Enlarge image

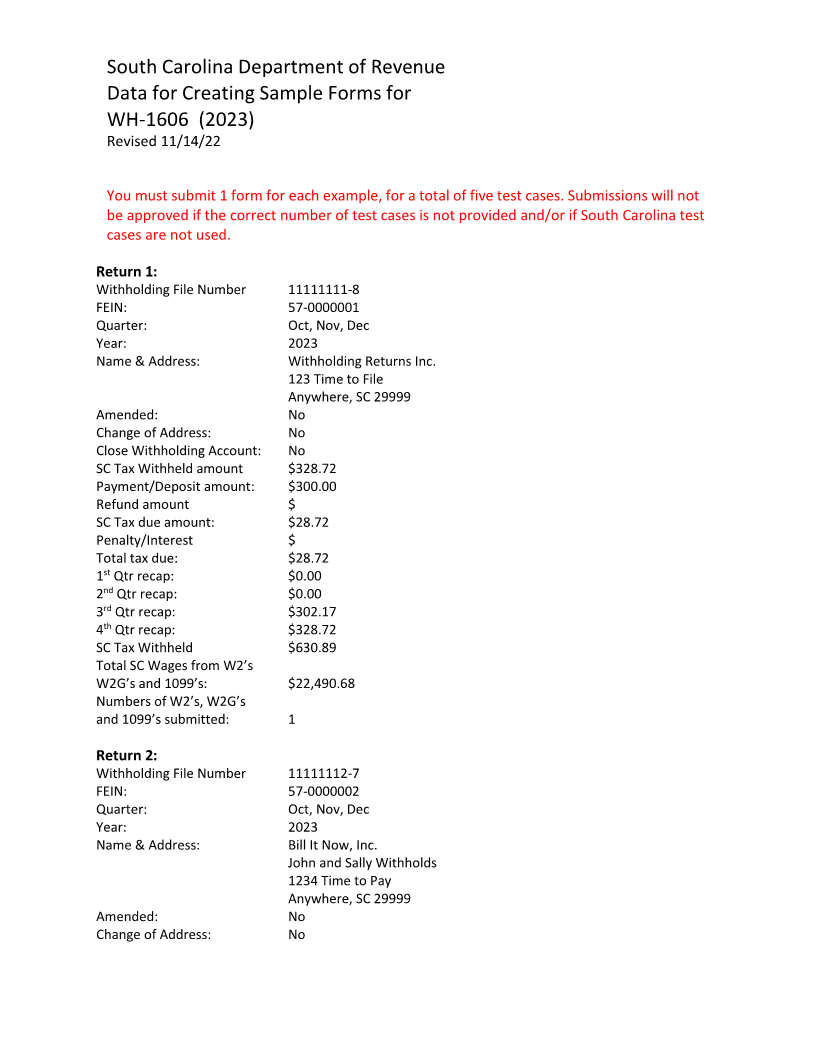

South Carolina Department of Revenue

Data for Creating Sample Forms for

WH-1606 (2023)

Revised 11/14/22

You must submit 1 form for each example, for a total of five test cases. Submissions will not

be approved if the correct number of test cases is not provided and/or if South Carolina test

cases are not used.

Return 1:

Withholding File Number 11111111-8

FEIN: 57-0000001

Quarter: Oct, Nov, Dec

Year: 2023

Name & Address: Withholding Returns Inc.

123 Time to File

Anywhere, SC 29999

Amended: No

Change of Address: No

Close Withholding Account: No

SC Tax Withheld amount $328.72

Payment/Deposit amount: $300.00

Refund amount $

SC Tax due amount: $28.72

Penalty/Interest $

Total tax due: $28.72

st

1 Qtr recap: $0.00

nd

2 Qtr recap: $0.00

rd

3 Qtr recap: $302.17

th

4 Qtr recap: $328.72

SC Tax Withheld $630.89

Total SC Wages from W2’s

W2G’s and 1099’s: $22,490.68

Numbers of W2’s, W2G’s

and 1099’s submitted: 1

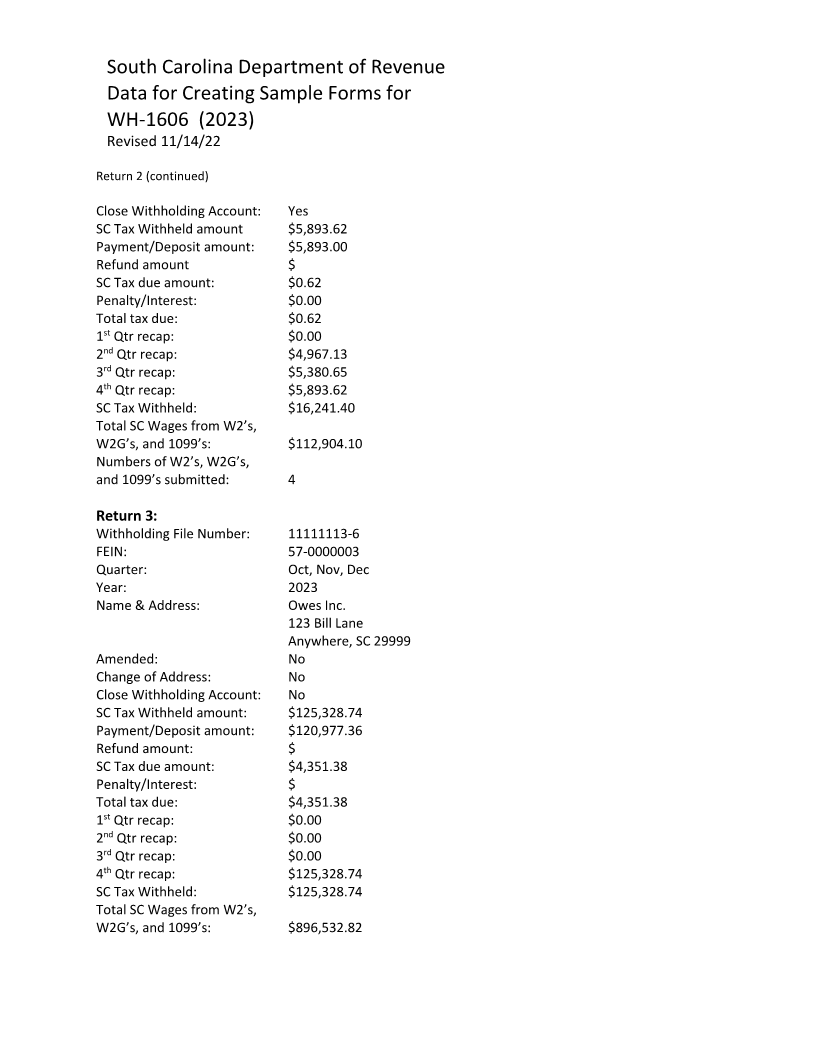

Return 2:

Withholding File Number 11111112-7

FEIN: 57-0000002

Quarter: Oct, Nov, Dec

Year: 2023

Name & Address: Bill It Now, Inc.

John and Sally Withholds

1234 Time to Pay

Anywhere, SC 29999

Amended: No

Change of Address: No