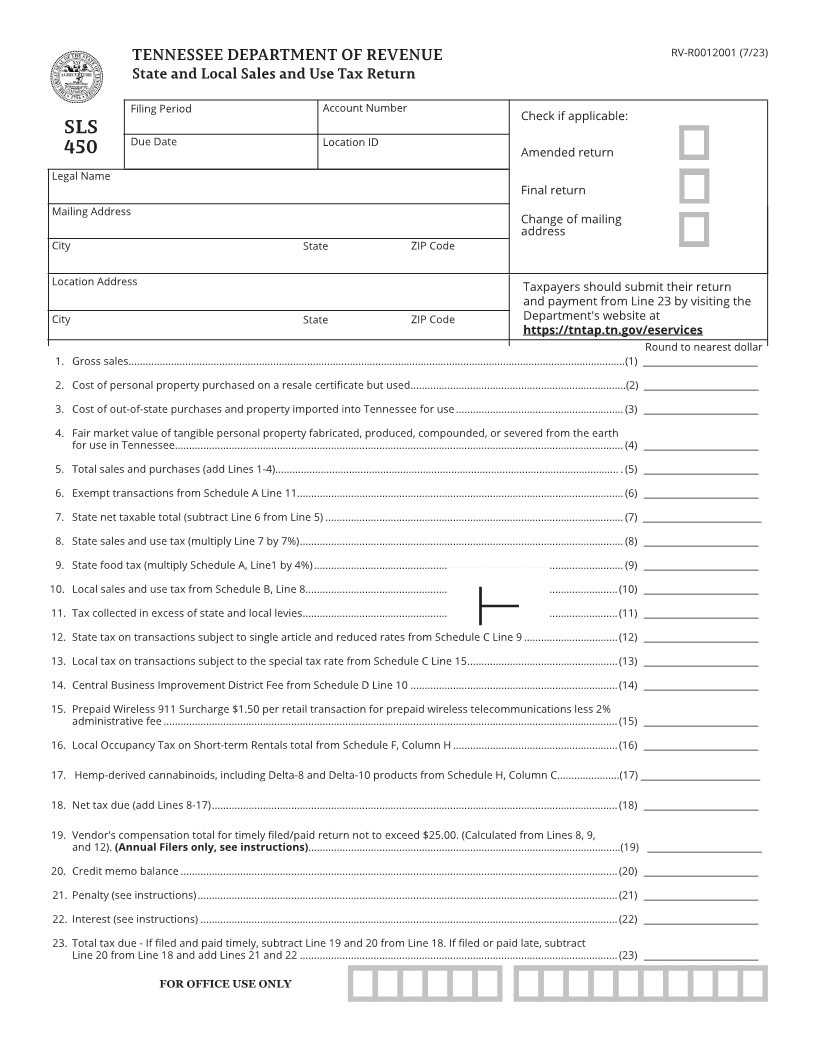

TENNESSEE DEPARTMENT OF REVENUE RV-R0012001 (7/23)

State and Local Sales and Use Tax Return

Filing Period Account Number

Check if applicable:

SLS

Due Date Location ID

450 Amended return

Legal Name

Final return

Mailing Address

Change of mailing

address

City State ZIP Code

Location Address Taxpayers should submit their return

and payment from Line 23 by visiting the

City State ZIP Code Department's website at

https://tntap.tn.gov/eservices

Round to nearest dollar

1. Gross sales............................................................................................................................................................................... (1) ________________________

2. Cost of personal property purchased on a resale certificate but used............................................................................(2) ________________________

3. Cost of out-of-state purchases and property imported into Tennessee for use ........................................................... (3) ________________________

4. Fair market value of tangible personal property fabricated, produced, compounded, or severed from the earth

for use in Tennessee .............................................................................................................................................................. (4) ________________________

5. Total sales and purchases (add Lines 1-4)......................................................................................................................... . (5) ________________________

6. Exempt transactions from Schedule A Line 11................................................................................................................... (6) ________________________

7. State net taxable total (subtract Line 6 from Line 5) ......................................................................................................... (7) _________________________

8. State sales and use tax (multiply Line 7 by 7%) .................................................................................................................. (8) ________________________

9. State food tax (multiply Schedule A, Line1 by 4%) ............................................................................................................. (9) ________________________

10. Local sales and use tax from Schedule B, Line 8 ..............................................................................................................(10) ________________________

11. Tax collected in excess of state and local levies ...............................................................................................................(11) ________________________

