Enlarge image

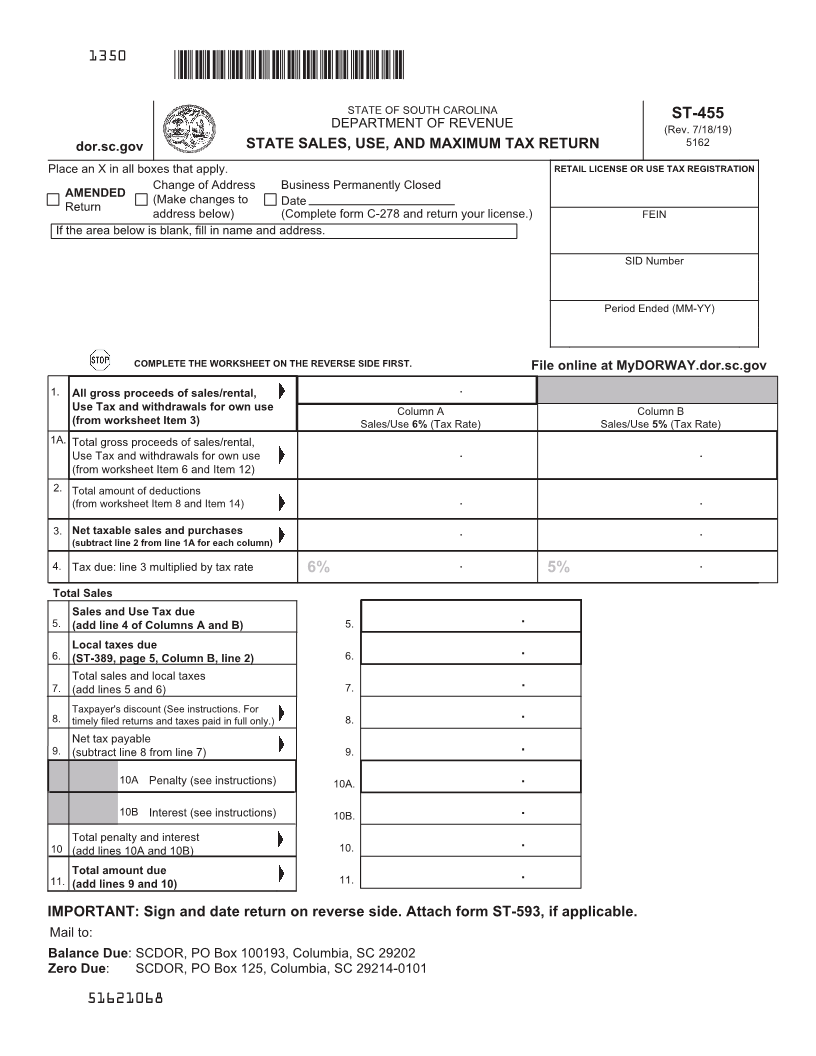

State Sales, Use, &

Maximum Tax Return

WHAT’S NEW

FOR MAX TAX?

• Effective December 1, 2023: this return

must be filed and paid electronically.

Visit dor.sc.gov/MyDORWAY to learn more

and get started.

• Some Items, including golf carts, ATVs, UTVs,

and dirt bikes are now subject to Max Tax.

Visit dor.sc.gov/max-tax to learn more.

Manage your tax accounts online for FREE!

Fast. Easy. Secure.

File Electronically Why you should use MyDORWAY

• Faster & easier than a paper return • Make ACH debit or credit card

• Stay up to date on tax rate changes payments with no convenience fees

• Additional $100 discount per year • Automatic calculations reduce errors

• Receive immediate confirmation • 24/7 account access

for transactions • Option to schedule payments

Ready to sign up for MyDORWAY?

Visit MyDORWAY.dor.sc.gov to get started.

You’ll need your FEIN or SSN, License Number, and a Letter ID or copy of your last return.

Tutorials are available at dor.sc.gov/MyDORWAY

Want more information about Max Tax? Visit dor.sc.gov/max-tax