Enlarge image

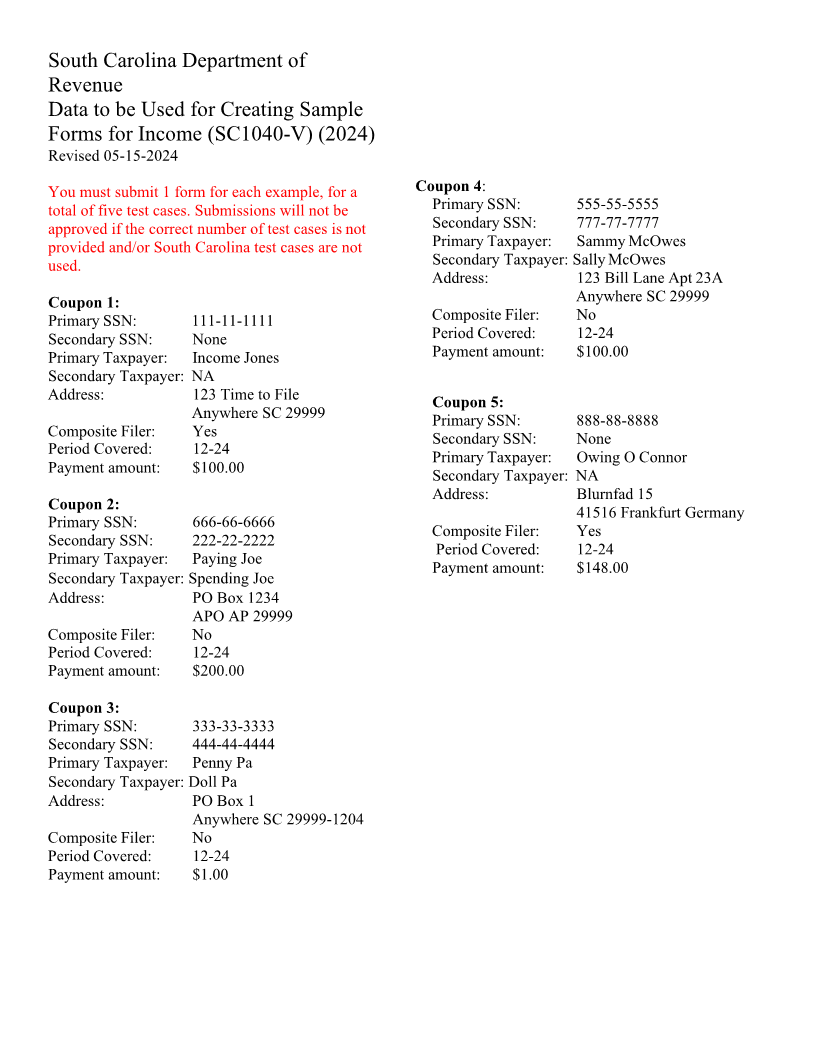

South Carolina Department of

Revenue

Data to be Used for Creating Sample

Forms for Income (SC1040-V) (2024)

Revised 05-15-2024

You must submit 1 form for each example, for a Coupon 4:

total of five test cases. Submissions will not be Primary SSN: 555-55-5555

approved if the correct number of test cases is not Secondary SSN: 777-77-7777

provided and/or South Carolina test cases are not Primary Taxpayer: Sammy McOwes

used. Secondary Taxpayer: Sally McOwes

Address: 123 Bill Lane Apt 23A

Coupon 1: Anywhere SC 29999

Primary SSN: 111-11-1111 Composite Filer: No

Secondary SSN: None Period Covered: 12-24

Primary Taxpayer: Income Jones Payment amount: $100.00

Secondary Taxpayer: NA

Address: 123 Time to File

Coupon 5:

Anywhere SC 29999

Primary SSN: 888-88-8888

Composite Filer: Yes

Secondary SSN: None

Period Covered: 12-24

Primary Taxpayer: Owing O Connor

Payment amount: $100.00

Secondary Taxpayer: NA

Address: Blurnfad 15

Coupon 2:

41516 Frankfurt Germany

Primary SSN: 666-66-6666

Composite Filer: Yes

Secondary SSN: 222-22-2222

Period Covered: 12-24

Primary Taxpayer: Paying Joe

Payment amount: $148.00

Secondary Taxpayer: Spending Joe

Address: PO Box 1234

APO AP 29999

Composite Filer: No

Period Covered: 12-24

Payment amount: $200.00

Coupon 3:

Primary SSN: 333-33-3333

Secondary SSN: 444-44-4444

Primary Taxpayer: Penny Pa

Secondary Taxpayer: Doll Pa

Address: PO Box 1

Anywhere SC 29999-1204

Composite Filer: No

Period Covered: 12-24

Payment amount: $1.00