12. State tax on transactions subject to single article and reduced rates from Schedule C Line 9 .................................(12) ________________________

13. Local tax on transactions subject to the special tax rate from Schedule C Line 15 .....................................................(13) ________________________

14. Central Business Improvement District Fee from Schedule D Line 10 .........................................................................(14) ________________________

15. Prepaid Wireless 911 Surcharge $1.50 per retail transaction for prepaid wireless telecommunications less 2%

administrative fee ................................................................................................................................................................(15) ________________________

16. Local Occupancy Tax on Short-term Rentals total from Schedule F, Column H ..........................................................(16) ________________________

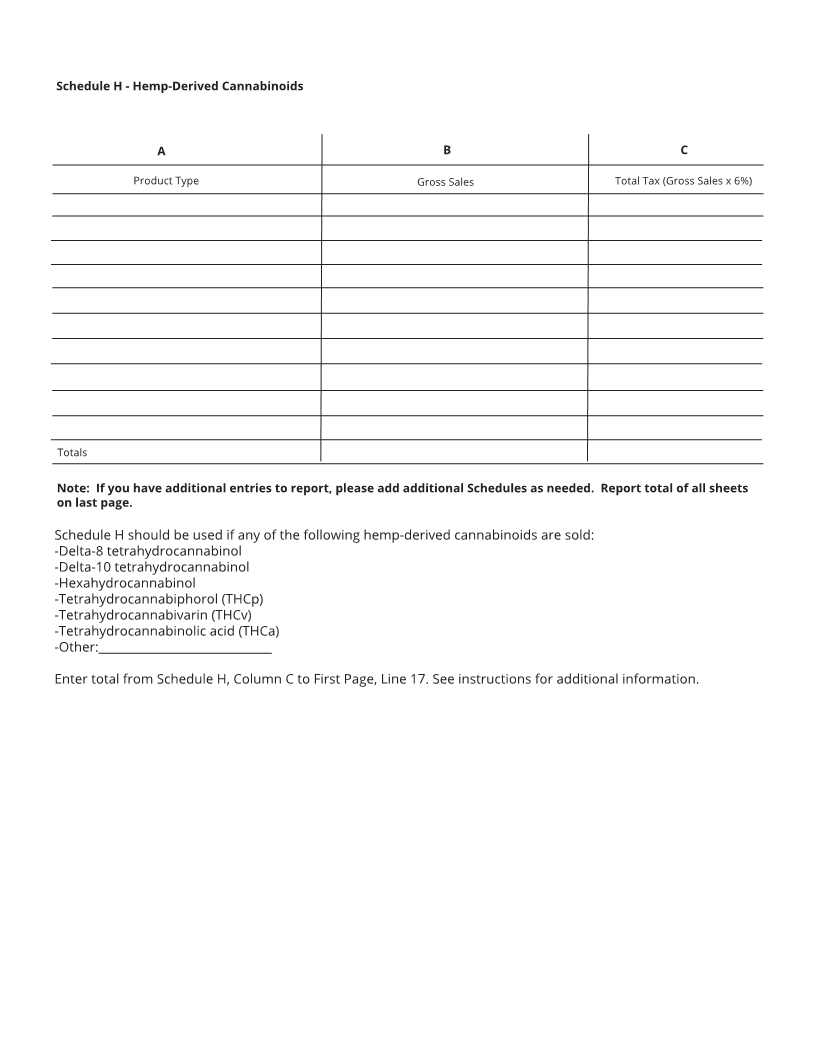

17. Hemp-derived cannabinoids, including Delta-8 and Delta-10 products from Schedule H, Column C......................(17) _________________________

18. Net tax due (add Lines 8-17) ...............................................................................................................................................(18) ________________________

19. Vendor's compensation total for timely filed/paid return not to exceed $25.00. (Calculated from Lines 8, 9,

and 12). (Annual Filers only, see instructions)..............................................................................................................(19) ________________________

20. Credit memo balance ..........................................................................................................................................................(20) ________________________

21. Penalty (see instructions) ....................................................................................................................................................(21) ________________________

22. Interest (see instructions) ...................................................................................................................................................(22) ________________________

23. Total tax due - If filed and paid timely, subtract Line 19 and 20 from Line 18. If filed or paid late, subtract

Line 20 from Line 18 and add Lines 21 and 22 ................................................................................................................(23) ________________________

FOR OFFICE USE ONLY