Enlarge image

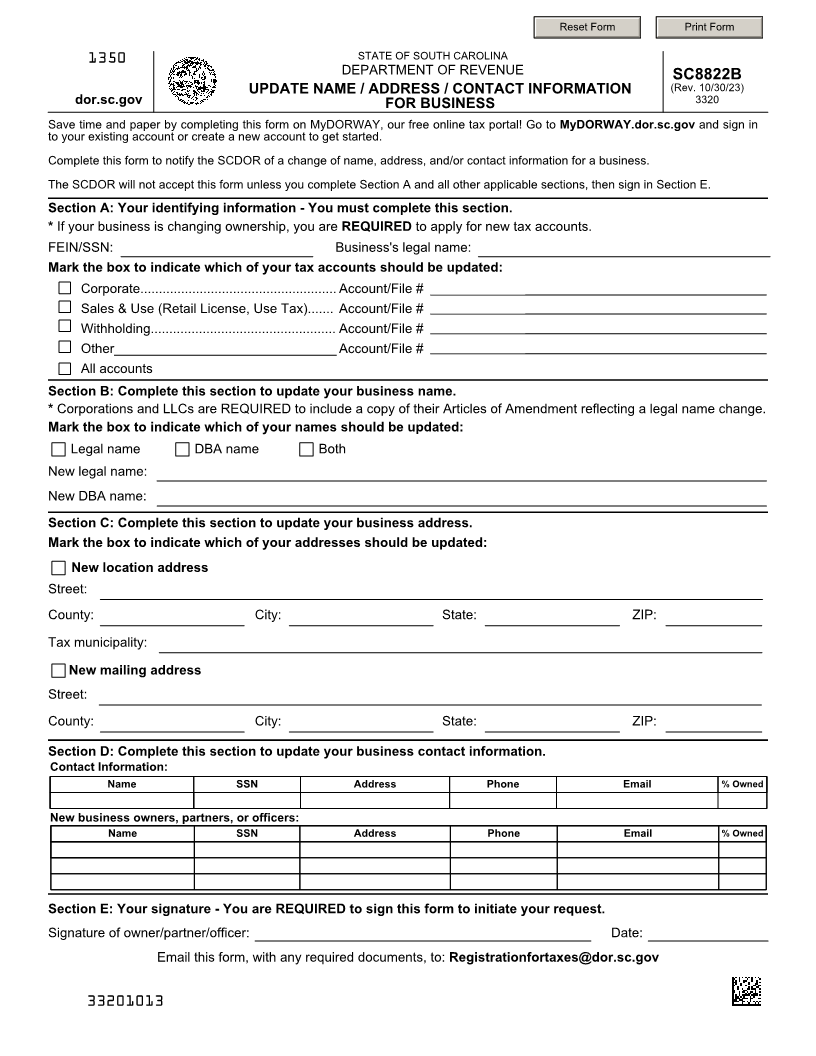

Reset Form Print Form

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

SC8822B

UPDATE NAME / ADDRESS / CONTACT INFORMATION (Rev. 10/30/23)

3320

dor.sc.gov FOR BUSINESS

Save time and paper by completing this form on MyDORWAY, our free online tax portal! Go to MyDORWAY.dor.sc.gov and sign in

to your existing account or create a new account to get started.

Complete this form to notify the SCDOR of a change of name, address, and/or contact information for a business.

The SCDOR will not accept this form unless you complete Section A and all other applicable sections, then sign in Section E.

Section A: Your identifying information - You must complete this section.

* If your business is changing ownership, you are REQUIRED to apply for new tax accounts.

FEIN/SSN: Business's legal name:

Mark the box to indicate which of your tax accounts should be updated:

Corporate..................................................... Account/File #

Sales & Use (Retail License, Use Tax)....... Account/File #

Withholding.................................................. Account/File #

Other______________________________ Account/File #

All accounts

Section B: Complete this section to update your business name.

* Corporations and LLCs are REQUIRED to include a copy of their Articles of Amendment reflecting a legal name change.

Mark the box to indicate which of your names should be updated:

Legal name DBA name Both

New legal name:

New DBA name:

Section C: Complete this section to update your business address.

Mark the box to indicate which of your addresses should be updated:

New location address

Street:

County: City: State: ZIP:

Tax municipality:

New mailing address

Street:

County: City: State: ZIP:

Section D: Complete this section to update your business contact information.

Contact Information:

Name SSN Address Phone Email % Owned

New business owners, partners, or officers:

Name SSN Address Phone Email % Owned

Section E: Your signature - You are REQUIRED to sign this form to initiate your request.

Signature of owner/partner/officer: Date:

Email this form, with any required documents, to: Registrationfortaxes@dor.sc.gov

33201013